EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Market abuse surveillance

What EY can do for you

Increasing complexity in detecting suspicious trading patterns, coupled with a heightened level of regulatory scrutiny, means firms are faced with the spiraling cost of compliance – and even higher penalties for noncompliance. Firms are implementing a scalable surveillance framework that works within a lean and agile operating model. However, doing so and expanding it across businesses in a risk-prioritized manner is difficult.

We have teams across the globe consisting of market abuse surveillance advisors with capabilities that have helped institutions to build effective surveillance successfully. Our advisors combine regulatory insight, technology experience and product-specific knowledge. Our innovative and agile approach involves close collaboration with your compliance, business and IT teams to make sure your surveillance framework is relevant to your operations and capable of evolving with your changing business needs.

Our market abuse surveillance team actively collaborates with regulators, technology providers, industry bodies and market participants to identify opportunities for market-wide synchronization of surveillance standards for data management, alert detection and disruptive technology adoption.

This supports us in working seamlessly across your organization to:

- Perform a health check on your existing trade surveillance ecosystem and recommend actionable improvement points

- Undertake a granular risk assessment to help identify areas of material control risk that are specific to your business and the market in which you operate

- Help you calibrate your surveillance parameters to reduce data noise and false positives

- Design advanced analytical reporting tools that provide relevant investigative data to your surveillance analysts

Management of market surveillance operations

Our team uses technology, data and industry insights to provide the following:

- Surveillance toolkit

Our surveillance toolkit is a culmination of years of successful service experience in market surveillance, technology and risk data. The toolkit can be used for remediation and business as usual (BAU) mode. This tried-and-tested set of tools and accelerators is designed to help reduce time to compliance and equip your BAU teams with leading-edge tools to detect, monitor and report suspicious trading activities.

- Standardized risk assessment

In response to new regulatory guidance and an evolving regulatory expectation, many firms are finding that legacy surveillance or market abuse assessments are no longer meeting the standards expected. Firms are enhancing their market abuse risk assessments to improve granularity, specifically across client types, product- and service-based risks, employee conflicts of interest, and the complexity and volume of orders and trades. These enhancements have, in part, been driven by the update to the Financial Conduct Authority’s (FCA) Financial Crime Guide, which now requires firms to consider traditional financial crime risk assessment factors when conducting a review of their market abuse framework and specifically asks that firms:

- Regularly update risk assessments

- Identify new or emerging market abuse risks

- Ascertain how the risk assessment informs which business to accept

- Align risk assessments and the procedures on the ground, as well as with other financial crime risk assessments (e.g., anti-money laundering (AML))

- Consider risk factors such as client types

- Regularly update risk assessments

Health checks

In response to new regulatory guidance and an evolving regulatory expectation, many firms are finding that legacy surveillance or market abuse controls are no longer meeting the standards expected. Therefore, firms are proactively assessing their market abuse policies, procedures and broader surveillance operating models to make sure that they are forward-looking and meet renewed expectations.

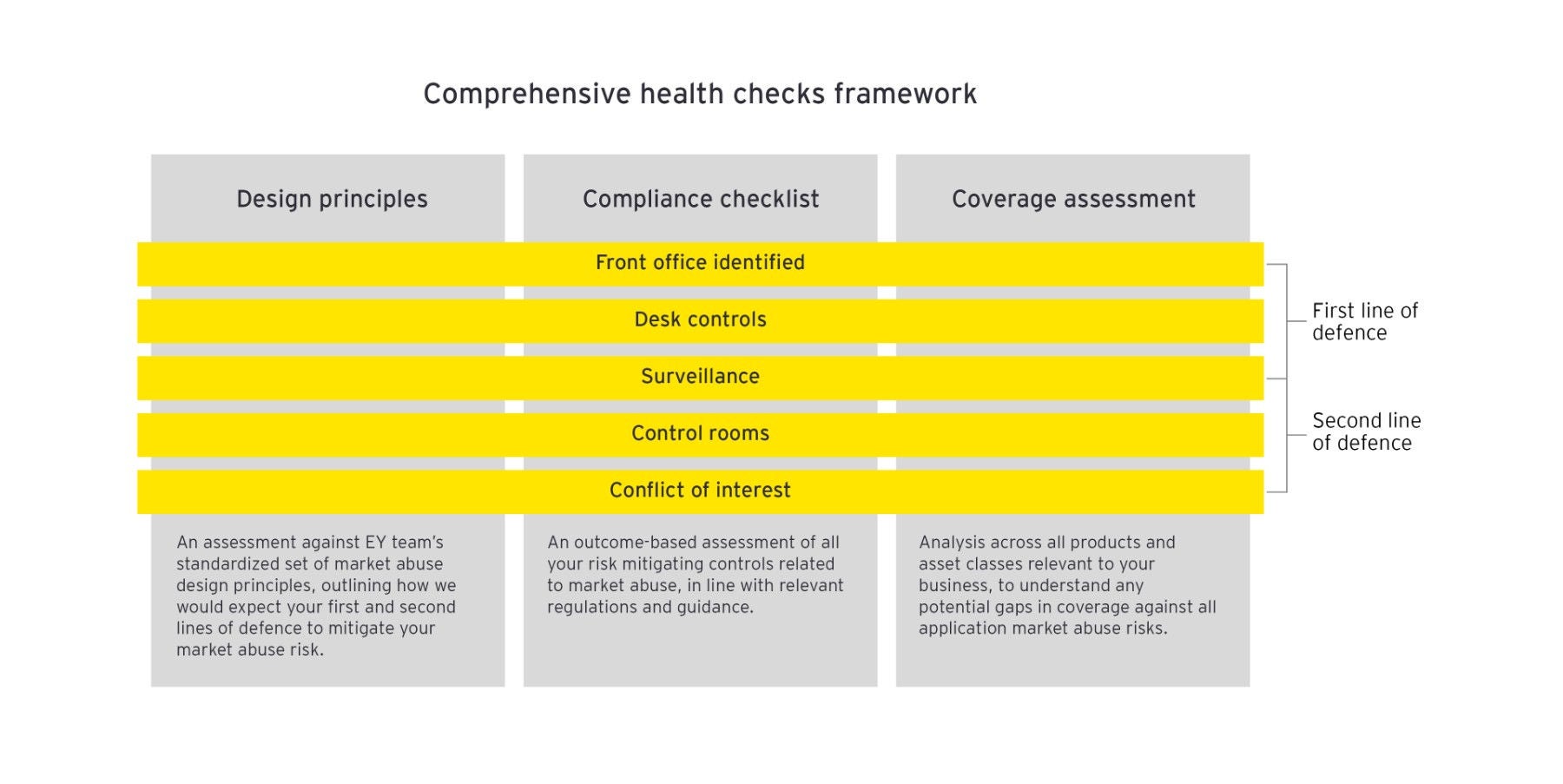

To support this, our team has developed a reusable and consistent approach to conducting market surveillance health checks that can be tailored to your needs, leveraging our experience to help deliver an efficient and proven review process. The assessment is centered around the EY surveillance framework and focused on three key activities, design principles, compliance checklist and coverage assessment.

Find out more about EY’s next-generation trader surveillance analytics, Odyssey-integrated trader surveillance.