OFS companies must consider innovative strategies, business models and measures for cost reduction and performance improvement to ensure that the oil and gas industry remains attractive.

Structural change is an imperative

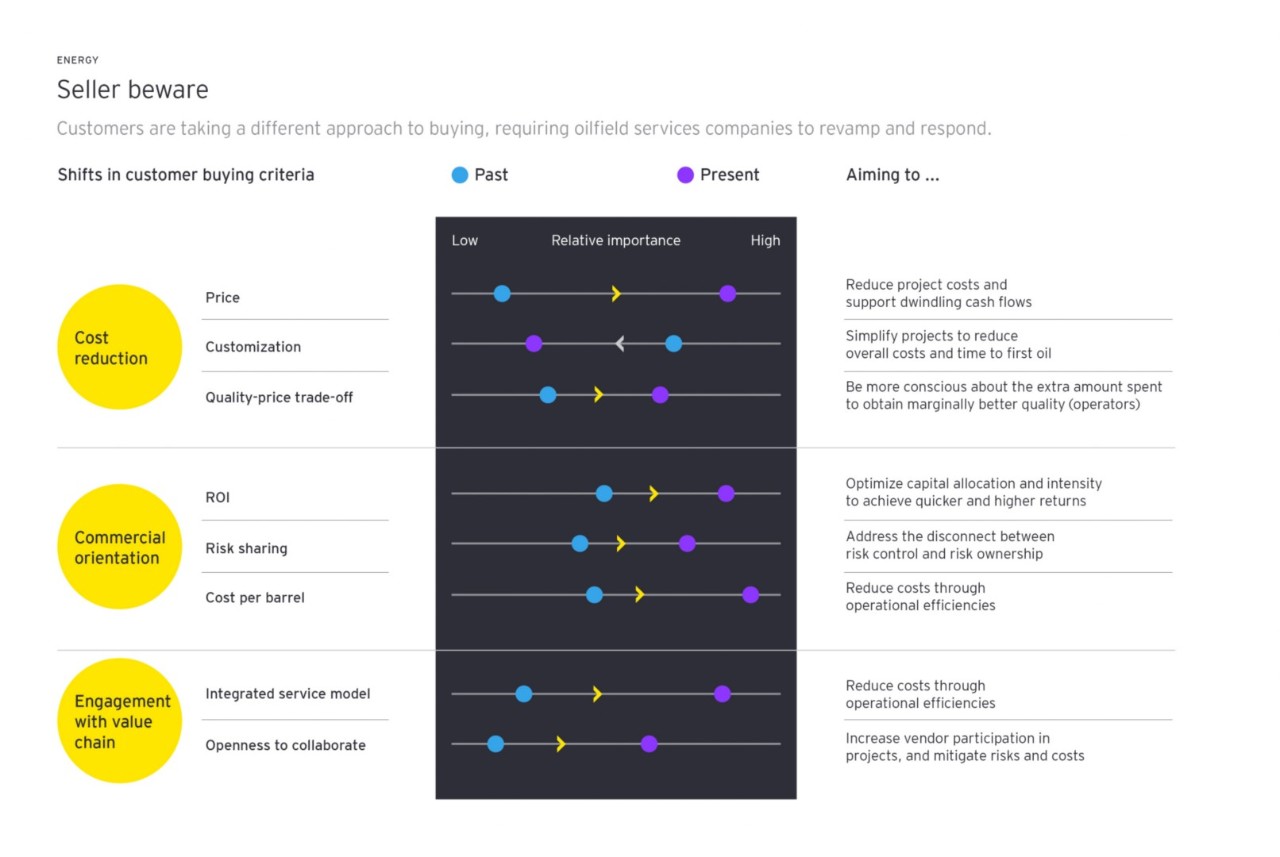

In an era of high oil prices, costs and risk considerations were a lower priority than bringing oil to the market. This encouraged an increase in upstream project complexity, resulting in a disproportionate rise in risks that the operators owned and the service companies controlled. The prolonged downturn exposed the vulnerability of such practices for project sanctioning and contractor engagement strategies. Operators have addressed this by reallocating risks and focusing on cost control and productivity optimization. As a result, OFS companies are under tremendous pressure to respond to the growing need for structural cost reduction and changes in their customers’ buying criteria.

The value proposition is at the crux of transformation

OFS companies must transform their value propositions if they are to bring about structural change and align their offerings with the changing buying criteria. This will be possible through:

Commercial innovation and transformation of existing offerings

This can mean investing with the customers, shifting toward opex-based pricing models and focusing on outcomes.

One-stop shop and more integrated, standardized and modular solutions

This involves OFS companies and operators shifting from serving as solution providers to business partners.

Widespread adoption

This means initiatives need to be implemented across the organization as a whole, not in silos.

The upside associated with implementing these models is significantly higher than the risk associated with cost overruns.

Three innovative commercial models

Model 1: Invest with the customer: take quasi equity positions

In this model, OFS companies deploy capital in the project in the form of products, services, technologies and finances, and the companies’ returns are linked to the project’s success in the form of equity profit share or hydrocarbon share.

Customer benefits

- Lowers development risk for the customer, as the OFS company absorbs greater risk

- Improves project’s sanctioning attractiveness because of lower risk and reduction in customer’s initial capital outlay

- Enables customer to retain asset ownership (in case of nonworking interest of the OFS company)

- Accelerates learning by aligning interests and ensuring that operators and suppliers collectively improve performance

Model 2: Opex-based pricing models: leasing or renting

In this model, OFS companies rent out an asset for a specified time frame while being responsible for asset-related costs and performance.

Customer benefits

- Reduces up-front capital investment by converting the customer’s capex outlay to opex

- Lowers customer’s operating expenses, as they do not pay for downtime

- Improves performance on ROI ratios such as return on capital employed (ROCE) and return on assets (ROA)

- Incentivizes the OFS company to improve performance

Model 3: Outcome-based models: payments linked to performance

In this model, OFS companies provide products and services with payment linked to performance metrics such as equipment uptime and production.

Customer benefits

- Reduces upfront costs for customers

- Partly transfers project risks to the OFS company and incentivizes it to improve performance

- Reduces hidden costs and time, as performance, not adherence to the service-level agreements (SLAs), is the sole focus

- Improves performance

Variance in risk and reward relative to value proposition

The combination of integrated solutions and outcome-based pricing models can significantly strengthen the value proposition and increase the earnings or profitability potential, relative to the increase in risk. This means the upside associated with implementing these models is significantly higher than the risk associated with cost overruns. This is due to: aligned interests and increased transparency and trust across the value chain; enhanced ability of the value chain to control outcomes; and compelling value proposition for operators.

Determining purpose and play

Value chain characteristics

Supply chain competence

Our proposed models are most likely to be successful on opposite ends of the supply chain competence spectrum.

- Competent and developed supply chain. A competent supply chain allows companies to be in control of their performance and the outcome, making risk- and production-sharing models feasible.

- Complex markets with an underdeveloped supply chain. Providing solutions across the supply chain in a complex market could fill the capability gap and serve as a reason for OFS companies to provide not only turnkey solutions, but also performance-based pricing models.

Characteristics of E&P companies

Companies with the following characteristics will be most attractive:

- Tier Two companies with upcoming field development projects. Many Tier Two companies have experienced challenging financial health and limited access to capital. Joint risk/reward and funding opportunities would help address these challenges.

- Private equity (PE) ownership. E&P companies with significant PE ownership place greater emphasis on life extension and pure financial return KPIs such as return on capital employed (ROCE). This opens the opportunity for partnering, offering larger packages of service, and sharing risk and value plays.

- National oil companies (NOCs). Mature NOCs are vertically integrated, have capabilities across the value chain and are typically willing to pay a premium for convenience. Conversely, immature NOCs typically lack certain capabilities, making them more likely to pay a premium.

History of collaboration

A history of collaboration through either industry clusters or joint efforts in product or service development ensures not only trust and transparency, but also strong networks across the industry. This will serve as a key driver for establishing new partnerships.

History of innovation

Certain plays and regions have a history of innovating and being at the forefront of technological enhancement. Our proposed models are more likely to be adopted in such plays because the operators are open to change.

Risk

Asset characteristics

As with the supply chain positioning factor highlighted earlier, being at either of the opposite ends of the risk profile spectrum is most attractive for OFS companies.

- Short-term plays. OFS companies are likely to prefer plays that allow them to quickly go to market and have a short-term developmental outlook. Challenging markets create pressure for short sales cycles, as companies have limited cash and want to reduce uncertainty and risk, which also enables them to be flexible. Investors are also interested in plays with shorter-term outlooks.

- Ultra-long-term plays in complex regions. Regions with a long-term outlook are attractive for OFS companies because there is room for a large company to develop a long-term partnership while building infrastructure, society and supply chains. However, this also presents greater risks.

- Limited reserve complexity. Low-risk plays, such as shales, are more likely to be preferred than higher-risk plays, such as deepwater projects. However, the superior technical capabilities of certain OFS companies can make higher-risk projects more attractive.

Complexity and political and regulatory stability

As above, projects on opposite ends of the political and regulatory spectrum are likely to drive success, per our proposed models.

- Stable political and regulatory environment. Most companies think long-term when entering partnerships and making investments. Companies are, therefore, more likely to invest in plays where the overall outlook is stable and where good infrastructure and other inputs are guaranteed.

- Complex regions with limited infrastructure. The need to build infrastructure enables OFS companies to increase their strategic importance across E&P and country development. Their role could entail infrastructure, societal and people development, and use of local content tailored to regions. Such plays provide an opportunity for a conglomerate of OFS companies to offer full-scale packages.

Financial feasibility

Access to capital

Access to capital is important because OFS companies need the financial strength and balance sheet to enter into alternative financing models. Capital availability depends on investor and lender sentiment, which varies across plays.

Low break-even point

Plays with a low break-even point are economically the most feasible because they are less likely to be canceled or deferred, while the profitability is high. Hence, such plays present limited risk for OFS companies.

Summary

In response to a changing market, operators must make structural changes. While none of these is one-size-fits-all, many are finding success with: alternative commercial models; a shift from capex- to opex-based pricing models; offering of performance-based contracts; and more. The shift requires transforming the operating model and developing a set of capabilities to ensure commercialization and profitability.