Chapter 1

The pandemic had substantial negative effects on supply chains

Certain sectors fared worse than others, but some life sciences companies reported few effects.

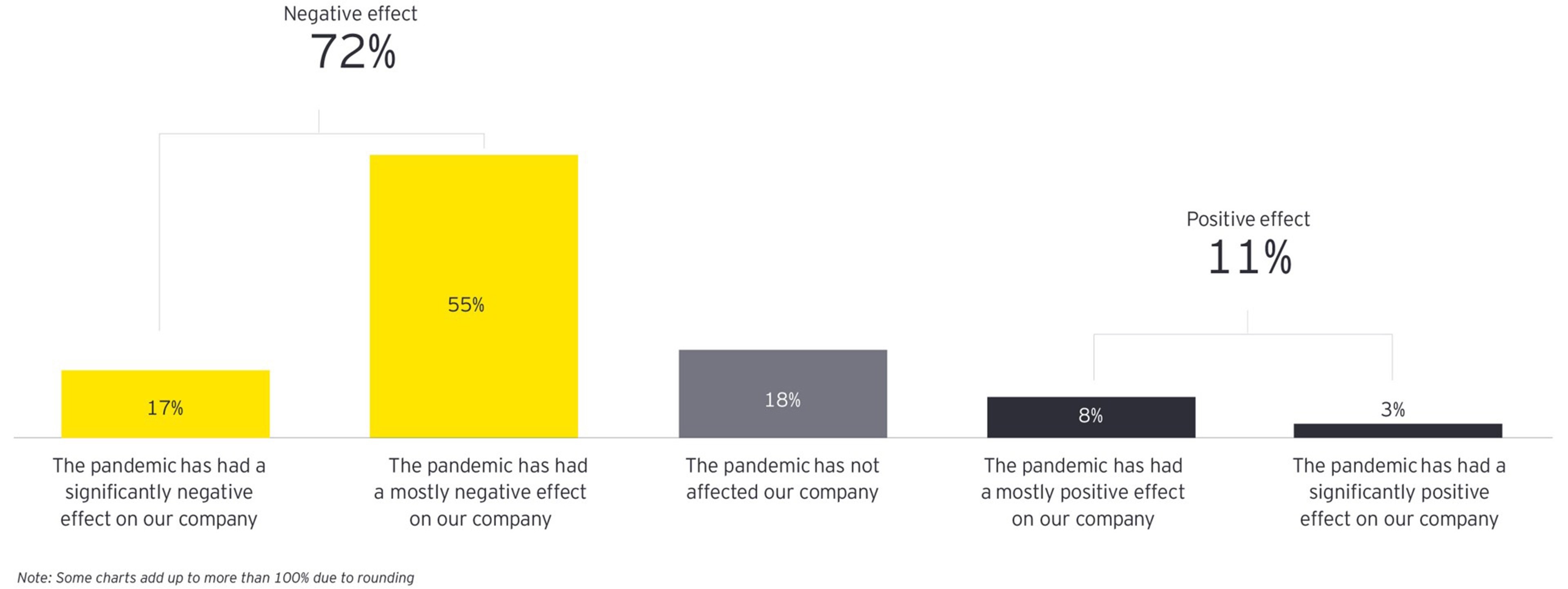

The COVID-19 pandemic was a global disruption across trade, finance, health and education systems, businesses and societies like few others in the past 100 years. It is no surprise then that only 2% of companies who responded to the survey said they were fully prepared for the pandemic. Serious disruptions affected 57%, with 72% reporting a negative effect (17% reported a significant negative effect, and 55% mostly negative).

Often in uncertain economic environments, companies slow their technology investments to a trickle. But during the COVID-19 pandemic, 92% did not halt technology investments. This speaks to the value of a digital supply chain in helping enterprises navigate disruptive forces and respond faster to volatile supply and demand.

There were some clear winners by industry during the pandemic, with 11% reporting positive effects, including increased customer demand (71%) and bringing new products to market (57%). These companies were mostly in the life sciences sector and the positive effects may be largely because the products they produce are essential. The pandemic also required some life sciences companies to double down on creating essential new products such as COVID-19 tests or vaccines. Other sectors, particularly consumer products, couldn’t keep products on the shelves in the early days of the pandemic since toilet paper, canned goods, flour and other staples were in high demand.

Some sectors were hit particularly hard, however. Among survey respondents, all automotive and nearly all (97%) industrial products companies said the pandemic has had a negative effect on them. In addition, 47% of all companies reported the pandemic disrupted their workforce. While many employees were asked to work from home, others — especially in factory settings — had to adapt to new requirements for physical spacing, contact-tracing and more personal protective equipment (PPE). Industrial products and high-tech manufacturing companies are investing overwhelmingly in technology to reduce employee exposure to COVID-19 in more labor-intensive industries. These are just a few examples of changes affecting supply chains across various sectors.

However, some positives have come out of the disruption. For example, supply chain finally got a voice, and much-needed investment in technical capabilities such as real-time visibility and resilience. The pandemic also forced supply chains to develop new agility to carry forward – for example, many organizations are building advanced analytics to do dynamic SKU rationalization rather than doing one off spreadsheet exercises when inventory gets too high or the next crisis requires optimization. And as a result, a high-performing supply chain is now perceived as a competitive necessity.

Chapter 2

Big changes are on the horizon for supply chains

Greater supply chain visibility, efficiency and resilience are top of mind.

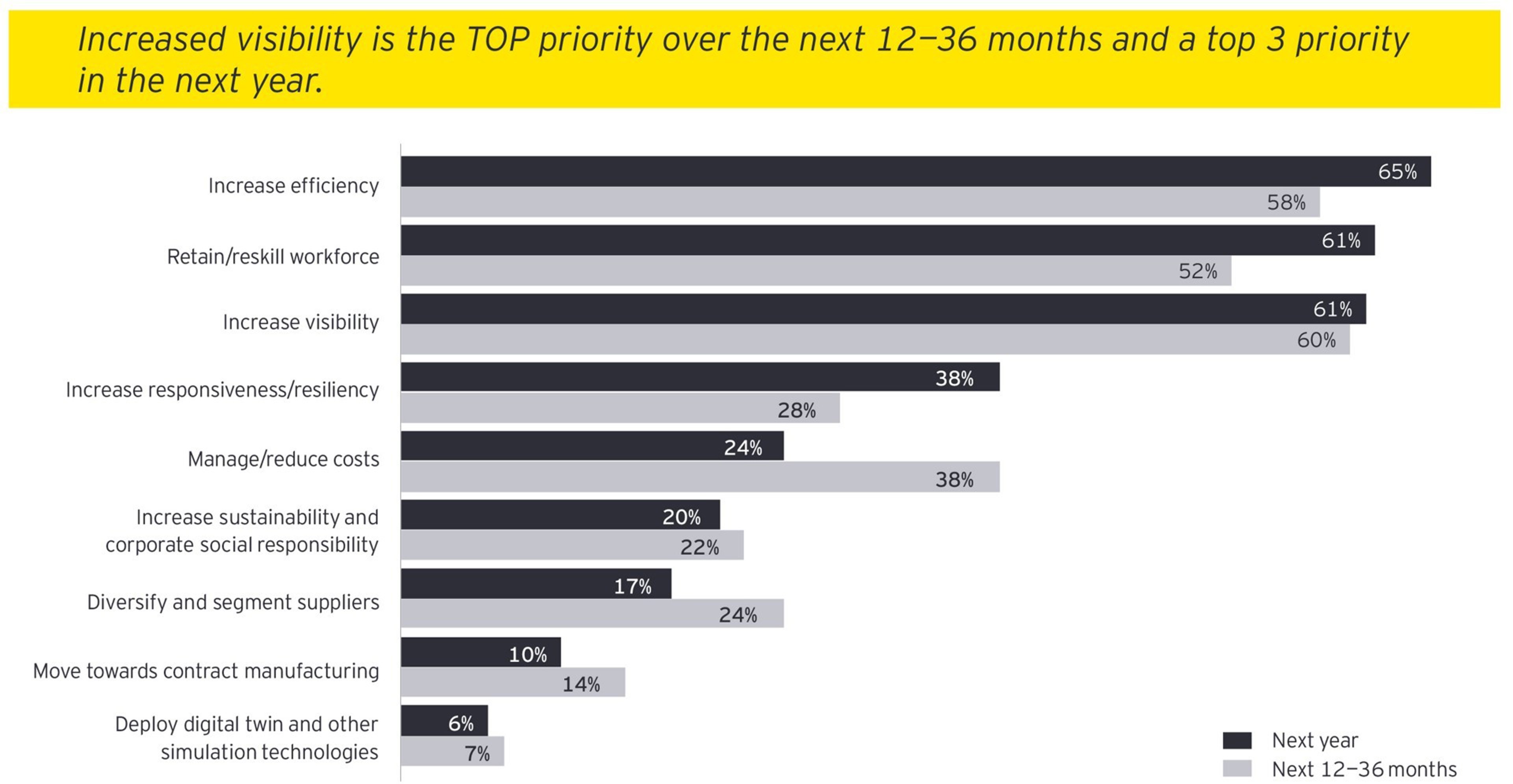

The executive supply chain surveys indicate that visibility, efficiency and reskilling supply chain workers will be top priorities. These findings are not surprising as cost-optimization in the supply chain will always be a focus, even in the face of building out additional resiliency. Cost reduction has in the past been achieved through lean operations, longer lead times and low-cost labor. But in the future, agility, visibility, automation and upskilled people will be key, which together drive not only cost reductions but better decision-making, and process standardization and excellence across the supply chain and clients eco-system partners.

The surveys show that supply chain visibility was a top three priority in late 2020 and the top priority in 2022. While increased broad supply chain visibility is a top priority, it remains a work in progress. Only 37% of respondents in 2022 have seen increasing visibility.

With the need for increased visibility across typically hundreds or thousands of suppliers, we are already seeing a shift from linear supply chains to more integrated networks connecting many players. Enabling this sea change are technologies such as IoT devices or sensors that provide valuable data on where goods are in the chain and their condition — for example, products for which temperature monitoring may be critical (i.e., frozen foods, vaccines or other medicines). Cloud based platforms for collaboration among suppliers and supply chain orchestration (i.e., control tower) also increased in terms of piloting and adoption.

With 61% of respondents saying they will retrain and reskill their workforce in the next year, there will be efforts to help workers use digital technologies, adapt to changing company strategies and ways of working like increased virtual collaboration, and assist people in operating equipment with health and safety in mind. Top workforce measures identified in the survey include increased automation (63%) and investments in AI and machine learning, with 37% of respondents already deploying these technologies and another 36% planning to use them soon.

It may be safe to assume that because of COVID-19 pandemic, companies put their sustainability goals on hold in order to manage through the pandemic. The 2022 survey found just the opposite — 80% are more focused on environmental and sustainability goals (ESG). Cost savings, compliance and pressure from the workforce and suppliers were the top motivators for improving supply chain sustainability. With investors seeking information on a company’s ESG performance, employees wanting to work for companies with sustainability built into their mission statements, increased customer expectations for sustainability and increasing regulation from various countries, sustainable supply chain practices no doubt are here to stay.

Related article

Chapter 3

The future of supply chains is digital and autonomous

The journey to digitized and lights-out operation has begun in earnest.

The pandemic has indeed accelerated many preexisting trends, and supply chain is no exception: Our 2020 survey found that 64% of surveyed supply chain executives say digital transformation will accelerate due to the pandemic. And our 2022 research report shows the race is on for digital enablement and automation: by 2035, 45% of supply chains are expected to be mostly autonomous (e.g., robots in warehouses and stores, driverless forklifts and trucks, delivery drones and fully automated planning).

However, simply utilizing digital technologies does not equate to creating a digitized, autonomous supply chain — it also needs connected supply chain technologies across planning, procurement, manufacturing and logistics that work beyond the organization’s four walls. It’s the difference between “doing digital” and “being digital.”

We can think about autonomous operations in terms of “lights-out,” “hands-free” and “self-driving,” where organizations use AI technologies across the end-to-end supply chain to help make predictive and prescriptive decisions. An example is responding to a change in customer demand, seen instantly by the entire value chain (the organizations, its suppliers and their suppliers’ suppliers) so they can collectively adjust supply plans and production schedules immediately. Ultimately digital and autonomous technologies will help make people’s jobs easier and the supply chain more efficient and optimized.

What comes next?

From the 2020 research, we see that 60% of executives say the pandemic has increased their supply chain’s strategic importance. Accordingly, enterprises urgently need to design a supply chain organization that will fit the new digital and autonomous-focused era.

Looking forward, multiple disruptions are happening more quickly and factors such as geopolitical risks, cyber threats and economic instability are continuing to put pressure on supply chains. So the supply chain of the future will need to be agile, flexible, efficient, resilient and digitally networked for improved visibility. Organizations, therefore, should focus on five priorities for recovery and beyond.

1. Reimagine the strategic architecture of your supply chain

- Continue to invest upfront in your supply chain strategy, architecture and operating model to increase flexibility and effectiveness.

- Rapidly redefine your supply chain strategy and alter global trade flows, considering new trade agreements, country incentives and omnichannel acceleration.

- Reimagine your supply chain operating model — what work should get done locally, regionally and globally, including warehouses and manufacturing sites. There are considerable tax implications here, and a new model can also help you prepare for future disruption.

2. Build transparency and resiliency

- Improve disruption response with real-time visibility and monitoring of your end-to-end supply chain, as well as performing scenario planning and simulations.

- Deploy technological capabilities that enable Tier-n transparency and communicate with stakeholders through broader data sharing agreements.

- Review your supply chain footprint. Our 2022 research shows that 54% of companies are looking to add suppliers. Do you have alternate sources of supply established? Are you confirming you do not have vendor or geographic concentration? Considering factors including geopolitical risk and cyber threats, should you reshore or reposition parts of your supply chain?

3. Extract cash and cost from your supply chain

- Achieve cost reductions strategically by reinvigorating and rethinking your overall ecosystem to better leverage suppliers, and pursuing more dynamic network optimization.

- Drive a step change in your supply chain cost structure and working capital profile by focusing on SKU rationalization, procurement spend reduction, logistics and warehouse optimization, and manufacturing productivity.

- Reduce working capital via supply chain segmentation, refreshed inventory planning parameters and changes in payment terms.

4. Create a competitive advantage with sustainability

- The future is a circular economy where there is no waste in your products or manufacturing.

- Explore ways to redesign and engineer new products to achieve this circular economy and monitor third-party risk with supplier sustainability assessments across tiers 1-3.

5. Drive agility and opportunities for growth through a digital supply chain

- Harness demand-sensing signals from consumer sentiment to influence production, enabled by fast changeovers for smaller batches and true collaboration with suppliers for real-time decision making.

- Work towards implementing the digital and end-to-end supply chain across planning, procurement, manufacturing and logistics. This can drive efficiencies and also open new revenue streams.

- Realize that companies are using supply chains as an engine for growth and a key differentiator versus competitors.

Many executives are hoping that the COVID-19 pandemic is a once-in-a-lifetime event. However, as the adage goes, “hope is not a strategy.” There are ways to stand out and better navigate the storms of the next inevitable disruption. These include reimaging your supply chain strategies for risk and resilience and finding ways to include operational excellence and standard work to help enable continual supply chain cost reduction. Invest in digital technologies such as cloud-based collaboration platforms, automation, and data analytics and AI at speed. It also is important to continually put humans at the center of your efforts and empower them to do extraordinary things – for example, in digital manufacturing, it’s essential to invest in both process excellence and the culture on the shopfloor for organizations to get the most from new digital capabilities. And with scarcity in truly skilled resources, think carefully about where to leverage expertise and where automate the tactical. In the past, supply chain did not always have a seat at the table to provide input to the overall strategy, now more than ever supply chain is seen as a strategic differentiator, and we don’t see that changing any time soon. So instilling supply chain employees with empowerment, ownership and accountability can incentivize them to achieve more capabilities than they, or the organization, ever thought possible.

Finally, innovate with customers in mind through a truly sustainable supply chain — one that is designed with circularity and the environment in mind. Following this path, your enterprise will be better prepared to manage whatever crises come next — turning potential disruptions into tremendous opportunities.

Summary

EY research shows that the COVID-19 pandemic accelerated preexisting issues in the supply chain and brought priorities such as visibility, resilience and digitization to the fore. While some sectors were hit hard by disruption, there were some winners, notably life sciences. But across the board, protecting, retraining and reskilling the workforce is a major priority, along with investing to make the autonomous supply chain a reality.