EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

The joint decision Α.1188/2022 (Government Gazette Β 6960/30-12-2022) of the Deputy Minister of Finance and the Governor of the Independent Authority for Public Revenue (IAPR), amended the decision Α.1138/2020, regarding the scope of application, time and process of electronic data transmission on myDATA digital platform.

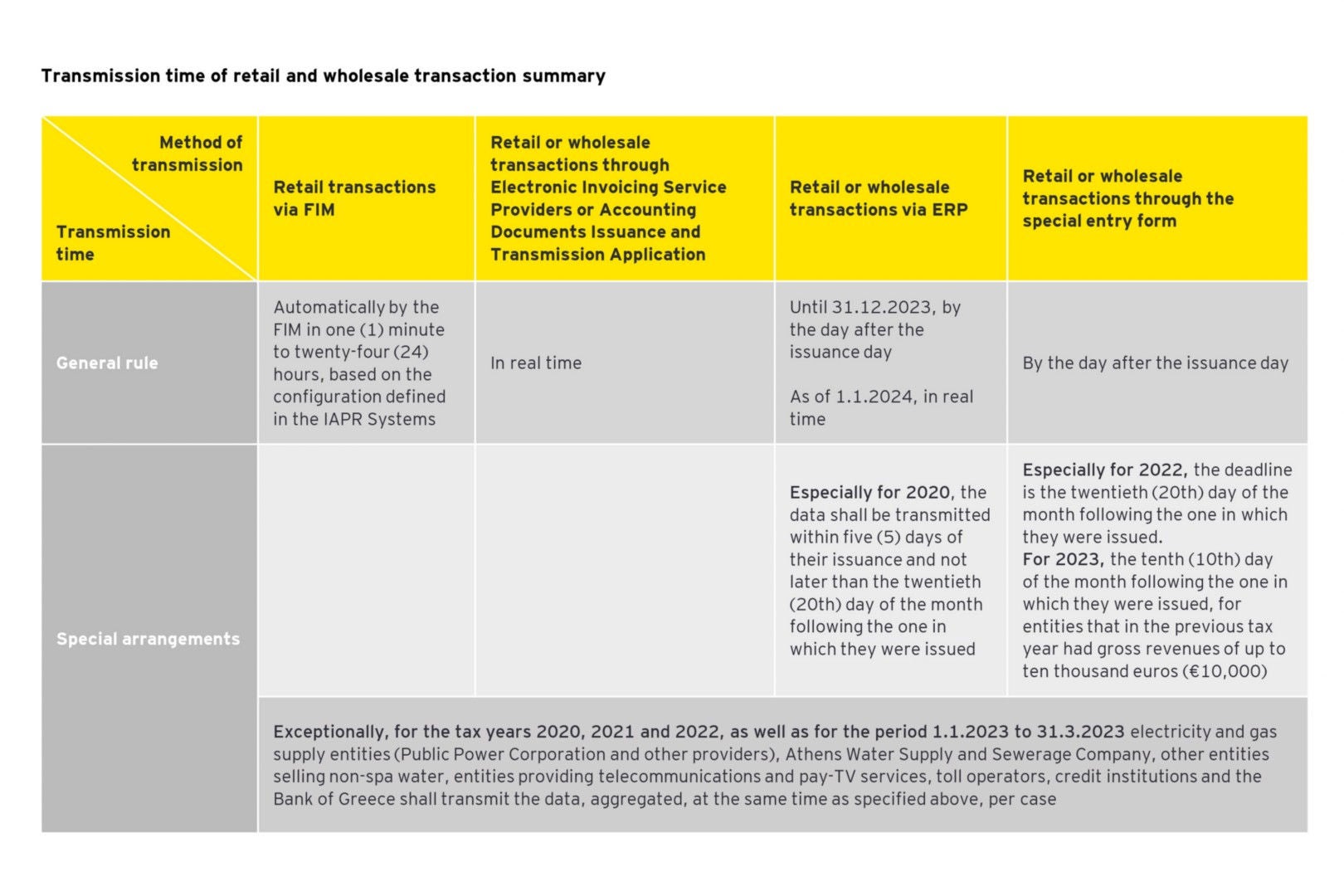

- As of 1.1.2024, the transmission of transaction document summaries through business management software (commercial/accounting, ERP) will be performed in real-time.

- Entities that use Electronic Invoicing Service Providers are not allowed to transmit invoices’ data through any of the other available ways, either for transactions with other entities (B2B), or with the State (B2G).

- The deadline for the transmission of omissions and discrepancies for the year 2021 by the recipients of the documents is extended until 31.3.2023.

- For 2022 transactions, revenues’ data are transmitted until 28.2.2023, expenses’ data until 31.3.2023, omissions and discrepancies until 30.4.2023 and adjusting entries until the filing of the 2022 income tax return.

Α. Transmission of data

Α.1. Obligation to transmit retail data issued via electronic tax mechanisms (“FIMs”) to myDATA platform

The obligation to transmit retail data issued via FIM to myDATA platform is extended for transactions of the period 1.1.2023 to 31.3.2023. Said transmission is performed either in detail or aggregated per month through business management software (commercial/accounting, ERP) or through the special entry form in all cases, i.e. even in those where no discrepancies are identified between the data transmitted by the FIM compared to the retail sales’ accounting entries.

Α.2. Transmission of retail revenues via FIM from hotels

- For year 2023, the hotels operating based on the “hotel day” which book the retail revenues data issued via FIM on a daily basis according to the “Z” opening date of each FIM, irrespective of whether “Z” is issued in the next day (after 24:00), after retrieving said data from myDATA digital platform (in which they will be transmitted through esend according to the provisions of the Decision A.1171/2021), may transmit them in aggregate with a revenue classification 1.95 “Other revenue deadlines provided data”.

- In that case, all the transactions’ summaries and classifications of retail revenues issued via FIM, are transmitted through business management software (commercial/accounting, ERP) or through the special entry form up to the deadlines provided per case.

Α.3. Obligation to transmit data in cases of clearing

- In the case of invoicing revenues (revenue of the company on the basis of invoices issued), and self-invoicing expenses, which arise after the clearing of wholesale and retail transactions (e.g., fees, ticket sales, etc.), it was clarified that the entities that carry out the relevant clearings have the obligation to transmit the data in question.

- In addition, it was clarified that in the case of tickets clearing by the Greek department of the international non-governmental organization IATA (International Air Transport Association) - BSP (Rilling and Settlement Plan), the obligation to transmit the data in question distinctively for their revenues, lies with the airline companies and the general tourism agencies. In the case of cargo clearing by the Greek section of the international non-governmental organization IATA – CASS (Cargo Account Settlement Systems), the obligation to transmit the data of invoicing revenues and self-invoicing expenses rests with the airline companies.

Α.4. Transmission of data through an Electronic Invoicing Service Provider

- It was clarified that especially for invoice data, entities that use Electronic Invoicing Service Providers are not allowed to transmit data pertaining to these documents through any of the other available ways, either for transactions with other entities (B2B), or with the State (B2G), in the context of public contracts.

- At the same time, it was clarified that, in any case, the process of total integration of entities that opt for electronic invoicing may be completed within six (6) months from the effective date in accordance with the relevant contract concluded with the provider of electronic data issuance.

A.5. Time of transmission of summary of wholesale transaction documents (invoices)

- As of 1.1.2024, the transmission of summaries of transaction documents through business management software (commercial/accounting, ERP) will be performed in real-time. It is noted that the transmission of said data until 31.12.2023 shall take place within the next day from the date of the document issuance.

- Furthermore, the transmission deadline for transactions of year 2023 for the entities which had gross revenues of up to ten thousand euros (€10,000) in the previous tax year and transmit the required data through the special entry form, is set on the tenth (10th) day of the following month in which the data were issued.

A.6 Method and time of transmission of revenues based on accounting entries

Especially in the case of transmission of revenues which do not relate to the issuance of a tax document, but to an accounting entry, the data is transmitted with the indication "accounting entry" until the twentieth (20th) day of the following month from the date to which the revenue relates.

A.7. Method and time of transmission of subsidies - grants

- Data pertaining to subsidies - grants are transmitted, with the corresponding indication, until the twentieth (20th) day of the following month from the date to which the revenue relates.

- In particular, for the subsidies - grants of year 2021, the relevant transmission deadline lapsed on 31.12.2022, based on the provisions set out in circular E.2046/2022.

A.8. Obligation to transmit data by the recipient of the goods or services due to non obligation of the issuer

- The aggregated data transmission from electricity and gas supply entities (Public Power Corporation and other providers), the Athens Water Supply and Sewerage Company, other entities selling non-spa water, entities providing telecommunications and pay-TV services, toll operators, credit institutions and the Bank of Greece, is also possible for the period from 1.1.2023 to 31.3.2023.

- From 1.4.2023 onwards, said entities transmit data relating to wholesale transactions in detail by the day after the next from their issuance date. Furthermore, the data of the retail revenue documents that have been issued without the use of FIM, shall be transmitted aggregated per month and until the second day of the following month from the month of issuance.

- Therefore, for the above transactions with these entities, the period during which the specified data are transmitted by the recipient of the goods or services (domestic entity) is up to 31.3.2023.

- It is noted that there was no change in all other cases for which the relevant obligation of data transmission by the recipient exists (e.g., transactions with a non-liable foreign entity, receipt of retail sales documents from Greece or abroad, etc.).

- Specifically, in the case of toll operators, for the transactions of retail revenue of toll documents issued at the toll stations, these are transmitted in aggregate on a monthly basis by the tenth (10th) day of the following month from the date of their issuance.

A.9. Time of transmission of summaries of retail transactions documents that are not issued via FIM

- Entities that do not have an obligation to use FIMs and issue retail documents through business management programs (commercial ERP) which are compatible with myDATA digital platform, transmit the relevant data until 31.12.2023, by the day following their issuance date.

- As of 1.1.2024 the above data is transmitted in real time.

B. Transmission of omissions and discrepancies

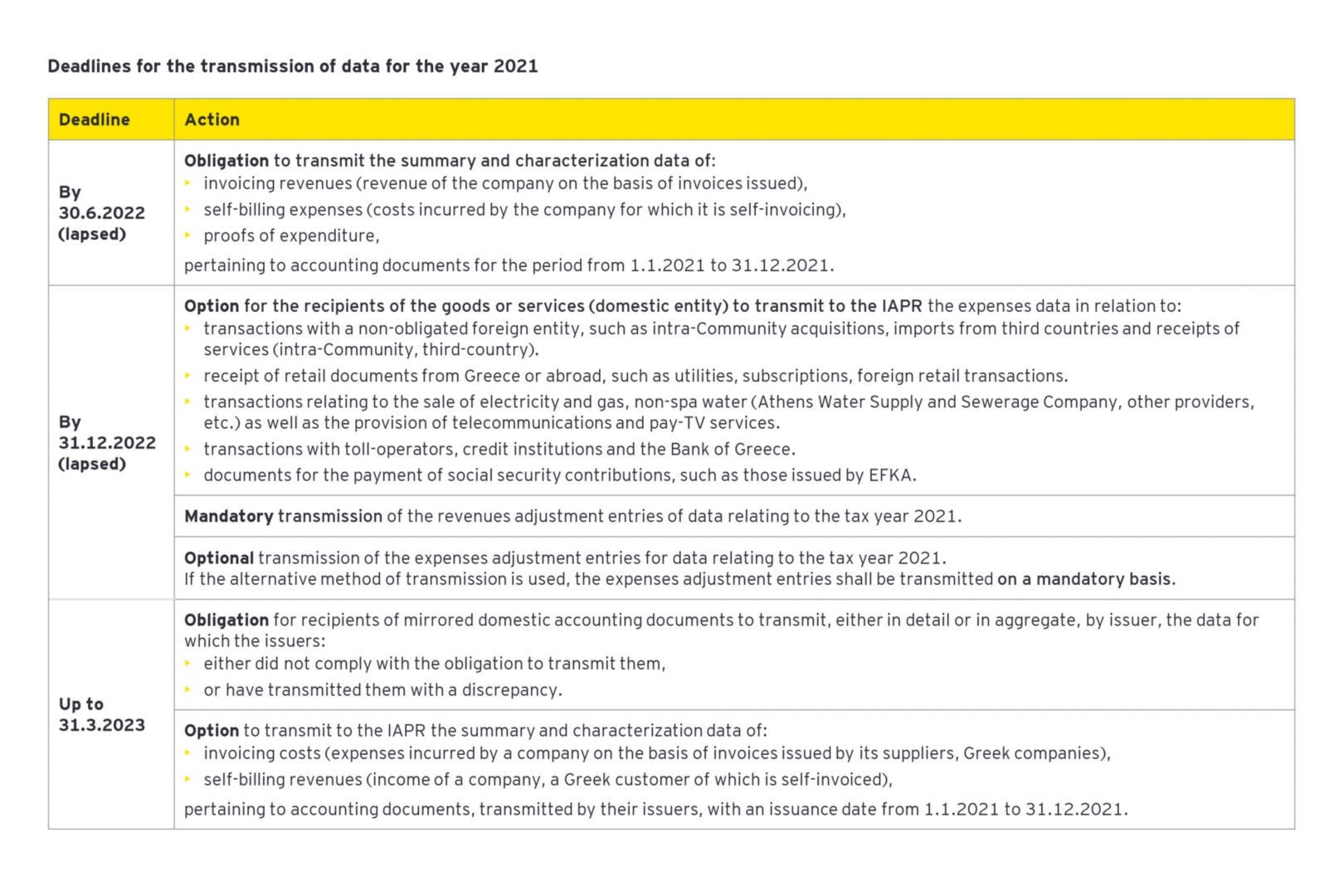

B.1. Deadline for transmission of omissions and discrepancies of year 2021

For year 2021, in the case, either of non-compliance with the obligation

to transmit the specified data by the issuers, or of transmission with a discrepancy, the deadline up to which the recipients of the mirrored domestic documents have the obligation to transmit them, either in detail or aggregated per issuer, is extended until 31.3.2023.

B.2. Non-transmission of omissions for transactions with specific entities

From 1.4.2023 until 31.12.2023, to the extent that the entities do not receive their expenses from electricity and gas supply companies (Public Power Corporation and other providers), Athens Water Supply and Sewerage Company, other entities selling non-spa water, entities providing telecommunications and pay-TV services, toll operators, credit institutions and the Bank of Greece, as mirrored documents of domestic expenses (Document Type A1), they shall continue to transmit them with Document Type of category B2, 14.30 - Entity Documents as indicated by itself (Dynamic) and they will not transmit omission of transmission by the issuers of this case.

B.3. Exclusion of non-profit legal entities governed by private law from the transmission of omissions and discrepancies

For years 2021 and 2022, non-profit legal entities governed by private law do not have the obligation to transmit data for which the issuer has either not complied with the transmission obligation, or transmitted data with a discrepancy.

C. Transmission deadlines

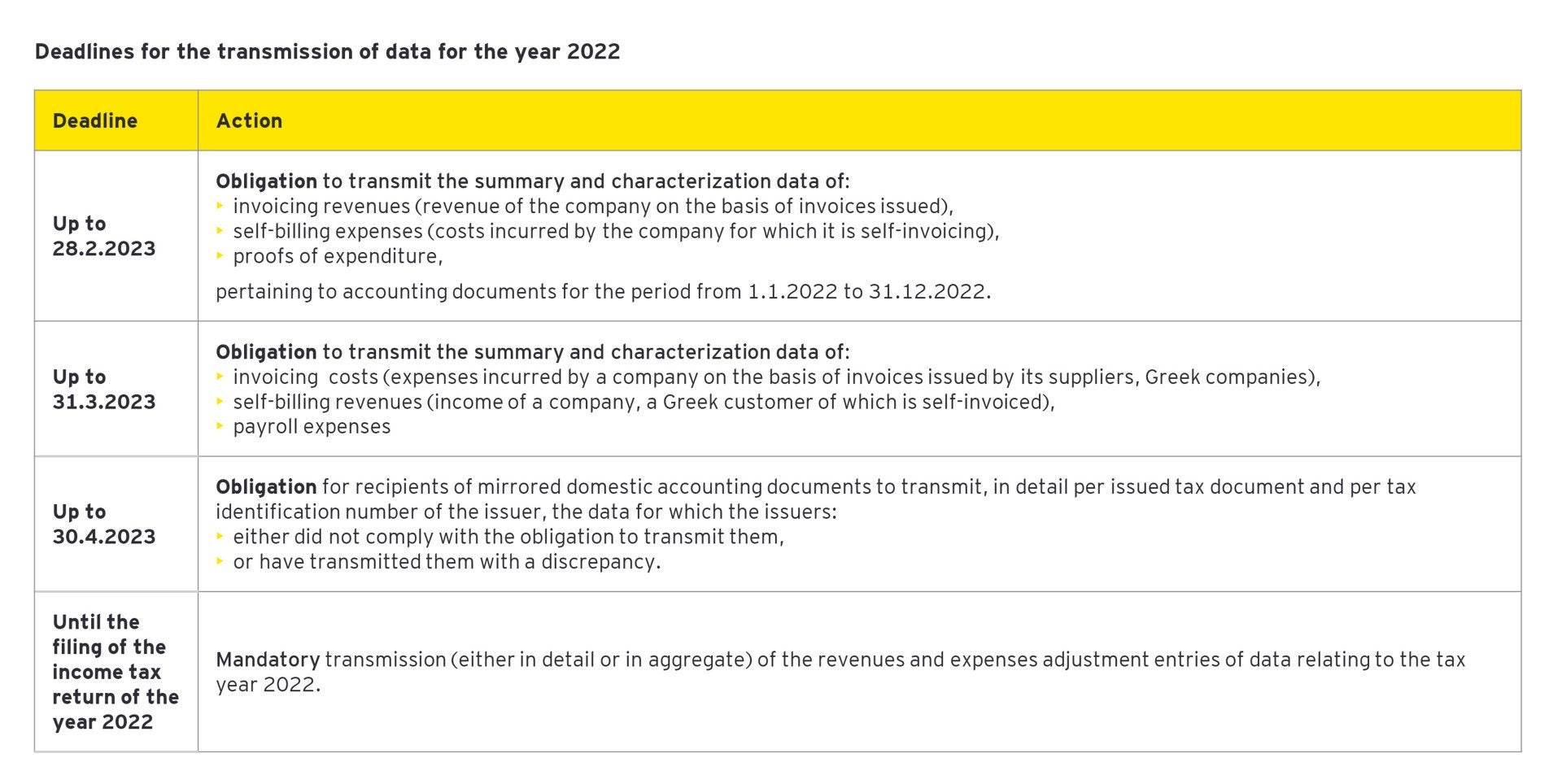

C.1. Data transmission deadlines for year 2022

- the data of invoicing revenues, self-billing expenses and proofs of expenditure are transmitted until 28.2.2023.

- the data of invoicing expenses, self-billing revenues and payroll expenses, are transmitted until 31.3.2023.

- the data in cases of transmission with a discrepancy and omission of transmission by the issuer, are transmitted by the recipient until 30.4.2023. For year 2022, the data are transmitted in detail per issued tax document and per tax identification number of the issuer.

- revenues and expenses adjustment entries are transmitted, either in detail or aggregated, until the filing of the 2022 income tax return.

C.2. Transmission of data from year 2023 onwards

From 1.1.2023 onwards, the data are transmitted to myDATA digital Platform, as defined by the provisions of article 15A of the Tax Procedures Code.

In view of the above, updated tables on the time and deadlines for data transmission are set out below.

D. Other issues

D.1. Clarifications regarding data transmission for 2022

- It is not mandatory to transmit data, related to Document Types 6.1 –Self-delivery Document, 6.2 – Proprietary use Document και 8.2 -Special Document - Proof of Receipt of Residence Tax.

- It is not mandatory to transmit the zero-value documents.

- In any case, the net value and approximate VAT categories shall be correctly transmitted.

- It is not mandatory to transmit other charges (withholding taxes, other taxes, stamp duties, fees and deductions).

D.2. Transmission of data by non-profit legal entities under private law, companies under article 25 of Law 27/1975 and civil non-profit entities

- Non-profit legal entities under private law, as well as the companies of article 25 of Law 27/1975, transmit data exclusively with Document Type 17.4 "Other income settlement records - Tax base", for their total revenues and 17.6 "Other expense settlement records - Tax Base", for their total expenses.

- In any case, they have the obligation to transmit data for the accounting documents that they issue, for transactions subject to VAT, as long as they acquire income from business activity based on the provisions of Law 4172/2013.

- In case they receive mirrored domestic expenses of category A1, they transmit classification of expenses with 2.95 Other expenses information.

- Civil non-profit entities, from the year 2022 onwards, transmit data in accordance with the general provisions.

D.3. QR code on the documents transmitted via ERP

In the accounting data issued, either by using business management software (commercial ERP), or through the Issuance and Transmission of Documents Application which is accessible through the website of IAPR (timologio), there may also be a two-dimensional barcode (QR code), which includes a link for direct access to a digital service of myDATA digital platform for a direct overview in a web browser of the document summary as it has been transmitted. When a document is successfully transmitted to myDATA digital platform (using the SendInvoices method), coded text is returned which is used by business management software to generate the QR code (URL type), through which the document is reviewed.

D.4. Optional transmission of data for certain sectors of small enterprises under the special flat-rate VAT payment scheme

Τhe obligation for data transmission, for the years 2021 up to 2023, becomes optional for entities included in the special flat-rate VAT payment scheme (Article 40 of Law 2859/2000).