Chapter 1

Banks are being bypassed

Trust and technology changes are eroding banks’ dominant role in trade.

Historically, banks took the role of “trusted” parties in the global trade world, issuing letters of credit (LCs), financing trade flows and processing documents. However, as trust among buyers and sellers has improved, demand for LCs has reduced and alternate options for financing, including open-account trade (when finance is not underwritten with an LC) have started to emerge. At the same time, technology is helping shape trade facilitation, and we see more self-funding and investment from institutional investors flowing into the corporate supply chain.

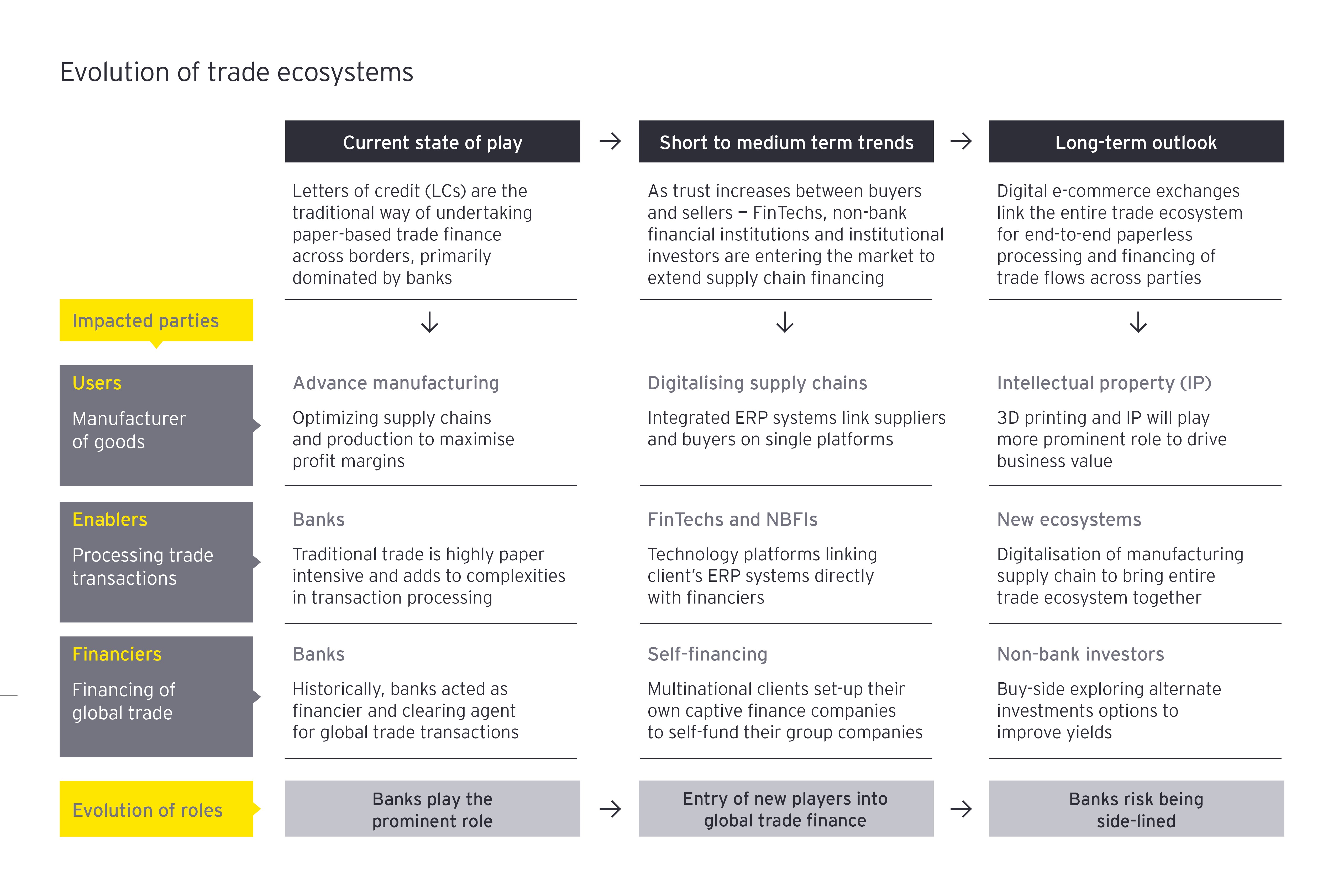

The impacts of these changes are expected to accelerate as trade ecosystems evolve (as illustrated in Figure 1). Banks that want to retain their market share and revenues may be forced to take on riskier clients to fill the gap.

Chapter 2

Demand for trade financing is changing

As the nature of trade evolves, how it is financed is also undergoing a fundamental shift.

The fundamentals of trade are changing as geopolitical tensions and technology innovations challenge the status quo.

- Localization of supply chains: Companies are localizing supply chains to insulate themselves from the impact of trade disputes, including higher tariffs and delayed government inspections, customs clearance, and licensing approvals. At the same time, automation is reducing the labor component of goods and, with it, part of the cost arbitrage between low-cost manufacturing and high-margin sales regions. Perhaps the most transformative innovation is the potential of 3D printing. Decentralized production for near end-consumers could potentially replace global distribution of many mass-produced goods. Localized supply chains will need funding in the countries of their presence or manufacturing. Global banks without a physical or virtual presence in these local markets will risk losing business to local players.

- Growth in services trade increasing demand for new services: Intellectual property-related services, such as patents, trademarks, copyrights, licenses and industrial designs, could comprise as much as a quarter of all total trade exports by 2030. Providing financing for the transfer of the increasing volume of services exports is a huge opportunity for global trade banks.

- “Democratization of trade” expanding the client base: E-commerce has opened up international trade to companies of all sizes; online sales platforms have broadened small enterprises’ reach to an average of 30 different economies. The democratization of trade opens up a new client segment for trade financing, but serving these smaller clients cost-effectively may be challenging for many banks as they are currently structured. New ways to reach them will need to be considered.

Chapter 3

Banks are being displaced as facilitators of trade

FinTechs and digital banks are eyeing banks’ global trade market share.

Banks’ role as processors of paper-based trade documentation, particularly LCs, collection documents and bank guarantees is changing as greater trust and technology, including optical character recognition (OCR), robotic process automation (RPA) and artificial intelligence (AI) improve processing efficiency and turnaround times.

- Trust:

- Open-account: Enhanced levels of trust and ownership have seen some buyers and suppliers start open-account transactions, reducing demand for LCs.

- Trusted trader networks: As banks share challenges around document processing, some large players are creating consortiums or networks to exchange common trade information to mitigate fraudulent transactions and duplicate financing.

- Technology:

- Distributed ledger technology (DLT): In the paper-intensive business of trade, DLT or blockchain could be a game changer, offering the ability for real-time review of trade documentation, traceability and transparency of ownership, while supporting data privacy.

- Internet of Things (IoT): The physical tracking data generated by IoT sensors offers granular insight into the location and quality of goods, reduces counterparty risks in delivery or payment, minimizes friction from trade disputes and provides corporate banks with real-time data on customers’ merchandise for credit assessment. Visibility of cargo movements helps mitigate fraud and corruption, while reduced delivery risks enable open-account transactions.

- Application programming interface (API) - enabled data sharing: Real-time data flows use APIs to link supply chains to financers for deep-tier financing.

But even as banks embrace these technologies, they are being disrupted by new players with a greater mastery of them. FinTechs have captured significant market share through their flexibility and speed in offering customized client solutions to corporates seeking open-account trade. Meanwhile, the rise of digital banks – new banks with the latest systems and technology – may even disrupt the disrupters, as well as displacing incumbents. FinTechs have already transformed consumer banking and now see trade as an opportunity to grow the asset side of their balance sheet.

Chapter 4

Banks are being disintermediated as financiers of trade

When trusted, digital infrastructure allows all trade players to connect directly, banks may be circumvented altogether.

The role of LCs in trade, as well as banks’ diversified deposit bases and ability to raise funding cheaper than others, has cemented banks as the cross-border financiers of trade. But, while banks have sought to strengthen this position by expanding into financing pre-shipment and post-shipment periods, and discounting LCs, their dominance is being challenged by:

Institutional investors: While banks, post global financial crisis, have faced more restrictions, especially on capital requirements when extending trade financing, the buy-side, including asset managers, pension funds and insurance companies, have surplus liquidity and are looking for yield. These buyers are exploring trade finance as a new asset class to diversify portfolios.

Captive financing: As cash-rich corporates question the interest and other costs paid to banks, some have set-up or expanded their own captive finance organizations to self-fund global trade.

The global trade finance gap of US$1.60t2 , that banks are unable to meet, offers significant opportunities to non-banks. This may lead to new market disruptions, including the creation of a common digital infrastructure, connecting players across the trade ecosystem and shifting paper-based processing to an end-to-end digital interface. Some corporates are building their own networks – walled garden financing – that combine working capital financing solutions with payment gateways for their own ecosystems. For example, e-retail platforms directly finance users’ supply chains using data derived from a common infrastructure.

Ultimately, we may see banks circumvented altogether, where corporates link their end-to-end manufacturing supply chain through a technology platform to a parallel common infrastructure that includes digital processing and financing of trade transactions via institutional investors.

Chapter 5

Banks have an opportunity to reinvent their role in trade

Organizations that can improve trust in and remove friction from trade will inevitably be critical players in the future.

Can banks continue to dominate global trade?

Banks can maintain their dominant role in the market through investment in five key areas:

- A trade transformation strategy helps enable banks to continuously evolve to compete with new market participants. Strategic partnerships with external firms will allow banks to unlock value and remain competitive.

- Digitalization of trade to achieve operational efficiencies and remove friction from paper-intensive global trade. This will require initially using OCR to convert paper into digital and then upgrading the core platforms for digital inputs from e-commerce common infrastructure.

- Effective capital management which helps unlock capital and liquidity through data-led portfolio management. The centralization of portfolio data sources will enable reduced risk-weighted assets (RWAs) and improved portfolio returns, while also helping banks’ trade businesses to attract incremental resources from senior management.

- Next-generation compliance, such as our Trade Risk Analytics Compliance Kit (TRACK), which helps banks adhere to stringent regulatory and compliance requirements and reduce penalties, delays, audits and potential reputational damage. Automation and machine learning can enable proactive controls and more adaptable compliance efforts that will allow banks to automate regulatory and compliance checks with limited human intervention.

- Data and insights: Over the medium term, we believe that data and insight will supersede balance sheets as the core differentiator for facilitators and financiers of trade. Corporates are demanding a holistic customized solution for their trade financing. Banks will need to deploy advanced analytics to gain better data driven insights into their corporate clients’ businesses by integrating client’s existing data across trade, cash management and FX within the bank. Data-driven insight is equally critical in helping tackle the small and medium-sized enterprise (SME) financing gap by connecting companies to both non-bank and bank sources of finance. But understanding the risks associated with these borrowers is vital for investors.

Data is potentially a huge differentiator for large global and regional banks that already have a wealth of data across departments. Those that can consolidate internal bank data with data from external parties, such as shippers and other logistics companies, customs authorities and others, will win the information advantage.

For banks to remain dominant, they must invest in a clear trade strategy to navigate current challenges while preparing for the next five years. They must ensure that strategic decisions made today will enable agility and allow them to work in unison with a shifting trade agenda and complex ecosystem of participants. This requires data sharing and collaboration across a trusted network of global trade players, combined with an understanding of evolving financial regulation and market-leading efficiency.

As they define their strategy, banks must look at new ways to retain their highest value clients – those at the top of the credit curve – and explore new ways to serve clients down the credit curve, including small and medium-sized enterprises.

The transformation of trade offers banks a valuable opportunity to transform – to reimagine how to facilitate and finance trade with no constraints and no legacy baggage. Banks should ask themselves how they would set-up their trade finance business from scratch. Are existing organizational structures still fit for purpose or could some parts of the business be housed in a different legal entity? Is it time to consider creating a new digital trade bank?

Amid the disruption of global trade, pure efficiency plays and incremental innovation are no longer enough to compete. Banks must embark on a trade transformation journey – and ultimately may have to disrupt themselves, and completely reinvent the role of a global trade bank.

Summary

Banks can maintain their dominant role in the global trade market if they take key steps now to adapt to change.