3. Average results per sector

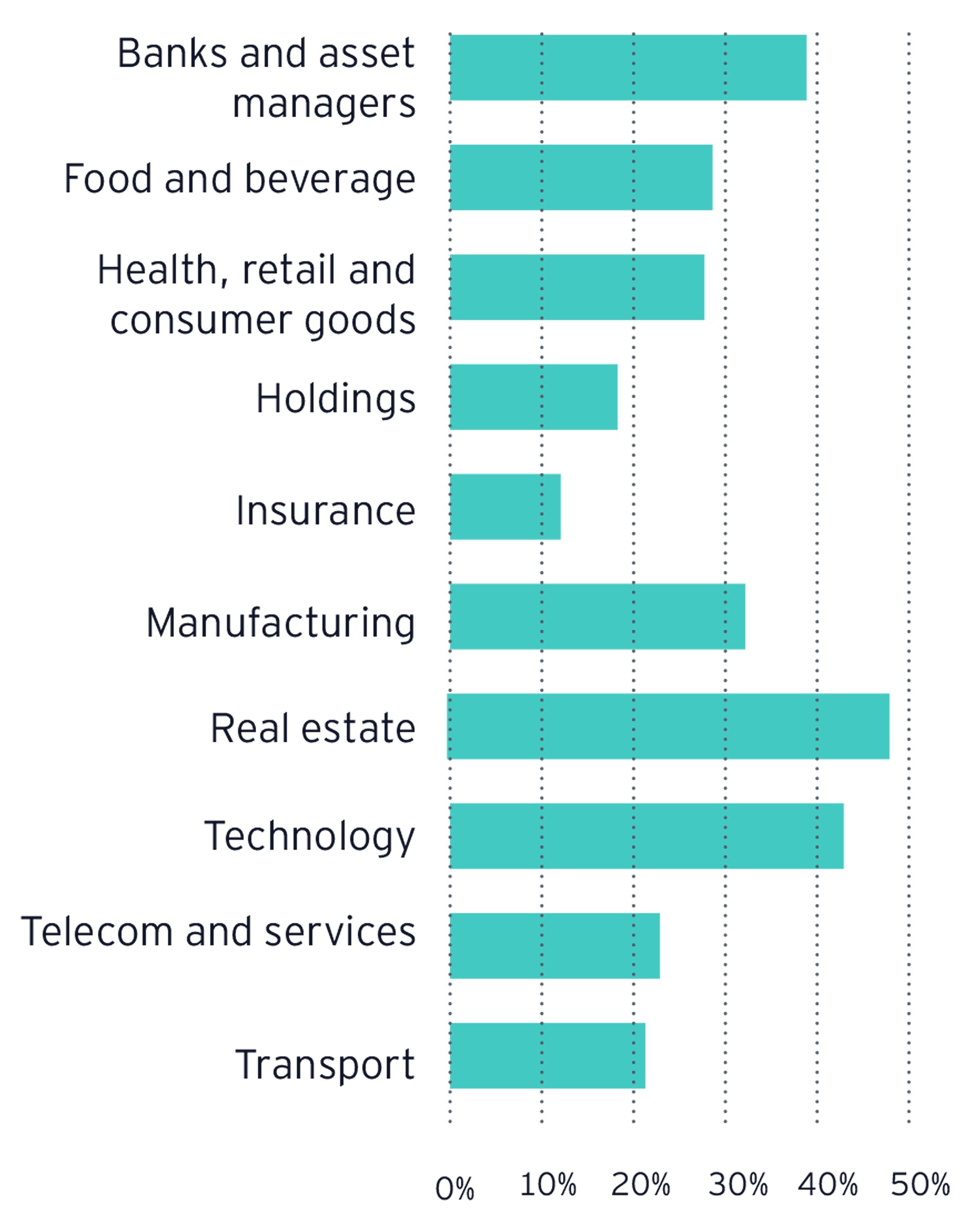

The Real Estate sector has the highest scores, in terms of coverage and quality of the disclosure. This sector is followed by the Technology sector. The ‘Banking and Asset Manager’ sector came in third place. In addition, the ‘Manufacturing’ sector scored relatively well.

These sectors are significantly impacted by transition risks, for example: exposure to fossil fuel supply chains for the Technology companies, changes in climate and energy policies for Real Estate companies. regulatory and commercial pressures for banks or accessibility to low carbon substitutes for manufacturing companies.

At the other end of the spectrum, ‘insurance’ companies and ‘holding’ companies were the underperformers. This finding is consistent with the Global Climate Risk Disclosure Barometer and highlights a global issue with climate risk disclosures of these sectors. However, the companies in the holding sector especially have expressed their commitment to strategically address the impacts of climate change and to manage the required transition.

Next to the sector company size is also a determining factor for the quality of climate reporting. Whether a company is listed or not influences the coverage and quality of the disclosures even more. The larger the company, the more detailed information can be found, especially when the company is listed. In contrast to listed companies, we notice that family owned companies communicate less information. Furthermore, CDP reporting contains more details than annual reporting or communication on the website. The presence of CDP answers is thus a decisive factor for company scores.