EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Limited, each of which is a separate legal entity. Ernst & Young Limited is a Swiss company with registered seats in Switzerland providing services to clients in Switzerland.

Update on Switzerland/France cross border tax and social security agreements

|

Executive Summary

Income tax

An agreement between Switzerland and France, signed at the end of June 2023 to supplement the bilateral double taxation agreement, contains new and permanent taxation rules for employment income from home working. The agreement includes a teleworking threshold authorized up to 40% for all cross-border workers (regardless of cross-border status). Temporary assignments carried out on behalf of the employer in the country of residence or in a third country are considered in calculating the 40% and must not exceed 10 days per year.

Social Security

Switzerland and certain European Union (EU)/European Free Trade Association (EFTA) countries have concluded a new multilateral framework agreement. This agreement allows employees to engage in cross-border telework from their country of residence, up to 49.9% (or less than 50%) of their working time, without affecting their Social Security subordination. If both the employer and the employee reside in a country that has signed the Framework Agreement, they have the option to remain subject to the Social Security scheme of the employer.

France announced its participation in this agreement on 2 July 2023, joining: Germany, Austria, Belgium, Estonia, Finland, Hungary, Ireland, Liechtenstein, Lithuania, Luxembourg, Malta, Norway, Netherlands, Czech Republic, Slovakia and Switzerland. The decision from Italy is still pending. For an updated list of signatory countries, please refer to: Cross-border telework in the EU, the EEA and Switzerland.

Background

As a reminder, taxation of daily cross-border workers depends on where they work. For employees working in a canton where there is no cross-border worker status, the tax treaty between France and Switzerland establishes the principle of taxation in the country where the employee works. If the employee works in a canton where cross-border worker status is granted (i.e., employee generally returns home every day (at least four days per working week for a 100% rate of activity — maximum 45 overnight stays per year outside of the country of residence) and has provided his tax residence certificate (form 2041-AS) to his employer, who must send it to the cantonal tax authorities), the individual will be taxed in his or her country of residence.

On that basis, two different tax regimes apply, depending on the canton in which the employer is located:

- Taxation of wages in the State of employment (no cross-border agreement) — Article 17 of the 1966 Double Taxation Agreement (DTA) between Switzerland and France — Geneva, Ticino, Zurich, Luzern, Uri, Schwyz, Obwald, Nidwald, Glarus, Zug, Fribourg, Schaffhausen, Appenzell Ausserrhoden, Appenzell Innerrhoden, St. Gallen, Graubünden, Aargau and Thurgau

- Taxation of wages in the State of residence — Agreement on the remuneration of cross-border workers of 11 April 1983 — Vaud, Bern, Basel Stadt, Basel Land, Solothurn, Valais, Neuchatel and Jura; cross-border being "any person resident in a State who pursues an activity as an employed person in another State with an employer established in that other State and who returns, as a general rule, each day to the State of which he is a resident"

The signing of this amendment is a further step toward formalizing the solution that Switzerland and France reached on 22 December 2022 regarding the taxation of teleworking for cross-border commuters. The next and final stage will be the approval of this amendment by the Swiss and French parliaments, which will then mark its entry into force. In the meantime, Switzerland and France have agreed to apply the teleworking arrangements in principle until 31 December 2024, based on the temporary agreement of 22 December 2022.

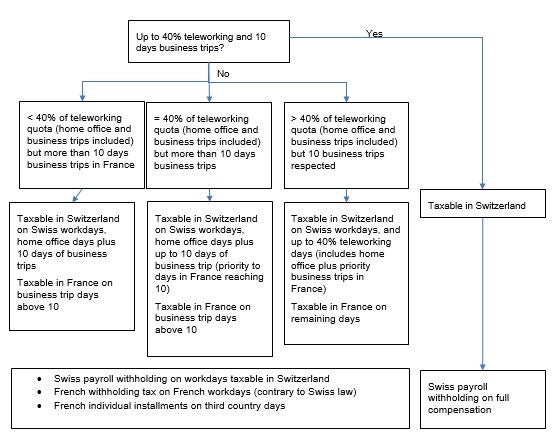

From a Swiss perspective, what are the provisions for cantons without cross-border agreement?

The agreement provides that for up to 40% of teleworking and up to 10 days of business travel outside of Switzerland, the daily cross-border workers will remain fully taxable in Switzerland. In practical terms, this solution means that employers can continue to deduct tax at source in Switzerland as if the teleworking activities carried out in France had been carried out on the employer's premises in Switzerland, thereby avoiding international tax allocation.

Should the teleworking exceed 40%, the exceptional arrangements as negotiated no longer apply; instead, the ordinary provisions of the double taxation agreement between Switzerland and France apply, which means that the portion of remuneration corresponding to teleworking is taxable in France from the first day of teleworking.

Switzerland and France communicated a joint interpretation rule to settle what happens if the 40% limit is exceeded and/or if the 10-day limit for temporary assignments is exceeded. To check whether the 40% teleworking rate is respected, the factors below should be considered:

- If the total is less than or equal to 40% and the temporary assignments do not exceed 10 days, there are no tax implications; 100% of the salary will be subject to Swiss withholding tax, deducted by the employer.

- If the 40% or 10 days of temporary assignments are exceeded, the days of teleworking (excluding temporary assignments) must first be counted as follows:

a. If the teleworking days exceed 40%, the totality of the teleworking days should be taxed in France via the French withholding tax system, by the Swiss employer. Withholding tax on behalf of a foreign state is, in principle, punishable under article 271 of the Swiss Penal Code.

b. If the number of teleworking days amount to less than 40% and the employee has had temporary assignments, the temporary assignments are deducted up to a maximum of 10 days. Employers must give priority to assignments carried out in France before those carried out abroad. Any surplus will be taxed in France under two separate systems:

i. If the surplus relates to temporary assignments in France, it should be taxed in France through French withholding tax by the Swiss employer, which is contrary to Swiss criminal law.

ii. If the surplus relates to temporary assignments in a third country, it will be taxed in France and the tax will be payable directly by the employee (provisional tax installments).

In relation to the impact of exceeding the thresholds, we have summarized below the various scenarios, impact on the tax status and withholding obligations:

Notes:

- The above does not exclude or consider taxation in third countries based on the nature and duration of the business trips in those locations and should be reviewed to confirm the taxation rights.

- While French tax law foresees French withholding tax on the French workdays by the Swiss employer, this is not possible under Swiss law.

- On the Swiss side, to avoid double taxation of the days taxable in France, Federal circular 45 (6.7) defines two methods, either through payroll directly by adjusting the taxable basis based on the number of workdays in Switzerland or through individual tax filing until 31 March of the following year.

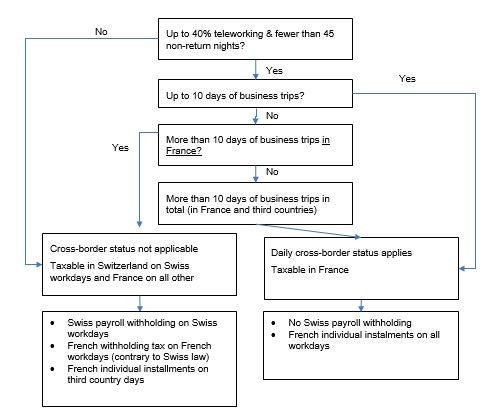

From a Swiss perspective, what are the provisions for canton with a cross-border agreement?

The agreement provides that up to 40% of teleworking, the daily cross-border will remain fully taxable in France (i.e., taxation in the country of residence, with the possibility of spending 45 nights a year outside of the country of residence).

The agreement clarifying the definition of cross-border commuter applies from 1 January 2023 and allows cross-border workers to telework up to 40% of their time without challenging the cross-border status. It is important to point out that these 40% are distinct from the 45 nights spent in the country of habitual employment. Typically, a cross-border commuter working full-time could spend one night a week in Switzerland and at the same time telework two days a week from home.

If the cross-border commuter works more than 40% of the time from home, the individual will have to pay tax in Switzerland on the days worked in Switzerland. The employer will have to make an international allocation of employment income (i.e., taxing in Switzerland the Swiss workdays only).

In relation to the impact of exceeding the thresholds of 10 days of business trips, we have summarized below the various scenarios, impact on the tax status and withholding obligations:

Notes:

- The above does not exclude or consider taxation in third countries based on the nature and duration of the business trips in those locations and should be reviewed to confirm the taxation rights.

- While French tax law foresees French withholding tax on the French workdays by the Swiss employer, this is not possible under Swiss law.

- On the Swiss side, to avoid double taxation of the days taxable in France, Federal circular 45 (6.7) defines two methods, either through payroll directly by adjusting the taxable basis based on the number of workdays in Switzerland or through individual tax filing until March 31 of the following year.

Exchange of information

- Once the amendment has entered into force (expected after 2024), the automatic exchange of salary data will apply to cross-border commuters. According to the provisional text version, the State in which the employer is situated shall annually provide to the employee's State of residence, in electronic format and no later than 30 November of the year following that in which the remuneration has been paid, the individual and nominative information such as: first and last name; birthdate; postal code of residence place and any other information available to facilitate identification of the person (address, place of birth, civil status, tax identification number); the calendar year in which the income is earned; the number of days or percentage of teleworking; and the total gross remuneration paid.

- The Swiss Federal Tax Administration sends the information concerning the employees resident in France directly to the French tax administration and vice versa. The attestation type and modalities of transmission from employers to authorities still need to be defined.

Obligation to certify teleworking days during the transitional period

- The transitional agreements that are valid until end of 2024 specify that the taxpayer should keep at the disposition of the tax authorities the certificate from his or her employer indicating the percentage of time spent on telework or the number of days spent teleworking. Note that, unlike previous agreements, which only mentioned the number of days worked at home, the percentage of working time teleworked is now also mentioned. This provides a degree of flexibility to employers who are not all equipped today to monitor teleworking days in detail. During the transitional period covered by the amicable agreement (valid at the latest until end of 2024), a copy of a telework agreement or employment contract mentioning the authorized rate of telework could constitute a conclusive document.

Defining telework and temporary assignments

Telework refers to any form of work activity in which work that could also have been carried out on the employer's premises is carried out by an employee in his or her State of residence. "State of residence" refers to the entire territory of the employee's State of residence. The definition also stipulates that teleworking must comply with the contractual provisions binding the employee and the employer, which still requires a contractual basis such as a teleworking agreement or a provision in the contract of employment.

The definition is rather broad: as long as telework is provided for contractually (telework agreement or employment contract), it is conceivable that the employee could telework from a co-working place or from a secondary residence, if they are located in his or her country of residence. The agreement also specifies that 40% of telework activity includes "temporary assignments carried out by the employee on behalf of the employer in the country of residence or in a third country, provided that their cumulative duration does not exceed 10 days per year."

Typically, business trips or training courses that a cross-border employee is asked to undertake in France or in another State on behalf of their employer are subject to taxation in France based on the criteria of place of activity (this applies for cantons not covered by the 1983 agreements). Consider, for example, the case of an individual living in Annecy who is asked by his Geneva employer to provide a training course in the United Kingdom (UK) to his UK colleagues of the group to which the Geneva employer belongs.

Accommodation has therefore been provided for this type of case. Whereas previously, the first day on a temporary assignment required an international allocation of employment income, the employer now benefits from a tolerance of 10 days. This avoids exposing the individuals concerned to an international allocation of their remuneration, up to 10 days yearly in any case.

Effect on Social Security

Since 1 July 2023, two regimes are applicable to EU/EFTA and Swiss citizens (third-country nationals not covered from a Swiss perspective):

1. New Framework Agreement extends teleworking possibilities: Teleworker Rules

The new multilateral framework between Switzerland and several EU/EFTA countries, allowing employees to engage in cross-border telework from their country of residence, up to a maximum of 49.9% (below 50%) of their working time, without affecting their Social Security subordination, currently applies to: Germany, Austria, Belgium, Estonia, Finland, France, Hungary, Ireland, Liechtenstein, Lithuania, Luxembourg, Malta, Norway, Netherlands, Czech Republic, Slovakia and Switzerland. A decision from Italy remains pending. For an updated list of signatory countries, please refer to: Cross-border telework in the EU, the EEA and Switzerland.

Important conditions

- Applicability: The Framework Agreement pertains to cross-border commuters, specifically employees working for an employer in one European state while residing in another European state. Both countries must have signed the Framework Agreement.

- Digital connection requirement: The employee should maintain a digital connection (IT link) to the employer's working environment while performing their work. It is important to note that the Framework Agreement is not limited to working from home; work can be conducted anywhere in the residence country as long as a digital connection is established. This IT link must be normally and habitually present but not necessarily during a 100% of the working time (e.g., reading materials or offline grading of tests by a professor). This entails that, as a rule, manual activities outside the employer's premises or business place do not fall within the scope of the definition.

- Limited work activities in other countries: The Framework Agreement appears to allow for limited work activities in countries other than the employee's residence or employer state. Occasional business meetings or client visits to third countries should not hinder the application of the Framework Agreement. Further guidance is expected in this regard.

- Percentage-of-work allocation: The teleworker should spend less than 50% of their working time in the country of residence and the majority of their working time in the employer state.

- Regular rules for non-Framework Agreement situations: For situations not covered by the Framework Agreement, the regular rules apply, including the 25% threshold, or a "regular" Article 16 agreement can be requested.

- Social Security contributions: The employee must have paid social security contributions in the employer's country of residence during the relevant period.

Teleworker A1 certificate under Article 16

The Framework Agreement is optional. Those who wish to avail themselves of its benefits need to apply for an A1 certificate based on Article 16 of Regulation 883/2004. The A1 certificate serves as proof that the social security legislation of the employer state is applicable. The application for an A1 certificate must be mutually agreed upon by the employer and the employee. In the absence of an A1 certificate, the regular rules apply, including the 25% threshold.

The A1 certificate under Article 16 will be issued for a maximum duration of three years at a time (country specific exceptions apply) and can be extended upon request.

2. Applying ordinary Social Security rules: Multistate Worker Rules

EU/EFTA countries that have not signed the new agreement or employers and employees who decide to not make use of the new teleworking rules will revert to the ordinary Social Security rules that were applicable before the COVID-19 pandemic. In such cases, teleworking in the country of residence is possible for up to 24.9% of working time, while the employee remains subject to the Social Security system in the employer's country.

If the 25% threshold is reached or exceeded, employees become subject to the Social Security of their country of residence. This can result in potential Social Security obligations for the employer in employee's residence country.

Next steps

In light of the above, employers should consider implementing tracking tools for the working locations of their employees so these are identified and properly handled from a payroll-tax-at-source withholding perspective. Employers should also consider establishing home-work policies or contractual agreements authorizing home-work (not to exceed the 40% threshold to minimize eventual French tax-at-source requirements for employers) and should communicate to their employees so they are aware of these rules and what do they mean for their personal tax compliance requirements in Switzerland and France.

It will be important for employers to stay informed during the transition period — until the end of 2024 and beyond — regarding further changes and communications on requirements for the tax rules as well as for the A1 application format and process.

For additional information with respect to this Alert, please contact the following:

Ernst & Young Ltd, Geneva

- Hugh Docherty, Partner, Global Mobility Leader, Switzerland

- Sandrine Berrette, Director, Payroll

- César Da Silva — Director, Global Mobility

Ernst & Young Ltd, Lausanne

- Marc Perret, Director, Global Mobility

Ernst & Young Ltd, Basel

- Julia Susan Nicolaus, Senior Manager, Global Mobility

Ernst & Young Ltd, Zug

- Markus Kaempf, Partner, Global Mobility

Ernst & Young Ltd, Zurich

- Gabriella Loosli, Assistant Director

Published by NTD's Tax Technical Knowledge Services group; Carolyn Wright, legal editor

For a full listing of contacts and email addresses, please click on the Tax News Update: Global Edition (GTNU) version of this Alert.