Global tax reform

Government policymakers around the world are working together on tax reforms that could significantly alter the way global businesses are taxed.

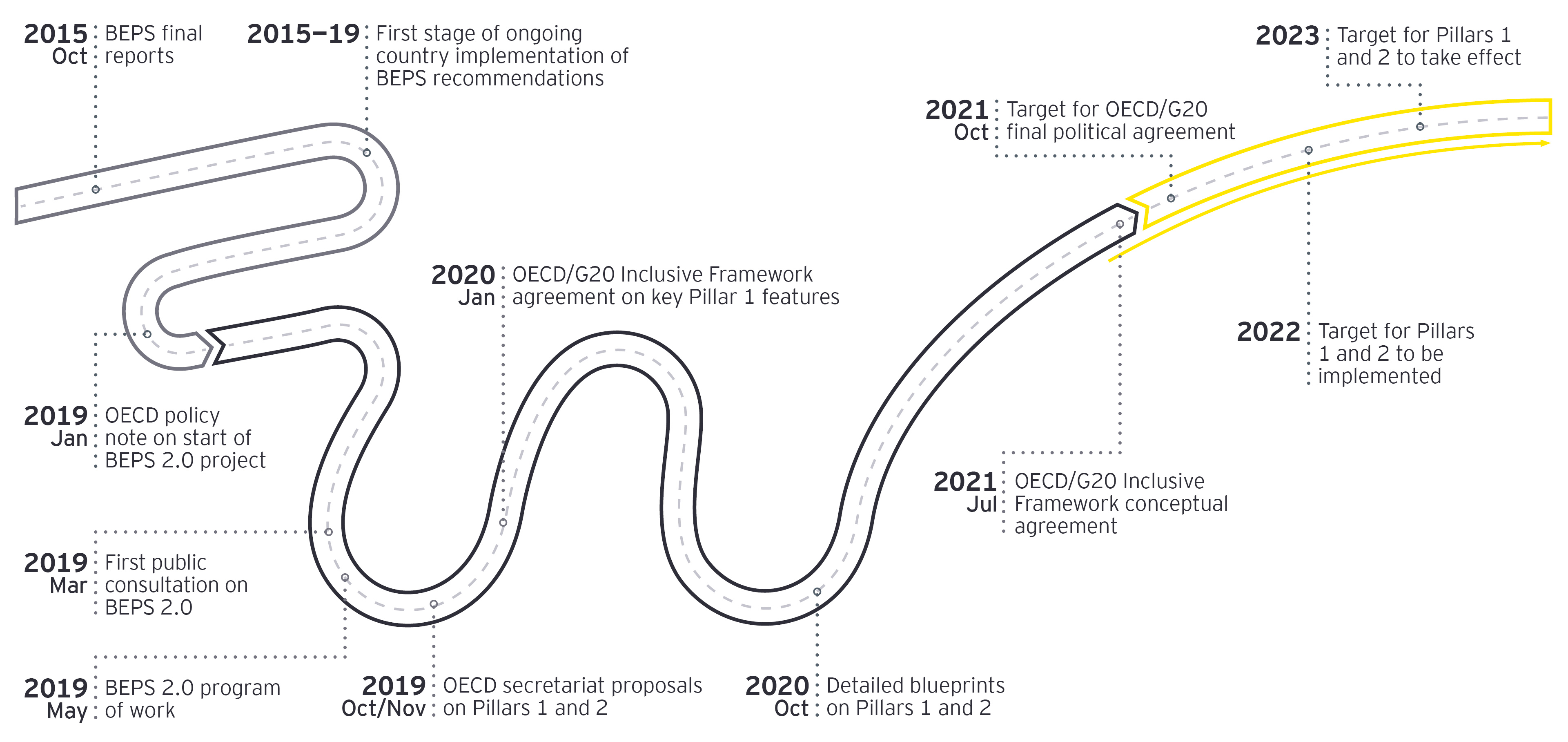

Of key importance is the OECD/G20 led project on addressing the tax challenges arising from the globalization and digitalization of the economy, commonly known as BEPS 2.0. The changes in development would significantly alter the overall international tax architecture under which multinational businesses operate.

The BEPS 2.0 project has two elements: Pillar One on new nexus and profit allocation rules with the objective of assigning a greater share of taxing rights over global business income to market countries and Pillar Two on new global minimum tax rules with the aim of ensuring that all global business income is subject to at least an agreed minimum rate of tax. All multinational companies will be affected by the fundamental changes to long-standing international tax rules contemplated under Pillar One and Pillar Two.

What global agreement means for the future of tax policy

Our latest thinking

The team

Contact us

Like what you’ve seen? Get in touch to learn more.