EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

How EY can Help

-

Our People Advisory Services team can help your business build a workforce with the right capabilities, profile and focus to meet your goals. Learn more.

Read more

Boardroom diversity can unlock new opportunities

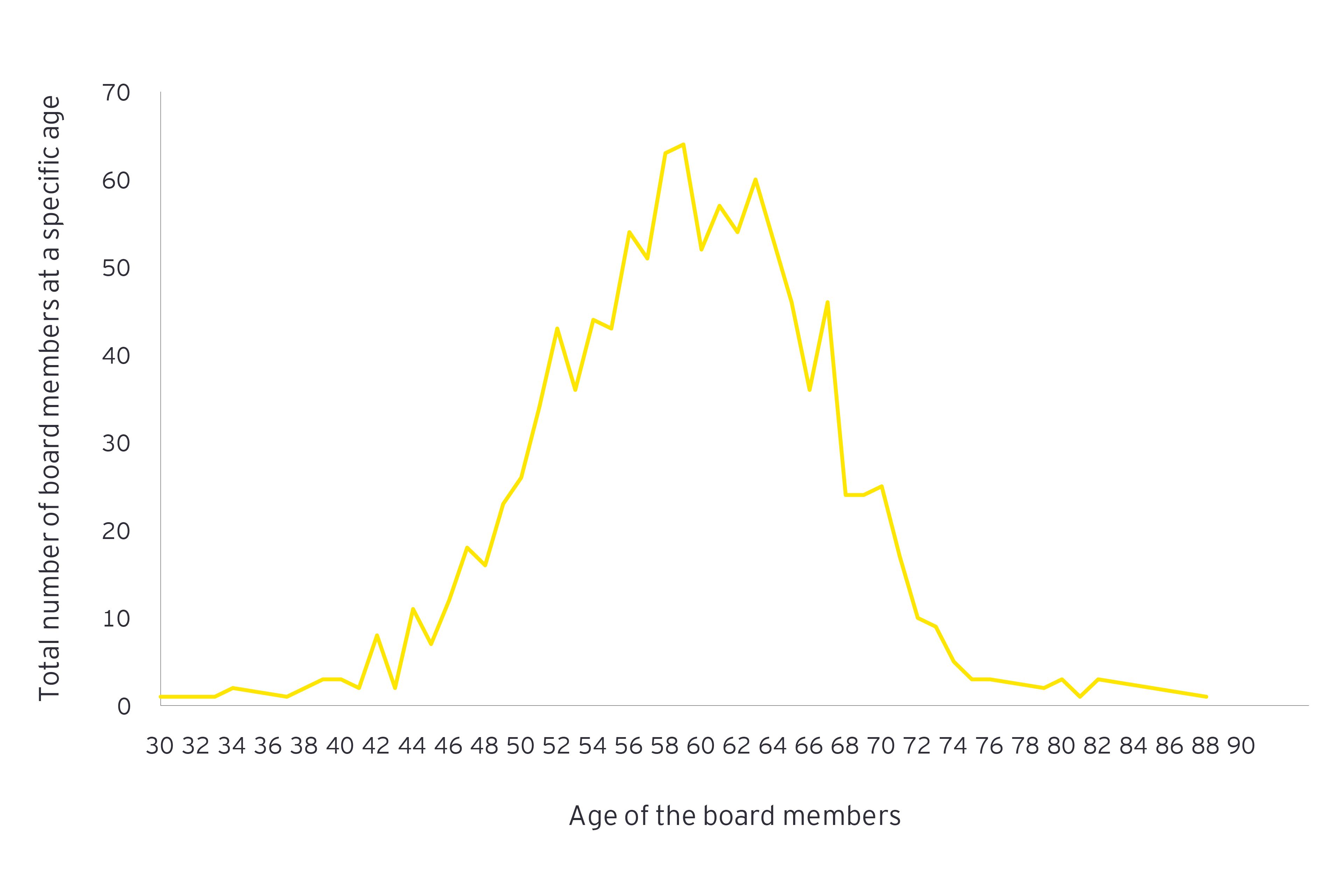

While the demands on financial services boardrooms have grown increasingly broad and complex in scope, the fundamentals of effective boardroom management have changed little. Put simply, boardrooms must bring together a blend of skills that inform and enhance decision-making across their firm to respond more quickly and effectively to market challenges. Strong foundations in traditional areas of expertise prepare individuals for this role, but a team of diverse backgrounds, experiences, age and skills will arguably better equip boards to anticipate emergent risks, preempt regulatory change and influence strategy, while holding management teams to account.

The nascent EY Boardroom Monitor makes clear the need for boards to strengthen their understanding of sustainability and technological developments, while seeking to grow more diverse representation that better reflects their customer base and improves their diversity of thought.

We believe the firms that actively develop their talent pipeline by expanding and upskilling their board in line with the shifts in the operating landscape will be best placed to succeed. Competition for talent will only escalate, and firms that act decisively now to bolster their boards where they are currently underweight will put their business in the best place to attract the top candidates.