EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

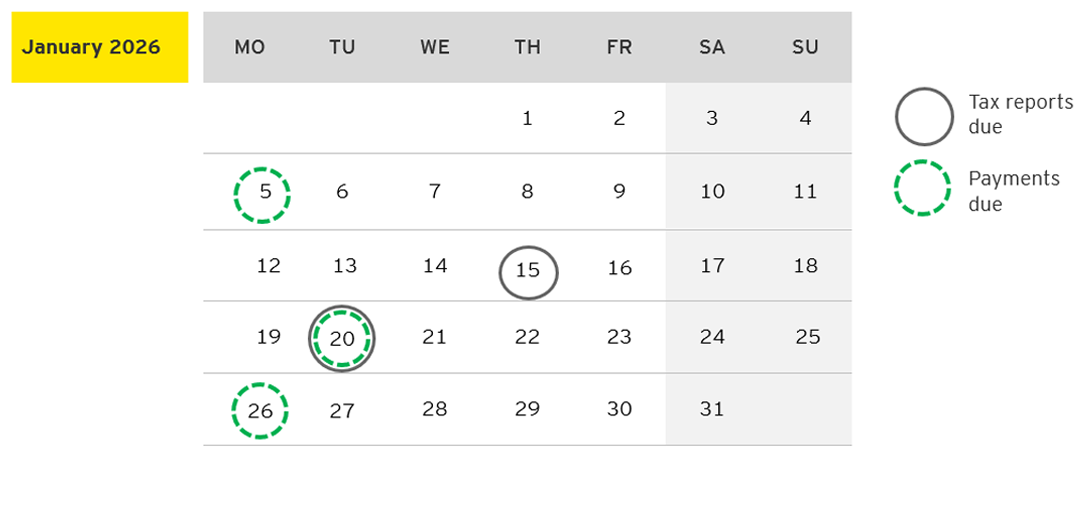

We bring to your attention a summary of the monthly compliance obligations for companies doing business in Kazakhstan - "Taxpayer Calendar", January 2026.

Tax reports due |

||

|---|---|---|

|

Deadline for submission |

Name of report |

Tax period |

|

15 January |

Excise duty declaration |

Q4 |

|

20 January |

Declaration on the payment for negative environmental impact (applicable to operators of objects of categories I and II, with the total annual payments of up to 100 MCI, upon receipt of a permit document in December 2025) |

2025 |

|

20 January |

Application for the import of goods and the payment of indirect taxes |

December |

|

20 January |

Calculation of current payments for the use of land plots (if a contract for temporary fee-based land use was concluded or a license for exploration or extraction of solid minerals was obtained in December 2025) |

2025 |

Payments due |

|||

|---|---|---|---|

|

Deadline for payment |

Name of payment |

Period for which payments are due |

|

|

5 January |

Personal income tax on income of persons engaged in private practice (private notaries, private bailiffs, lawyers, professional mediators) that was received in December 2025 |

December |

|

|

20 January |

Excise duty, including the excise duty on imported goods from the Eurasian Economic Union countries |

December |

|

|

20 January |

Payment for negative environmental impact: purchase of pollution permits by operators of objects of categories I and II, with the total annual payments of up to 100 MCI (when a permit document is issued in December 2025) |

2025 |

|

|

20 January |

Import VAT on goods imported to Kazakhstan from the Eurasian Economic Union countries |

December |

|

|

26 January |

Advance payment of corporate income tax |

January |

|

|

26 January |

Pension fund contributions withheld at the source of payment made to employees as well as individuals providing services under independent contractor agreements |

December |

|

|

26 January |

Obligatory social health insurance contributions made to the State Social Health Insurance Fund by employees as well as individuals providing services under independent contractor agreements |

December |

|

|

26 January |

Single payment |

December |

|

|

26 January |

Individual income tax on the income of an individual entrepreneur applying a special tax regime via a special mobile application |

December |

|

|

26 January |

- foreigners and stateless persons sent to the RK by a non-resident legal entity that is not registered as a taxpayer in the RK |

December |

|

|

26 January |

Individual income tax withheld at the source of payment |

December |

|

|

26 January |

- non-resident individuals from sources in the RK, including income from activities in the RK under a labor agreement (contract) concluded with a resident or non-resident who is an employer |

December |

|

|

26 January |

Corporate income tax withheld at the source of payment made to residents |

December |

|

|

26 January |

Corporate income tax withheld at the source of payment made to non-residents |

December |

|

|

26 January |

Mandatory Employer Pension Contributions (MEPC) calculated on income paid to employees |

December |

|

|

26 January |

Mandatory Occupational Pension Contributions (MOPC) calculated on income paid to employees |

December |

|

|

26 January |

Obligatory social health insurance contributions made to the State Social Health Insurance Fund |

December |

|

|

26 January |

Payment for the use of radio frequency spectrum by foreigners, stateless persons and non-resident legal entities not operating in the Republic of Kazakhstan and not registered as taxpayers of the Republic of Kazakhstan, upon receipt of a permit in December 2025 |

December |

|

|

26 January |

Payment for the use of land plots: at the expiry of the contract for temporary reimbursable land use or its termination in December 2025 |

For the actual period of land use in 2025 |

|

|

26 January |

Payment for outdoor (visual) advertising |

January |

|

|

26 January |

Social contributions to the State Social Insurance Fund |

December |

|

|

26 January |

Social tax |

December |

Other reports due

Kazakhstan legislation stipulates other types of reports (e.g., statistical reports, reports of the taxpayers that are subject to monitoring, etc.) due for filing with the appropriate authorities. There are also other tax payments to the budget with specific payment and filing deadlines. The volume and content of the reports and payment deadlines are determined depending upon the activities performed by an entity. Please contact EY if you require information on other types of reports.