EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Limited, each of which is a separate legal entity. Ernst & Young Limited is a Swiss company with registered seats in Switzerland providing services to clients in Switzerland.

How EY can help

-

Our team can help your business manage risk and volatility in complex areas related to treasury and commodities markets. Learn more.

Read more

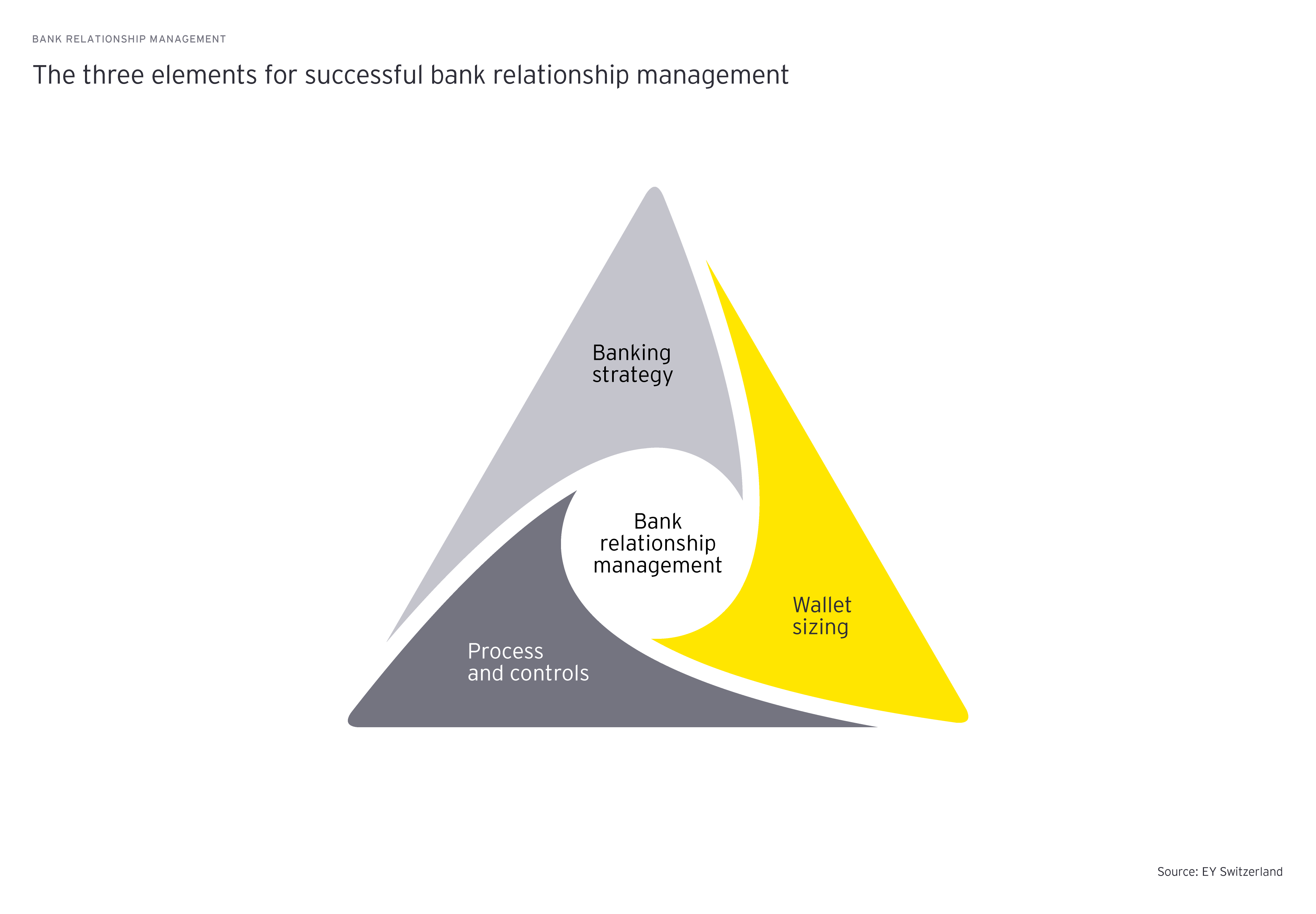

- A solid banking strategy defining the groups’ needs and approach to banks and other financial and non-financial institutions such as FinTechs;

- Robust processes and controls to ensure efficiency and identification of risks as well as appropriate mitigation; and

- Transparent bank fee analysis (wallet sizing) to determine the total amount of business that a company does with its banking partners, allowing companies to manage overall bank spending to achieve a well-balanced banking portfolio.

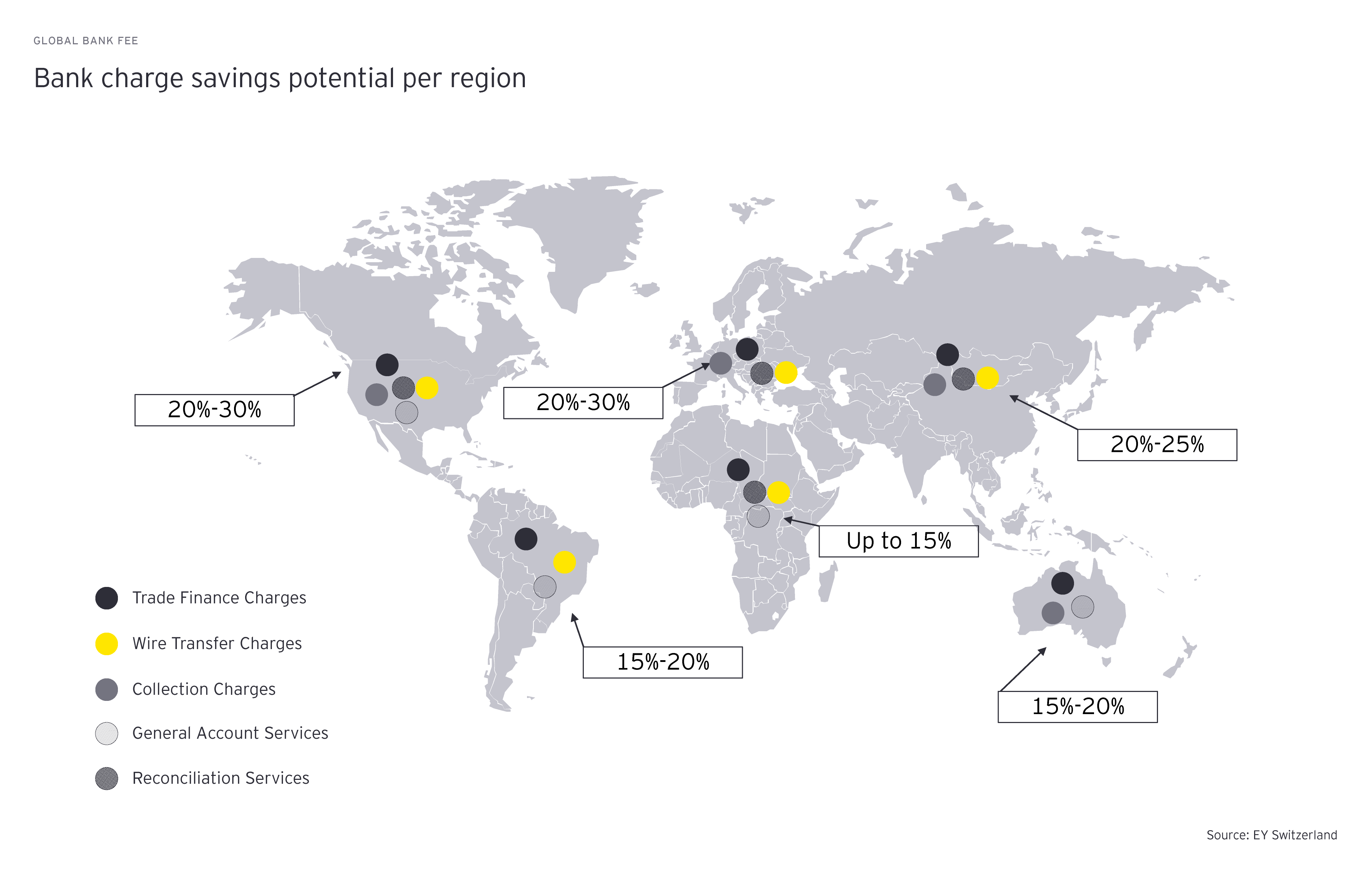

As companies are preparing to accelerate their various transformation goals and seek to double down on their cost-saving ambitions, the third element of successful bank relationship management – wallet sizing – is surprisingly frequently overlooked. Based on our experience, the magnitude of potential savings is often underestimated and substantial savings with limited to no impact on operations can be achieved. With fees that are not aligned to the market norm, which refers to situations where companies are paying significantly more for services than the average market rates, coupled with the lack of visibility and the difficulty in aggregation and analysis, these costs can rapidly accumulate, leading to a considerable impact on a company’s bottom line.

In light of these potential cost savings, this article seeks to show the pivotal role of bank fee optimization. It will explore the challenges companies encounter when dealing with fees not aligned with market norms, as well as the significant benefits that can be harnessed by undertaking a comprehensive bank fee optimization project.

What is Bank fee rationalization?

Bank fee rationalization refers to the process of analyzing, streamlining and optimizing the fees charged by financial institutions for various banking services. By evaluating the fee structure, understanding purchased services and negotiating with banks, companies can eliminate unnecessary charges, achieve better terms and align their banking relationships for their specific needs. This exercise aims not just to slash bank fees to the lowest possible level, but rather to evaluate the relationships in their entirety. It involves careful consideration of “give and take” elements, which can include variables like service quality and credit commitments, with the ultimate goal of establishing a fair and balanced partnership between companies and their financial partners.

Why are bank fees complex?

Visibility of global banking operations poses a challenge to over 80% of companies, and more than 60% are dissatisfied with the clarity of their current bank charges. Consequently, it is hardly surprising that the majority of these companies, over 80% in fact, do not periodically reconcile their bank charges and remain unaware of their wallet size, a figure derived from the volume of transactions and the value of the charges (EY internal global research 2022).

The challenge of assessing bank fees arises from their inherent complexity. There are over 150 different types of bank charges, including, and not limited to, transaction, account maintenance, wire transfer and forex charges that, while typically invisible and discrete, are frequently not explicitly agreed upon with the banks. Oftentimes, these fees are aggregated and packaged into the value of bundled transactions. This bundling significantly complicates the process, making it understandably difficult for companies to carry out any meaningful reconciliation. In addition to the inherent lack of transparency and significant complexity, there is also a notable absence of standardization in the market. Despite the existence of market initiatives aiming to standardize bank fees and to provide corporates with uniform reporting methods (like TWIST BSB, camt.086), these measures have not yet gained widespread adoption and consistent implementation by banks.