Chapter 1

Building a sustainable recovery

The right kind of recovery could bring more resilient and productive economies, a greener future and a fairer society.

An effective recovery will address the fallout of the crisis, ensure financial institutions are able to lend to the economy, and support companies and individuals through a new business cycle. There will be trade-offs in this transformation, and those who are left behind will need to be supported.

We detail six areas of collaboration critical for generating the overarching objectives for a sustainable recovery: more resilient and productive economies, a greener future and a fairer society.

Objective 1: More resilient, productive economies

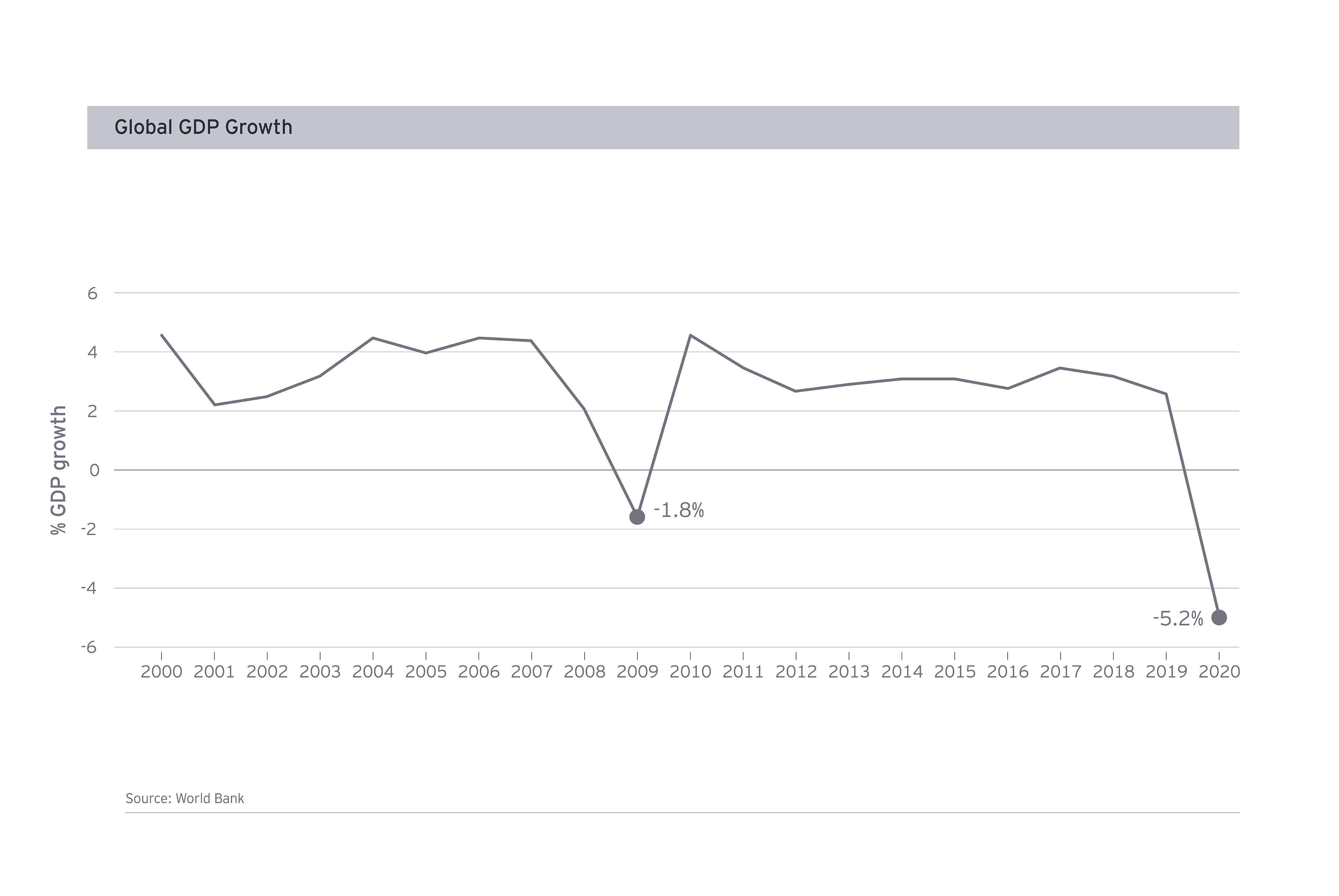

The crisis has exposed economic weaknesses in even the most advanced economies. The lockdowns have resulted in a slump in consumer demand and supply chain disruptions. Businesses have responded by cutting wages, furloughing or laying off workers. Widespread liquidity shortages have increased the risk of defaults and bankruptcies.

Coupled with this, growth in global productivity – a key driver of growth in incomes and prosperity – has been slowing over the past decade. The actions that are implemented to increase economic resilience and generate employment may further impact measurable productivity. (The EY Enterprise Resilience Tool can help you prioritize your actions to reframe your organization’s future, adapt and increase resilience.)

The crisis has also revealed weaknesses in public service provision, with struggling healthcare systems and inadequate social safety nets in some countries. Such issues exacerbate inequality and lead to social destabilization.

Efforts to achieve economic growth must address all these challenges. We need to combine investment, market reforms, higher skills and new technologies to create jobs, while boosting productivity and rebuild more resilient public and private sectors. We have the opportunity to reframe the global economy in ways that make it smarter, less wasteful and more efficient to underpin a better future.

Objective 2: A greener future

The case for a green recovery is clear. More than half of the world’s total GDP is moderately or highly dependent on a stable environment and is therefore vulnerable to disruption due to climate change.⁴ Without action to address climate change, an additional 100 million people could be pushed into poverty by 2030 and 143 million in just three regions could be displaced.⁵

Not only would action on climate help to mitigate these dire predictions, but the United Nations estimates that a move to low-carbon, resilient economies could create, 65 million new jobs between now and 2030⁶.

The pandemic has brought environmental concerns to the fore in the public consciousness too, as the enforced pause on industrial output and travel have resulted in cleaner air and CO2 emissions (not atmospheric levels) are estimated to be at the lowest level in 14 years⁷.

The need for action is clear to institutional investors. In Q1 of 2020 we have seen an increase in climate change resolutions backed by shareholders⁸. Far from the COVID-19 crisis putting the brakes on environmental progress, it has accelerated it. Climate change is a transnational issue that requires a globally collaborative policy response. Governments, businesses and society urgently need to collaborate to develop and adopt solutions to head off the worst consequences of this truly global risk.

Objective 3: A fairer society

In the aftermath of the GFC, recovery in many markets was uneven; it failed to address social divides and, in some cases, deepened them. These issues have been thrust into the spotlight in the current crisis. Increasing numbers of workers are in poorly paid jobs, or are self-employed or on zero hours contracts, making them more vulnerable to layoffs during the economic downturn and with less access to social security safety nets. Health inequality has also been one of the crucial issues of the pandemic. Moreover, the recent wave of protests that has spread from the US across Europe to Australia, although not a direct consequence of the pandemic, nevertheless demonstrates the urgent need for inequality to be addressed.

The opportunity to address social inequality, improve outcomes for all citizens, including fairer access to employment must not be missed this time. A sustainable recovery is not just about creating jobs, it’s about creating good quality, accessible jobs that improve peoples’ lives, which in turn creates more stable societies.

Social inclusion is a priority that underpins sustainable economic prosperity. This is supported by an independent Global Commission on the Future of Work, which recently concluded that it is by upgrading their social contracts and better equipping their citizens to navigate the world of work that countries can most effectively boost their economic growth and development.⁹

Every country and region will have different priorities and starting points, but the starting principle for all governments should seek to build more productive resilient economies while tackling climate change and social inequalities.

“Returning to growth involves making intentional choices about the kind of economy we want to build; the kind of society we want to create,” says George Atalla, EY Global Government and Public Sector Leader. “It is about deciding the kind of world we want to live in.”

Chapter 2

A new model for collaboration

To build a sustainable recovery beyond the pandemic, public and private must work together as never before.

In the heat of the pandemic, we’ve seen the development of extraordinary models of collaboration. For example, it has resulted in the largest exchange of scientific data in history. It has brought head-on competitors into joint initiatives. While there have been some rifts among governments and international institutions, we have also observed fast collaborations between state and enterprise to deliver technological and medical solutions at speed. It has shown us what we can do when we focus on a common goal. However, it has also exacerbated some geopolitical tensions and led many countries to adopt a country-first response.

Given that another pandemic in the future seems relatively likely, closer coordination between central government and local governments, closer international collaboration and the use of technology, for example to implement advance warning systems, have become paramount.

In order to build a sustainable recovery beyond the pandemic, we need a new public-private model of collaboration. Coalitions between economic players – governments, regulators, banks, and companies – can transform how we create value for all. Without them, economic recovery will be less quick, less assured and less sustainable.

Chapter 3

Six priority areas for collaboration

An effective recovery means finding the right balance across a matrix of priorities.

To generate sustainable growth and employment, and deliver the priorities for a reframed future, governments, banks and businesses need to collaborate in six key areas: dealing with the aftermath; directing investment; balancing fiscal priorities; supporting global trade; driving innovation and focusing on jobs and skills.

1. Managing the aftermath

Measures to contain the COVID-19 pandemic have left many businesses and individuals in a perilous financial state, despite income guarantees, rent and tax deferrals and enhanced jobless benefits. Helping them regain financial stability and providing a platform for businesses to grow will be critical to the recovery.

As we emerge from the crisis some businesses will be able to re-set, but we will inevitably see significant levels of distress and bankruptcies. Financial institutions, alongside governments and regulators must work together to deal with the overhang of non-performing loans (NPLs) and kick start the economy in line with the principles for recovery.

Tools that may be utilized to build systemic support include:

- Lender of last resort schemes – the facilitation of a form of ‘debtor in possession’ financing targeting firms in distress.

- Asset management companies – where a government owned asset management company can take the role of freeing banks from NPLs and, with sufficient state support, can provide adequate solutions to the underlying borrowers.

- Asset protection schemes – a risk sharing scheme, through which the government provides the banks with protection against losses on certain loans or assets.

Regulators can also support financial institutions by providing clarity on the timing of a return to stress-testing and treatment of capital buffers, so as not to limit banks’ risk appetite.

As well as helping finance businesses, and helping corporate, commercial and SME clients access government stimulus, banks also have a role to play in enabling them to focus on growth. In addition to providing funding for growth capex, banks can step in as a broader service provider, using their networks to connect companies across supply chains, to proactively address weaknesses where they may arise.

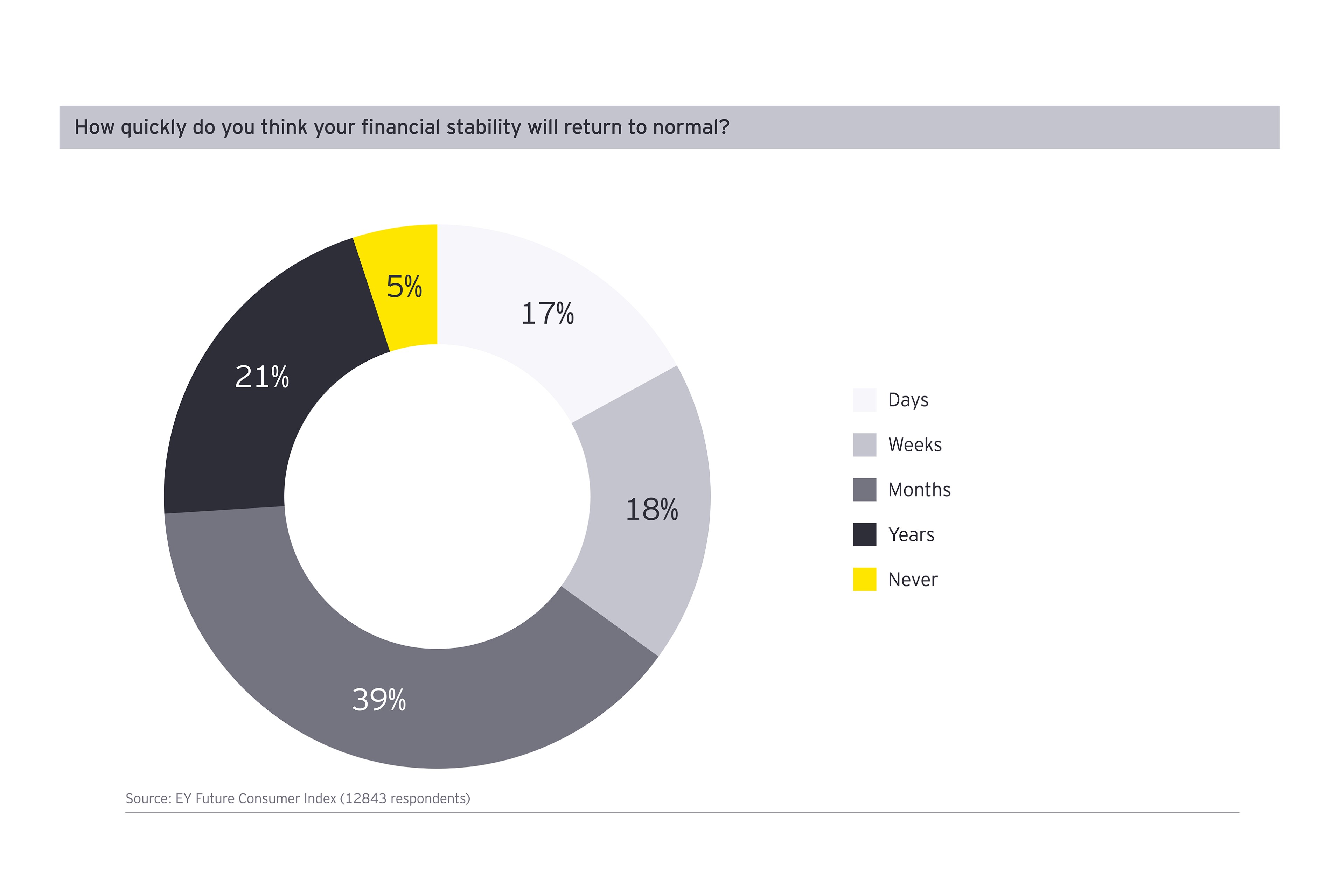

Financial wellbeing for individuals is also key. Despite a large part of government stimulus so far being focused on maintaining household incomes, according to the EY Future Consumer Index (May 2020)10 84% of consumers feel somewhat or extremely concerned about the impact of the pandemic on their finances and 26% fear it will take them years to regain the level of financial stability they had before the crisis. In some countries, this is leading to record high savings rates.

Helping individuals feel confident in spending and saving decisions will be instrumental to the recovery. Further measures may therefore be needed such as minimum income guarantees and newly designed social security safety nets that work for the self-employed and those on zero hours contracts.

The financial services sector can also help. By offering proactive financial support, advice and incentives, banks can help individuals better manage their finances during continuing uncertain times. Financial institutions need to respond well to boost consumer confidence and provide financial safety nets.

“Given the global nature of both the COVID-19 pandemic and the financial sector,” says Jan Bellens, EY Global Banking and Capital Markets Leader, “continued resilience is a global effort that will need the buy-in of both public and sectors internationally.”

2. Directing investment

The role of government as an active investor is particularly important in the immediate aftermath of major crisis with large financial implications, and as such, governments and central banks need to kickstart economic recovery through capital investment projects. However, given the debt hangover from the last recession and the levels of fiscal support already provided during the peak of the pandemic, many governments will be severely constrained, with record levels of public debt. Hence, it is critically important for them to carefully target their investments and also to encourage private sector investment. For example, central banks can offer attractive “funding for lending” schemes to encourage commercial banks to lend in targeted growth areas.

In order to shape a more sustainable recovery, the state must direct investment not only towards “shovel-ready” infrastructure projects that will generate immediate jobs and growth, but also towards longer-term structural shifts including investment in green technologies and digital infrastructure.

The EU Green Deal is now bolstered by a recovery-focused Next Generation EU fund, which makes €750b available largely for green and digital investments. Key objectives of the European Green Deal as the EU recovery strategy include a large renovation program of buildings and infrastructure; investment in renewable energies including hydrogen; EV infrastructure (including 1 million charging points); and green public transport for cities. Together with additional budgetary funds earmarked for 2021-2027, this brings the total EU recovery armory to €1.85t. Spending under the recovery plan will have to be guided by a sustainable finance taxonomy, which requires investments to contribute to at least one of six pre-defined environmental objectives, such as climate change mitigation.

China, too, is taking a long-focus lens to investment stimulus, speeding up infrastructure projects. A total of 25 provincial-level regions have put new infrastructure projects in their government work reports, with 21 advancing 5G network construction. In the next five years, the economic output indirectly driven by 5G businesses in China will hit 24.8t yuan, according to predictions by the China Academy of Information and Communications Technology.11

With already record injections of relief into the global economy, it’s vital that governments embed rigorous and transparent tracking of spending. Taxpayers, who will ultimately pay for these measures, need to know what principles have guided the spending decisions and what environmental, social and economic outcomes have been achieved. Measuring value for money can provide important lessons to improve the eventual economic multiplier of all this stimulus, help direct further investments, while also minimizing the risks of fraud or abuse.

Commercial banks will be instrumental in shaping the recovery too. For example, over the past decade, they have pioneered new forms of sustainable finance. While green bonds are now well established, 2019 saw rapid expansion in sustainability-linked loans, which reward businesses with lower interest rates for hitting specific environment, social or governances related targets. The continued expansion of sustainable financing will support a greener recovery.

3. Balancing competing fiscal priorities

As governments begin to piece together the framework for long-term economic prosperity, they will need to strike a balance between stimulus measures, measures intended to raise revenue and incentives to shift behavior.

EY’s Stimulus Tracker provides a real-time source of data on the incentives governments across the world are adopting and shows that many governments are using the same tools to support their economies. Many of these measures are very similar to those employed during the GFC. Leading stimulus measures currently being deployed across the globe include:

- Employee retention schemes (tax credits, payroll tax relief and grants for employers tied to retention)

- Extended unemployment benefits

- Tax payment deferral and/or acceleration of tax refunds and tax credit payments

- Accelerated depreciation measures

- Loans and guarantees

- Conversion of deferred tax assets into tax credits

- Introduction or extension of loss carry backs

Once we are through the worst of the current crisis and economies are firmly on the road to recovery, governments will be considering what role tax will play in creating long-term growth and shoring up budgets in deficit. After the GFC, it was clear that there was a balance to be struck between raising revenues to pay for services or cutting services to fit into a budget. Governments around the world found revenues in three places and we might expect a similar approach now. This could include:

- Direct taxes – for example, minimum taxes, changes in the tax base, and increases in rates

- E-Tax: compliance and enforcement – increasing calls for transparency and increasingly digital tax administrations could continue to drive compliance

- Indirect taxes – we may see a proliferation of consumption and excise taxes and increases in the rates of those currently in place

While raising revenue after the COVID crisis will be a high priority, governments will need to carefully consider how to deploy tax policy and other fiscal measures to avoid unintended consequences. International cooperation to close loopholes and provide an equitable taxation landscape will be important even as protectionism and a move away from global cooperation continue as headwinds.

Moves to improve tax compliance by harnessing AI and analytics are generally accepted. Apart from the obvious fiscal benefits of efficient tax collection, there are also risks of increased controversy as governments use more sophisticated tools to interrogate data.

In the midst of this dynamic tax environment, tax initiatives can help drive businesses to cleaner and more effective methods of operation, increased efficiencies, reduced footprints, and more focus on calls from stakeholders for responsible environmental policies. Incentives that support both corporate and personal investment in green technologies, in building efficiency retrofits and clean physical infrastructure can act as accelerants for the economy. At the same time, governments might consider using taxation and other means to price the impact of activities that generate negative externalities, such as carbon and greenhouse gas emissions and single-use plastics to reflect their environmental impact.

“Tax reform can nudge corporate and individual behavior in positive directions,” says Cathy Koch, EY Global Tax Policy Network Leader, “and it can deliver a greener, fairer and more efficient tax system.”

4. Supporting global trade

Global trade will remain critical to long-term economic growth and competitiveness. Trade has been buffeted by geopolitical headwinds, fractures in over-linear and inflexible supply chains, commodity price shocks and record levels of mistrust in international organizations such as the World Trade Organization (WTO).

Some companies, as detailed by the World Economic Forum,12 have struggled to maintain flows of critical supplies through the peak of the pandemic and have been focusing on the difficult work of making supply chains more resilient. But in many cases – pharmaceuticals and food, for example – supply chains held up remarkably well, at least in advanced economies. While there are movements to re-onshore or near-shore production, creating regional ecosystems of supply that can better handle future shocks, we need to guard against a knee-jerk response to a temporary crisis. Unfortunate by-products of the pandemic are growing protectionism and trade barriers. Most impacted are the emerging market and lower-income economies, who will need continued multi-lateral assistance.

We shouldn’t forget that globalization, leading to increased economic trade, has lifted billions out of poverty, accelerated many countries’ progress out of subsistence farming, and been a critical force for good. Domestic duplication of production may create local jobs in the short-term but will also erode efficiency and competitiveness. Longer-term economic growth depends on healthy and open competition. The recovery will thus require strong multilateral cooperation to complement national policy efforts. This means reducing tariff and nontariff barriers that impede cross-border trade and global supply chains as well as scaling back capital flow measures as global financial sentiment recovers.

Greening the supply chain has been a priority for companies focused on sustainability for a decade: now it needs to be a priority for all. It’s not enough for companies to monitor and reduce their own greenhouse gas emissions; they must apply these standards across the full supply chain, bringing higher standards to bear on every supplier to scale progress vertically across industry sectors. Regulators can underpin that by ensuring that companies report openly and consistently on the sustainability of their supply chains, banks can incorporate these measures into their underwriting criteria and investors can vote accordingly.

5. Driving innovation

Historically, some of the greatest innovations have emerged from collaborations between governments and the private sector to solve specific challenges. The internet and the global positioning system (GPS) are both examples of transformative technologies that were essentially the result of government-funded innovation, but the private sector was then instrumental in the development a wide range of real-life applications.

The scale of stimulus spending means governments have a real opportunity – and obligation – to partner with businesses to turbocharge innovation as a path to sustainable growth.

Winners in the next economic cycle will have harnessed the power of advanced technologies while also protecting and restoring the environment. The private sector often leads in understanding areas for innovation, but the scale of stimulus spending means governments have a real opportunity – and obligation – to partner with businesses to turbocharge innovation as a path to sustainable growth.

Germany’s €50b investment program provides a current example of how a basket of measures can be designed to create jobs, improve infrastructure and drive a progressive agenda. In addition to upgrades to the national railway and local transport, 5G and 6G network solutions will deliver 5G to the whole country by 2025. 5G is an example of innovation that will bring future growth opportunities enabling products and processes that have just not been possible to date.

Public-private partnerships in innovative technology can be used to generate significant jobs and growth, sparking innovative solutions and work to decarbonize the economy. South Africa’s Renewable Energy Independent Power Producer Procurement Program, for example, has successfully channeled private sector expertise and investment into grid-connected renewable energy. Some US$14b has flowed into 64 projects, some of them already online, leading to substantive drops in average solar photovoltaic and wind tariffs (68% and 42% respectively). The initiative has also created an estimated 39,000 new jobs for the young and women and reduced South Africa’s carbon emissions by 33.2 million tons.13

Tax incentives to encourage business investment in innovation, whether that be digital technologies, green technologies, health research or moon-shot R&D are proven public sector levers that deliver large paybacks.

However, governments, businesses and the financial services sector need to ensure that investments in innovation create opportunities, reduce inequality and lead to net gains in employment. They need to guard against basic like-for-like automation that eliminates low-skills jobs with no innovation dividend, or only focusing solely on leading-edge high-tech innovation that only creates opportunities for the most highly educated.

Governments can do more than just fund innovation; they can ensure learning is plugged back into the state. Digitalization lessons from the private sector, for example, can be applied to public sector services to deliver efficiency and better access, while preserving provision in the face of budget deficits.

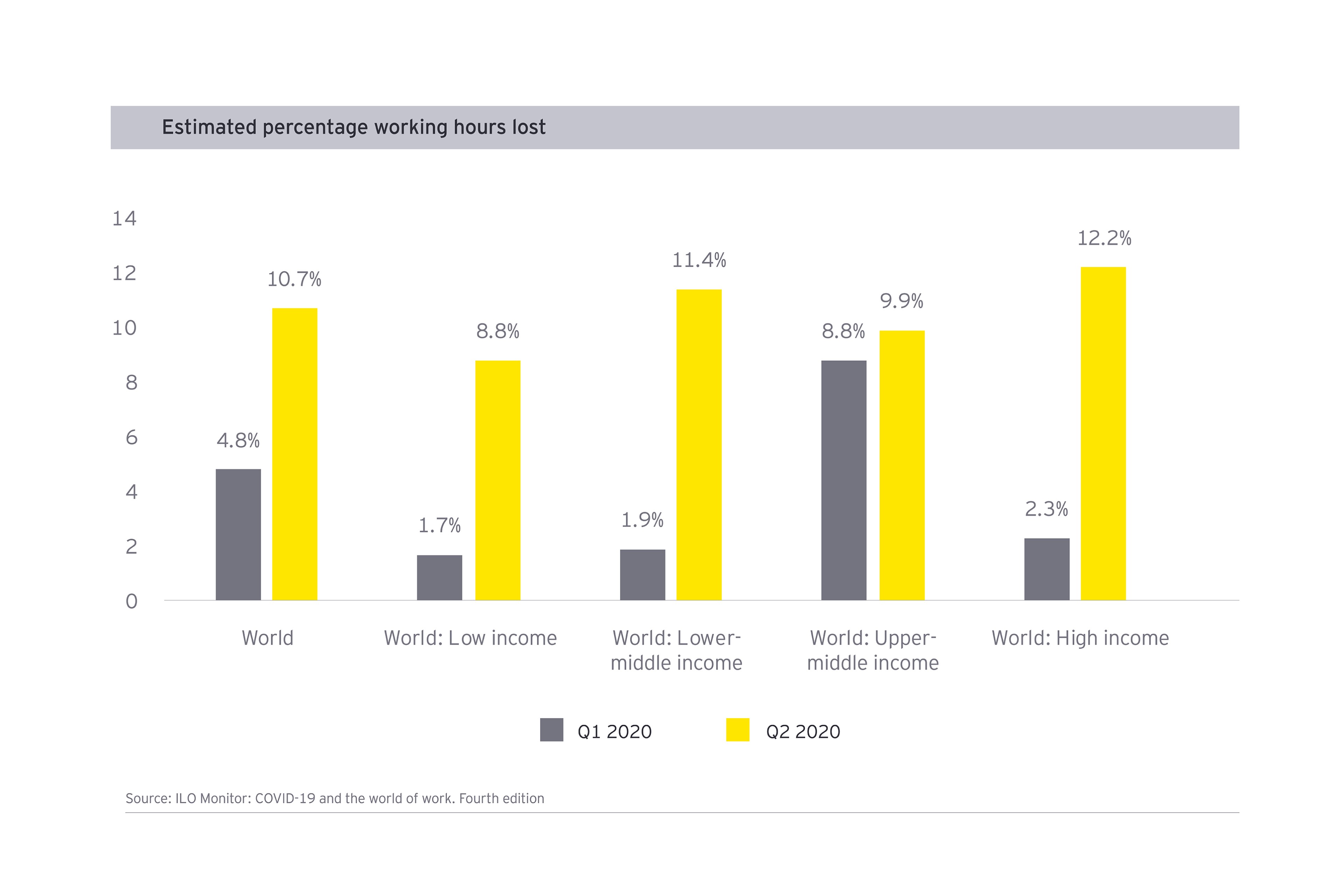

6. Focusing on jobs and skills

In the US, over 20 million have lost their jobs since the pandemic struck; in the UK a record 1.8 million have applied for Universal Credit.14 In spite of government funding to provide income to furloughed staff, the calamitous drop in jobs in two major economies reflects corporate lack of confidence in the immediate future.

The unskilled and low-paid are at the sharp end of redundancy as a result of the pandemic due both to the fact that heavily-hit sectors (retail, hospitality, live events) tend to employ large numbers of low-skilled workers and to the amplification of existing trends, such as increasing automation and the shift from traditional to green industry that were already eroding jobs.

Structural shifts from analog to digital, from brown to green economies, will also create fall-out in the short term. Governments will need to launch creative re-training programs to address unemployment and close the digital divide; they will need to build bridges for employees transitioning from the old to the new.

In addition, the ILO reports that young people are disproportionately affected by the crisis, with multiple shocks including disruption to education and training, employment and income losses, and greater difficulties in finding a job. More than four in ten young people employed globally were working in hard-hit sectors when the crisis began and almost 77% of the world’s young workers were in informal jobs.

A proposal from Harvard Law School, the Clean Slate Project15, invites experts to imagine what labor law would look like if we were starting from scratch, from a clean slate. This kind of thinking, of a radical reset, is needed to ensure prosperity from the next growth cycle is shared more equitably.

Upskilling the workforce – investing in human capital – is a priority shared by enterprise and government and is best tackled in partnership. In the next phase of the recovery, government should switch, for example, from offering generic employment credits to targeted tax incentives to encourage job creation and skills development; it can link stimulus relief to guarantees of job security and training. Business can work with both government and educational providers to reframe education, investing in apprenticeships and training for the future. The more that businesses are required to report on measures around diversity, inclusion, skills development and job creation with consistency and transparency, the greater the incentive they will have to maintain these positive actions in the longer-term.

As part of the EU’s Green Deal, the €150b Just Transition Mechanism16 focuses on “making sure no-one is left behind” in the transition away from fossil fuels. The collaborative fund, involving both public and private investors, will focus on vulnerable regions and re-skilling affected workers.

As employers move rapidly to more agile models of employment to deliver leaner and more adaptable operations, governments need to respond with labor reform, modernizing social security safety nets and extending employment benefits to those working in the gig economy. Public policies can make it easier to shift from one mode of employment to another, to allow flexibility in the workforce while guarding against its worst consequences including low pay and insecurity.

To generate sustainable growth and employment, and deliver the priorities for a reframed future, governments, banks and businesses need to collaborate in six key areas: dealing with the aftermath; directing investment; balancing fiscal priorities; supporting global trade; driving innovation and focusing on jobs and skills.

Chapter 4

A greener, fairer, more resilient future

The current crisis presents an opportunity to accelerate the pace of change while building a sustainable recovery.

Before the COVID-19 crisis, the world was already changing, but the current crisis presents an opportunity for governments and businesses to accelerate many of these shifts while building a sustainable recovery. It is an opportunity that shouldn’t be wasted.

The return to economic growth may be prolonged and uneven, but we are confident there is opportunity in the recovery. Governments, working with the financial sector and private enterprise, can reframe the global economy, to forge a more resilient, more equitable and more sustainable future through the decisions they take.

However, the scale of the challenge is such that a new public-private collaborative model is needed to create new sources of economic and social value. These sources are green and enabled by advanced technologies.

Through policy, regulation, collaboration and investment we can bulldoze obstacles to growth, challenge wasteful, inefficient and unsustainable business models and learn to do more with less through smarter technologies and a more circular economy.

The current global crisis has provided a unique chance to reframe the future by building a fairer, more prosperous society founded on greener, more resilient, productive economies.

Summary

Governments, financial institutions and businesses have a strategic opportunity. Shaping the recovery and the economy in a way that will reframe the future can deliver a more sustainable and more equitable revival.