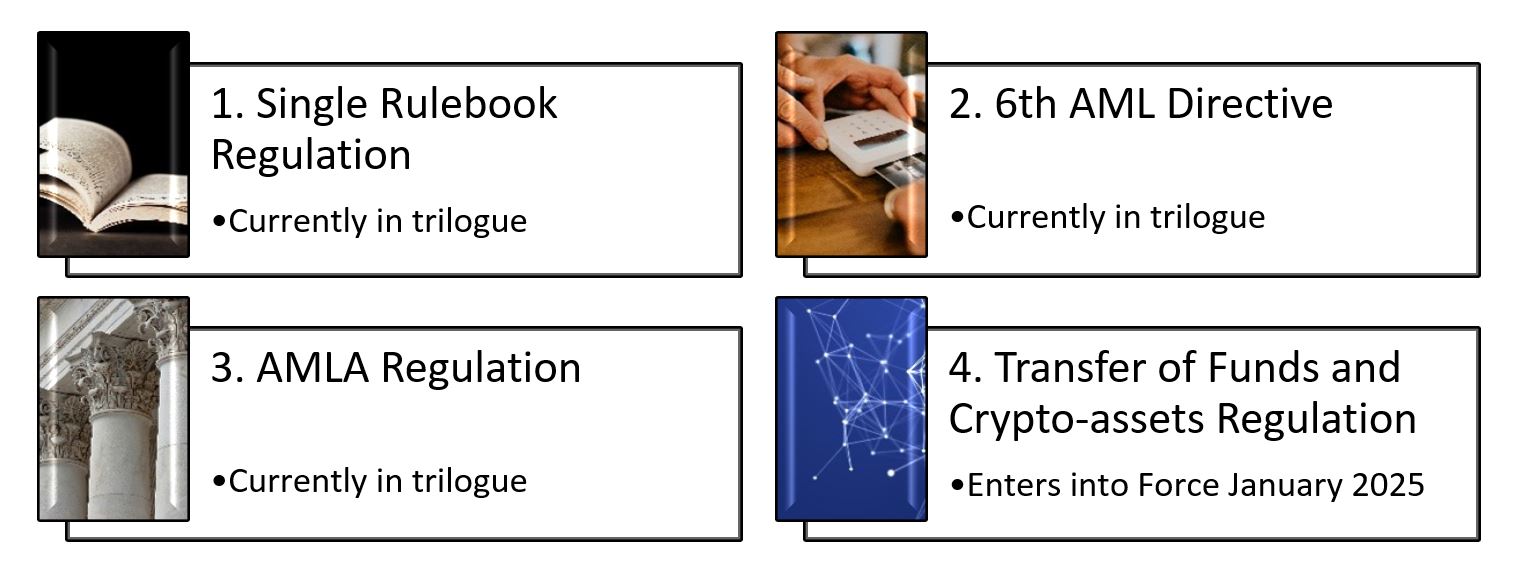

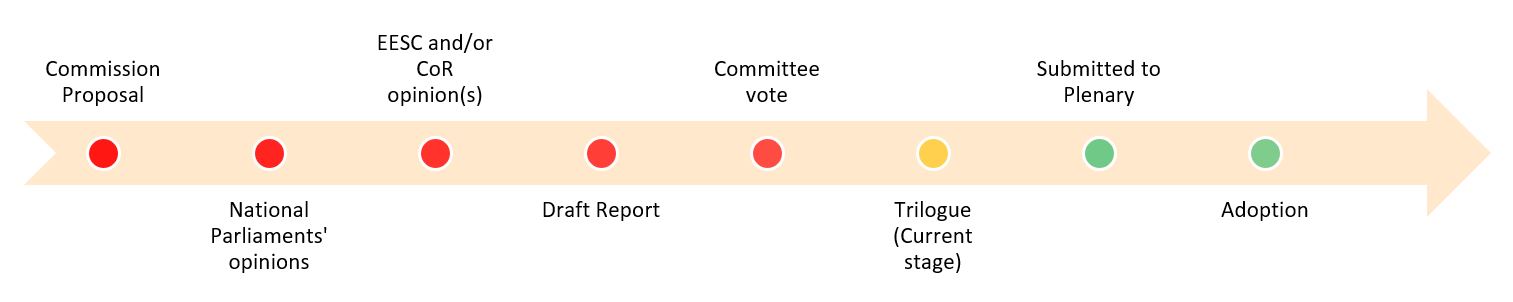

The original timeline for the AMLA regulation suggested that the Authority would be established at the beginning of 2023. However, it appears the EU Parliament is already behind schedule, with further disruptions to the legislative process expected due to the change in presidency later this year and the EU Parliament elections in 2024.

The final proposal, TFR, will apply from January 2025. MiCA will generally enter into force in July 2023, however, the provisions concerning Stablecoins will enter into force in July 2024.

Next steps for firms

In relation to MiCA and TFR, as the regulations are finalised, the next step is to implement relevant changes. These regulations are aimed specifically at firms involved in the transfer of crypto-assets and will not have any impact on firms not specifically involved in crypto-assets. Some crypto asset service providers (“CASPs”) should already be well into the process of establishing and improving their AML compliance programmes in order to comply with the 5th AML Directive. Given that payment service providers (“PSPs”) have been covered by the wire transfer regulations for a while, implementing the new obligation to include payer and payee details on fund transfers should not be too difficult to apply.

As the remaining three proposals are still being debated in trilogue, we do not recommend firms to take any immediate actions as the discussion’s points are many and we have to wait and see the final versions. From a strategic point of view, dedicating resources to follow the proposals would mean; systems, controls, policies, procedures, people and technology, can all be adapted or enhanced ahead of implementation.

Please see EY’s previous article on the subject here.

EY as an organization is committed to the fight against financial crime. We welcome the Commission’s efforts to improve the AML/CTF regulatory regime across the EU. In particular, we consider that strong focus on improving enforcement of AML/ CTF regulatory regimes across Europe would considerably improve the fight against ML/TF, and support firms in their efforts to establish robust AML/CTF control environments.

For further information about our services or to discuss these changes, contact our team: