EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

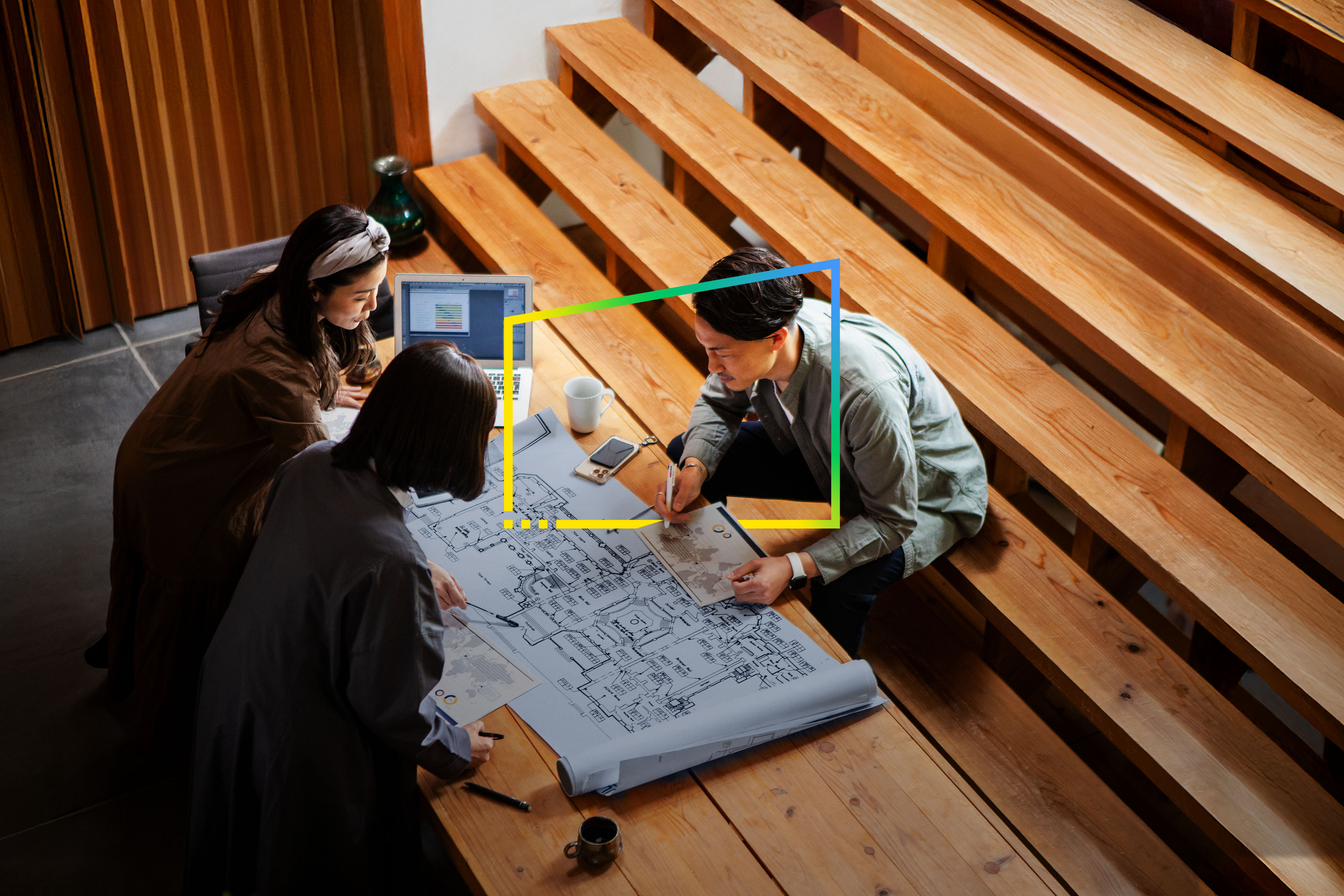

Japan Business Services – supporting the global growth agenda of Japanese companies

EY's Japan Business Services (JBS) is dedicated to supporting Japanese companies expand their business globally and develop strategies for further growth. As a network of over 650 professionals in around 100 major cities around the world, we provide services in Assurance, Consulting, Strategy and Transactions, and Tax. JBS is an integral organization of EY Japan that leverages our global network and insights to help clients reach better decisions and generate value.

Providing values beyond financial support in the post-globalization era

When Japanese companies wish to expand their business in the global market, they need to adapt to the specific business environment in each country.

Professional knowledge and rigorous preparations are essential for setting up operations overseas. This includes market analysis of the target country, collecting information about taxes and legal regulations, disclosing financial information in accordance with local accounting standards, and performing comprehensive risk management for complex projects.

We leverage our world-class network to support clients enter the global market, as well as to provide advice in developing growth strategies. Our services go beyond simple business advice to include in-depth, value-added services such as gathering the latest information regarding investment laws, providing support to acquire local corporations, and offering subsequent management advice.

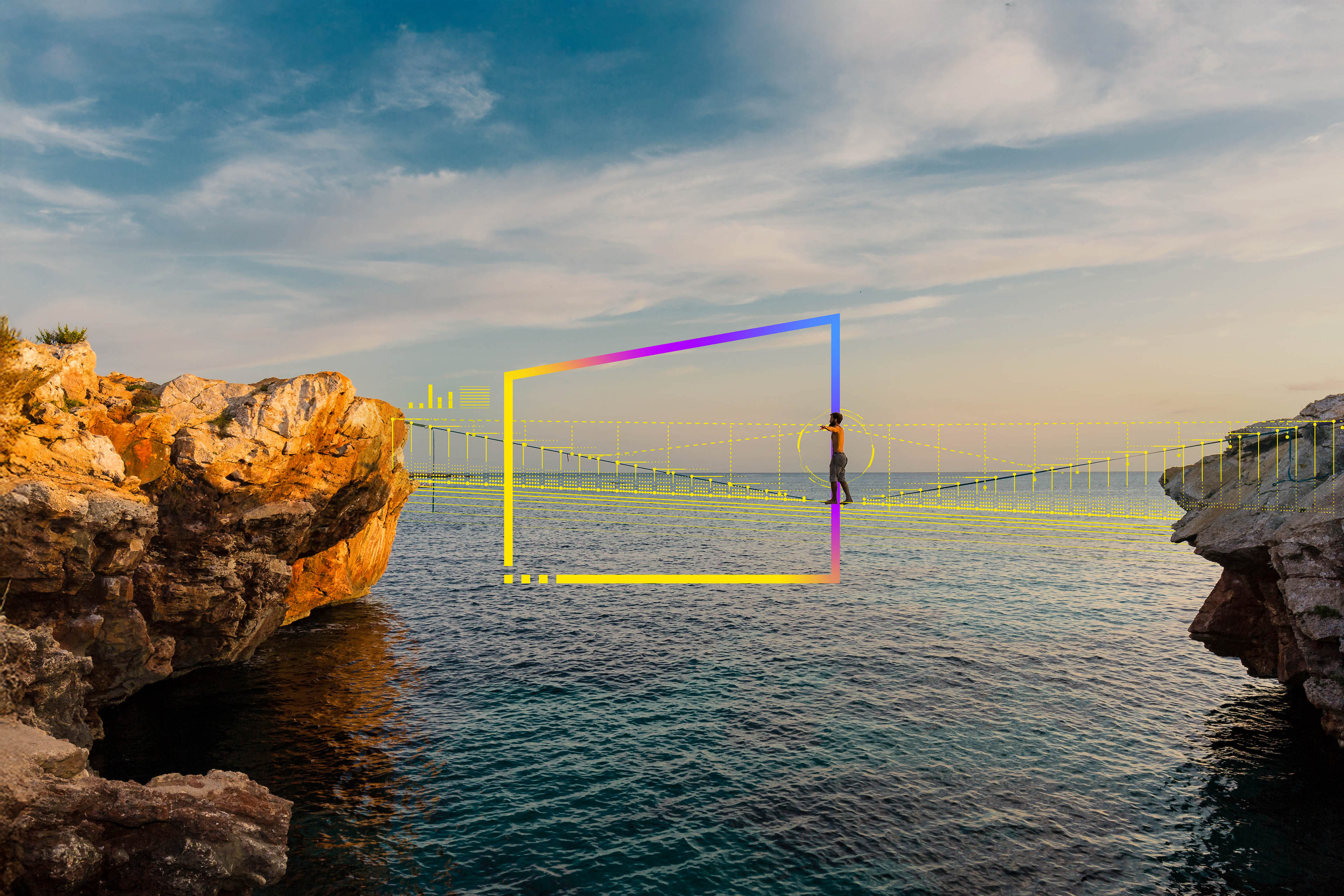

JBS values

To provide exceptional and consistent services on a global scale, we prioritize Diversity, Equity & Inclusiveness (DE&I), a core value and key for growth at EY.

JBS supports the overseas expansion of Japanese companies and the design of growth strategies by leveraging our substantial knowledge and insight of diversity, such as the individual characteristics and varied environment of each region. We are committed to be:

1. Insightful

JBS professionals throughout the globe, with in-depth experience of Japanese corporate culture and business practices, accurately identify your changing needs and bring valuable knowledge and insight in our response.

2. Connected

JBS professionals collaborate and communicate seamlessly and effectively worldwide, drawing on EY’s global network to support you and the needs of your business.

3. Responsive

JBS provides timely and targeted support not only as a specialist finance and business advisor, but also as one global team with the latest information and insights to address your changing needs.

The team

Jeff Watts

Japan Business Services Global Leader

Hirotaka Hayashi

Japan Business Services Deputy Global Leader

Takashi Ouchida

Japan Business Services Global Assurance Leader

Our latest thinking

Private Equity Pulse: key takeaways from Q4 2025

The PE Pulse is a quarterly report that provides data and insights on private equity market activity and trends. Read the latest report.

How do CEOs reimagine enterprises for a future that keeps rewriting itself?

EY-Parthenon CEO Outlook 2026 explores how leaders use AI, transformation and portfolio strategy to navigate uncertainty and drive sustainable growth.

Top 10 geopolitical developments in 2026

Geopolitical volatility and uncertainty will persist in 2026. There are three geostrategic actions to build resilience and set strategy. Learn more.

Can AI advance toward value if workforce tensions linger?

AI success needs tech and talent to turn adoption into transformational impact, the EY 2025 Work Reimagined survey shows. Learn more.

How can reporting shape a nature-positive future?

The EY Global Nature Action Barometer suggests that companies have not yet developed sufficiently robust reporting on nature. Read why.

How can you navigate your IPO planning with confidence?

The EY Global IPO Trends covers news and insights on the global IPO market for Q3 2025 and an outlook for Q4 2025. Learn more.

How can responsible AI bridge the gap between investment and impact?

Explore the ways in which responsible AI converts investment into meaningful impact.

How CEOs juggle transformation priorities – the art of taking back control

EY-Parthenon CEO Survey September 2025 reveals how leaders build confidence, resilience, and growth strategies amid disruption and transformation.

How does EHS investment drive clear commercial value?

Organizations that strategically invest in environment, health and safety initiatives may have a competitive advantage in a volatile world. Read more.

How agentic AI can reshape your tax function

Discover how agentic AI empowers tax functions, automating complex tasks for accuracy, efficiency, and opening new strategic possibilities. Learn more.

How responsible AI can unlock your competitive edge

Discover how closing the AI confidence gap can boost adoption and create competitive edge. Explore three key actions for responsible AI leadership.

How can cybersecurity go beyond value protection to value creation?

The 2025 EY Global Cybersecurity Leadership Insights Study found that CISOs account for US$36m of each strategic initiative they are involved in. Read more.

Why operational resilience is a strategic priority for insurance CROs

The second annual EY/IIF insurance risk management survey highlights the importance of resilience and how CROs aim to instill it. Learn more.

Six actions to turn soaring energy demand into lasting prosperity

Business energy demand is soaring. Are providers ready? EY research reveals how they can fuel growth to deliver true energy prosperity. Learn more.

The five habits of successful Geostrategists

All companies are shifting strategies to adapt to geopolitical risk. Here is how to invest more efficiently and strategically than your competitors. Read more.

How telcos can help enterprises scale emerging technologies

Enterprises are pursuing digital transformation by investing more in emerging technologies – and vendors must adopt new strategies to help them succeed. Read more.

4 pillars of a responsible AI strategy

Corporate AI adoption is surging amid genAI advancements. Establishing responsible AI policies is crucial to mitigate risks and ensure compliance.

How will your decisions today shape the future for generations to come?

Discover how shifts in demographics and tech reshape priorities, urging new models for growth through innovative organizational strategies. Read more.

Top 10 risks for the government and public sector in 2025

The risk landscape for governments is complex and interconnected. Discover the top 10 risks and how mitigating them will build trust and prove value.

Top 10 opportunities for technology companies in 2025

Technology companies are at a pivot point and transformation is at their fingertips if they act on these top 10 opportunity recommendations from EY in 2025.

Top 10 geopolitical developments for 2025

Geopolitical risk will remain elevated due to economic sovereignty and global rivalries. Learn how to manage the uncertainty to grow your business.

Six steps to prepare for the operational impact of Pillar Two

Get ahead of operational and technology considerations for BEPS 2.0 Pillar Two reporting. Understand what to assess, plan, operate and monitor. Learn more.

How will climate transition planning empower you to shape the future?

The sixth EY Climate Action Barometer shows an increase in companies reporting on climate but falling short of carbon ambitions. Learn more.

Execs double down on AI: explore 5 AI adoption strategies for success

US execs double down on AI investments, signaling that AI is pioneering the business future. Discover our five key strategies for enterprise AI adoption.

How generative AI is transforming the future of commercial real estate

Commercial real estate leaders need to evaluate the risks as they seek to leverage the benefits of GenAI in real estate.

How AI-powered data optimization drives tax and finance transformation

Transform your tax and finance with data-driven insights. Discover how strategic data use can guide decisions and streamline compliance. Learn more.

Global Audit Quality Report: a commitment to continuous improvement

The global EY organization is committed to continuously improving audit quality, which helps build confidence and trust in the capital markets. Learn more.

Four factors to guide investment in battery storage

RECAI 63: Demand for battery energy storage is growing amid grid volatility. The EY ranking of investment hotspots highlights opportunities. Learn more.

How can trust survive without integrity?

The EY Global Integrity Report 2024 reveals that rapid change and economic uncertainty make it harder for companies to act with integrity. Read our findings.

CIO Survey: will you set the GenAI agenda or follow the leaders?

Get insights on how CIOs will address the challenges and capture the full benefits of GenAI in the 2024 EY CIO Sentiment Survey.

How the drivers of private equity value creation are changing

Discover the five key drivers in private equity value creation in uncertain markets.

How can the moments that threaten your transformation define its success?

Leaders that put humans at the center to navigate turning points are 12 times more likely to significantly improve transformation performance. Learn More.

How GenAI changes the way CPG and retail operate — and consumers too

As generative AI for business takes-off so do generative AI business use cases for retail and CPG. But GenAI will change consumer behavior too. Learn more.

How can boards convert sustainability from a wish to a winning reality?

Boards must lead a decisive sustainability agenda or face a constrained future, finds the EY Europe Long-Term Value and Corporate Governance Survey. Read more.

How to find certainty amid tax policy transformation

EY 2024 Tax Policy and Controversy Outlook explores what you should act on now and what you should keep an eye on next. Learn more.

Tech disruptions can inform the economic impact of AI

Discover learnings from three key historical episodes of rapid technological change that may help predict the economic impact of AI.

How can you cut costs and still accelerate growth?

Explore strategic IT cost optimization opportunities that can leverage technology spend and value, amid rising AI investments to fund innovation.

Top 10 resolutions for wealth and asset management success in 2024

Wealth and asset management firms should aim to be “the best versions of themselves” in what promises to be another challenging year. Read more.

How can AI unlock value for industrials?

Five initiatives are explored for AI deployment by industrial companies to unlock real value, now and in the future. Learn more.

Top 10 geopolitical developments for 2024

An even more complex geopolitical environment is on the horizon. Learn how businesses need to innovate and adapt their strategies to stay ahead.

Top 10 Opportunities for Technology Companies in 2024

Technology companies have plenty of opportunities to act upon in 2024, despite a challenging macro environment. Here are the top 10.

How bold action can accelerate the world’s multiple energy transitions

Our energy system is reshaping at speed, but in different ways across different markets. Three accelerators can fast-track change. Learn more.

Five “no regret” actions for TMT companies to unlock generative AI’s potential

Learn how Technology, Media & Entertainment, and Telecom companies can create value with generative AI.

Are the global winds of change sending offshore in a new direction?

Turbulent times in the offshore wind sector could change the way large-scale energy projects are built and funded in future. Read more in RECAI 62.

Five ways CIDOs can usher in a new era in business

Emergence of the chief information and digital officer: the new leaders defining the future of the enterprise. Read more.

How Europe’s FS leaders are approaching generative AI adoption

Discover how financial services leaders are approaching generative AI adoption.

How will you respond to clinicians sounding the alarm on unsustainable care delivery models?

The EY Global Voices in Health Care Study finds health systems must embrace sustainable care delivery models to address workforce challenges. Learn more.

Is your greatest risk the complexity of your cyber strategy?

Organizations face mounting cybersecurity challenges. The EY 2023 Global Cybersecurity Leadership Insights Study reveals how leaders respond. Read more.

Why a 15% financial statement tax rate may not avoid global minimum tax

A 15%+ financial statement effective tax rate may not be enough to avoid global minimum tax as part of BEPS 2.0 Pillar Two. Learn more.

8 ways interest rates affect transfer pricing and how to adapt

There is a consensus among economists that higher interest rates will remain in the medium -term. Businesses need a strategy. Read more.

How can the vantage of space give you strategic advantage on Earth?

Unlock the power of space to transform your business! Discover how insights from Earth observation data can help your organisation. Seize the opportunity now!

How the TNFD framework is informing DENSO’s action on biodiversity

DENSO is working with EY on risk analysis and disclosure in advance of adopting the TNFD framework.

How to give health consumers the access and experience they value most

The EY Global Consumer Health Survey 2023 findings suggest health executives should focus on access to care, cost and experience factors. Learn more.

How to serve consumers who rely on tech, but don’t trust tech

Our global research shows how digital is transforming the consumer and why relationships shaped by trust, respect and value are critical. Learn more.

Why wavering consumer confidence could stall the energy transition

The Energy Consumer Confidence Index reveals that the impact of the energy transition is hitting home. Discover more.

Five steps tax accounting teams can take for BEPS 2.0

With BEPS 2.0 due to come into force in late 2023/early 2024, tax accounting teams prepare for Pillar Two rules on global minimum taxation. Learn more.

How ESG data markets have evolved for financial services

The need for ESG data from financial services organizations is increasing rapidly, and ESG data markets are evolving to meet the demand. Learn more.

How to capitalize on the power of technology as a driver of growth

Technology is an important driver of growth for private enterprises. Find out how they are building their digital and cyber capabilities.

The CIO Imperative: How emerging tech can accelerate a path to sustainability

Enterprises are increasingly looking to leverage new technologies like 5G and IoT to deliver their ESG goals. Learn more.

How can corporate reporting bridge the ESG trust gap?

The EY Global Corporate Reporting and Institutional Investor Survey finds a significant reporting disconnect with investors on ESG disclosures. Learn more.

How electric vehicles are reshaping the car buying journey

The latest EY Mobility Consumer Index shows that digital auto retail is being driven by the rise of the electric vehicle. Learn more.

On September 8, 2020, EY Japan held an online event on the theme of corporate institutions and talent management entitled “EY Global Workforce and Mobile Talent Conference”.