The “back to normal” fallacy

Without an effective deployed vaccine or better treatments, we will have to live with cycles of resurgence and potential mutation that could last for many more months, if not years.

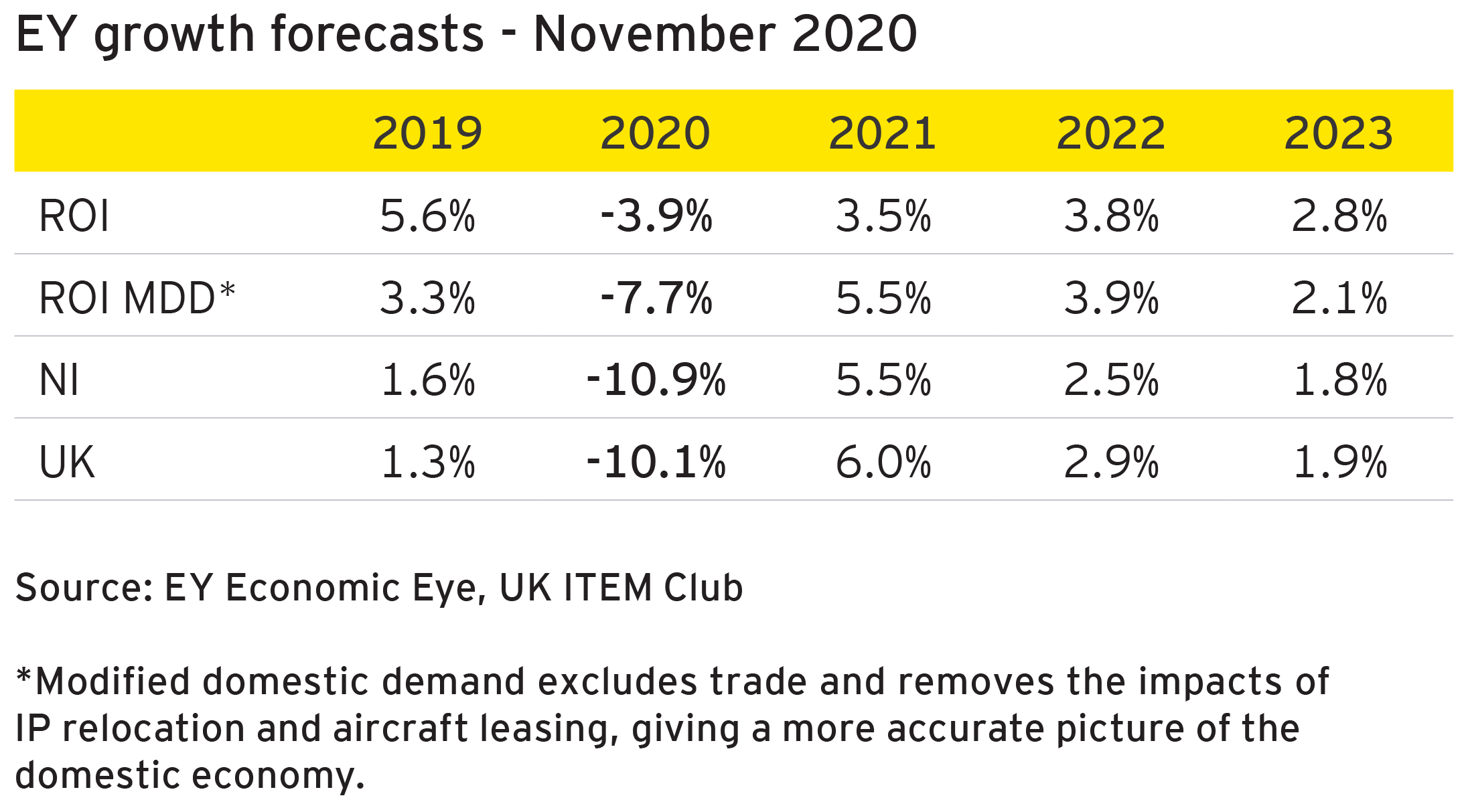

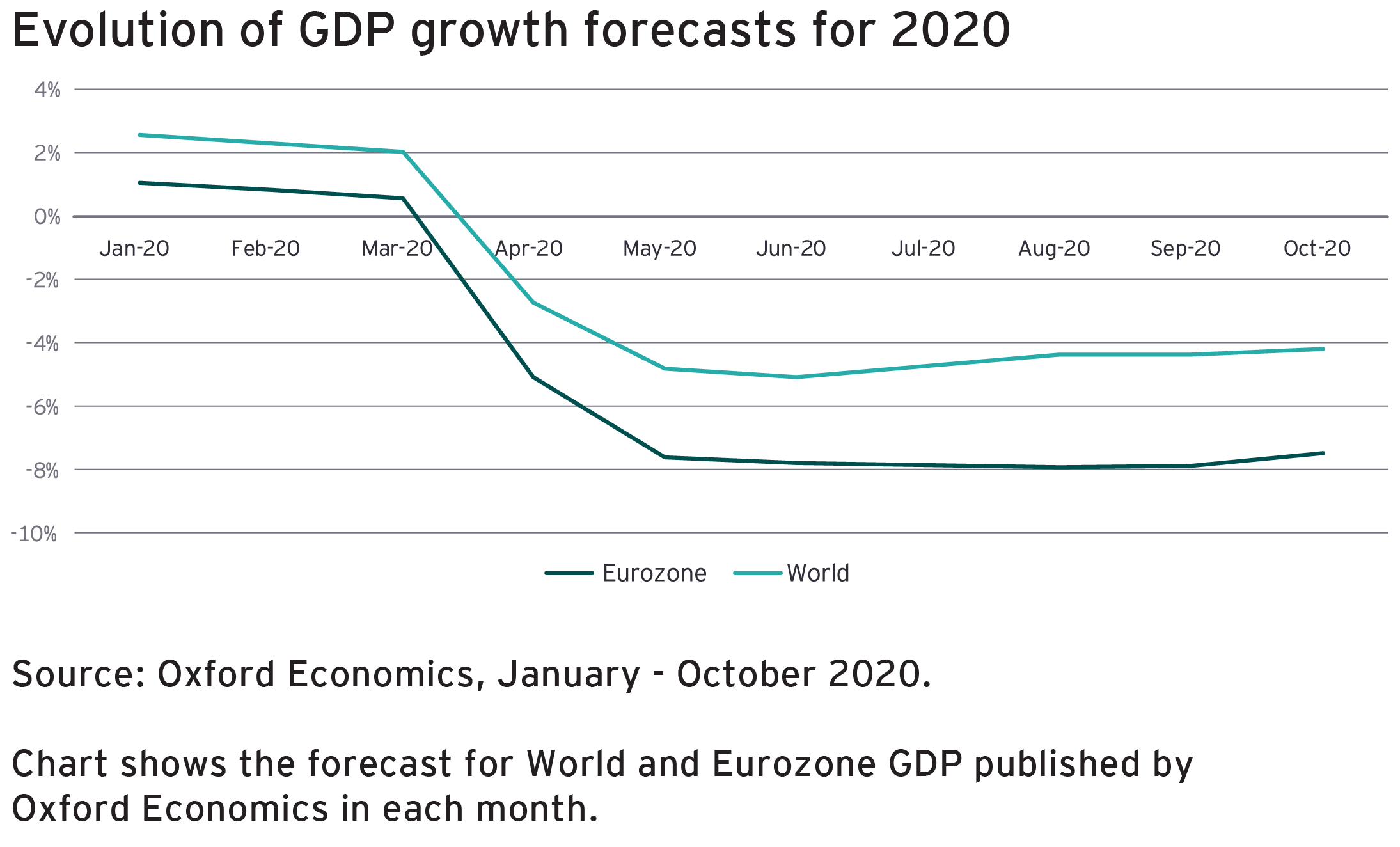

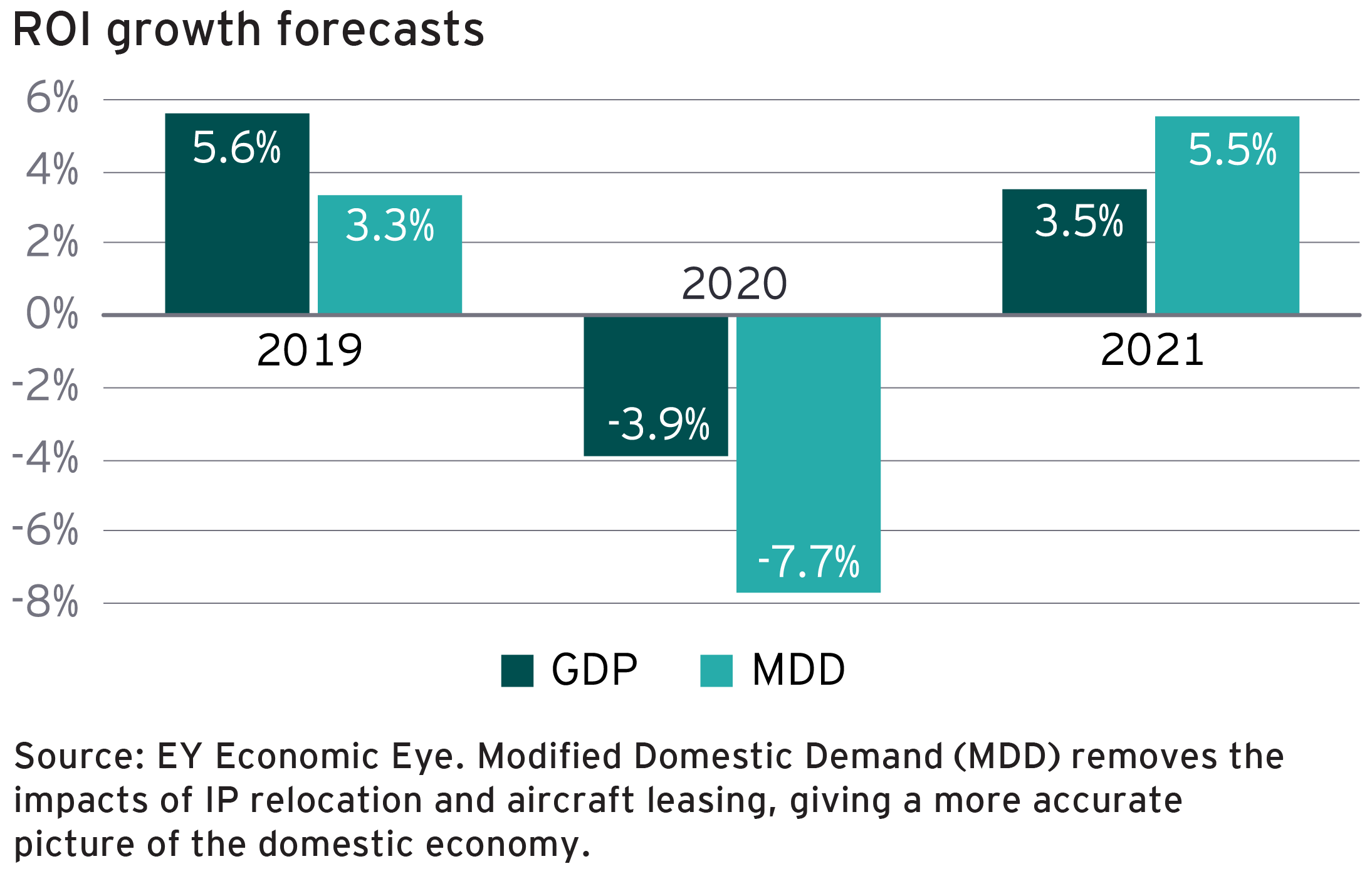

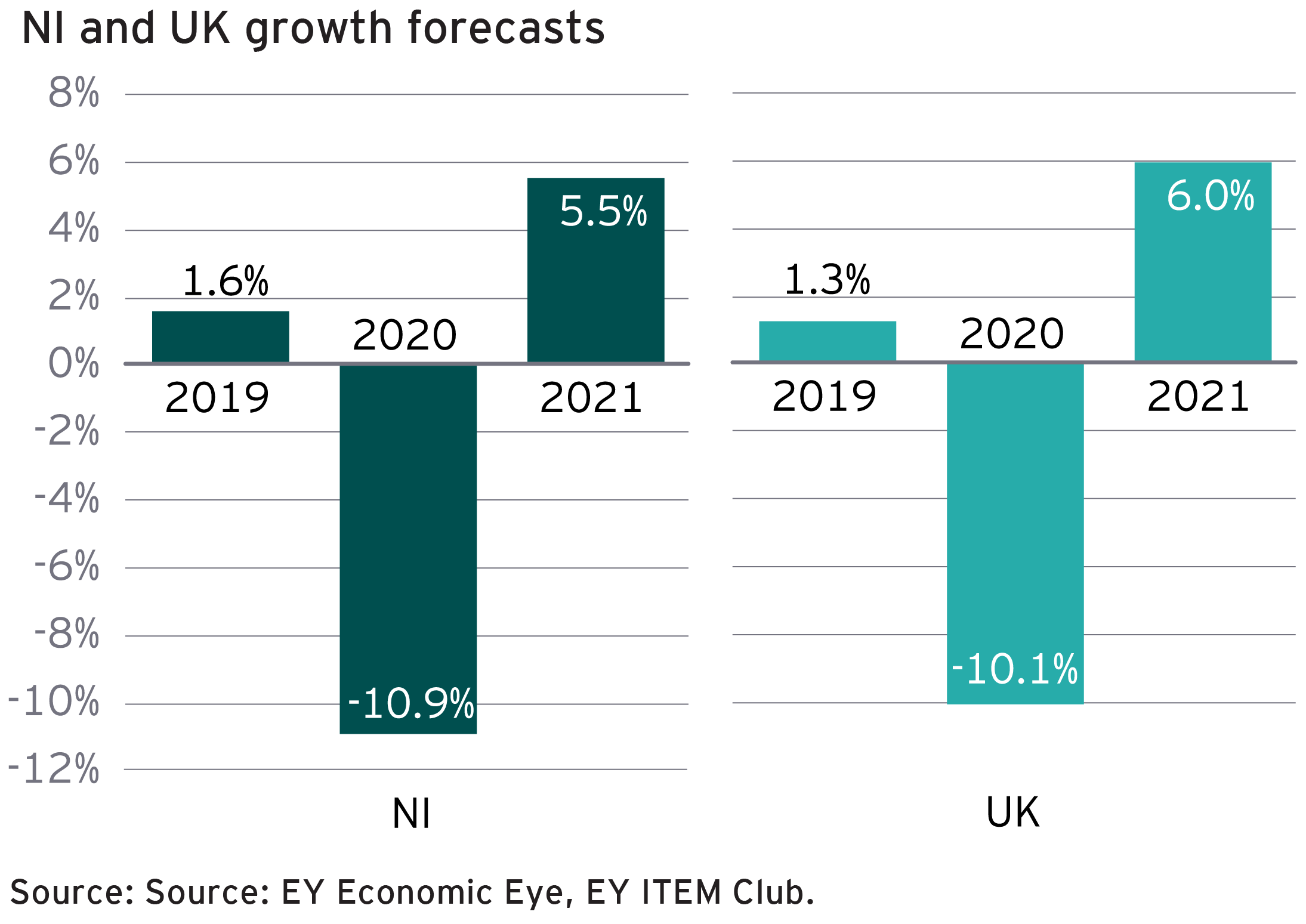

Continual economic shockwaves

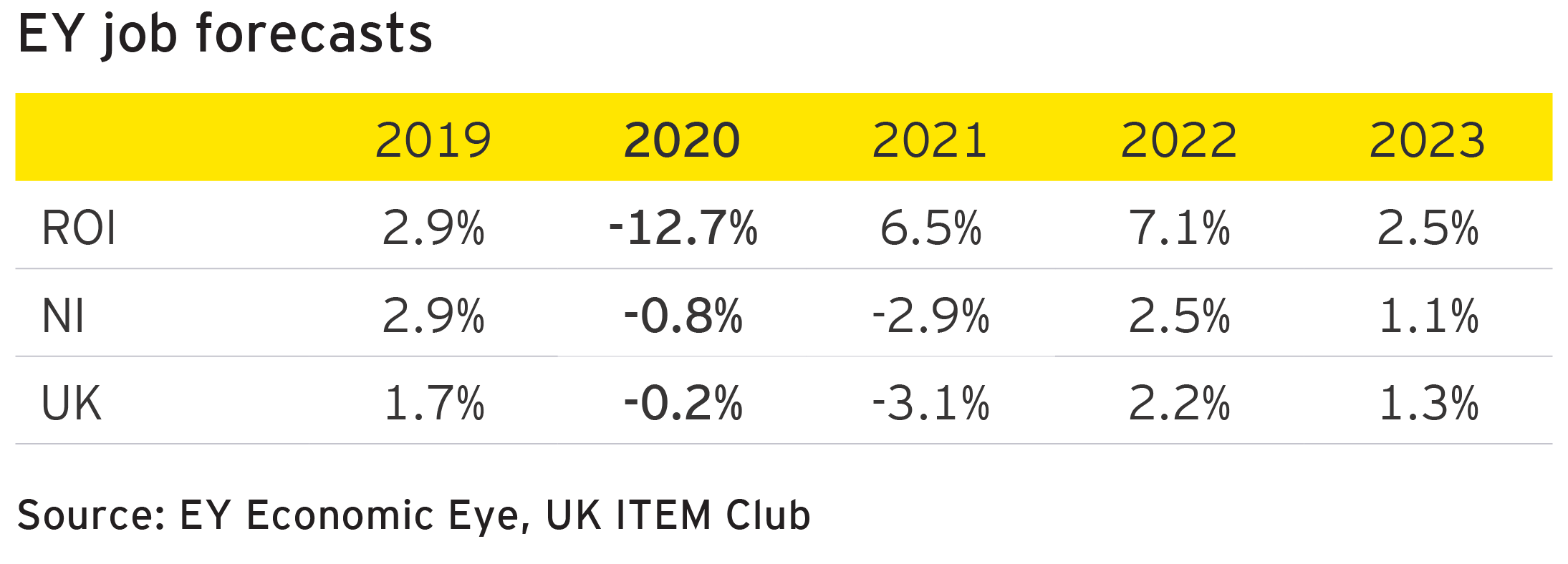

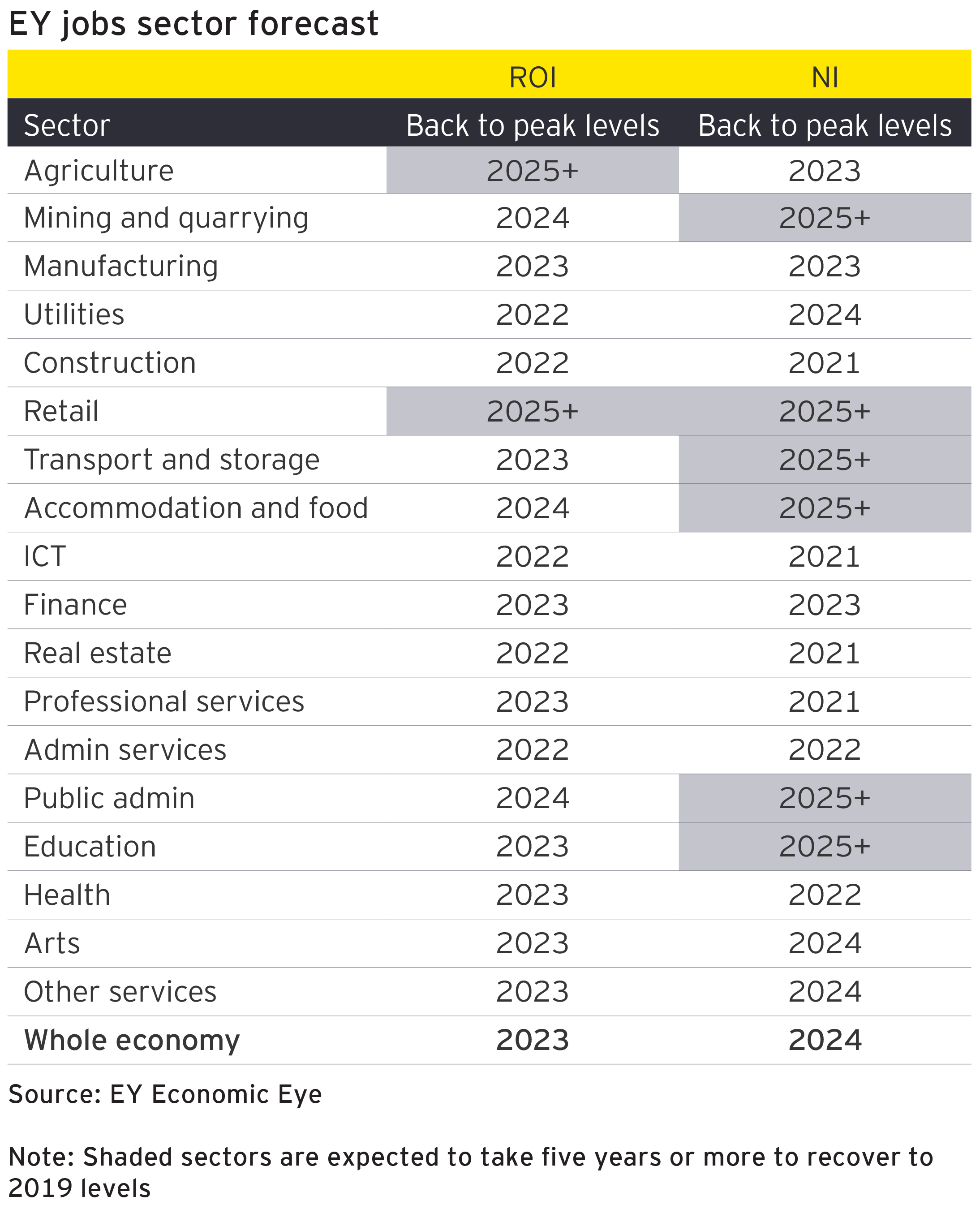

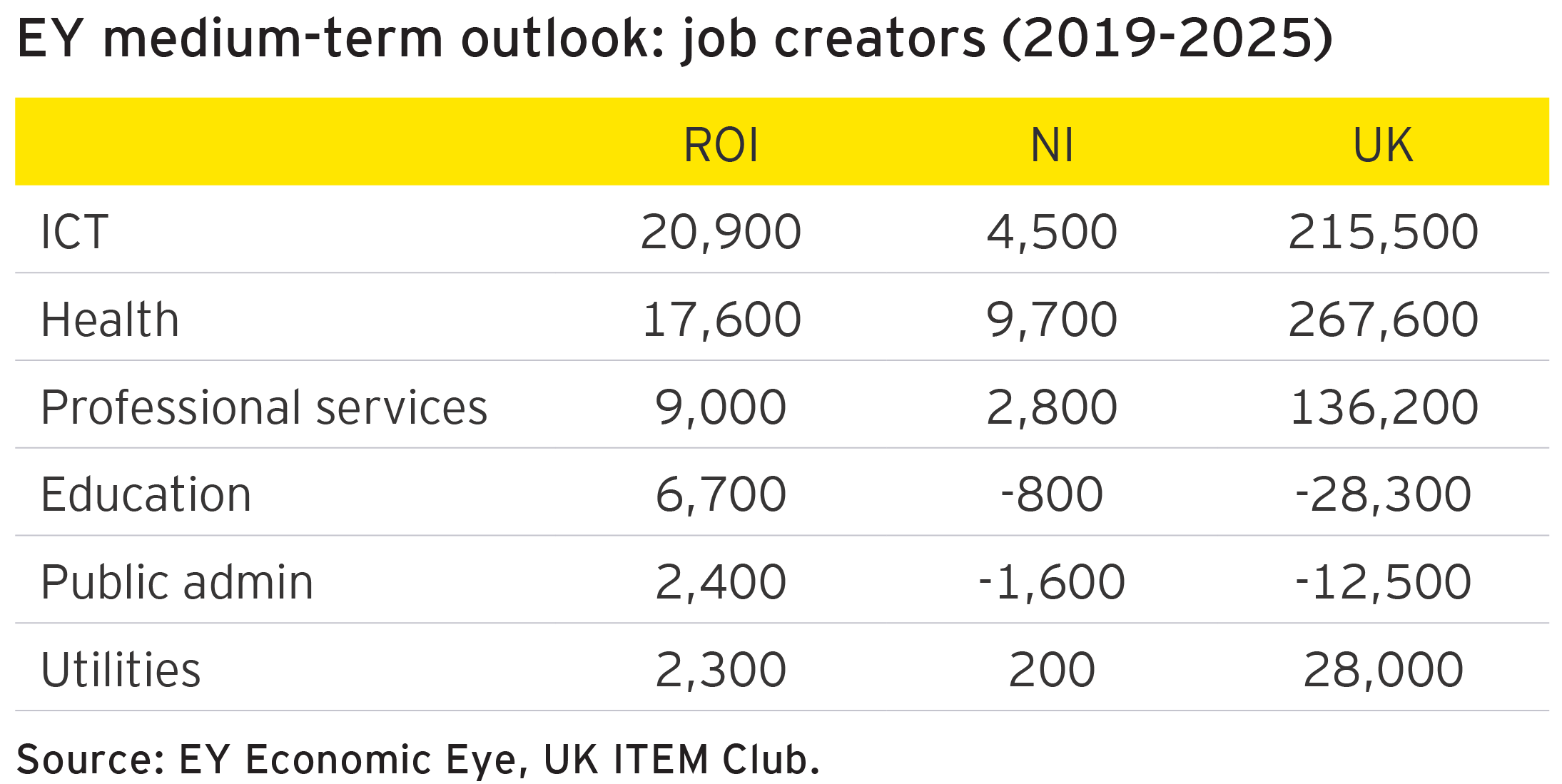

The economic effects of the pandemic vary greatly by industry with retail, travel, hospitality and leisure industries amongst the hardest hit. Government supports are buffering the economic shock, but business leaders are wondering how long can the supports be sustained?

Mass-market digitisation

The lockdowns and social distancing measures have accelerated digital business. These trends were already happening but the overnight shift to digital by the traditionally slow adopter consumer segments has seen a landslide to digital customer interaction and cashless transactions. There has been a surge in uptake by digital first timers and an extension of digital service consumption to a wide array of emerging new services such as medical consultations, fitness training and education.

From quick-fix tech to sustainable solutions

Overall business leaders are relieved at how quickly their organisations have been able to sustain business working from home (WFH). In most cases, their technology was imperfect for a long-term switch and had been designed for partial WFH policies. Investments have been ramped up to implement enduring and secure WFH infrastructure, usually with video and collaboration software.

The people and culture conundrum

Business leaders are universally concerned about the impact of WFH on their employees. The potential effects of isolation and the wider COVID-19 human impacts on wellbeing and mental health are top of mind. Measures to survey and check in on staff have been widely implemented.

Hybrid models for collaboration, innovation and esprit de corps

Leading organisations have been learning from “born on the web” companies who use collaboration technologies to facilitate ideation and design thinking sessions. However, even the most advanced are missing the opportunities to bring people together physically at times.

The future is agile

In a world where physical and virtual meetings are small and short, leaders are looking at ways to divide up the work into more manageable chunks. They see the future as lots of smaller interdependent things being progressed in shorter “sprints” which will require management to learn new ways of co-ordination.

Business and societal convergence

Many business leaders are stepping up to see how they can give something back to limit the wider downside and help emerge well. Community has become more important to employees as they reconnect locally and there is a greater awareness of the environmental consequences of a commuter-based model. There is a recognition that the burden of restarting the economy cannot rest entirely with government. Businesses can invest in creating jobs, apprenticeships, reskilling and education to the benefit of society as a whole. Big business has a role to play in helping small and medium businesses.