Within the US alone, we estimate that strengthening trust could help banks create an additional US$11.3t in assets.

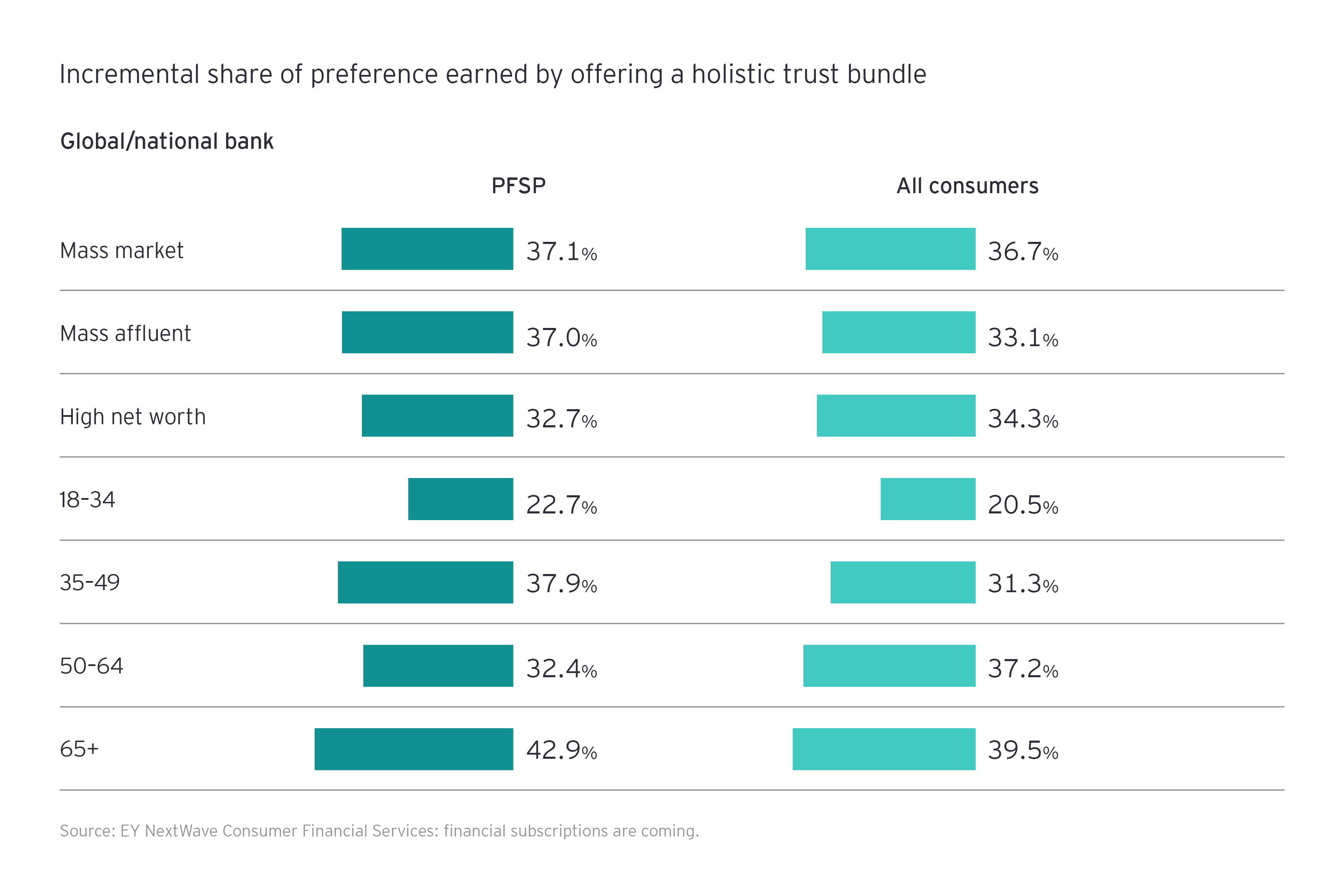

We compared a share of preference scores with those offering a “trust bundle” against the base case of current offerings for banks, and we found a clear advantage for those with features that built trust with customers. This advantage translates to a significant revenue opportunity — within the US alone, we estimate that strengthening trust could help banks create an additional US$11.3t in assets.

These results point to some clear short-term actions for banks:

- Enhance data security and privacy protection, and put customers in control of their data. In some jurisdictions, open banking regulation already mandates this. But banks that take a proactive approach to empowering customers could differentiate from competitors.

- Emphasize ethics and transparency. As the use of artificial intelligence (AI) and machine learning in decision-making increases, the rationale for these decisions can be opaque and subject to unintended bias. While some of these effects can be limited by good governance and ensuring the diversity of the teams developing algorithms, it is critical for banks to have clear audit trails for decisions, and to be able to explain, in simple terms, the rationale behind any decisions to customers.

- Ensure open communication. Bad press around data leakages, or unjustified credit decisions will impair trust in the sector. Past experience shows that the least impacted firms within and outside of financial services are those that have taken time to acknowledge the full impact of a breach and build confidence with customers that it was being effectively resolved. At a minimum, banks should test such scenarios to ensure an effective response when something does go wrong.

2. Make it simple and seamless

Customers are demanding dynamic, customized experiences that predict and meet their needs in real time. And they want interactions to be simple. According to the 2019 Edelman Trust Barometer, nearly three-quarters of people agree that financial services firms should lead on creating and using emerging technologies that make doing business with them easier. Similarly, the 2019 EY FinTech adoption survey (pdf) highlights that one of the reasons SME adopters chose FinTech is their 24/7 availability.

Digital innovation

73%of people agree that their financial services firms should lead on creating and using emerging technologies that make doing business with them easier.

Source: 2019 Edelman Trust Barometer

Banks need to focus on the “brilliant basics” – giving both personal and business customers a positive experience that meets their needs. This starts with fast, digitized online customer onboarding, enabled by new technologies that allow them to conduct their own know-your-customer (KYC) reviews and get instant decisions and disbursement of credit.

Technology can also help banks bridge the industry’s “advice gap” and deliver the right advice to the right customer at the right time. Many banks have already piloted video tellers and AI-driven business advisors, while others are offering products that seek to positively influence overall customer wellbeing.

Delivering the simple, easy experiences customers want depends on banks building a deeper understanding of them – using technology and data insights to know them better than they know themselves and being ready to support them, not just through their major financial moments, but in all the moments where a decision or transaction is made.

3. Help customers achieve bigger goals

Banks that consistently outperform the market take a strategic approach to meeting customer expectations. They identify a target customer segment and work systematically to understand this segment to develop and market relevant products, allocate investments in capital, ensure management focus, maximize share of wallet, and guide virtually every other significant decision.

Banks must shift from the traditional “product-push” approach to one focused on helping customers achieve their wider ambitions. For consumer banks, this may mean helping customers prepare for big life events, such as weddings or retirement, building their financial skills or achieving major goals such as buying a home.

One bank in Tennessee has decided to target customers in a clearly defined set of communities. By focusing on meeting the needs of this specific group, the bank has lifted ROE above the cost of equity.

For banks serving SMEs, it’s time to go beyond the “brilliant basics” and add more value by:

- Connecting clients to an ecosystem of suppliers and distributors

- Providing data-driven insights on customers, products and regions that support growth

- Supporting productivity with a range of services, including human resources (HR), talent, tax and regulatory compliance provided by bank partners

- Navigating larger commercial customers through increased business risk and helping them enhance performance in a weak market

Banks with corporate customers can also reap the benefits of a targeted approach. A high-performing bank in the Philippines focuses on serving just a few industries, including transportation, using its deep knowledge of these sectors to offer clients relevant services across all aspects of the business.

Building on trust to improve experiences

Changing expectations and increased competition make it even more challenging for banks to remain relevant to customers. But, high-performing organizations know that creating a customer-focused culture is critical to lifting profitability in tough conditions and allowing investment in the digital transformation programs that will drive long-term value. Building true customer centricity does not happen overnight, but banks can begin now by building on the latent trust of existing customers, improving their experience and taking a strategic approach to meeting wider expectations.

Summary

FinTechs and BigTechs have raised the bar for customer service, but high-performing incumbents are maximizing two competitive advantages – deep customer insights and the ability to use their size to lower costs. Building on consumers’ higher levels of trust in their primary financial services provider; delivering easier, more intuitive experiences; and supporting customers to achieve wider goals can help banks leverage these advantages to grow revenue.