- Investors’ confidence toward Europe surging after three years of decline

- Brexit uncertainty slows FDI into the UK but it remains the top destination for FDI in 2017

- FDI into France surges and Paris overtakes London as the most attractive European city according to investors’ sentiment

Europe attracted a record level of foreign direct investment (FDI) with 6,653 projects in 2017, according to the 2018 edition of the EY European attractiveness survey. However, the growth in Europe slowed for the first time in three years (to 10%) having achieved an average growth of 15% over the past three years amid amplified geopolitical concerns. Meanwhile, investor sentiment is more buoyant with 50% of more than 500 investors highlighting confidence in Europe, expecting Europe’s attractiveness to improve over the next year (up from 35% in 2017).

Andy Baldwin, EY EMEIA Area Managing Partner, says:

“Investors from around the world continue to be drawn to Europe as a stable place for business growth and investment. Yet, despite a positive sentiment, the uncertain political environment is invoking caution. With China’s rise to the number two spot for investment and protracted Brexit negotiations between the UK and mainland Europe, governments in Europe need to remember that it’s the relative attraction of the whole that keeps investment momentum into Europe and it’s not a zero-sum game.

“Business leaders in Europe need to look at the geopolitical risks that can impact both their export potential as well as how they operate their supply chain across the region. The optimism of 2017 that we had seen the high water mark of populism has been replaced by new fears and uncertainty in Eastern Europe, secession risks in Spain and an expansionist macroeconomic agenda of the new Italian administration.”

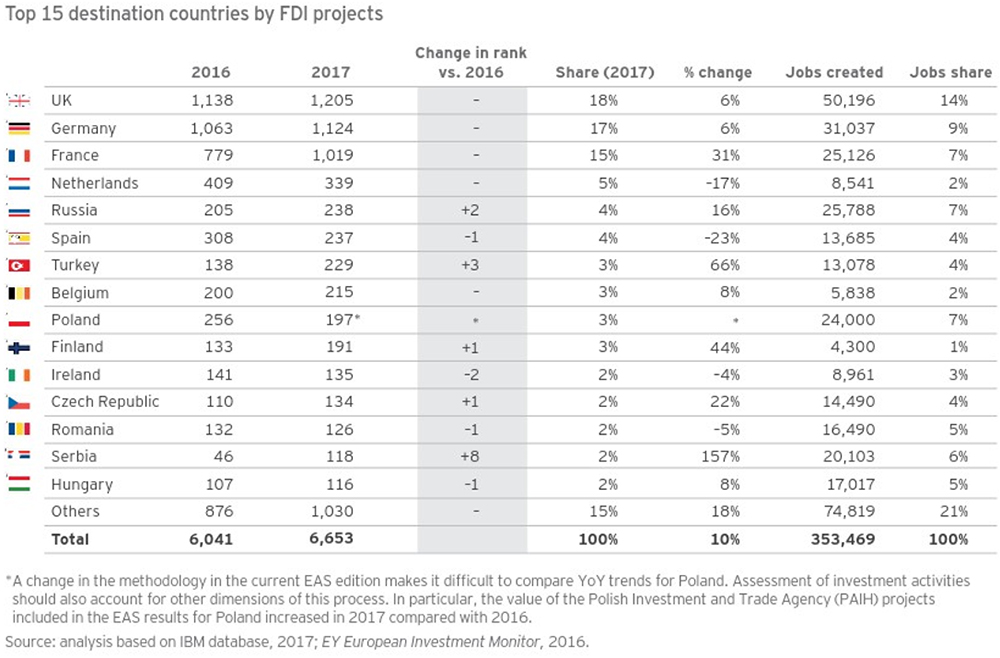

A new map of investment in 2017

Despite concerns around Brexit and broader political uncertainty, the UK surprisingly registered growth of 6%, only a modest slowdown compared with 7% growth last year and it retained its position as the top destination for FDI in 2017 by number of projects (1,205). With the UK still attracting the majority of inbound European investment – especially in relation to the financial and digital sectors – the survey shows its key role in the wider attractiveness of Europe. Germany continues to attract a diverse range of projects, but given the tightening labor markets and rising costs its growth dropped to 6% (compared with 12% in 2016). France surged ahead and recorded spectacular growth of 31% year-on-year with 1,019 FDI projects in 2017, closing the gap with both Germany and the UK as investors responded to the French Government reform agenda.

Central Eastern European countries continue to attract more FDI than its Western European counterparts under the umbrella of European Union (EU) membership. For example, Russia moved up two positions in the top 15 countries (to fifth place) by FDI, recording a solid FDI growth rate of 16%. Among all European countries, Serbia, which joins the rankings for the first time, recorded more than 150% growth year-on-year.

In Western Europe, after a very positive performance in 2016, Spain drops one position to sixth place, registering negative FDI growth of -23% year-on-year. The Netherlands (-17%), Ireland (-4%) and Romania (-5%) also join the group of countries recording negative growth among the top 15 by FDI projects.

Investors are ready to bet on Europe

Following three years of decline, investor sentiment to invest in Europe is now recovering, with 50% expecting Europe’s attractiveness to improve, up from 35% in 2017. This year, investor confidence on the future of the EU also improved, with 77% of respondents reacting positively, up from 65% last year.

The rising optimism about Europe is also reflected in organizations’ investment plans. Among companies with a presence in Europe, 41% plan to expand. And, international companies without a presence in Europe are also optimistic, with 12% seeking to establish new European operations in the year ahead, more than twice the number (5%) in the 2017 survey.

Despite an overall positive story the survey shows that investors are highly concerned about global and regional geopolitical instability, which ranks as the greatest risk to adversely affecting the attractiveness of Europe in the next three years (39%). This is followed by economic and political instability in the EU, excluding Brexit at 36% and the rise in populist and protectionist feelings among politicians and populations ranks as the third risk (34%). Investors identified Brexit (30%) and competition from emerging markets (26%) among the top five risks.

US businesses continue to be the single biggest investors into Europe

Recording 1,381 FDI projects, US companies confirmed their place as Europe’s biggest investors, accounting for 21% of all European FDI projects in 2017. FDI projects from the US in 2017 grew by 8% over the previous year, which was slightly slower compared to 2016 growth (10%). This modest drop may herald the reversal of US overseas FDI flows into the domestic market in response to the US tax reforms.

The majority of FDI investment into Europe, however, came from intra-European FDI flows, with European countries accounting for 56% of inbound FDI projects in 2017. German companies led the way, notably in manufacturing where the FDI projects grew by 17% year-on-year. Additionally, cross-border investments by UK companies surged 35% last year, especially to Germany (110 projects, up 83%) and France (79 projects, up 46%). Cross-border investments in financial services by UK companies increased by 93%, to 54 projects as firms executed Brexit contingency plans to retain EU ”passporting.”

Paris is the most attractive city for FDI ahead of London according to investors

Within Europe, wealth creation is becoming ever more concentrated in the largest cities and regions. London retains its longstanding leadership as the number one city by FDI projects and emerges once again as the top European financial center followed by Paris and Dublin. However, when looking at investors’ sentiment, Paris was ranked over London for the first time as Europe’s most attractive destination for FDI (37% vs. 34% in the 2017 survey) with a gap of 3 percentage points. Meanwhile, Germany’s federal structure and strong FDI appeal is spread across four cities which feature in the survey’s top 15 most attractive cities for investors: Berlin, Frankfurt, Munich and Hamburg.

In terms of regions, while Western Europe remains investors’ preferred target for FDI at 53%, China moved up four points to take the second place overall. Northern America slipped to fourth position leaving the third place to Central & Eastern Europe.

Digital economy emerges as the key driver of future growth

More than one-third (34%) of investors believe that the digital economy is the top driver of growth in Europe in the coming years. Investors identify “enhancing investments in digital technologies and infrastructure” together with “enhancing workforce skills for the digital age” as Europe’s top priorities in the digital age (45% and 42%, respectively).

With 1,172 FDI projects in 2017, the digital sector already leads the rankings of the top European 10 sectors by FDI projects, accounting for 18% of market share. This result represents 33% growth year-on-year, representing the second-fastest growth behind the pharmaceutical sector, which achieved 78% year-on-year growth. The digital sector also created the second-largest number of jobs through FDI with more than 37k new jobs created.

Baldwin says: “Europe’s capacity to hold its attractiveness and capture future growth is tied to its path to become a digital leader. Businesses and the public sector need to join efforts in creating an integrated digital infrastructure and ecosystem. This will be key to provide businesses, investors and citizens access to a prosperous, stable and attractive environment.”

- Ends -

EY European attractiveness survey rankings