Chapter 1

Priority 1: Pursue operational excellence and agility

Media and entertainment executives are evaluating their enterprises to stay relevant and sustainable.

In nearly all industry subsectors, the evolving nature of revenue generation — in terms of its mix, model and the contribution margin it generates — combined with the pressing need to release trapped capital to fund growth, is leading companies to proactively break through organizational inertia and spur transformation.

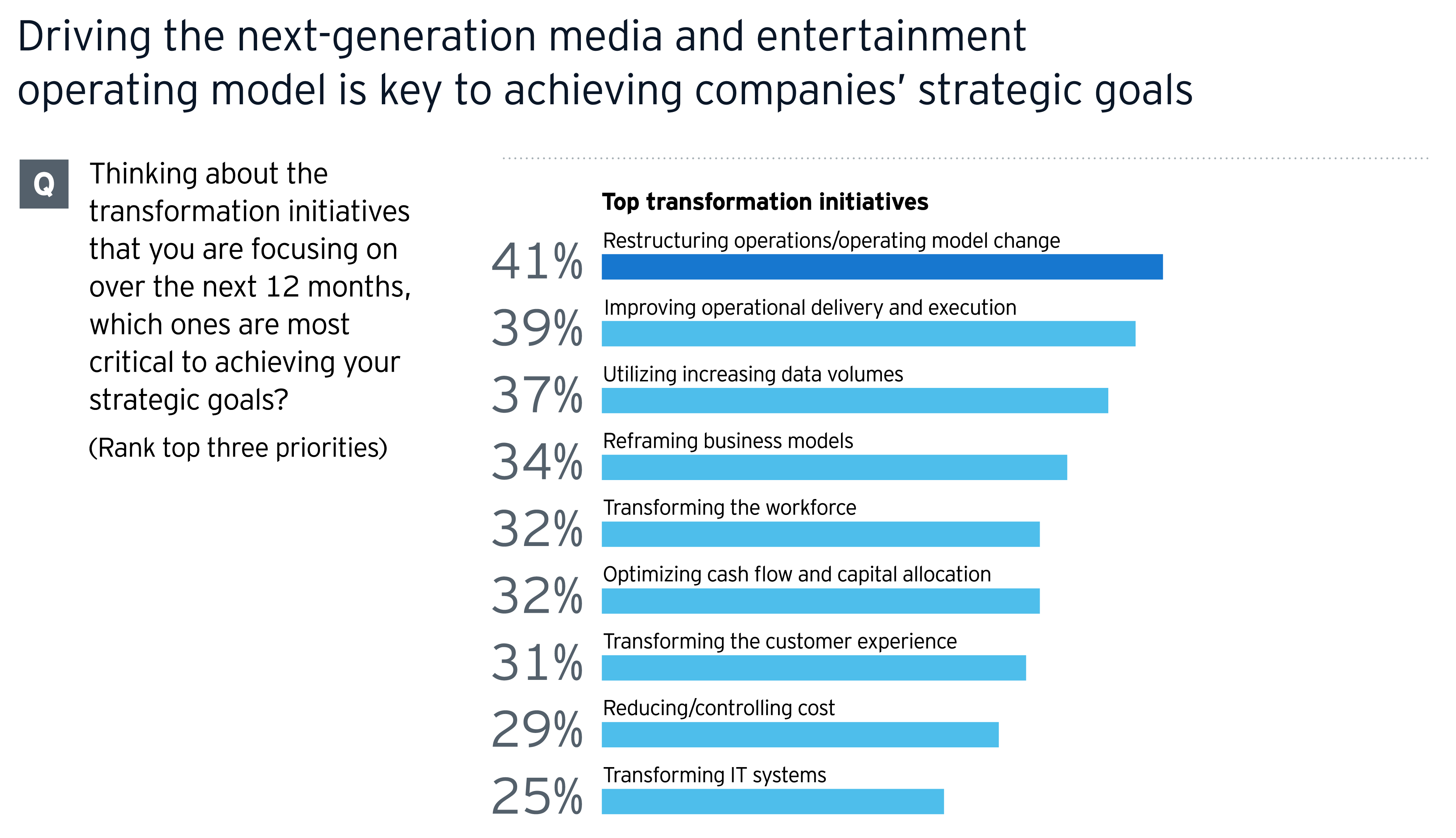

Across the industry, executives identified operating model change, and operational delivery and execution as two major priorities. Getting the operating model right is seen as truly transformational by almost two-thirds (63%) of those who are embarking on it.

What is the rationale driving operational excellence?

First is the emphasis on efficiency and the need to free up capital to compete in other areas such as content and technology spending or, as one executive stated, “cost savings in day-to-day operations that will enable capital investments.”

The second rationale is effectiveness such as the ability to execute at speed, or as one executive summed it up, “operational innovations to improve the way we perform.”

Rarely are efficiency and effectiveness exclusive. For example, automation improves execution by enabling processes that were otherwise manual or were impractical under legacy operating models. At the same time, automation, according to 46% of industry executives, is the single most important tactic for cost savings.

How are executives trying to make their enterprises more efficient and effective?

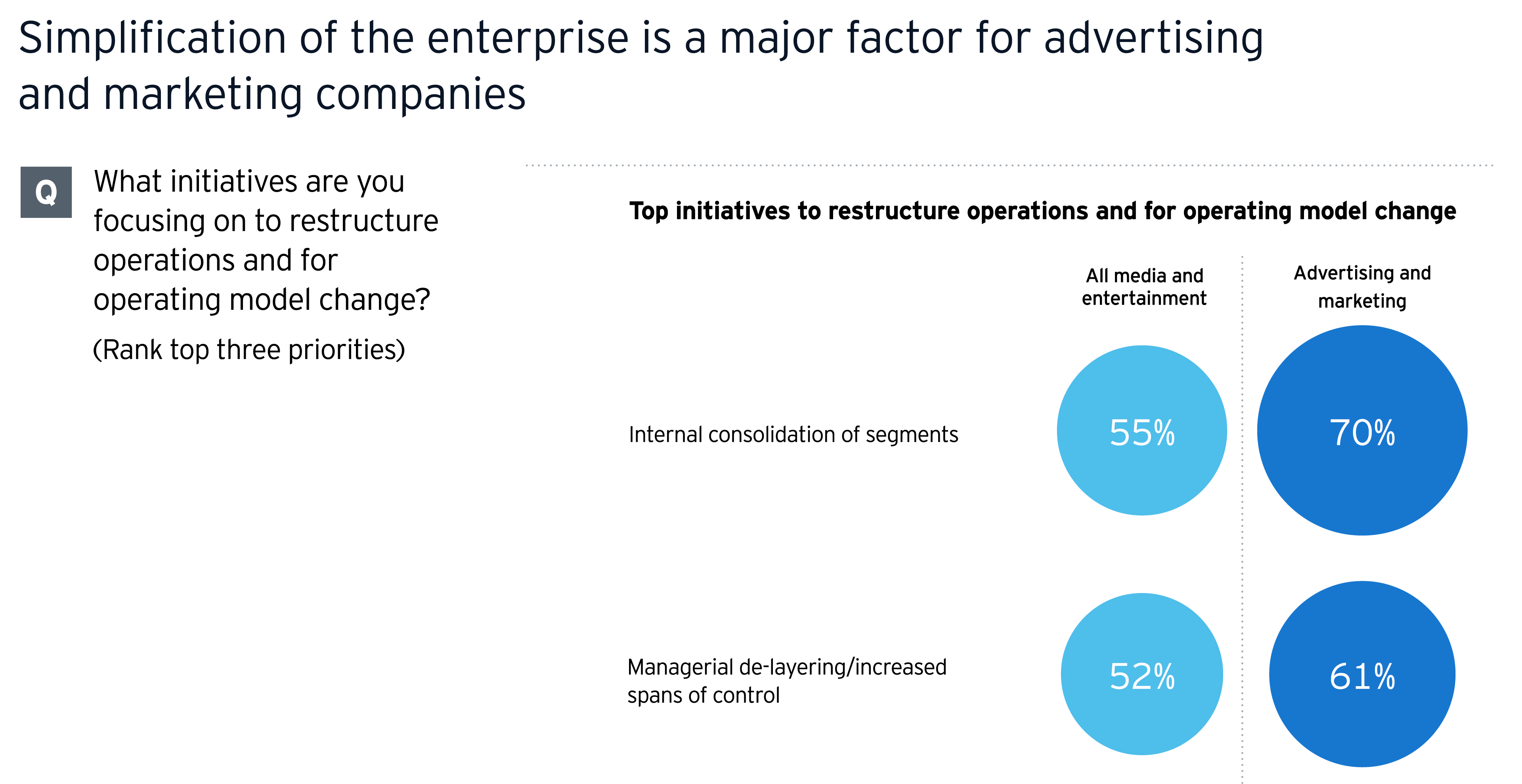

Simplification emerges as a major theme, and the number one initiative for simplifying the enterprise is consolidating internal segments to streamline the business (55%), integrating overlapping, duplicative corporate and business-level functions or merging stand-alone divisions and operating segments. Closely linked is the delayering of management and creating a broader purview for managers who remain (52%).

This approach to simplification is more pronounced in certain media industry subsectors such as advertising and marketing, where agency businesses frequently operate more fragmented operating models, often the outcome of multiyear acquisition programs. In addition, at advertising and marketing enterprises, the standardization of processes to simplify operational delivery and execution is also seen as a more significant opportunity than in other subsectors (63% vs. 38%).

Keep it simple

55%of executives want to streamline their business by consolidating internal segments.

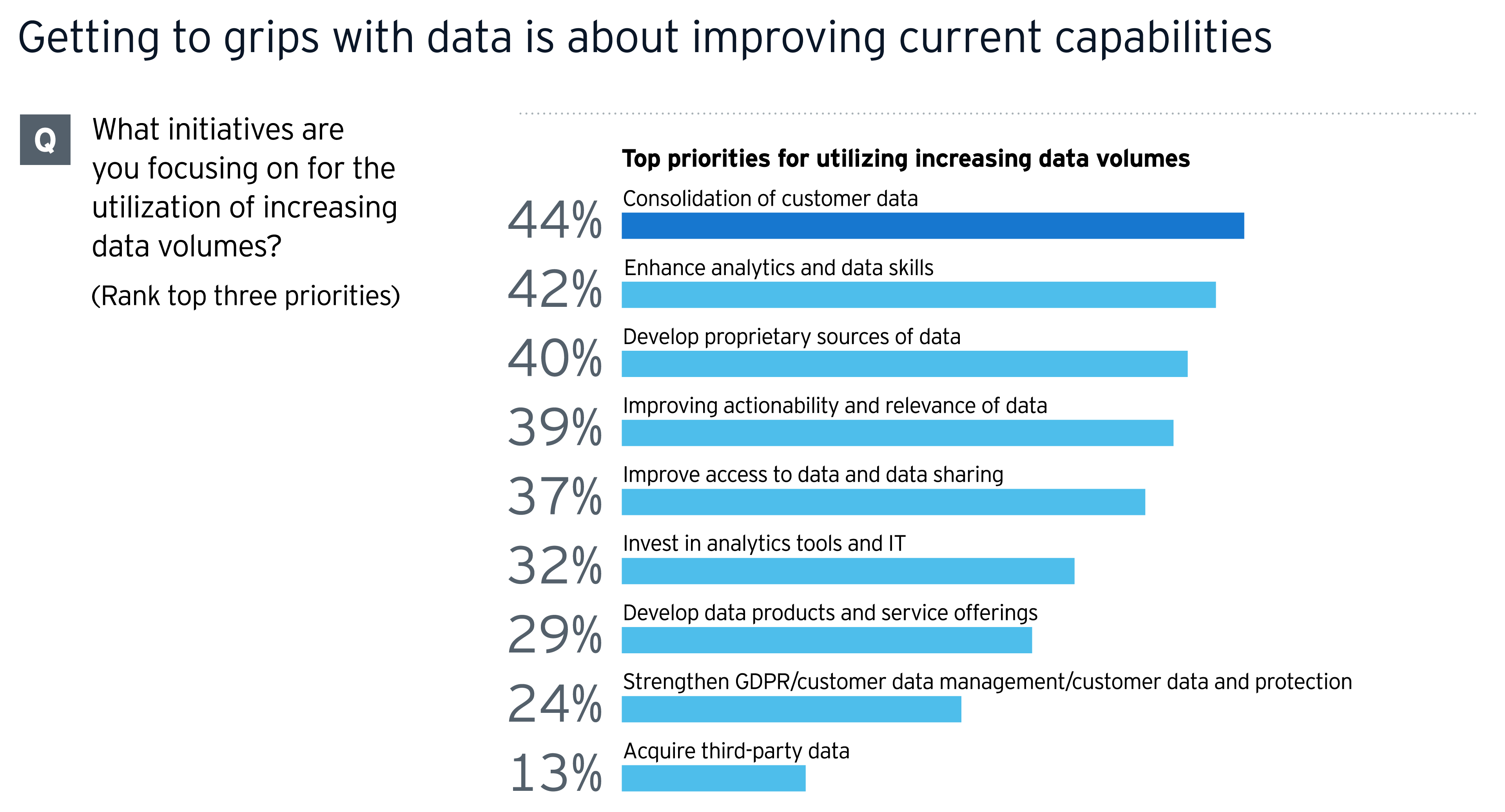

For several years, the utilization of data has also been a hot topic in many media enterprises both for improving operations and driving growth. Almost two-thirds of media executives see the increasing availability of data as an opportunity (62%). In some subsectors, such as information services — where data underpins the entire business model — the development of data products and service offerings logically is the top priority (44%). Yet for many enterprises, the ability to effectively utilize data remains elusive.

Major efforts by media companies on the data agenda include:

- Consolidating existing customer data (44%), thereby better understanding what they have today

- Enhancing the analytics and data skills of the organization (42%), thereby doing more with what they have

- Developing proprietary sources of data (40%) to better leverage what is available but untapped, to stimulate incremental commercial opportunities

The modern media enterprise is far more digital, data-driven, process-heavy and complex than ever before. As these trends intensify, media executives are looking for ways to free up resources and unburden the enterprise, allowing it to focus on what is important and strategic.

To optimize corporate activities that are subject to regulatory and compliance scrutiny, many media companies are centralizing functions into shared services frameworks, either insourced or outsourced.

For example, companies are increasingly working with third parties to run key areas such as tax, internal audit, legal, third-party risk management and cyber security as a managed service where the external partner delivers expertise and up-to-the-minute capability and technology.

Chapter 2

Priority 2: Reboot innovation strategy and approach

Many successful companies have had strong, charismatic leaders who seemingly shape and guide their organizations in their own image.

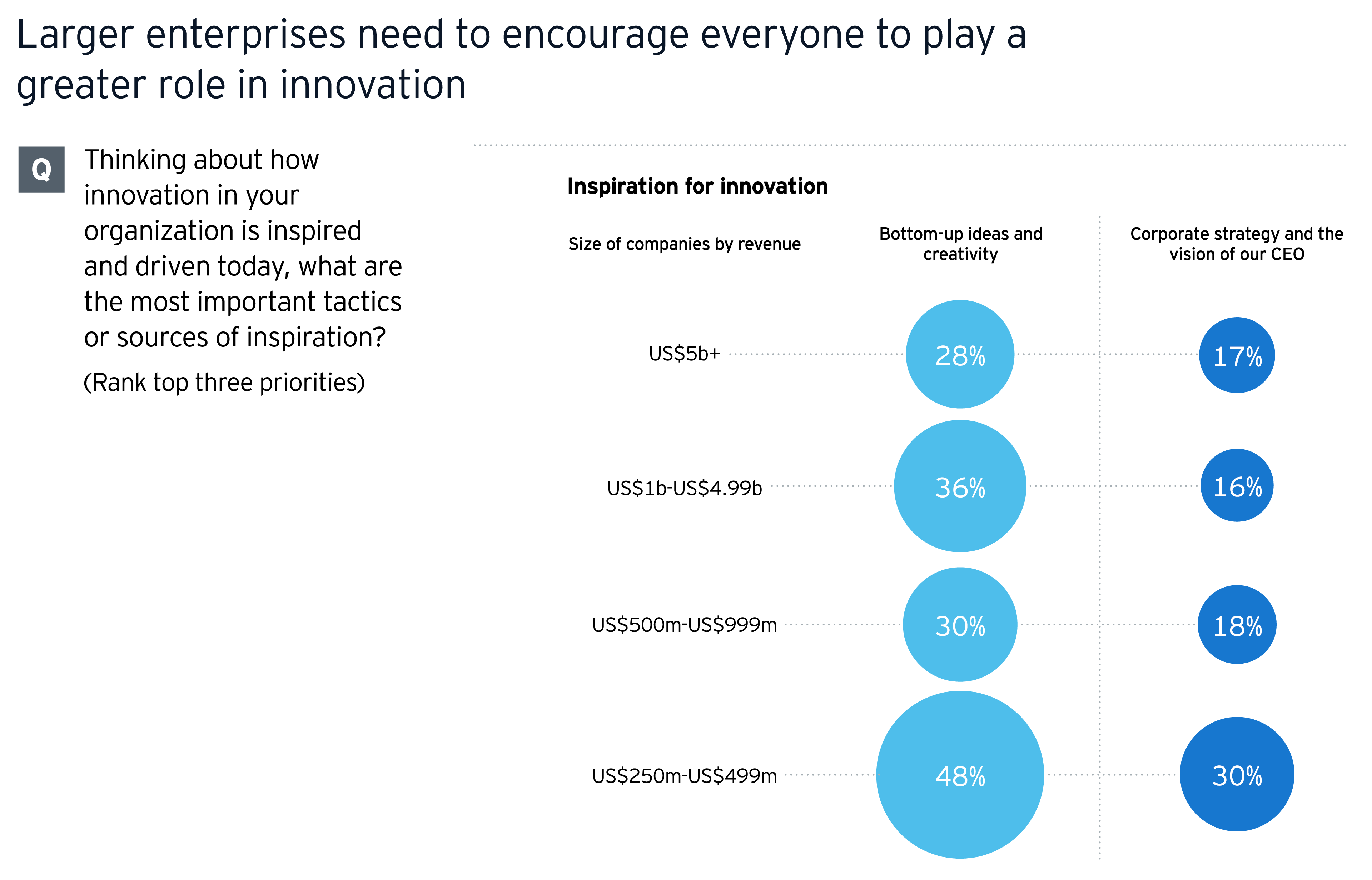

Media and entertainment leaders will always be integral to innovation in their enterprise. Across the industry, just 18% of executives see leadership buy-in as a barrier to innovation. It is the lowest ranked barrier and yet there is scope to do more. Only 20% of M&E executives consider their corporate strategy and the vision of the CEO as a leading driver of innovation in their enterprise.

Why are CEOs struggling to impose their innovation strategy and vision, and what more can they do?

The standout challenge, which executives are acutely aware of, is the pressure to deliver today and plan for tomorrow, the balance of sustained performance with long-term innovation. It was the biggest barrier to innovation, identified among their top three by almost half of executives (44%).

By necessity it leads to a strategy with multiple horizons, not all of which knit seamlessly together. As one executive noted, “the general idea here is to define steps for the next three, five, seven years and so on,” and then make investment decisions accordingly.

Balance sustained performance with long-term vision

44%of executives see the pressure of short-term performance as a barrier to innovation.

How are media and entertainment companies seeking to innovate? By pursuing several different strategies and initiatives, ranging from appointing Chief Innovation Officers to foster ideation from within the company to establishing in-house incubators, funding external venture capital investments or sourcing disruptive capabilities through acquisitions.

Developing a network of external advisors to showcase new opportunities is also a key ingredient for a robust innovation program.

There’s no one path to innovation, but it’s clear that it doesn’t happen by accident; it needs structure, leadership and above all recognition.

Innovation originating from within the organization was only important in certain sectors and types of organizations. For example, this more organic route to innovation was important for advertising and marketing businesses (47%) and for smaller companies. Bottom-up innovation was relevant for 48% of those in the US$250 million-US$500 million revenue range as compared with just 28% for those generating more than US$5 billion.

Coordinating innovation and allowing bottom-up ideas to flow is inherently more challenging if organizations are more mature, siloed and disparate, indicating why larger enterprises will find structured approaches to be more effective.

Chapter 3

Priority 3: Accelerate talent and skills development

People are the foundation of the enterprise, and media executives acknowledge the need to meaningfully nurture and develop their talent.

Like every industry, managing today’s workforce presents complexities for media and entertainment companies. We can expect tomorrow’s workforce – with its demographic spread and range of backgrounds, habits, demands and expectations – to be very different.

Employee attitudes about the workplace are changing quickly. For many, work is more than “checking into” a job; rather, work is a vehicle for making a difference. Purpose-driven, socially responsible organizations have become magnets for young talent.

In this context, the need to close the talent gap and build skills is rising in importance. Across the board, 33% of executives identify talent management as one of the greatest drivers of change in their business, ranking higher than competition, technology disruption or even changing customer expectations.

Closing the talent gap

33%of executives identified the need to close the talent gap and build skills as a driver of change.

A failure to bridge the talent gap continues to hold companies back. Among the biggest barriers to innovation in media companies is inadequate skills and training (30%), but there are broader issues.

To remain relevant, workers need to migrate up the value chain, reinventing themselves and constantly improving their capabilities. The relevance of expertise over experience tips in favor of the former.

How are media and entertainment companies transforming their workforce?

Among media executives, the number one preferred option for accelerating the development of talent is to upskill the existing workforce (49%). As one executive stated, “people development, that will get us where we want to be.”

If upskilling is the preferred option, going externally to recruit new skill sets also remains an important part of the mix and a tactic for 36% of media executives. It is less favored than upskilling because the rapid treadmill of industry change means that whoever is brought into the enterprise today needs to be upskilled tomorrow.

Any emphasis on recruitment as a tactic creates a potentially costly cycle of short-term fixes.

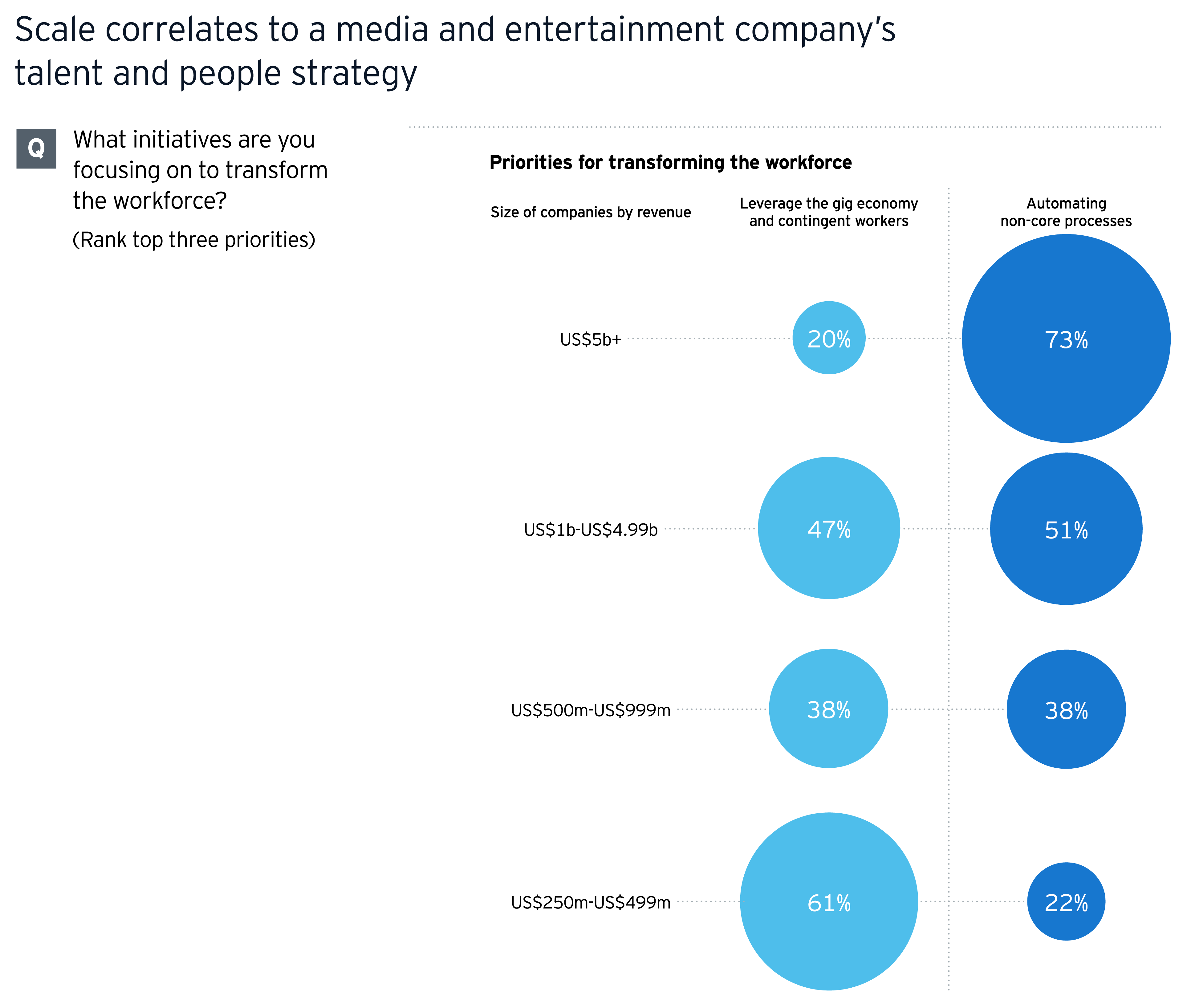

One solution to this paradox is the gig economy, which provides easy access to relevant skills and talent without the long-term costs of training and upskilling. Freelancers have long been a mainstay in the media industry, especially in subsectors such as advertising and TV and film production. Expectations are for their importance to grow.

This is already a tactic favored by smaller companies, and it should be embraced by larger ones. Of companies in the US$250 million-US$500 million range, 61% identify the gig economy as relevant to their talent strategy vs. just 20% for enterprises with turnover above US$5 billion.

Chapter 4

The way forward

When industry change is inevitable, learning from their peers about the priorities that make a difference, will help executives make more informed strategic choices.

By prioritizing three levers of action, media and entertainment companies can address their short-term challenges, while simultaneously preparing for long-term value creation.

- Operational change

The pursuit of operational excellence needs to balance efficiency and effectiveness if it is to create a media and entertainment enterprise that will compete in a rapidly changing ecosystem. Focusing only on one of these will deliver short-term but unsustainable results.

- Innovate by design

Innovation is a deliberate action, supported by clear structures, leadership and processes. At the same time, the approach to innovation must be multi-faceted and not rely on isolated initiatives or narrowly defined approaches.

- Focus on core skills

Building an environment of continuous learning and development is about more than checking boxes, it is essential to sustain the evolution of the enterprise. The rapid pace of change in media and entertainment makes upskilling an effective way to confirm capabilities keep pace.

Summary

As the next wave of media and entertainment enterprise takes shape, EY research highlights the actions leaders are taking and their priorities for shaping change.

Industry leaders are reinventing their businesses by focusing on operational excellence and agility, including the simplification of the enterprise. They also highlight the need to reboot innovation and to evolve the talent model, particularly through upskilling.