Our approach to activate the wedge strategy

Anchor your ecosystem in holistic, hyper-personalized experiences

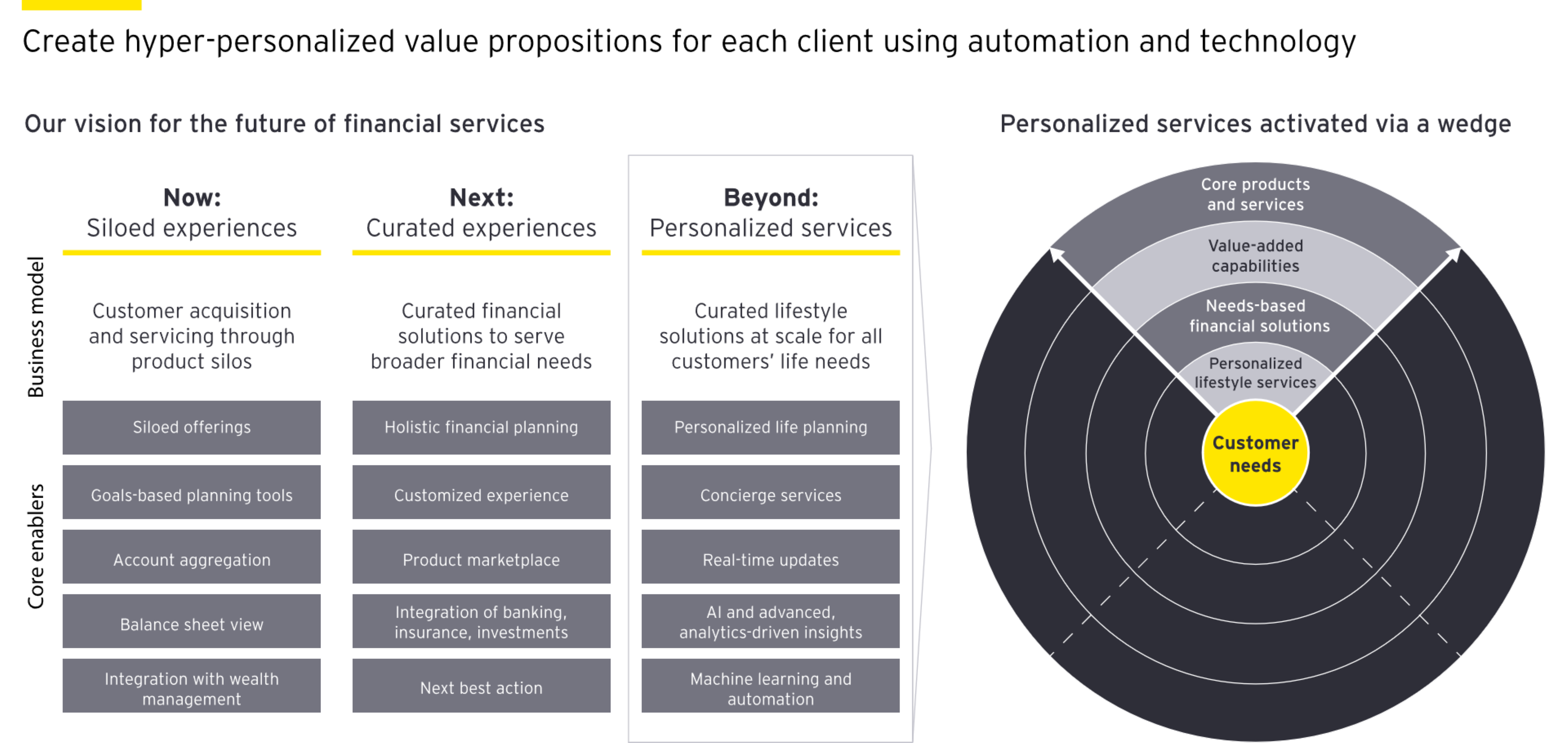

FIs must identify new value propositions for their customers — organizing around the sale of products is not effective in the current landscape. It will take lifestyle-based offerings to make a difference. The customer, not the product, will be the P&L.

For FIs, this will require a major rethink of their businesses. Institutions will need to invest in data and analytics capabilities to put themselves in their customers’ shoes and explore new partnerships, business models and value-added experiences. Then, they’ll need to synthesize these ideas into an integrated offering aimed at improving their customers’ financial well-being.

Perhaps the biggest task will be achieving hyper-personalization at scale and tailoring efforts to feel timely, relevant and credible. This requires analysis of transactional and behavioral data and an adoption of open platforms so that information can flow to trusted partners. “Closed-loop, data ecosystems” can help realize hyper-personalization at scale because they enable a continuous learning cycle for artificial intelligence to serve customized and contextual experiences, content, offers, recommendations and insights.

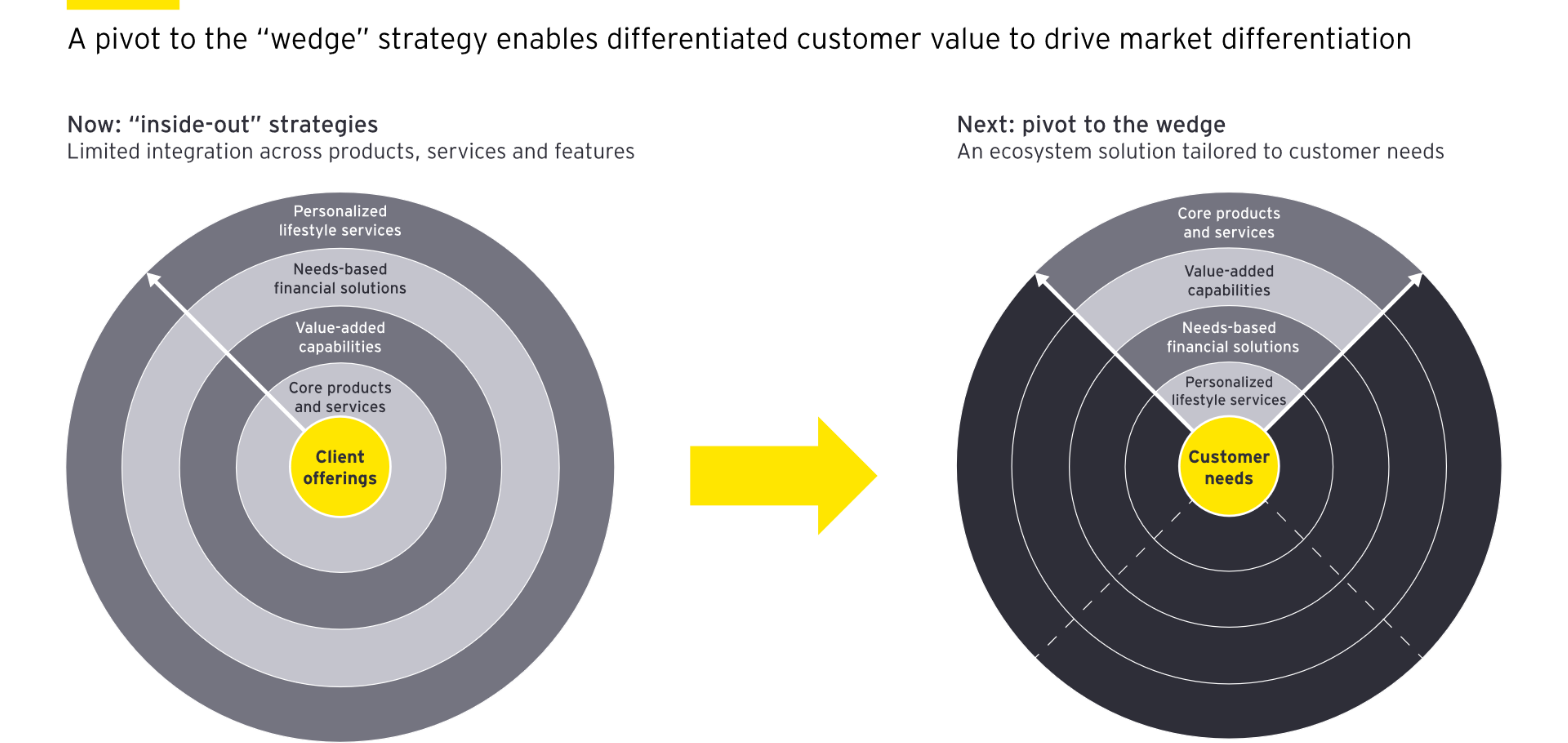

Transform your business model to put the customer at the center

Create personalized value propositions

To start, FIs should define their wedge strategy — their integrated value proposition — to target a specific audience of customers or primary needs. They should then reach that wedge with capabilities most relevant to their value propositions. For example, if a bank identifies that recent graduates care about savings and debt management, the bank should tailor its online services to make savings and debt management easier for this group and tie those capabilities to the lifestyle and life stage priorities of that audience.

This method allows FIs to build momentum through quick wins, while simultaneously establishing a process that tests, learns and adapts based on customer feedback. The result: FIs can create network effects to drive greater value across segments, allowing each dollar invested into the business to go further.

Invest in your data ecosystem: customer insights enable hyper-personalization

To truly serve an audience-of-one, you need to place data in the hands of decision-makers. Some of those decision-makers might even be algorithms.

Machine learning can enable personalization at scale, synthesizing large quantities of data to recommend products to customers based on current interests and circumstances. The goal is to engage clients with the right content, at the right moment, in the right space. Personalization can and should exist across channels — from online and mobile experiences to targeted emails and text messages to AI-powered chatbots. Additionally, front-office staff should have access to the resulting data so that customer experiences are seamless between the digital and physical realms.

However, to pull off a successful personalization strategy, FIs must also invest heavily in data security and data governance. Personalization is about adding value to a customer relationship rather than just marketing more effectively.

Shift from product-centric P&L to customer-centric P&L

Your customers are your competitive advantage, not your products. Customer-centricity shifts value away from profit pools that are based on a product or line-of-business (LOB) model to a customer-need-based revenue model — any other outcome isn’t customer-centric. This breaks the traditional, siloed structure of financial institutions and creates a framework to aggregate products and services into curated solutions. The downstream impacts will be profound, touching marketing, distribution, underwriting, finance, operations, technology, risk and compliance. What’s more, new KPIs and metrics will come along with the change, fundamentally transforming how businesses consider their success.

Let the facts drive the decision-making

Collaboration between a financial institution’s business, technology and marketing leaders is key to customer-centricity, but the process is more powerful when informed by rigorous data analysis and qualitative research. A modern approach to user research, rapid concept testing and experience delivery will help banks focus on their “Minimum Awesome Proposition” (MAP), not just their MVP. “Viable” is not a synonym for “good.” This test-and-learn mentality means bad ideas fail fast, and good ones are accelerated for approval.