Chapter 1

EV sales defy predictions for growth

Despite external headwinds, conditions align for mainstream EV adoption.

Car drivers are buying EVs at record pace, not put off by rising EV costs or long lead times. Momentum is building in the bus and truck segments too. Municipalities and commercial fleet operators see potential in electrification, especially as prices become increasingly competitive with diesel alternatives.

Across the globe, EV sales doubled in 2021 and jumped 55% in 2022, accounting for 13% of all vehicle sales. In 2022, EV sales in China reached 27%1 of total vehicles sold; in Europe, they made up just over 20%. And, in the US, EV sales increased to more than 7% of all vehicle sales.2

Surprisingly, this demand for EVs comes despite huge turmoil in supply chains, record prices for battery metals and ongoing COVID-19 pandemic disruptions in China. Economic headwinds, the cost-of-living crisis and rising energy costs have done little to restrain enthusiasm. In EV terms, 2022 ended very strongly indeed.

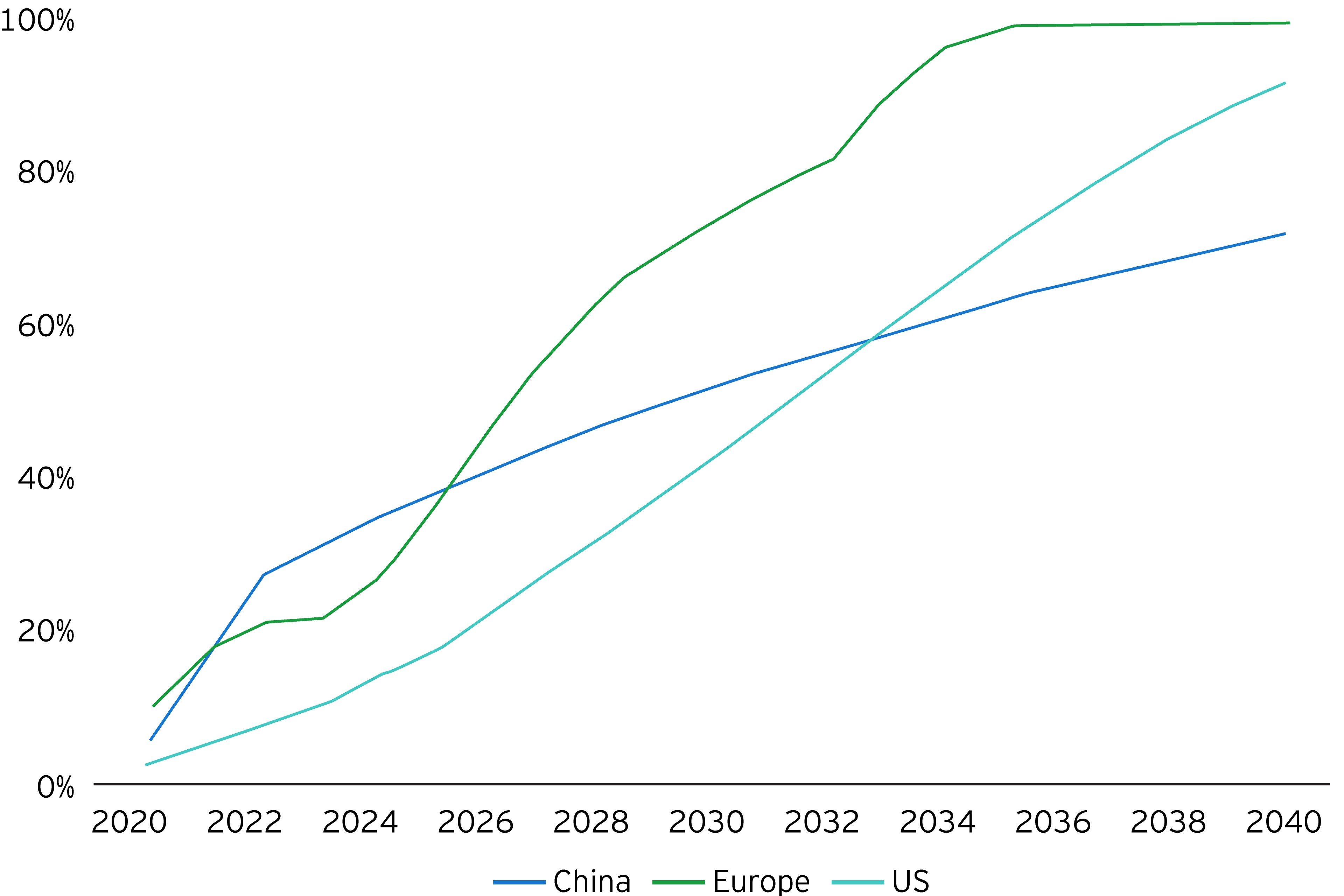

Electric light vehicles sales forecast, by region, 2020-40

EV sales expected to outstrip all other regions by 2030

Why eMobility is gaining traction

Several factors feed into the uptake in eMobility:

- Regulation is giving certainty to the direction of EV travel. It builds toward 2035 when most developed economies pledge to phase out sales of new internal combustion engine (ICE) vehicles.

- Global subsidies and incentives, which topped US$30bn by the end of 20213, are making EVs more affordable. Subsidies continued into 2022, though some markets, such as China, are becoming self-sustaining.

- EVs fit with the societal and political urgency to decarbonize. They help to reduce dependency on fossil fuels at a time of high energy prices and security concerns.

- Global automakers are proving their commitment to an electric future by investing almost US$1.2t into EV production and battery facilities.4

- Utilities are continuing to invest in EV infrastructure, driven by consumer demand, revenue opportunities and sustainability goals.5

In addition, EVs are getting better looking and more desirable. Customers are being won over by greater vehicle choice, shortened charging times and longer range. And they are getting much more familiar with how eMobility technology works, which boosts confidence. The EY Mobility Consumer Index6 finds that 52% of respondents lean toward a fully electric, pure hybrid EV or hybrid vehicle as their next purchase — up from 30% in 2020. It’s the first time that the balance has tipped in favor of EVs. And preferences for fully electric cars have tripled, from 7% in 2020 to 20% in 2022.

Indeed, this is such a rapidly evolving industry that EV uptake predictions are quickly outdated. Already, Europe and China are one year ahead of the predictions made in 2021 using the EY Mobility Lens Forecaster.7 And the US is four years ahead, largely because of the 2022 Inflation Reduction Act, which could boost the numbers of passenger EVs on the road to 36 million vehicles by 20308, up from 2.4 million in 2021.9

Now, the EY Mobility Lens Forecaster10 estimates that EV sales in Europe will beat other powertrains, such as diesel and petrol, as early as 2027. China and the US can expect to get there by 2032. And EY estimates that sales of battery EVs and plug-in hybrid EVs will make up 55% of total global vehicle sales by 2030. In Europe, that could rise as high as 74% and, in the US, 43%. That, for industry participants, indicates the colossal task ahead.

EV future potential

55%of total global vehicle sales by 2030 will be battery EVs and plug-in hybrid EVs.

Affordability is an issue, but the big mass-market push is on

In the early days of EVs, tech-savvy, keen-to-experiment and affluent early adopters got on board. In China and Europe, they’ve taken EVs past 20% of total vehicle sales. Globally, the number has reached 13%. Now it’s all about the big push to get to the next 60% — and then we’re deep into mass-market territory.

Initially, we saw tech-savvy, keen-to-experiment and affluent early adopters get on board. Globally, they took EVs to 13% of total vehicle sales. Now it’s all about the big push to get to

the next 60% — and then we’re deep into mass-market territory.

Today’s EVs are moving beyond the luxury segment as automakers introduce new models at lower price points. But cost remains a barrier. The average price of a new EV is 27% more than ICE equivalents in Europe, and 43% more in the US. There are no EVs under €20,000 (US$21,300) available in Europe or the US today.11

However, the up-front cost of an EV is only part of the story. Over the lifetime of the vehicle, EVs are cheaper to run and maintain than ICE vehicles, while government subsidies can contribute as much as 20% of the purchase price.12 Unfortunately, some would-be buyers aren’t grasping the long-term savings on EV ownership.

Chapter 2

Six essentials determine the future direction of eMobility

If the EV is ready, but the supporting resources are not, the journey will be prolonged.

A decade or so from now, will we reflect on how EVs came ahead of the machinery and infrastructure that were needed to make them work. To avoid a modern-day cart-before-horse scenario, we need to manage six essentials that are critical to securing the future of eMobility.

Failure to get these six essentials right, could result in missed net-zero targets or unresolved air quality issues. And, perhaps, wasted investment or an extended eMobility transition period.

Collectively, the ecosystem must unite around these six essentials, which were identified in conjunction with business leaders who contributed to our survey.

1. A resilient supply chain

Demand for EVs is accelerating, but rollout is being hampered by supply chain constraints.

The EV segment has been hard hit by the tide of inflation. And rising minerals prices threaten to slow, or even temporarily reverse, the long-term trend in falling battery costs, which are the most expensive component of EVs.

So, in the short term, the cost of building EVs is going up as demand for key materials increases and as supply remains challenged. Battery shortages, coupled with EV-to-ICE price inequity, present serious challenges to EV sales targets and climate goals.

Europe and the US, which are heavily dependent on imports of raw materials and batteries, primarily from China, are taking production into their own hands. They are moving quickly to manufacture their own EV components. Automakers are investing in the upstream battery market and along the battery value chain. Meanwhile, investment in gigafactories is designed to meet future local demand for batteries and reduce dependency on producing nations. It is a long-term commitment, but securing the supply chain is critical to the ongoing availability of affordable vehicles.

2. Clean and green power

EVs stand to become the biggest consumers of clean and green power, but currently just over 3% of the transport sector runs on renewable energy. Renewable production must increase to both decarbonize the grid and meet anticipated EV demand.

An accelerated transition to cleaner and lower-carbon generation will further improve local energy security and reduce costs to consumers. The US aims for electricity that’s 100% free of carbon pollution by 2035.13 The EU looks to remove hydrocarbons from its energy mix and proposes to increase its 2030 target for renewables from 40% to 45%.14 The key to achieving these targets includes faster permitting and the development of flexibility markets to manage supply intermittency.

3. Accessible charging infrastructure

EV adoption will stall without a public network of fast chargers for drivers who can’t charge at home or at work, as well as for long-distance drivers and those in need of a quick top-up.

To tally with accelerated adoption of EVs, for example, EY estimates that 2.8 million public and destination charge points, and 2.4 million private workplace chargers, will be needed in Europe by 2030. To get close, that means 670,000 new charge points must be installed every year — or 13,000 every week. In the US, over 400,000 public charge points are needed by 2025, with that number rising to over 1.1 million in 2030.

Fast and efficient rollout depends on the removal of regulatory barriers, improved access to land for infrastructure and faster passage via local authority permitting channels. Ultimately, however, utilities must deliver more timely grid connections. And infrastructure must be equitably distributed in the spaces and places where people live and work.

Ultimately, utilities must deliver more timely grid connections. And infrastructure must be equitably distributed in the spaces and places where people live and work.

4. A smart grid

The more charging infrastructure we install, the greater the demands on the electricity grid. Once EV stock exceeds 20% of electricity demand, the need for grid upgrades becomes significant.15

But EVs can become a resource for grid stability rather than a challenge to it. They can be integrated with smart grid technologies to better manage energy demand and lessen the risk of overloading transformers or transmission lines. Existing solutions include time-of-use tariffs to incentivize EV owners to charge their vehicles at off-peak hours16 , demand-response mechanisms and bidirectional charging.

Vehicle-to-grid (V2G) technology is the next evolution. Though still at an early stage of development, it allows the grid to push and pull energy to and from connected vehicles if demand threatens supply. A recent study by IRENA indicates that V2G could reduce the cost of grid reinforcement by 10%.17

Utilities must play a critical role in ensuring that EVs are integrated. Grid forecasts for EV integration can estimate the impact of future additional loads. And coordinated plans for grid expansion and enhancement, and digital technologies for two-way communications and pricing between EVs and grids, will further support integration.

5. Digitization

Millions of EVs will generate masses of data — a new challenge in road transport. Data storage, ownership, usage and regulation must be resolved to allow enhanced eMobility services and monetization.

The ecosystem connects EVs and chargers with energy, buildings and corporate infrastructure. It bulges with data, which can give truer assessments of infrastructure needs. It can support better understanding of grid networks and inform decisions to integrate renewables. On the customer side, data can be used to tailor products and services around unique needs.

Data, once converted into a digital format, allows EV drivers to benefit from interoperability. It means they can connect wirelessly, roam and pay to charge in a safe, easy and convenient way, which builds customer confidence and advocacy for EVs. However, greater interoperability depends on open connected platforms for data sharing, as well as fair and transparent data access requirements. This will mean adopting and harmonizing open protocols to support interconnections between EVs, charge point operators (CPOs) and eMobility service providers. And for that, the ecosystem of players must put aside competition in the interests of the common goal.

6. Skilled labor

As one powertrain gives way to another, the transition is forecast to create more jobs than it displaces. In the US, a net gain of two million jobs would be realized in 2035 if all new car and truck sales were electric.18 Similarly, approximately 1.1 million permanent jobs would be created if the entire European fleet were electric.19

However, the skills and competencies required in EV manufacture are significantly different from those demanded by ICE. Failure to attract and retain staff, and to provide adequate training, will impact production lines and the availability of vehicles.

On the road to an all-EV lineup, many automakers are committing to safeguard jobs and upskill staff. Some team with technology partners, universities, community colleges and learning platforms to create tailored training pathways. However, governments must get behind the skills transition too, with investment in apprenticeships and recognized qualifications for electric powertrains.

Chapter 3

Collaborate to make eMobility work

The ecosystem must unite around milestones and problem solving.

As EV adoption accelerates, the big-picture lens is being replaced by a forensic inspection of the mechanics of making eMobility work for a rapidly expanding market. It means pre-empting and working through some of the unintended consequences of policy and ambition preceding capability and execution.

These consequences are potentially huge. They range from stranded assets in carbon-intensive sectors; old ICE vehicles rehomed in poorer countries where they continue to pollute; and the socioeconomic divide created by the perceived higher cost of EVs versus ICE vehicles. Resolution of issues as big as these cannot happen in silos. They depend on everyone pulling in the same direction and collaborating.

Business leaders from across the eMobility ecosystem, who participated in our study, point to greater cohesion between participants and a willingness to share information.

They told us how regulators, utilities and CPOs are working together so that residents in apartment blocks who want to charge can do so. They explained how these parties calculate the power and infrastructure needed to support the charging demands of electric heavy-duty vehicles. They also recounted how cities are working with utilities and CPOs to inform local policy decisions on the electrification of passenger and commercial fleets. And they cited automakers and utilities that are putting in place educational programs to equip workers with the skills needed for the electrification of transport.

Collaborative endeavours, such as these are taking place at a local level but are being replicated across the wider eMobility landscape. They are part of the shift toward making the transition to EVs work for everyone. Crucially, within that, utilities are charged with delivering on two priorities — enabling EVs to charge and controlling EV consumption for load management purposes, because without utilities, the transition will not work for anyone.

Related articles

Summary

Despite challenging economic and geopolitical conditions, EV sales are surpassing expectations. Early adopters in major markets have pushed total EV sales up to 20% or more. To achieve mainstream EV adoption, however, EV costs must come down, and the ecosystem of players must collaborate around six essentials.

A local perspective

A local perspective