EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

A market doubled in size in 10 years

The original Alternative Investment Fund Managers Directive (AIFMD I) came into force in early 2013. Its arrival ignited debate across Luxembourg with many stakeholders flagging its scope (too broad) (“Isn’t it just meant for hedge funds?”) or expressing concern about potential disruption to well-established operating models. The perceived threat of “double regulation” with new manager-level rules layered atop existing product-level oversight, loomed large, prompting fears of increased compliance burdens and reduced agility.

Yet, rather than stifling innovation, AIFMD catalyzed transformation. It laid the groundwork for Luxembourg’s emergence as a major player in the alternative investment space. The Directive’s implementation was driven by forward-thinking leaders who recognized its potential and rallied to shape a thriving ecosystem. Their strategic foresight and collaborative execution turned regulatory challenge into competitive advantage.

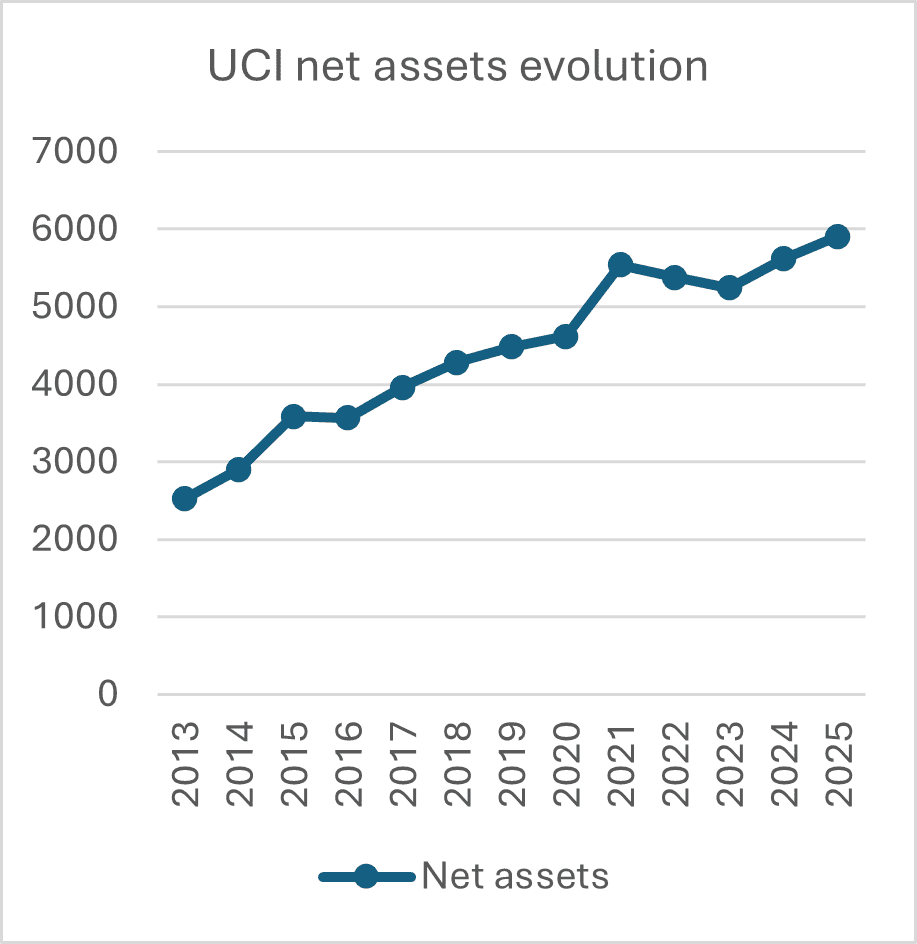

And this is really what we have seen come to fruition. Over the past decade, Luxembourg’s fund industry has experienced remarkable growth. Net assets of regulated funds surged from EUR 2,904 billion in 2014 (at the implementation of AIFMD I) to nearly EUR 6,000 billion by July 2025. This expansion (nearly doubling in size) outpaces most European jurisdictions. In fact, excluding ETFs, no other market has matched Luxembourg’s growth trajectory.

This moment presents an opportunity to elevate Luxembourg’s AIF brand to rival its globally recognized UCITS reputation. With bold vision and decisive execution much like the original response to AIFMD I, Luxembourg can once again lead the way in shaping the future of European fund management.

So, getting into technical details, what are the changes that AIFMD II puts forward, and how will it impact fund managers?

Source: ALFI statistics

What should we expect in terms of business after the application of AIFMD II?

Luxembourg transposition

On 3 October 2025, the Luxembourg government filed the long-awaited draft law transposing Directive (EU) 2024/927 (commonly referred to as AIFMD II/UCITS VI). This draft law amends both the 2010 Law and the AIFM Law by introducing a suite of changes aimed at enhancing governance, liquidity management, and operational flexibility, as well as expanding the allowed services for asset managers.

Ancillary services: expanding the manager’s toolkit

One of the most notable evolutions under AIFMD II is the expansion of ancillary services. AIFMs will now be permitted to administer benchmarks, provide loans and credit servicing, and offer non-core services without requiring portfolio management authorization. The Luxembourg transposition goes further by allowing fund managers to offer these services to third parties, effectively broadening their commercial scope and client base.

This flexibility is expected to attract multi-service platforms and tech-enabled managers, particularly those seeking to consolidate operations across fund administration and distribution.

Depositaries: cross-border capabilities unlocked

AIFMD II introduces a derogation allowing AIFs to appoint depositaries in other Member States, subject to regulatory approval and market conditions. While Luxembourg opted not to allow foreign depositaries for its domestic AIFs, it did authorize Luxembourg-based depositaries to serve AIFs domiciled in other EU jurisdictions.

This strategic choice positions Luxembourg as a regional depositary hub, enabling local institutions to expand their footprint and service offerings across borders, while maintaining high standards of investor protection and operational oversight.

ETFs: auditor report exemption enhances competitiveness

The Luxembourg transposition introduces an exemption from independent auditor reports for in-kind subscriptions. This is part of a move aligned with the current momentum in the Luxembourg ETF market. Further measures in this regards were implemented in 2025 through the tax reform which has extended the exemption from subscription tax to active ETFs, and the reporting flexibility provided by the CSSF in its FAQ on the 2010 Law. The latter allows managers of active ETFs to publish portfolio holdings at a lower frequency than for the portfolio composition file and/or with a time lag. These measures as a whole are expected to boost Luxembourg’s attractiveness for active and passive ETF sponsors, particularly those targeting retail and institutional investors across Europe.

The ETF auditor report exemption for contributions in kind is to be seen as a competitive advantage for Luxembourg, making it more attractive for ETFs by increasing efficiency and lowering costs when assets are contributed instead of cash, provided all unitholders are treated fairly. It also provides managers with more flexibility in how they structure their funds and manage incoming assets.

Marketing delegation: clarifying the role of distributors

AIFMD has detailed requirements in terms of delegation, including in the instance of sub-delegation by the third party. Nevertheless, marketing of funds can happen through independent distributors without the fund manager’s knowledge. In order to further clarify the legal requirements applicable, the new Directive clarifies that independent distributors, acting on their own behalf, do not constitute a delegation of the marketing function. This provision significantly reduces compliance burdens for fund managers, especially those operating across multiple jurisdictions with diverse distribution networks.

Luxembourg’s adoption of this clarification is expected to streamline distribution models and support cost-efficient scaling for emerging managers.

Loan origination: a structured framework with local nuance

AIFMD II introduces a harmonized framework for loan-originating AIFs, including definitions, risk retention rules, leverage caps, and transparency requirements. Luxembourg’s transposition adds further clarity by explicitly prohibiting consumer loans to align with national consumer legal framework.

Importantly, a three-year transition period (ending in April 2029) has been granted, allowing certain loan-originating alternative investment funds to adapt their structures and compliance frameworks. This measured approach is expected to support the growth of private debt and real asset strategies, while ensuring investor protection and systemic stability.

Looking ahead: strategic positioning in a competitive landscape

With over 1,000 fund managers and dozens of depositaries operating in Luxembourg, the transposition of AIFMD II and UCITS VI marks a pivotal moment for the industry. The reforms not only align Luxembourg with EU-wide standards but also leverage national discretions to preserve its competitive edge. Yet, it’s important to note that the regulation is a tool – it must be strategically applied to deliver results. Luxembourg is certainly not the only country jumping at the opportunity to gain a competitive advantage with AIFMD II, so success will rely on whether the regulation will be used as a strategic enabler for innovation, cross-border expansion and long-term competitiveness.

Summary

AIFMD laid the groundwork for Luxembourg’s emergence as a major player in the alternative investment space. The Directive’s implementation was driven by forward-thinking leaders who recognized its potential and rallied to shape a thriving ecosystem. Moving forward, what are the changes that AIFMD II puts forward, and how will it impact fund managers?

Related articles

In the context of the transition to the new UCITS/AIFM Directive, ESMA published on 16 April 2025, the final reports on its Guidelines and RTS on liquidity management tools under the AIFMD and UCITS Directive. The RTS was submitted to the Commission, which has 3-4 months to adopt it. Once published in the Official Journal, it is expected to apply on the 20th day following the publication . The Guidelines, in turn, are expected to apply for new funds from the same day as the RTS, meanwhile existing funds will be granted 12 additional months to comply with the new rules.

The new AIFMD Directive’s roll-out unpacking main impact on IFMs

The proposal reviewing AIFMD and the UCITS Directive (the new Directive) was adopted by the Council on 26 February 2024. EY Luxembourg’s Laurent Capolaghi, Private Equity Leader, and Vincent Remy, Private Debt Leader, highlight some of the main changes impacting investment fund managers.

Key trends that will determine the future of depositaries in Luxembourg

Depositaries play a key role in safeguarding investors’ interests through obligations imposed to them by the UCITS and the AIFMD law. The efficiency and effectiveness with which these players conduct their operations is therefore key for protecting the trust into the Luxembourg investment fund sector. Within this article we will explore some key trends that Executives of depositary organizations have to address, not only to ensure ongoing compliance with their obligations, but also to maintain their competitive position.