Chapter 1

Four ways that governments are responding

Jurisdictions are reducing rates and easing compliance, among other actions, as the crisis unfolds.

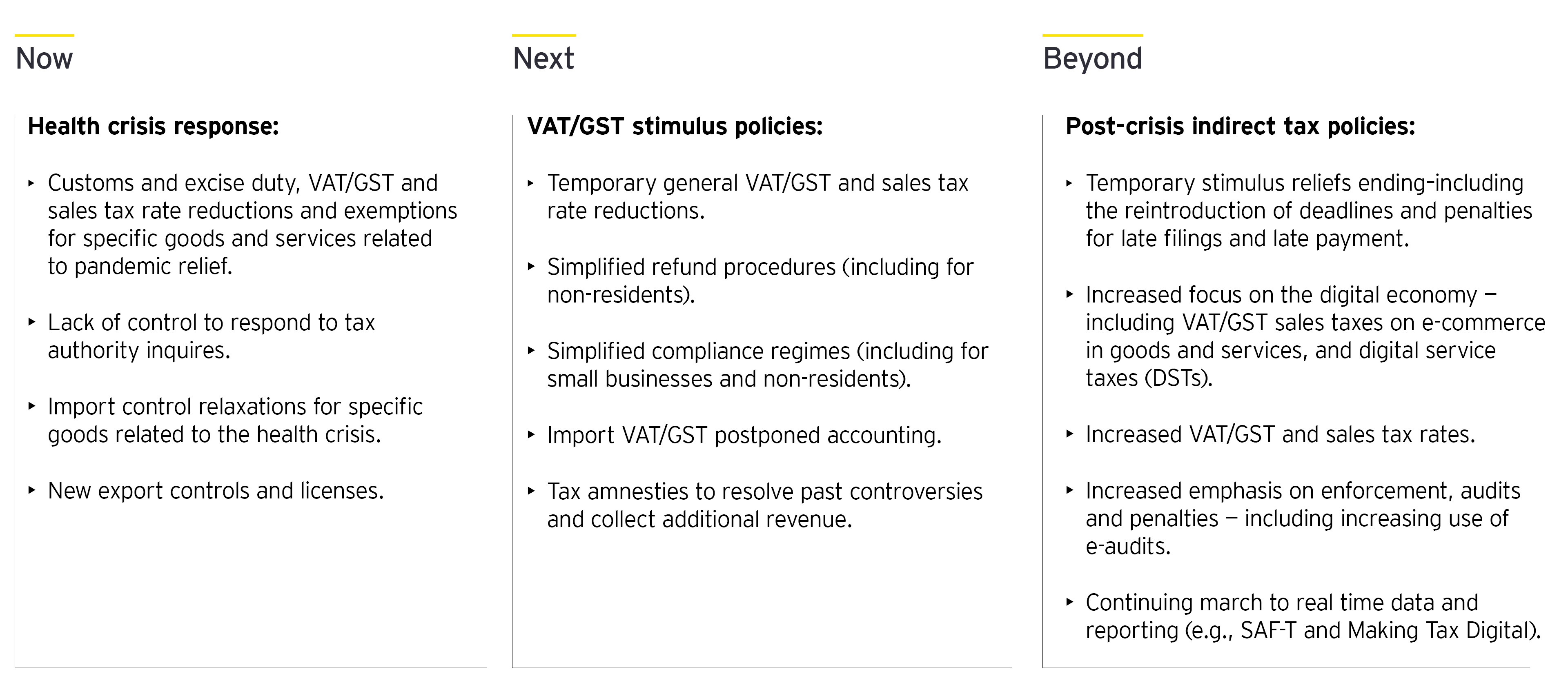

At the moment, the main areas of government action related to VAT/GST and sales taxes are:

- Reducing VAT, GST and sales and use tax (SUT) rates and introducing exemptions

- Relaxing compliance obligations for filing, payment, penalties and debts

- Accelerating VAT/GST/SUT refunds

- Adapting tax audits and dispute resolution procedures

But what longer-term policies are likely to follow? And how can multinationals understand what is available around the world to help them now?

COVID-19: How are governments responding to the call for stimulus?

VAT/GST and sales tax rate reductions and exemptions

Because the most immediate need is to respond to the health crisis itself, many governments have acted so that duties and taxes do not increase the cost of vital equipment for hospitals and so that compliance processes do not prevent goods from moving freely.

Some countries have adopted temporary VAT/GST rate reductions or exemptions targeted at goods directly connected with fighting the pandemic or aimed at vital sectors of the economy that are particularly affected by the crisis, such as tourism. In the short term, these measures are finely targeted, and most are intended to be short-lived.

However, it seems likely they may be extended if the pandemic continues longer than anticipated. In that case, countries might also consider adopting similar targeted measures to support particular industries, products or regions to help their economies compete.

Because the most immediate need is to respond to the health crisis itself, many governments have acted so that duties and taxes do not increase the cost of vital equipment for hospitals and so that compliance processes do not prevent goods from moving freely.

In the post-crisis recovery period, general VAT/GST and sales tax rate reductions might help to stimulate consumer spending. For instance, in the immediate aftermath of the 2008 financial crisis, the United Kingdom reduced its VAT rate from 17.5% to 15% from 1 December 2008 to 31 December 20091. Of course, any decrease in rates would need to be balanced with the resulting reduction in revenue, which could exacerbate budget deficits.

In the longer term, rates seem likely to return to pre-pandemic levels on all goods. Indeed, if the 2008 financial crisis is a guide, rates could even increase. However, many countries, especially in Europe, already have high VAT/GST rates, and further increases could be difficult to impose. Instead, governments may look to other indirect tax approaches to plug their COVID-19 budget deficits and compensate for lower receipts from income and profit taxes.

If so, the digital economy seems the most likely source of funds. This might involve adopting and extending digital service taxes (DSTs) and similar taxes and rolling out VAT/GST measures aimed at digital services and e-commerce in goods. Indeed, there are already signs that this is happening. India, for example, extended the scope of its Equalization Levy on 1 April 2020, and Indonesia has introduced digital tax measures that provide for offshore VAT collection for electronic sales into Indonesia.

Relaxation of compliance measures

Ongoing indirect tax compliance may prove particularly burdensome to businesses struggling to meet the immediate challenges created by the pandemic. Therefore, the most widely spread indirect tax actions are concentrated on easing the impact of consumption tax compliance on taxpayer resources and cash flow. These measures are being introduced in most jurisdictions, and they are vital to businesses of all sizes. Common compliance-related relief includes:

1. Extension of filing deadlines

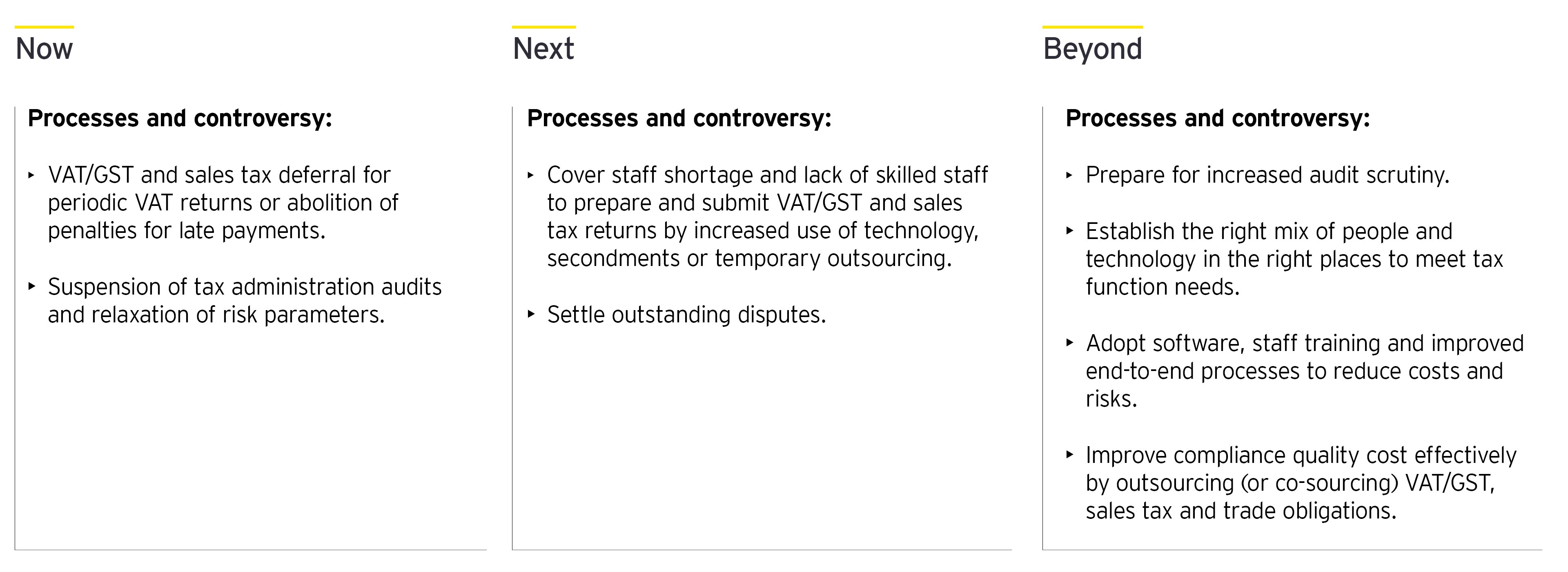

In most countries, periodic consumption tax returns must be filed regularly throughout the year, often monthly. Businesses may struggle to file returns on time as key staff may be absent, or they may have insufficient access to the data or technology needed to fulfill these obligations.

In response, VAT/GST/SUT deadlines in many jurisdictions are being pushed out by several weeks or months to provide additional time for taxpayers to file returns and related forms, such as standard audit file for tax (SAF-T) listings. Poland has also deferred the introduction of its SAF-T reporting obligation from a planned introduction date of 1 April 2020 to 1 July 2020.

2. Deferral and suspension of tax payments and penalties

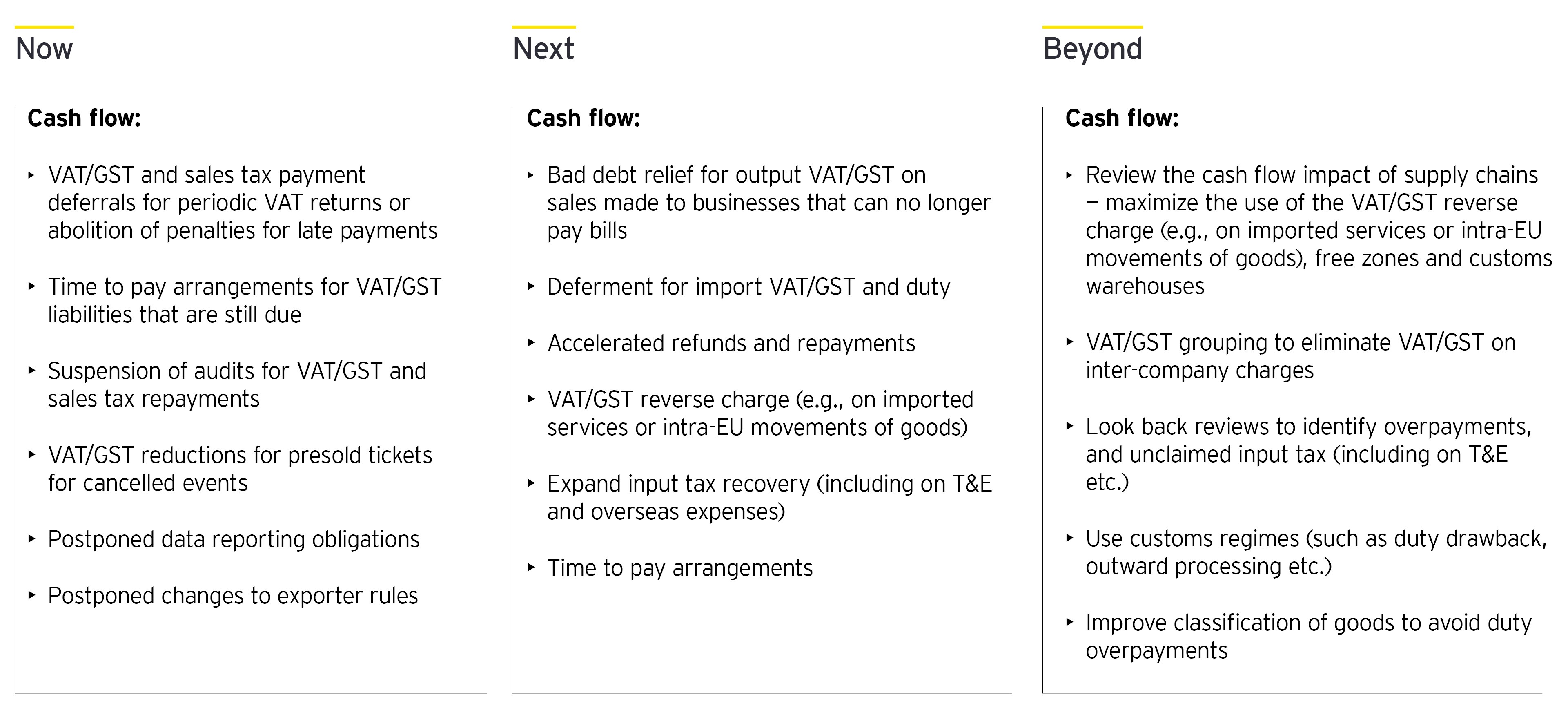

While filing returns on time during the crisis may be hard for many businesses, meeting VAT/GST and sales tax payment deadlines may be even more difficult. The disruption to economic activity caused by the pandemic is having an unprecedented impact on businesses of all sizes, many of which are now facing severe cash shortages.

Addressing these immediate difficulties is a top priority for many governments. Jurisdictions have announced short-term payment deferrals of one or two months, while a few have suspended VAT/GST or sales tax payments altogether for the moment (although taxpayers may still need to submit returns on time). In addition, many jurisdictions are also temporarily waiving penalties for late filings and late payments

3. Time to pay arrangements

Businesses that owe VAT/GST and sales tax debts may be able to use a jurisdiction’s general tax debt payment plans (sometimes referred to as “time to pay” arrangements). As the crisis continues, tax administrations are publicizing these arrangements more widely, and some are relaxing the rules for using them. Businesses should not overlook using these arrangements as they may be vital in assisting where formal deferrals or suspension arrangements are not available, are restricted to certain classes of business or have ended.

Easing immediate VAT/GST and sales tax compliance burdens will no doubt provide much needed breathing space for many businesses, which may be sufficient to tide them over the crisis. But, if the crisis continues for longer than anticipated, these temporary measures may need to be extended or additional easements may be required. Doing so may prove difficult for some governments, which often rely on indirect tax receipts to meet their own cash flow requirements and to fund public spending.

However long the measures last, taxpayers will need to be careful to maintain good accounting practices during the period that obligations are relaxed. They should plan now for how they will meet their obligations in the future, especially if key staff have been furloughed or are still absent from work when normal obligations are re-imposed. Equally, taxpayers must closely monitor levels of accrued or deferred indirect tax debts, as payments will resume in the future and past liabilities will need to be paid in full eventually.

Accelerated VAT/GST and sales tax refunds

A wide range of businesses are currently carrying excess input tax credits (that is, they have incurred more VAT/GST in a period on business expenditures than they have charged VAT/GST on sales). For many businesses this is a new situation created by the crisis—for example, because they are now carrying excess inventory that will not be sold or that will be heavily discounted, or because they have purchased additional equipment to manufacture new products or to allow employees to work from home.

In the longer term, taxpayers may expect increased scrutiny, and compliance and reporting obligations may even increase once the crisis has ended. This was the case following the financial crisis.

VAT/GST credits can have a severe impact on cash flow—especially if the amounts paid to suppliers must be carried forward for months or years before being offset or repaid. Some countries are responding by accelerating VAT/GST and sales tax refund procedures. This may involve quicker processing or allowing more frequent requests (such as monthly rather than annually). Some authorities may even consider relaxing the audits and risk checks carried out before making refunds, for example, for amounts below certain thresholds or for businesses with good compliance records.

Adapted audits and dispute resolution

Tax administrations are temporarily changing their tax audit policies and practices to reflect new guidelines on social distancing and to reduce the resources needed to deal with time-consuming audits (both by the tax administration and taxpayers). Most authorities are stopping or reducing their physical audit activity, and some are relaxing their risk parameters for businesses with good compliance records. Tax courts are also suspending activity in many places. Taxpayers with open or disputed tax positions may wish to enter into discussions to reach agreement for past periods and achieve certainty for the future.

In the longer term, taxpayers may expect increased scrutiny, and compliance and reporting obligations may even increase once the crisis has ended. This was the case following the financial crisis, as governments looked to consumption taxes to meet their revenue needs in the face of reduced direct tax receipts. It seems inevitable that tax administrations will return to the increasing digitalization of VAT/GST compliance and reporting, requesting more real-time data from taxpayers.

Chapter 2

Using the indirect tax function to respond to the crisis

Effective indirect tax approaches are vital today and can continue to add value after the pandemic.

The large number of COVID-19 stimulus measures being adopted around the world can seem overwhelming. In this environment, the indirect tax function should play a vital business role. This is an opportunity to add value to the entire enterprise by identifying relevant measures and taking steps to take full advantage of them, as well as by identifying additional opportunities to release cash.

In the immediate crisis, two issues are paramount: tackling the health emergency and ensuring business survival. In the short- to medium-term, managing cash effectively will continue to be a priority for most businesses. As formal stimulus measures end, survival will continue to be important, but so will recovery and transformation.

Dealing with day-to-day tax compliance needs may continue to prove difficult, especially in prolonged lockdown periods, which may increase enterprise risk. These are areas where the indirect tax function can play a key role in maintaining the health of the business and in its recovery.

In addition to using the formal stimulus easements, businesses may take this opportunity to improve how they manage VAT/GST generally, release cash tied up in indirect taxes, improve working capital and reduce borrowing requirements. Simple approaches may include claiming bad debt relief, improving sales and purchase invoice processing, and ensuring VAT/GST is recovered on all eligible expenditures (including employee travel and expenses).

Even as restrictions are lifted, indirect tax can play a crucial role in the return to growth. Effective management of costs, cash flow and compliance obligations will continue to be priorities. After the pandemic, businesses will continue to derive value from effective indirect tax approaches identified during the crisis.

Summary

As the crisis continues and business viability is uncertain, managing cash effectively will remain a priority for most companies. But as indirect tax rate reductions and related measures end, recovery and transformation will take precedence.