Chapter 1

ASEAN-6 EV market overview

Varying EV readiness across the ASEAN-6 presents adoption challenges despite a positive shift in policies and consumer attitudes.

Despite slow historical adoption of EVs by the ASEAN-6, Southeast Asia is seeing a rapid shift in policies and consumer attitudes toward EVs. This is driven by growing societal concerns over climate change and the challenge of meeting carbon reduction targets.

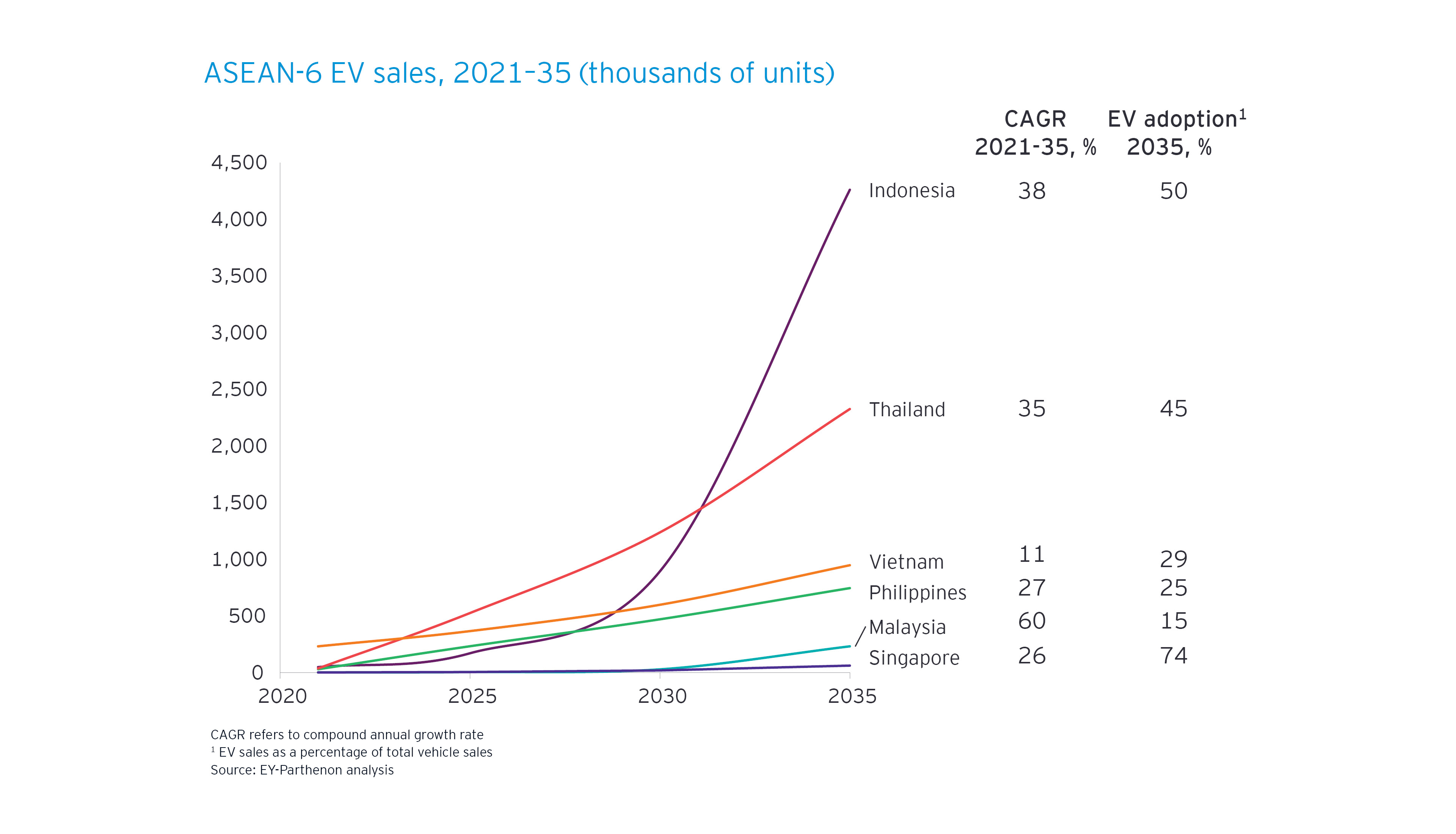

According to an EY-Parthenon analysis, Southeast Asia’s total EV sales volume is forecast to be about 8.5 million units by 2035. Of these, Indonesia is expected to be the region’s largest market by volume, with estimated sales of 4.5 million units across all three EV segments.

While Thailand is predicted to come in second in terms of its estimated sales volume (2.5 million units), its EV estimated sales value of US$35b–US$42b by 2035 is expected to be larger than that of Indonesia (US$26b–US$30b) due to greater demand for passenger vehicles at higher price points.

Historically, two- or three-wheeled vehicles have been the predominant mode of transport across the ASEAN-6. Electrification of this segment has been the fastest as electric cycles, scooters and motorcycles are relatively affordable and less reliant on specialist charging infrastructure whose availability varies considerably within the region.

As the affluence of ASEAN-6 consumers grows, sales of electric passenger cars may begin to challenge the dominance of two-wheelers. It is estimated that cars will account for about 80% of ASEAN-6 EV sales value by 2035. An increasing push for fleet electrification by regulators is also expected to drive EV sales growth of taxis, buses and other commercial vehicles across Southeast Asia.

Varying EV readiness and market opportunities across ASEAN-6

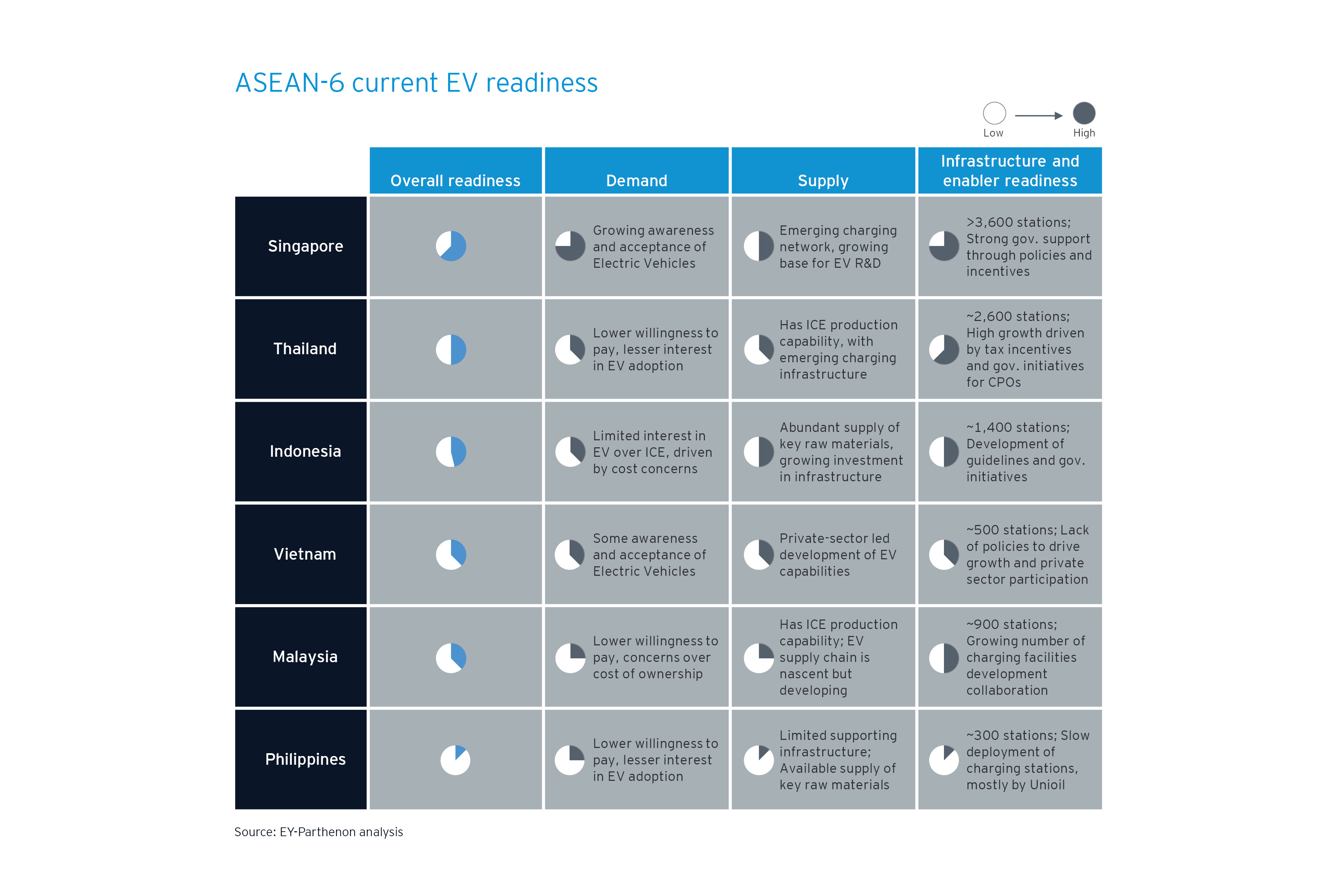

ASEAN-6 countries differ in their “EV readiness” or preparedness in making the EV transition and meeting national goals in this process. Market opportunities will therefore vary across the region and businesses should consider demand-side, supply-side, and infrastructure and enabling factors that impact EV readiness. A look at these factors reveals that cost, availability of charging infrastructure and EV supply chain readiness are key ASEAN-6 challenges in EV adoption.

Demand-side factors have impacted consumer awareness and acceptance of EVs across the ASEAN-6 to various extents. They include financial and tax incentives for end users, such as rebates or subsidies at the point of sale to enhance the appeal and affordability of EVs for consumers. Preferential road access for EV users can make it more convenient to own and operate EVs. Such access may include financial and nonfinancial incentives, such as discounted or free parking, toll road discounts or exemptions, and dedicated parking spaces for EVs.

Supply-side factors aim to boost production capacity. They include financial and tax incentives for EV manufacturers (such as grants or loans to stimulate investments in the EV value chain), tax exemptions or adjustments to boost local production as well as support for R&D and training. Governments can also reduce barriers to entry, such as relaxing foreign ownership restrictions to encourage manufacturers and operators to enter the market.

Infrastructure and enabling factors include government support for the capital or operating costs of building out charging infrastructure and regulatory measures, such as limits and penalties to drive the replacement of internal combustion engine vehicles with EVs.

By considering these factors, companies will better understand the overall EV readiness in each ASEAN-6 country that impacts local opportunities.

Chapter 2

Capturing value beyond EV sales in Southeast Asia

Addressing issues that drive adoption is critical to effectively seize opportunities across the region’s EV ecosystem.

The expected growth in EV sales up to 2035 will present opportunities for both incumbents and new entrants to expand in Southeast Asia. Such opportunities will not only vary across countries in the region but also across the end-to-end EV value chain from raw materials processing to charging infrastructure and software.

An EY-Parthenon analysis estimates the region’s EV ecosystem to be worth about US$100b–US$120b by 2035 and suggests it can be broken down into six key value pools. These include raw materials and processing; energy production; battery production, assembly and recycling; vehicle manufacturing, retailing and aftermarket; charging infrastructure; and charging management software.

Vehicle manufacturing, retailing and aftermarket is expected to be the largest opportunity and account for about 69% of the region’s total EV ecosystem value in 2035. This is expected to be followed by battery production, assembly and recycling (11%) as well as raw materials and processing (9%).

Two-pronged strategy needed to help drive growth

While Southeast Asian countries increasingly identify EV adoption as a keystone in their carbon reduction plans, EV affordability from the consumer’s perspective presents a significant challenge to the achievement of these goals.

Consequently, some of these countries are realizing the need for a two-pronged strategy that is expected to increase EV affordability more quickly. This involves a supply-side approach that invests in the longer-term production of cheaper EVs locally as well as demand-side measures, such as tax cuts and increasingly aggressive purchase cost subsidies on imported models.

To increase EV affordability more quickly, countries need a supply-side approach that supports local, longer-term production of cheaper EVs as well as demand-side measures, such as more aggressive purchase cost subsidies on imported models.

Access to raw materials is crucial to battery production, which needs to be at an adequate level to enable EV sales growth. Several Southeast Asian countries have substantial reserves of key raw materials, including nickel — the most important metal in lithium-ion EV batteries by mass — and copper.

Increasing the flexibility of car use is crucial to future sales growth as well. Original equipment manufacturers are already offering innovative models — such as fractional ownership, car subscriptions and battery-as-a service — in some markets.

Charging infrastructure is another key area as the availability and ease of use of charging stations is a crucial factor that can help drive demand for EVs. However, there are not enough chargers in Southeast Asian markets to support the projected growth in EV adoption.

In response, Southeast Asian governments are incentivizing the building of more chargers and have set targets for charging network growth as well as accompanying policies, including minimum charge point and interoperability requirements.

Charging also offers a range of potential activities, such as charger manufacturing, installation and field services, asset ownership, and charge point operation. Investors can adopt and adapt these according to risk appetite, capital availability and synergies with existing business models.

Chapter 3

Strategies for success in the Southeast Asian EV market

Players must leverage sector experience and synergies, scalability, funding, and technological advantages to win.

The Southeast Asian EV market is relatively nascent and underexploited compared with more developed EV markets. However, industry incumbents and smaller, new startup entrants seeking to seize opportunities in the region will need to take a long-term view. They will also need to understand the nature of the market, their strengths and weaknesses as well as available synergies within the value chain.

An EY-Parthenon analysis has identified four factors that all players seeking to succeed in the Southeast Asian EV market must address. Sector experience includes existing capabilities, assets and relationships that could give companies a competitive advantage in a related, new EV market. Scalability is the ability to leverage financial and nonfinancial resources to launch new EV-related products and services and manage rapid growth. Funding refers to access to capital markets to fund the growth strategy, and technological advantages include technologies and know-how that give the owner a competitive advantage in the chosen EV-related market.

No single player naturally possesses the full complement of these success factors. While incumbents typically have vast sector experience and inherent scalability through access to internal resources, they may need to develop funding access and acquire technological advantages. In contrast, startups typically possess proprietary technological advantages but require funding, which is crucial to help acquire customers, sector experience and the resources required to scale up.

For interested investors, success in the region will require a deep understanding of local markets as well as an analysis of available value pools and locations of existing operations within the value chain. Long-term commitment, a well-defined vision and a detailed strategy are crucial as well. While the ASEAN-6 EV market remains nascent and accessible to both incumbents and new entrants from a wide range of industries, interested investors should consider acting in the region now as this window of opportunity will not remain open forever.

Our related articles

⠀

EVs are gaining traction in Southeast Asia as societal concerns over climate change increase. To succeed in the region’s EV market, players must address four key factors: sector experience, scalability, funding and technological advantages. They also need to understand local markets and consider opportunities from available value pools and synergies within the value chain.