Point-of-sale lending is an instant and convenient credit-granting process for consumers that is seamlessly embedded in the checkout process. Merchants benefit from potentially higher conversion rates.

Young borrowers put technology first and expect transparency

POS lending and the digital transformation of consumer financing meet the changing expectations and habits of young borrowers. Millennials and their successors in Generation Z are digital natives with smartphones, their devices of choice. Rather than talking to a specialist when taking out a loan, they prefer digital self-service tools that allow them to make an informed decision best suited to their needs.

These buyers have high expectations around digital offerings that have been shaped by leading digital and technology players. POS lenders have understood this from the beginning, and one of their hallmarks is their ability to provide a superior user experience. The rationale is easy to follow since one of the key metrics, conversion rate, is ultimately driven by a frictionless credit-granting process.

As these younger borrowers become increasingly influential, the relevance of traditional bank branches for short-term loans is expected to further decrease, especially as banks ramp up their own digital finance offers. However, it would also be a mistake to completely dispense with the bank branch, since, if cleverly reinvented, it has the potential to be an important differentiator from the digital-only competition.

Young borrowers have the highest expectations from digital offerings — keeping them happy can potentially delight customers in other age groups.

What’s in it for the payments industry?

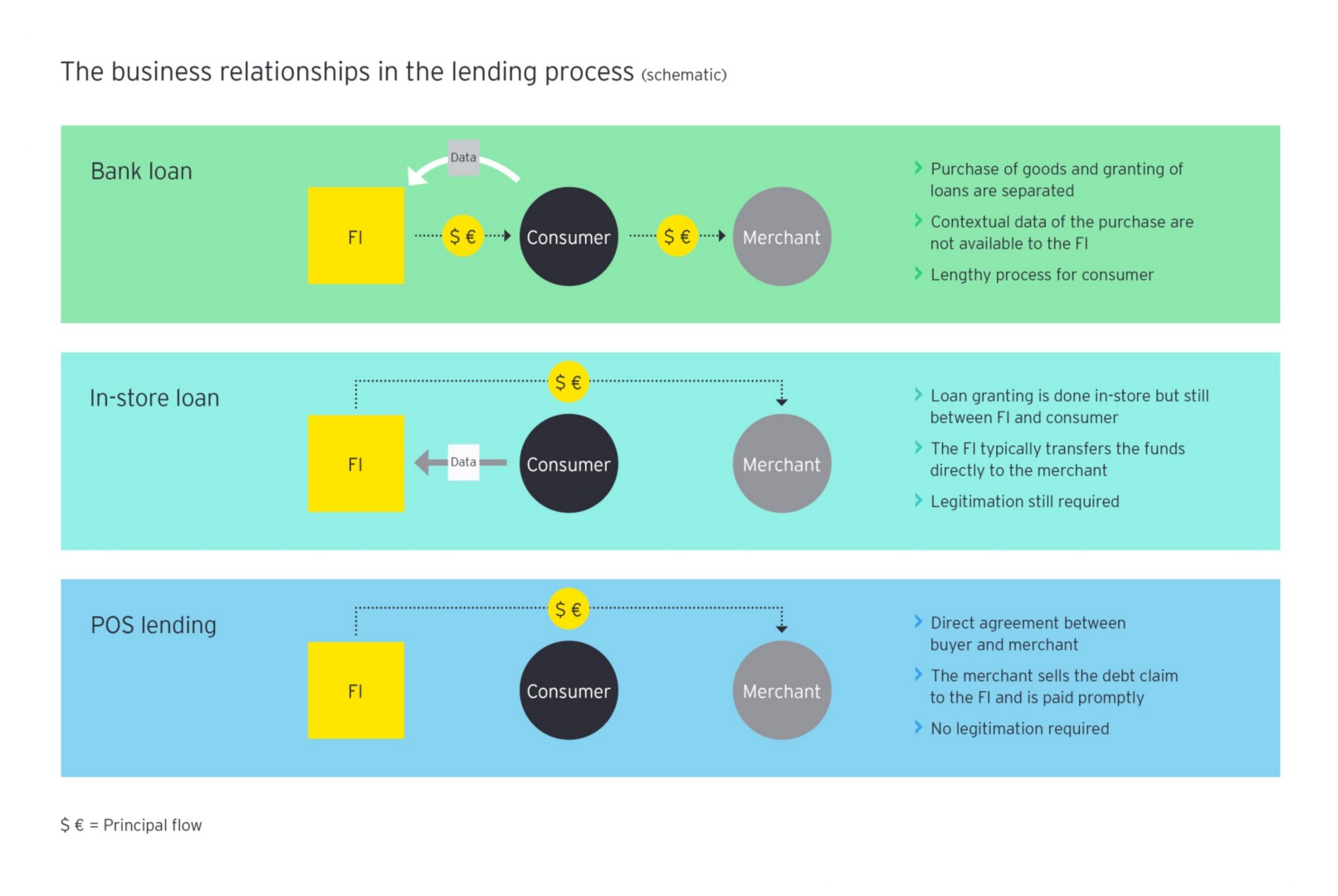

Traditional banks and financial institutions (FIs) have so far been hesitant to enter the POS lending space. In part, this is due to fears of undercutting their existing business, but for those that approach it in the right way, this form of lending has significant benefits:

- Contextual information around the loan (i.e., goods purchased, demographics of purchaser) can enable a more dynamic risk-scoring process, leading to higher approval rates, lower default rates and tailored consumer pricing.

- Sales and distribution efforts for POS lending can be leveraged within the merchant’s existing channels.

- Direct business relationships with merchants allow for up- and cross-selling of payment-related services.

Untapped physical POS market provides big potential

POS lending is still in the relatively early stages of development but is available at an increasing number of online stores. Consumers have eagerly embraced this convenient, immediate and often more transparent form of credit, which is showing a younger digital-savvy generation of buyers the ease of dealing with FinTechs and alternative lenders. Looking ahead, we expect even greater potential for POS financing in the mostly untapped offline world. Opportunities are significant, not only for traditional players in consumer financing but also for those from the payments industry already present in the POS space.

Summary

The digital transformation of consumer financing puts traditional lenders under pressure and presents opportunities for the payments industry.