EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

As consumer expectations evolve, retailers are under more pressure than ever to deliver authentic, customer-centric value propositions.

In brief

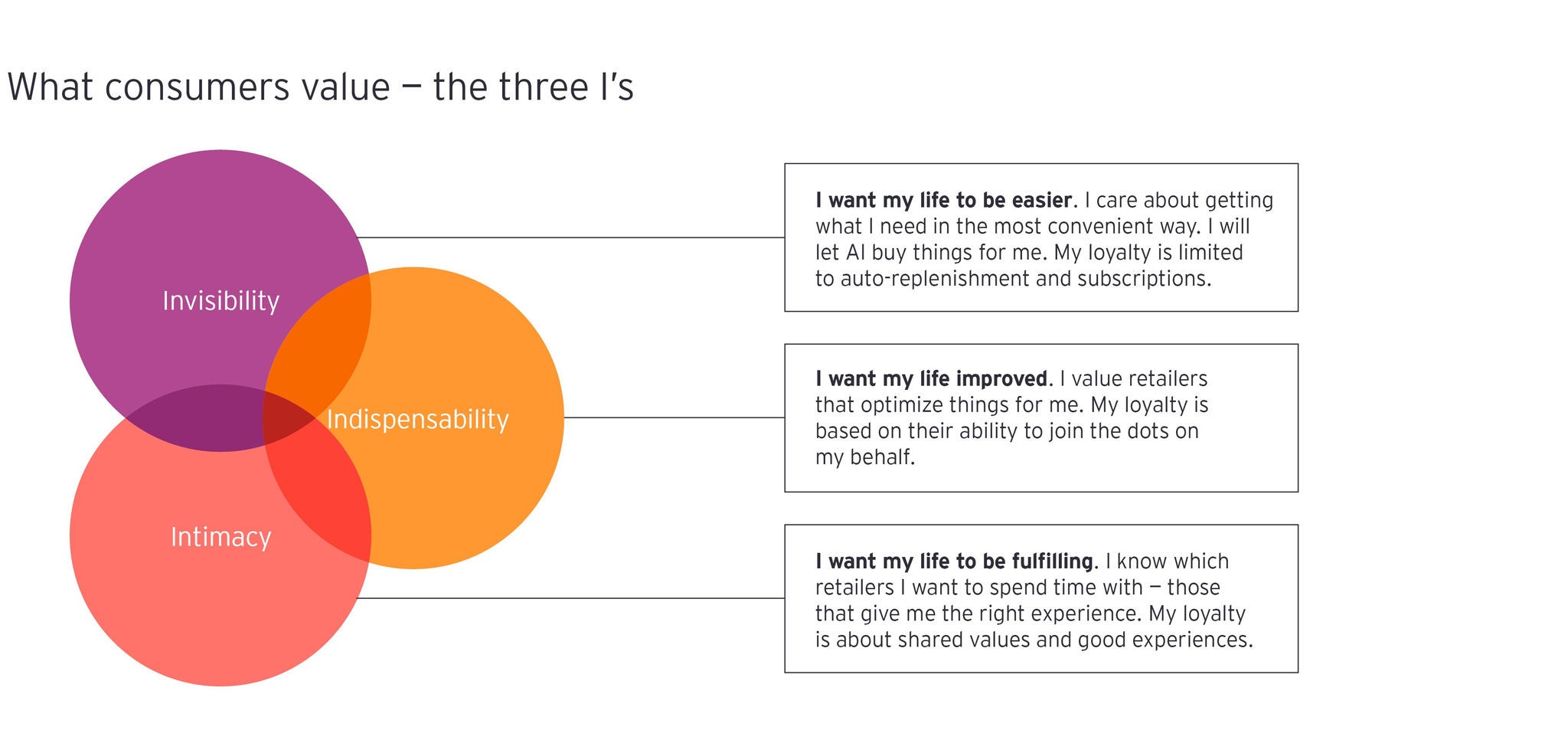

- Insights from the EY Future Consumer Index show consumers have three core demands: make life easier, make it better and make it more fulfilling.

- Consumer demands are driving three guiding principles for the evolution of retail value propositions: invisibility, indispensability and intimacy.

- Retailers must deliver the right mix of invisibility, indispensability and intimacy to avoid becoming irrelevant, but it is not one size fits all.

Even before the COVID-19 pandemic, retailers were struggling with a shift online that threatened to disintermediate their traditional store-based strategies. But retailers that were able to provide essential goods and invest in their digital capabilities benefited during the pandemic. Those that could not struggled with a lack of access to their customers. But unprecedented times are not unprecedented. Retail has emerged leaner and meaner from unprecedented times before. Despite the much publicized “retail apocalypse” following the recession of 2007–09, which forced the closure of tens of thousands of stores, incumbents have continued to weather disruption and improve their business.

Download the EY Future of Retail Report

As retailers look to the future, there are two fundamental differences in their operating environment that will cast doubt on their tried and tested strategies.

The first is that the disruptive forces shaping the industry are no longer framed by distinct events, but are instead forming a constant backdrop that continually tests retailers’ resilience and agility. Retailers enjoyed a decade of relative economic stability between the recession and the outbreak of COVID-19. Today, the impact of COVID-19 is being compounded by supply chain shocks, accelerating inflation, the war in Ukraine and wider geopolitical tensions. Together, these factors are collectively undermining the era of globalization and the relative prosperity that businesses have thrived in for decades.

Against this backdrop, the need for customer-centricity is not retreating, but accelerating as consumer expectations evolve, enabled by other factors such as increased transparency and choice, rapid technological shifts (especially in digital environments), mounting concerns and commitments around sustainability, and convergence between different sectors as retailers explore new ways to unlock value.

The second difference is the change taking place in the relationship that retail has with consumers, where the long-held principle of customer-centricity is likely to no longer be enough to confer loyalty. In truth, retail has failed to truly embrace customer-centricity over the decades. Instead, retailers have used their focus on scale, scope and efficiency to drive a value proposition that puts other business needs first. It could be argued that retailers have grown for decades by making their customers do much of the work for them, by making them part of a process optimized around stores and the products retailers sell. Traveling to a store, trudging through aisles of stock, trawling through a vast range of products to get to what you want at a price you can’t negotiate, carrying them to the checkout, queuing to pay, scanning the items and taking the products home yourself hardly constitutes a customer-centric experience.

This is changing as consumers become more central in defining the activities of retailers. The internet has provided greater knowledge, choice and transparency. Online platforms have redefined expectations of choice and convenience by showing consumers what can be achieved. Immersive digital and physical spaces have created new approaches to experience. Smartphones and logistics platforms have exponentially improved the way consumers can access and receive products. Consumer values around social and environmental issues are increasingly shaping what they buy and whom they buy from.

Retailers are now in a landscape where the customer is truly king, and just delivering customer-centricity is no longer enough to confer loyalty or advocacy. Instead, retailers must find ways to integrate themselves into the everyday lives of their consumers by delivering tangible and intangible value. Success is now defined by the ability to build a trusted long-term relationship; the simple act of transactionally selling products will no longer be enough.

This transition will prove difficult for incumbent retailers. They have built vast and profitable businesses spanning channels, categories and continents using legacy infrastructure that will be difficult to disentangle from. Efforts to change are evident, but the scale of change required is not. KPIs built on sales per square meter will not be fit for a customer base that increasingly blends its shopping habits between stores and online. Promotions designed to increase basket sizes are less resonant with customers who want to buy “better” products rather than “more” stuff. Generic layouts in stock-heavy stores ignore the serendipity and enjoyment that consumers crave when they interact with brands.

The three I’s that will shape future retail value propositions

The lessons that can shape the future of retail lie in three distinct areas. The first remains in the past, with retailers needing to understand what made them relevant in the first place. From the marketplaces of ancient civilization to the mom-and-pop stores that once served local neighborhoods, retail has historically been more than just a place to shop. Stores and markets served as community hubs for social interaction and local events. Shopkeepers knew their customers by name and enjoyed a level of intimacy that today’s mass market retailers struggle to replicate.

The second lies with the level of expectation conferred by innovation and the rapid development of technology platforms. Users of video-streaming channels have come to expect picking up where they left off on any device, in any location, at any time. Consumers expect to find what they want, whenever they want it, whether using search engines to quickly gather information, or ordering products within a 30-minute delivery slot. These expectations of convenience make the provider of the service almost invisible to the consumer, who only sees what they want, when they want it, wherever they are.

The third area comes from the blurring of boundaries between different areas of consumer need, which is driving convergence between sectors and leading to the emergence of new service models. For example, if someone wants to lead a healthier life, they might look to eat and drink better, exercise more, take dietary supplements, seek health advice and monitor their progress. Individually many of these things are found in different places but providing all of them as one service would make that service provider indispensable to the customer by holistically solving a distinct area of consumer need.

Collectively, these three I’s will shape the successful retail value propositions of the future by enabling them to differentiate their offering and provide tangible benefits and value back to the consumer:

- Invisibility — retailers can make consumers’ lives easier by providing them with the products they need when and where they need them, smoothly and seamlessly, making the transaction a process that they’re barely aware of.

- Indispensability — retailers can make consumer lives better by providing them with bundled products and services that can solve areas of holistic need using an ecosystem of partners that make the transaction part of a service to improve their lifestyles.

- Intimacy — retailers can make consumer lives more fulfilling by providing them with experiences that resonate with them, reflecting their core values, and making the transaction secondary to the services they provide.

We explore each of these value propositions in more detail in our report. However, they should not be viewed in isolation, nor should all three be considered as equal for a retailer looking to transform for the future. As retailers seek to reshape their strategies, they must examine their core capabilities and corporate purpose to identify the right blend of invisibility, indispensability and intimacy for their business. For example, a future value proposition might focus heavily on delivering a seamless “invisible” experience through the retailer’s online channels but could repurpose physical stores to build “intimate” experiential services, while training staff to provide expert advice that can connect products with services to become more “indispensable.”

Related articles

Future Consumer Index: Five consumer types you need to understand

The 11th wave of the global study explores the emerging priorities that will shape future consumption patterns. Learn more.

When experience defines how consumers buy, what will retailers sell?

Instead of the “store” of the future, retailers should be thinking about the “space” of the future. Find out more.

How will customer-first technology create retailer value that lasts?

Retailers must build technology foundations for the future to respond to changing consumer behaviors and expectations around how they shop. Find out how.

Summary

The changes in consumer expectations are accelerating and are unlikely to revert to how they used to be. Retailers must revisit what their value proposition means to the customers they serve. How are they making customers' lives easier, better or more fulfilling? How can they deliver the right blend of convenience, service and experience to demonstrate the value that they can provide? How do they differentiate from the multitude of other sellers that customers can choose from?