As we enter the holiday period, the mood of consumers is subdued. What does this mean for retailers?

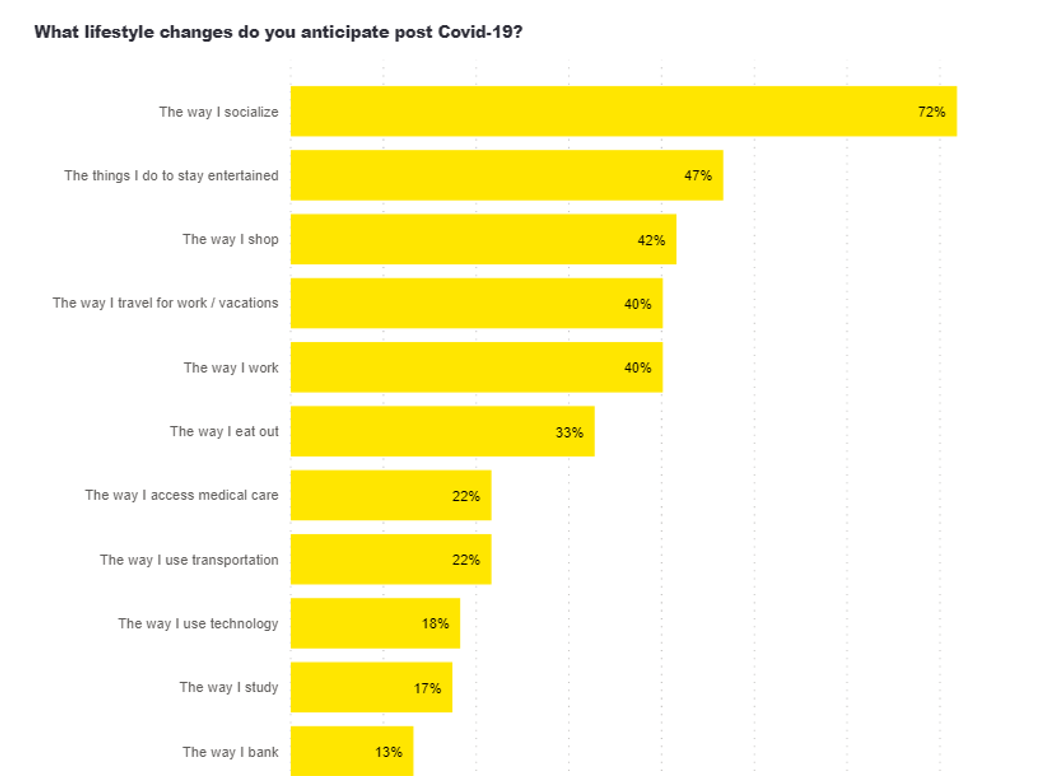

In the short-term, retailers need to review their marketing strategies to ensure they can maximise the opportunities of what could be a dramatic reduction in spending. Online campaigns and capacity need to be maximised; and the technological and fulfilment infrastructure needs to adequately support online demand.

In the longer term, the online experience needs to be enriched with easy access to expert advice so that retailers can replicate the in-store benefits of physical engagement with both products and staff. Fashion retailers, for example, have started to respond to this trend with online stylist advice. Categories such as technology have an even greater opportunity to engage their customers through tactics such as video calls with consumers to help them choose the right product.

To ensure the customer is not lost to a slicker experience elsewhere, physical retailers need to ensure they have: a well-thought-out product range; the option of expert, instore advice (perhaps with appointment bookings); and the ability to convert and seamlessly fulfil demand that best suits the customer - either through immediate pick up in store, same day collection, or delivery to home.

Retailers must also focus on building the organisational agility to pivot their offer and channel mix to the changing consumer. Are they reacting to customer needs? Have they taken cost and complexity from stores and truly simplified to focus on what the customer wants? Have they maximised their capabilities online?

Retailers cannot afford to stay still in this constantly changing consumer market. What would have been a 10-year transition has happened in less than a year, and retailers need to act now with agility and focus. Doing so now will maximise their chances of thriving into Black Friday and Christmas and taking advantage of future growth opportunities as we head into 2021.

Methodology

The Malta Future Consumer Survey was carried out in the first week of November 2020 with a stratified random sample. The survey will be conducted periodically to capture changes in consumption.