1

Economic update

Despite Australia’s positive economic performance, there are still risks and challenges ahead

The Australian economic recovery from COVID-19 continues to be stronger than expected and world leading – reflecting a strong health outcome and an effective policy response.

In the December quarter of 2020, the Australian economy expanded by 3.1%, leaving the economy just 1.1% smaller at the end of 2020 than at the end of 2019. This momentum has continued into 2021. The April Consensus Economics forecasts anticipate that the Australian economy will be almost 2% larger at the end of 2021 than the end of 2019.

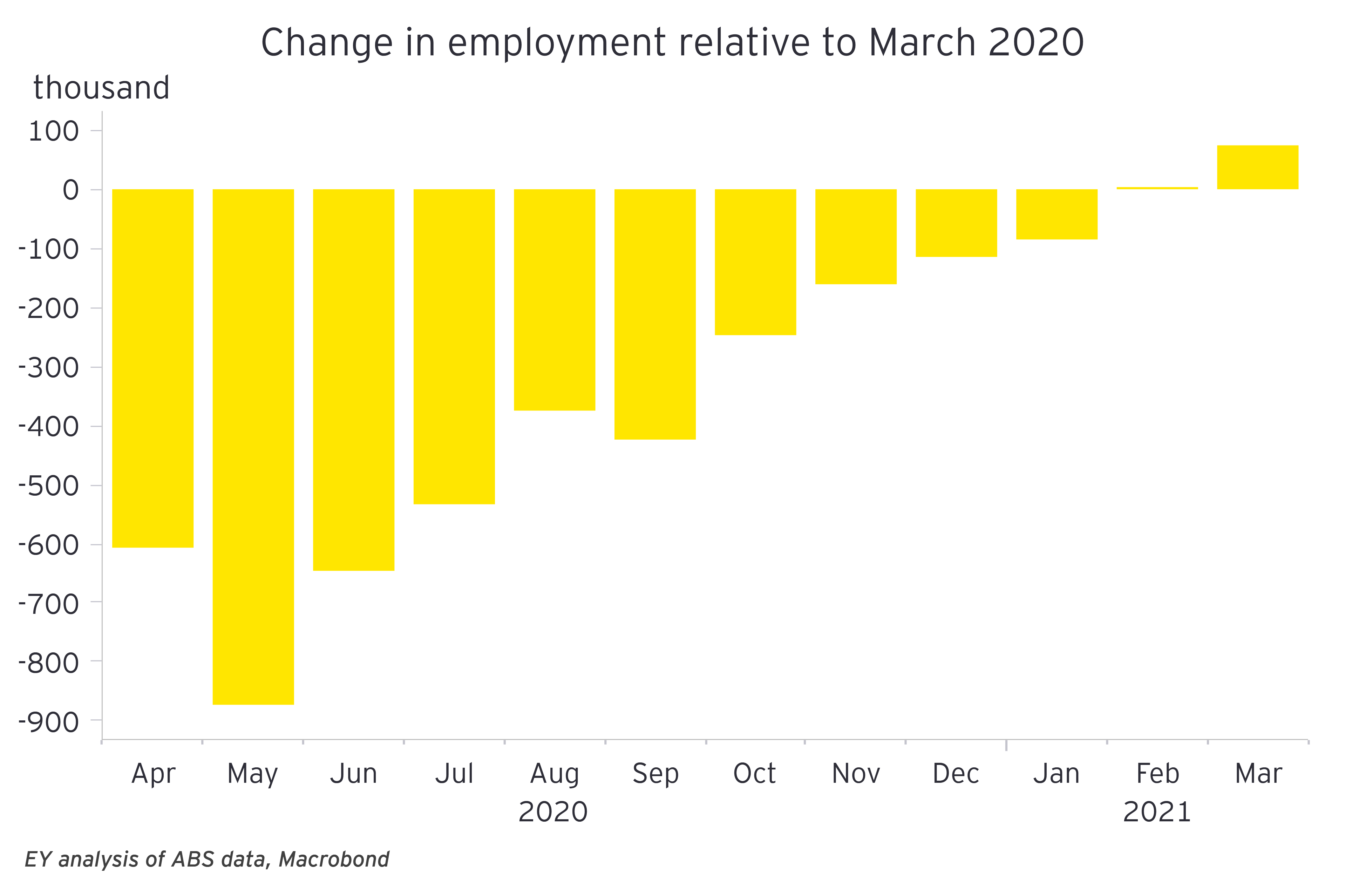

This strength in recovery can been seen in the labour market. As of March, almost 75,000 more people were employed than before the pandemic and hours worked, a key indicator of output, was 1.2% higher than a year ago. The unemployment rate continues to fall faster than expected, falling to 5.6% in March and is already lower than Treasury’s 5¾% expectation for 2022-23.

While household income rose in 2020, lingering spare capacity in some sectors of the labour market remains a challenge for wages growth, which was weak going into the pandemic and is expected to remain weak for some years. The unemployment rate, at 5.6%, is well above full employment (estimated to be around 4.5%) while under-employment is elevated at 7.9%. Reserve Bank of Australia (RBA) forecasts expect wages growth to remain below 2% until at least 2023.

Likewise, annual inflation was just 1.1% in the March quarter, and despite possible volatility, is expected to remain below the target for some time to come. Based on this outlook, the RBA is expected to maintain its current forward guidance that the official cash rate will not be increased until at least 2024. The RBA is also expected to deliver ongoing, but tapered expansion of the quantitative easing (QE) program. However, there is uncertainty as to whether yield curve control will be extended from April to the November 2024 bond.

With weak wages growth, households will need to run down the war chest of savings accumulated over the past year in order to maintain consumption levels seen over the second half of 2020.

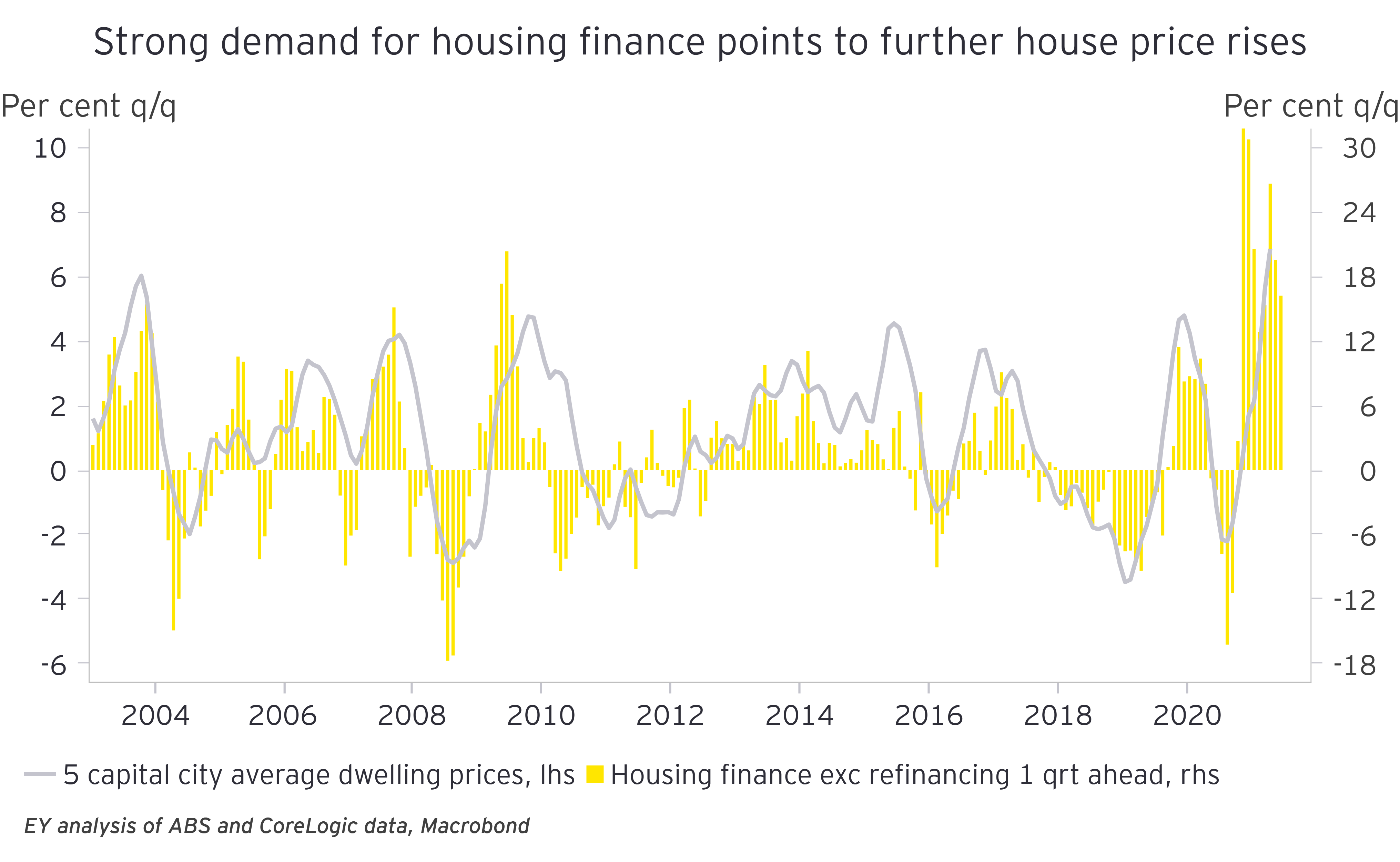

Households’ willingness to rundown savings will reflect confidence, job security and house prices. House prices since the start of the year have been rising at a rapid pace. Nationally, house prices rose by 2.8% in March, the fastest pace since 1988, rising by a further 1.8% in April. Prices are now 7.7% higher than they were at the end of 2020. There are early signs that monthly price gains may continue to moderate – new listings are lifting, and affordability constraints are hitting first home buyers. However, given low interest rates, house prices are expected to continue to rise over the coming year, albeit at a more moderate pace than of late.

Like households, Australian businesses are currently navigating the withdrawal of direct support. Insolvencies, which are currently around 50% lower when compared to a ‘normal’ year are expected to rise over the coming months as the ‘normal’ insolvency cycle resumes and the impact of the withdrawal of government support starts to play out.

Despite NAB’s business survey recording the best business conditions on record, businesses look to be taking a cautious approach, shoring themselves up in the face of continued uncertainty. Nonfinancial business deposits are 17.9% higher over the year and business credit is flat.

This cautiousness is best seen in businesses’ reluctance to take on large, long-term investments. While the Federal Government’s instant asset write off and accelerated depreciation measures have seen a lift in near term forecasts for business investment, long- term consensus investment forecasts are a concern and point to an underlying lack of confidence.

Despite Australia’s positive economic performance to date, there are still risks and challenges ahead: a lingering unevenness in the recovery, the slow vaccine rollout and long- term structural challenges – weak business investment, slow productivity improvement and soft wages growth – that may prevent Australia from realising its potential. The Federal Budget on 11 May is key in understanding the policy and fiscal response from here.

New Zealand

Like Australia in many ways, the economic rebound in New Zealand has been stronger than expected. At the end of 2020 the New Zealand economy was just 0.9% smaller than at the start, despite a small quarterly contraction in the December quarter. Over the course of the year, border controls largely kept the health crisis at bay, while strong demand for New Zealand exports and significant fiscal policy supported the domestic economy.

Asset prices in New Zealand have experienced rapid growth, with house prices rising by 24.3% in the year to March 2021. Low interest rates and the removal of loan to value ratio (LVR) restrictions early in 2020 were significant demand side drivers, alongside limited growth in supply. In response, policy makers have deployed macroprudential policy, implemented changes to tax policy settings, and broadened the mandate of the Reserve Bank of New Zealand (RBNZ) to consider house prices when setting interest rates.

2

Credit growth

Housing lending has underpinned credit growth

Credit growth continues to be supported by housing credit, while business credit remains generally flat or has declined for the major banks in this half compared to the prior comparative period.

Concerned that responsible lending obligations might be unduly constraining banks’ lending, the Federal Government still plans to remove most of the responsible lending obligations currently included in consumer protection legislation. The aim is to improve the efficiency of the approval process for consumers and small businesses by removing ambiguity over compliance requirements and reducing verification and inquiry requirements to minimise loan processing delays – reducing the ‘time to yes’ for loans.

NIM

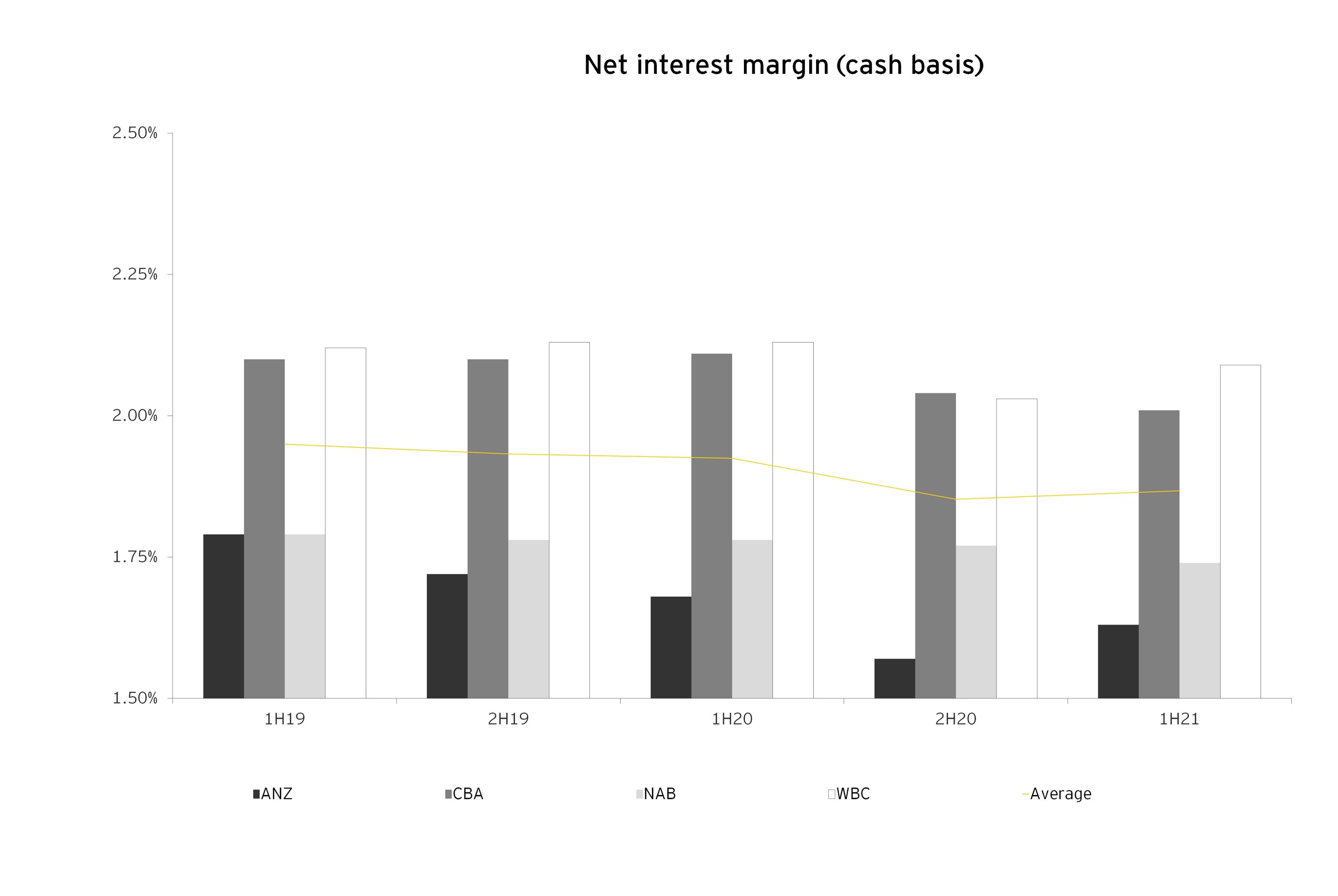

NIM declined due to low interest rates, excess liquidity and intense competition. The shift in asset mix toward lower margin fixed-rate housing loans has also put pressure on margins. ABS data indicates that the share of fixed rate loans for new housing finance commitments rose from 13% in March 2020 to 41% in March 2021 [1].

Lower funding costs offset some of the margin pressures and have helped sustain NIM. The major banks have benefitted from the availability of low-cost funding under the RBA’s Term Funding Facility (TFF) and the shift in deposit mix toward lower cost at-call deposits. Deposit has provided a further boost to NIM.

The banks have also adopted a disciplined approach to pricing for risk, applying differential pricing for higher risk loans.

However, lower volumes have negated some of the impact of positive NIM factors on net interest revenues.

Source: EY analysis

NIM is likely to remain constrained over the medium-term, given RBA expectations that the official cash rate will not increase until 2024 at the earliest.

Mortgages

New housing loan commitments have continued to show very strong growth, reaching record high levels and increasing by more than 55% over the year to March [2]. However, the major banks have grown below system amid a fiercely competitive market. Mortgage growth has been largely driven by lending to owner-occupiers, including first home buyers taking advantage of government incentives and low interest rates. Investor lending has also gained momentum in recent months to finish 54% higher over the year to March [3]. However, the share of these higher risk investor home loans as a proportion of total housing credit remains low. The share of high LVR and high debt to income lending has also been increasing since mid-2020 [4], but both remain low by historical standards.

In an environment of very low interest rates and rising housing prices, regulators and policy makers are closely monitoring lending standards. There has been no notable evidence of a decline in housing lending standards. For example, the share of loans with an LVR ratio above 80% is just 21% of outstanding credit. And importantly, the current housing market has been driven by owner occupiers – currently more than 74% of new loan commitments – not investors. However, should credit underwriting standards deteriorate, the introduction of macroprudential controls by APRA is a likely outcome. These could include a cap on the share of loans with a high LVR or debt to income ratio. The challenge for APRA will be to ensure that controls do not unduly restrict the supply of credit to first home buyers.

While rates on shorter-term fixed loans offered by the major banks continue to fall – some advertised rates are now below 2% – a number of banks have recently increased rates on four-year fixed-rate loans. The move reflects anticipated increases in funding costs amid rising long-term bond yields and the end of the TFF in June, and the pricing in of a possible rate increase in 2024.

Business banking

While there has been little change in small-to-medium enterprises (SME) lending at the system level over the past 12 months [5], there are signs that conditions are starting to improve. Business credit looks to be stabilising, following eight months of contraction. The latest EY Capital Confidence Barometer shows that Australian firms expect revenue and profitability to be back to pre-pandemic levels either this year or next. As the economy has started to recover, some of the banks have noted growth in business credit in recent months.

However, small businesses are reporting that access to finance remains challenging, particularly for new businesses. Banks are taking a cautious approach in deciding whether to finance small businesses, focusing on the more profitable customers and sectors likely to see good growth as the economy recovers. They are also pricing for risk and imposing more restrictive terms on loans.

Buy now, pay later options

The buy now pay later sector continues to grow rapidly as new providers enter the market. RBA research indicates the value of BNPL transactions increased by around 55% in 2019-2020 [6]. However, this is off a low base, with the value of BNPL payments estimated to be equivalent to less than 2% the total value of Australian debit and credit card purchases in 2020 [7]. Nonetheless, some of the major banks have invested in BNPL providers, and introduced new ‘no interest’ credit card and BNPL-type products to attract and retain customers who are seeking convenient and cost-effective ways to make purchases.

Lending transformation

The pandemic has highlighted the need for more efficient and flexible lending models. Some banks have faced challenges with evaluating and processing large volumes of mortgage loan and refinancing applications as housing credit activity has soared.

In response to these challenges, the banks have focused on reducing the ‘time to yes’ and ‘time to cash’. They have invested heavily in their systems to streamline processes, including compliance with responsible lending requirements. This has led to improvements in home loan approval times over recent months. It has also enabled the banks that were losing ground to regain momentum.

Looking ahead, the banks have an opportunity to build on the initial changes already made to accelerate the transformation of their lending operations. Tech-enabled processes and data-driven decision-making will drive the development of smarter lending models. For example, data-driven insights that incorporate more forward-looking and behavioural data in retail and SME banking will enable more granular and customised loan pricing. Banks also need to integrate their products with customers’ unique life moments, to engage with them more personally. So, rather than confining their role to conventional mortgage servicing, banks can include themselves in other parts of a customer’s home-buying journey to better anticipate the customer’s evolving needs. This means banks can target customers with more personalised propositions to help retain and grow their customer base.

3

Costs

Strong management of underlying operating expenses helps to offset increased technology investment spend

The banks continue to manage underlying operating costs well. Generally, these costs declined or were flat for most of the banks. However, there are ongoing remediation programs and the need for accelerated technology investment – to enhance digital capabilities and continue to innovate for future growth and further cost reduction.

With earnings growth and margins under pressure, reducing costs and increasing productivity is imperative for the banks to drive profitability. The banks are continuing efforts to tighten their cost bases and increase efficiencies by simplifying their businesses and reengineering processes.

Cost transformation

The pandemic has given banks a fresh opportunity to rethink cost transformation, by identifying targeted operational, structural and strategic cost reduction opportunities. And as the bank sector resolves the conduct and remediation issues that have plagued it in recent years, the focus on operational efficiency and cost structures will intensify.

Opportunities that banks can consider include:

- Laying the groundwork for more intelligent operations: Banks should think about how to balance internal resources with external providers and use artificial intelligence to automate or accelerate manual processes. They should also consider adjusting the level of straight-through processing and deploying automation to reduce dependence on individual third parties. Deploying managed services, especially in areas that do not provide a material competitive advantage, such as anti-money laundering checks, know your customer services or tax-related activities, can reduce costs.

- Realigning fixed costs for a changed operating environment: The success of remote working and digital channels means banks can consider adopting a flexible, hybrid approach to working. This will help banks to both reduce costs (by reducing their real estate footprint) and retain a competitive edge in the talent market. The accelerated shift towards digital banking and the decline in foot traffic in branches has led the major banks to announce further optimisation of branch networks in recent months. Banks will also re-evaluate their mix of onshore and offshore functions, with the pandemic highlighting the risks of relying on offshored or outsourced back office operations for key processes and infrastructure.

- Realigning portfolios: We emerge from the pandemic, identifying strategic growth and divestment opportunities to free up capital will be important. We may see further divestments of non-core portfolios that do not deliver growth for the banks.

4

Asset quality

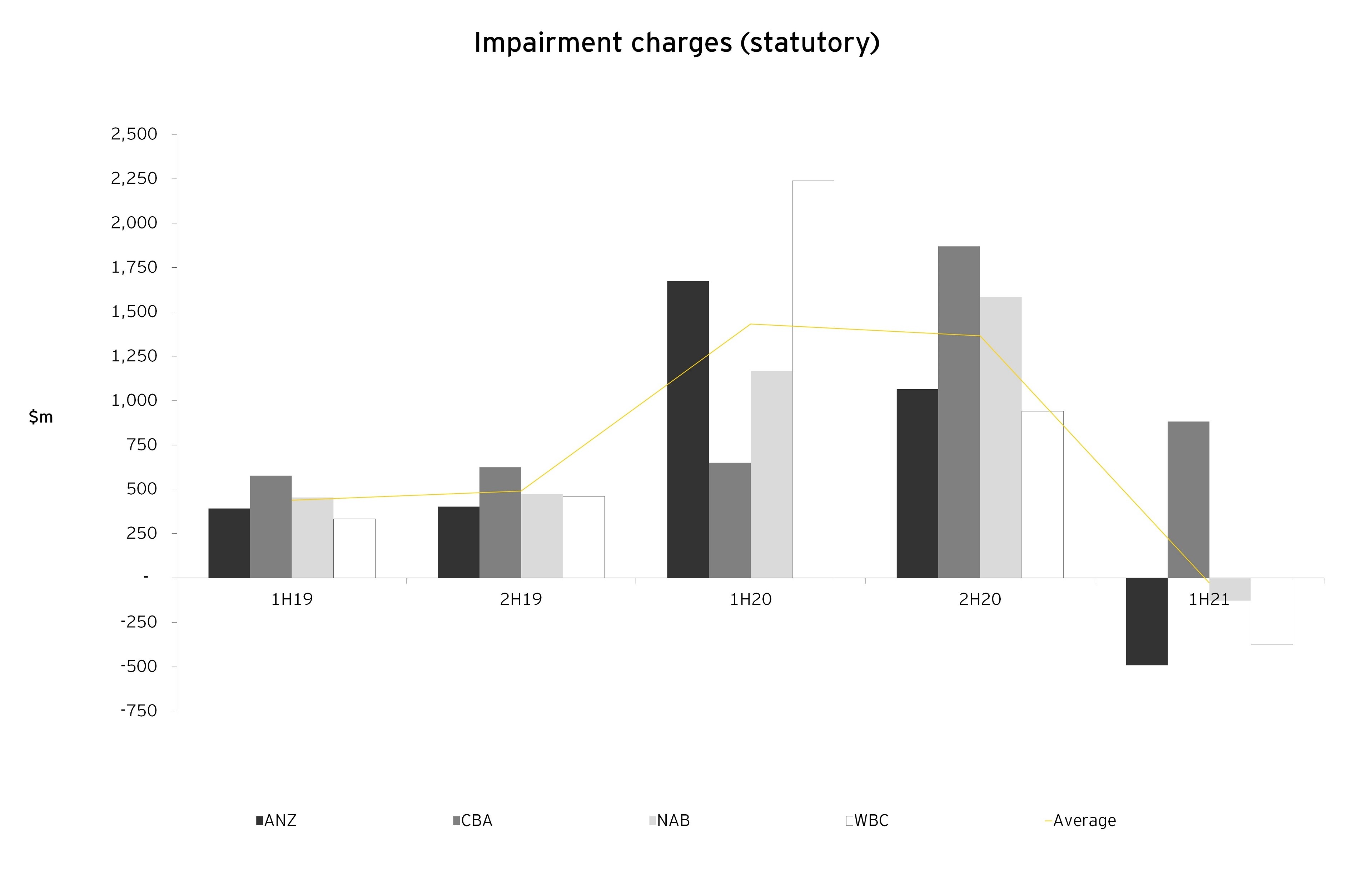

Fears of a blowout in bad debts are easing on the back of a firming economic recovery

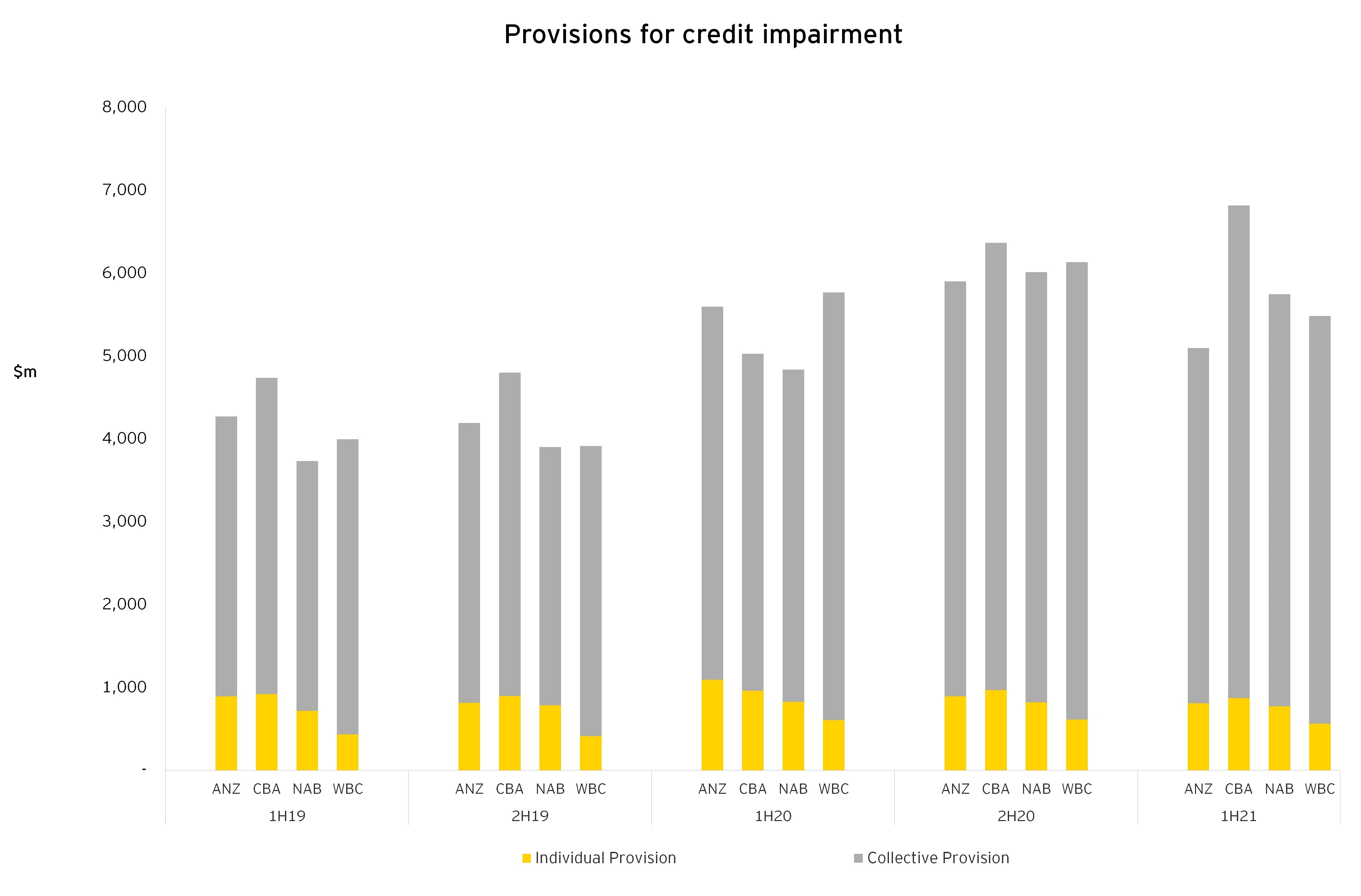

The banks have experienced some deterioration in asset quality in recent months. This is likely to continue as the impact of the unwinding of government and regulatory support measures plays out and new COVID-19 challenges add to asset quality risks. The banks retain high levels of credit provisions and have raised management overlays in the first half in response to the ongoing uncertainty.

However, current indications suggest the increase in nonperforming loans will be more modest than previously feared, given the better than expected economic conditions. Most customers who used the loan deferral program have returned to making repayments, with only a small number requiring ongoing assistance.

The percentage of loans subject to repayment deferral has continued to decline steadily. At the end of February, $14 billion worth of loans remain deferred [8]. This represents just 0.5% of total loans, down from a peak of 10% in May 2020. Housing loans make up the majority of loans still on repayment deferrals, at $11.7 billion. Low interest rates and mortgage prepayment buffers mean most households are well positioned to manage their debt commitments.

While SME loans account for just $1.5 billion of loans still on repayment deferral, the share of major banks’ SME lending with a relatively high probability of default has increased, suggesting that banks expect the performance of some SME loans to deteriorate [9]. Businesses in sectors that remain under pressure, such as the arts, recreation, accommodation, food and transport sectors, are most likely to be at risk.

Commercial property impairment levels remain low but are expected to rise, driven by the office and retail property markets, particularly in CBDs. The shift to more flexible remote working arrangements is weakening demand for office space, while brick-and-mortar retail stores are struggling to compete against the pandemic-driven and accelerated shift toward online retail.

Source: EY analysis

Source: EY analysis

Collections transformation

With an increase in the number of customers likely to need customised payment strategies and solutions, banks are taking a more considered approach to collections. Banks need to understand which customers are fundamentally financially secure, those that will rebuild and those that need help with a pathway to recovery. At the same time, they need to maintain a fine balance between risk management, treating customers fairly and building trust. Banks that fail to achieve this balance face the risk of regulatory penalties and reputational damage.

Effectively and sensitively managing collections and recoveries requires a focus on intelligent automation, bolstering self-service capabilities and investing in addressing information gaps and operational inefficiencies. This will help banks adapt their debt collection models to better manage loan impairments now and curb loan losses in the future.

5

Capital

The banks have further strengthened their balance sheets and built substantial capital buffers against potential future shocks

Having shored up their balance sheets in anticipation of a wave of loan defaults that have not (yet) eventuated, banks are flush with capital.

Divestment benefits, lower levels of RWA, lower dividends and the impact of APRA’s concessional capital treatment of deferred loan repayments drove solid improvements in banks’ capital positions. Upcoming asset sales are expected to further support banks’ capital positions. All the major banks have increased their CET 1 ratio, well above prudential minimum requirements.

There has been renewed speculation about the future of the major banks’ New Zealand operations, following the announcement by one of the banks that its New Zealand business is under review. Higher capital requirements introduced by the RBNZ have been the catalyst for a reassessment by the banks of their New Zealand exposures.

Funding and liquidity positions have also improved. As well as the TFF, strong deposit growth in 2020 coupled with a shift to lower cost at-call deposits and banks’ downward repricing of deposits have provided the banks with access to plentiful and low-cost funding.

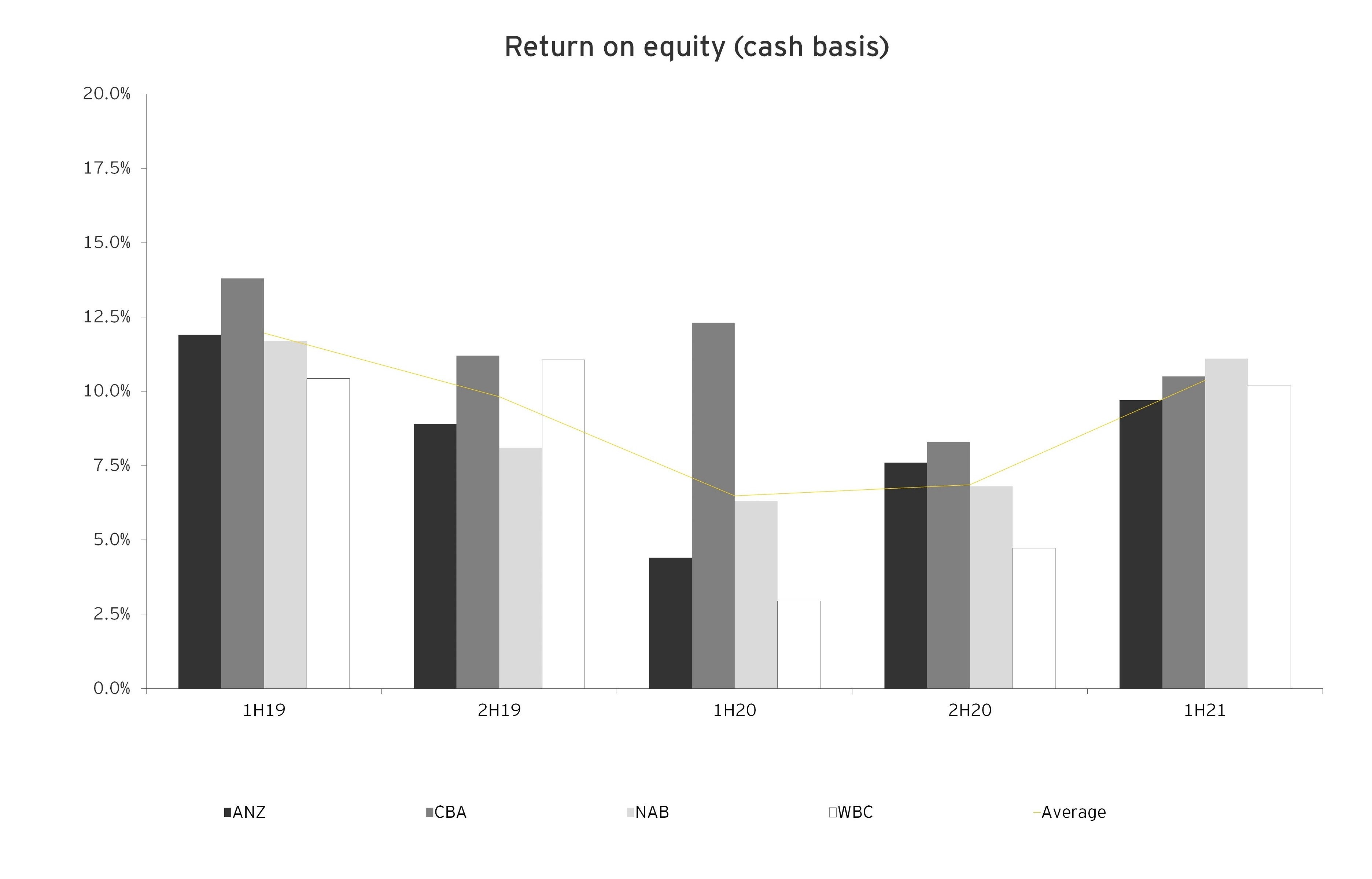

ROE was higher for most of the banks driven by an increase in underlying earnings.

Source: EY analysis

Following the relaxation of APRA’s guidance on dividends, the banks announced higher interim dividends. They are moving toward restoring higher payout ratios but are likely to take a cautious approach in the short-term. The RBNZ has also eased dividend payment restrictions placed on New Zealand banks after the onset of the pandemic, allowing banks to resume dividends of up to 50% of earnings. The restrictions will be completely removed from 1 July 2022, if there is no significant deterioration in the New Zealand economy.

6

Prioritising the sustainability agenda

The pandemic has reinforced a focus on sustainability as a means toward resilient recovery

The sustainability agenda is already a priority for the banks, but as public sentiment, regulations and government policies evolve, this is likely to increase. As highlighted by the EY fifth global Institutional Investor survey, the pandemic has reinforced a focus on sustainability. Although many organisations are in crisis-response mode, wider ESG issues remain critical and have renewed importance in being essential to resilience, long-term recovery and driving a genuine sustainability agenda. The EY Future Consumer Index has also shown that, many individuals are increasingly placing their values and the environment at the centre of purchasing decisions.

Recent regulatory developments have placed climate change risks high on the sustainability agenda for the banks. With the recent release of APRA’s draft guidance on managing financial risks and opportunities of climate change and the announcement that climate vulnerability assessments will commence with banks this year, pressure has mounted for banks to formulate climate risk and broader ESG strategies, set sustainable financing targets and implement changes needed to lending practices and operations to support the transition to a low carbon economy. APRA has also warned financial institutions to be alert to the impact on economies and industries of government policy changes that are occurring around the world [10].

Cybersecurity is rising higher on the agenda. The repercussions of the pandemic, including remote working and economic hardship, have led to increased cyber-attacks and frauds. Banks need to review and improve cyber strategies, particularly as regulators increase scrutiny around best practices and governance, and expect banks to improve controls.

As we move toward a post-COVID-19 environment, the banks can expect to be under greater pressure from shareholders and stakeholders to prioritise and disclose ESG factors. This is more than a reputational imperative. Investors and customers will increasingly use ESG metrics information to determine a business’s value, considering its resiliency against short-term shocks and how its purpose aligns with long-term value creation.

Meeting these expectations will require the banks to build stronger connections between financial and non-financial performance. They will need to identify not just risks but also new opportunities presented by ESG, notably in sustainable finance. Greater consistency and transparency in reporting on how progress is being made will also be important.

7

What next?

A unique opportunity for banks to accelerate their transformation journey and build a more successful and sustainable future

The pandemic has accelerated banks’ digital agendas and provides them with the opportunity to rethink their transformation journeys, with the goal of identifying new revenue streams and creating better customer experiences.

To do this, banks must build a strong core by doubling down on investment in:

- Resilience to enable agility: The pandemic has shown that you cannot predict all risks but that building resilience means building an organisation that can respond with agility and flexibility when they occur.

- Cost management as the foundation of profitability: Banks that consider the crisis as an opportunity for holistic cost reduction across three levers — operational, structural and strategic — can find strategic ways to align resources to maximise potential.

- Greater customer-centricity enabled by internal and external data: Banks that want to create long-term value will need to adapt business models to enable new ways to support customers throughout their banking journeys, using advances in technology and new ways of capturing data.

The pandemic presents a unique opportunity for banks to accelerate their transformation journey and cultivate the innovation that will build a more successful and sustainable future.

Summary

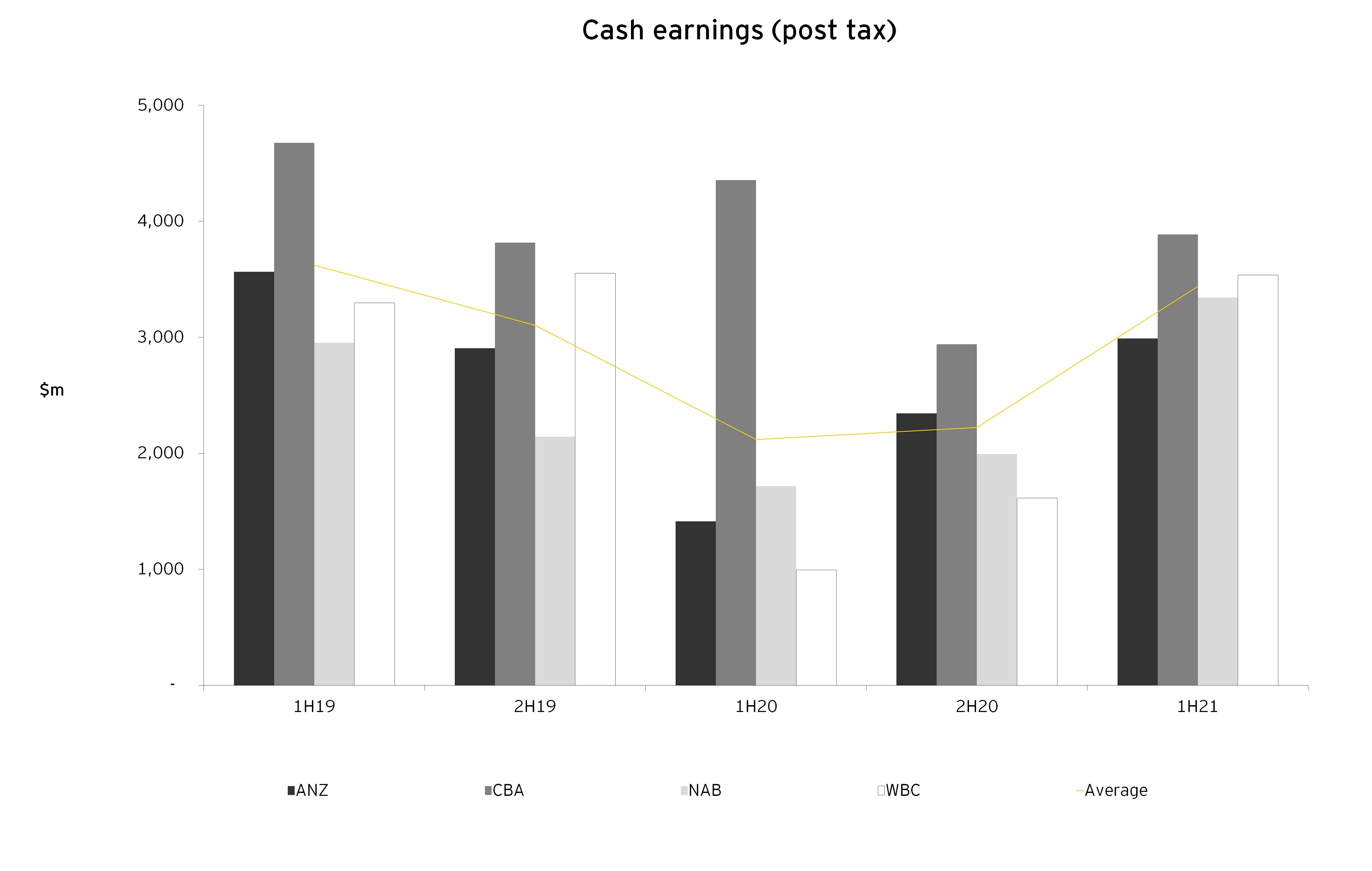

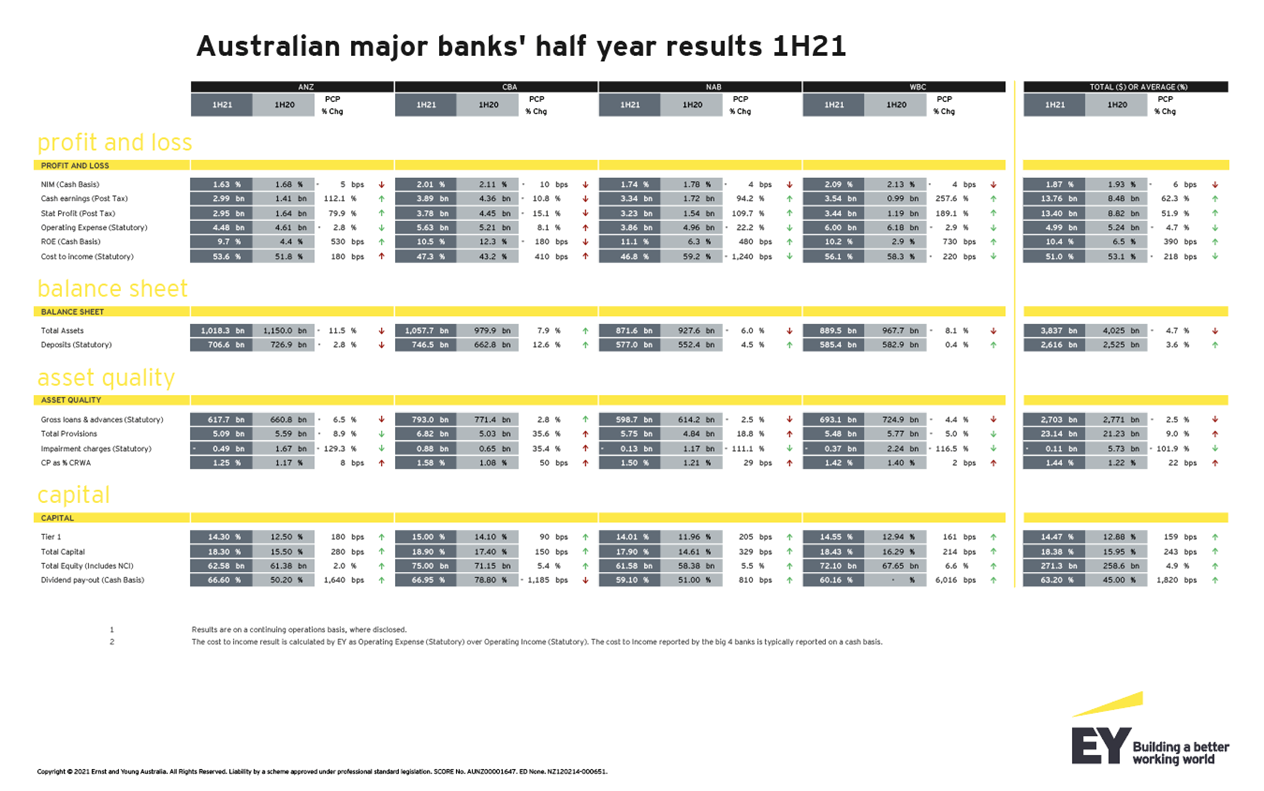

The Australian major banks’ half year results reflect a more positive operating environment than might have been expected this time last year.