Chapter #1

Key takeaway #1

Life insurance and retirement consumers want products that cover loss of income and are willing to exchange health data for lower rates

Life insurance and retirement consumers want products that cover loss of income and are willing to share health data in return for lower rates

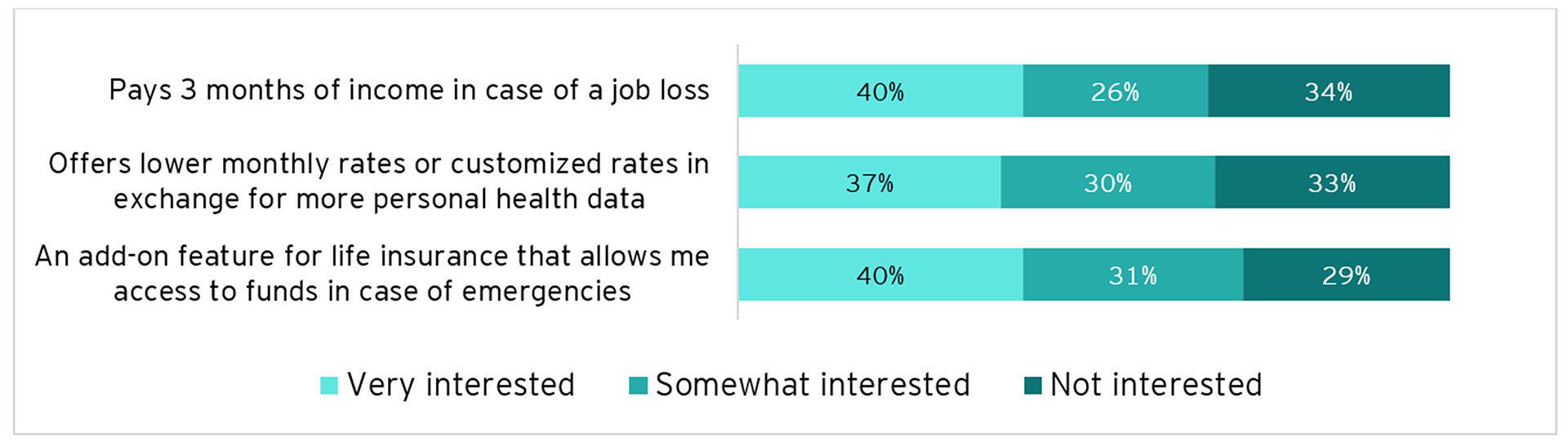

Survey respondents were presented with questions about life insurance or life insurance-related products and services that could be of interest to them. The impact of COVID-19 has caused people worldwide to be hit with (temporary) job loss and uncertainty about the continuation of their businesses. This appears from three notable survey results, which are presented in the graph below.

Respondents were asked the following question: “How interested are you in the following types of insurance?”

EU (France, Italy) survey data, EY Global Insurance Survey conducted in late 2020.

1. The survey results show that 66% of customers have an interest in products that pay three months of income in the event of job loss due to a pandemic. This interest has certainly increased due to the crisis, but it remains a relevant product even in more normal times. Losing their income is a risk consumers can very easily imagine. Insurers are well-positioned to provide peace of mind in bridging the gap of not being able to rely on a steady income for a couple of months. It is worth noting that the welfare system in Belgium already provides the means to do that, but it does not cover the entire loss of wage, certainly not in the case of self-employed insurance clients.

Recommendation: In times of COVID-19, life and retirement consumers are worried about their financial well-being and losing a loved one. Insurers and retirement planning companies will need to offer value propositions that highlight how they can help support consumers’ lives, with high degrees of financial security and physical and mental health.

2. 67% of consumers are interested in exchanging personal health data for a product with lower or customized monthly rates. Consumers are increasingly open to sharing their data, as long as the scope of its usage and its benefits are made crystal clear to them. Providing transparency on the use of the consumer’s data as well as the company’s security policies is crucial to build strong client relationships based on trust. Only then will they allow their data to be used in exchange for financial and non-financial benefits. Keep in mind that data sharing is not without its limitations. Regulation is quite strict on this, certainly when it comes to health-related data used in premium calculation. However, as consumers are becoming more open to data sharing and new pricing models are beginning to emerge, regulatory changes are to be expected. It is therefore important to note this shift in consumer expectation and to be ready when it materializes. It will be important to educate consumers about both the benefits and the pitfalls when sharing their data in an insurance context.

Recommendation: ensure a frictionless customer experience at all times. Technology is crucial to data gathering, but it is only an enabler. Don’t expect all customers to be tech-savvy: a hassle-free onboarding for clients to your applications is a must.

EY Insurance Consumer Survey

67%of consumers are interested in exchanging personal health data for a product with lower or customized monthly rates.

3. A third noticeable result shows that consumers (71%) are open to accessing reserves of their life insurance in case of emergencies. This result is aligned with the finding that they are interested in a product that pays out in case of job loss, in order to reduce risk during uncertain times. Consumers find it relevant, not to call upon their long-term savings as part of life insurance, but to have access to an add-on that allows them to overcome short periods of deficits.

Recommendation: Add-ons like this one can quite easily be incorporated in the existing life insurance product offering, provide up-sell benefits, and are guaranteed to have an appeal to clients.

Chapter #2

Key takeaway #2

Personal lines consumers are interested in usage-based and home protection-related products

Life insurance and retirement consumers want products that cover loss of income and are willing to share health data in return for lower rates

Survey respondents were presented with questions about life insurance or life insurance-related products and services that could be of interest to them. The impact of COVID-19 has caused people worldwide to be hit with (temporary) job loss and uncertainty about the continuation of their businesses. This appears from three notable survey results, which are presented in the graph below.

Respondents were asked the following question: “How interested are you in the following types of insurance?”

EU (France, Italy) survey data, EY Global Insurance Survey conducted in late 2020.

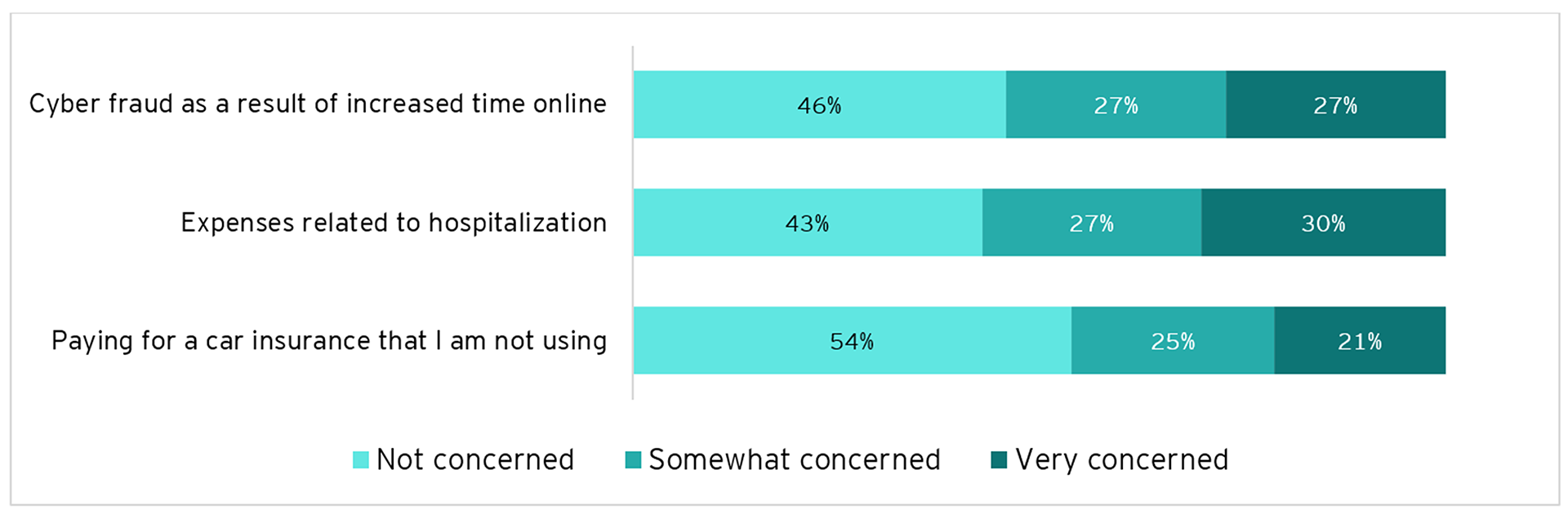

Results show that one of the consumers’ top concerns is cyber fraud as a result of increased time online (54% of respondents). This not only because of the fact that people are working more from home, but also because of an increase in online traffic for non-professional reasons such as shopping. This is followed by the concern of paying for car insurance which is not used (46% of respondents) as a result of forced lockdowns.

Furthermore, we can see that customers' worries relate predominantly to their financial well-being. Indeed, their biggest concern is hospitalization expenses. Since we already enjoy good healthcare in Belgium, it will play a less prominent role here.

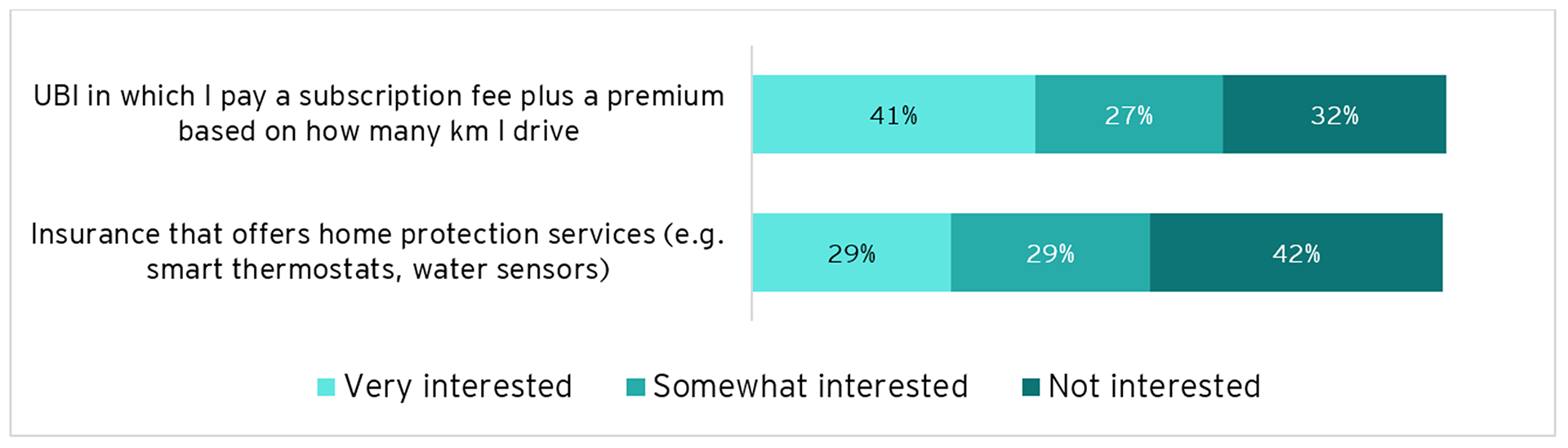

To see if these (new) concerns would result in a change in product preferences, an additional question was asked: “How interested are you in the following types of insurance?”

EU (France, Italy) survey data, EY Global Insurance Survey conducted in late 2020.

Consumers are clearly concerned about having to pay excessive premiums for car insurance they use less: 68% of respondents are interested in usage-based insurance for cars. Many car insurers on the market already distribute this type of mileage-linked product, using smart recording devices for exact measuring and fraud limitations at the same time. The popularity of this type of insurance is on the rise and has only been keeping increasing as of COVID-19. Given that remote working is expected to continue in the long term for many employees, insurers should develop products suited to this new normal.

Another consequence of spending more time at home is consumers’ search for products that cover home protection services. Although the number of thefts has decreased, people are becoming more interested in services that include smart sensors that measure (energy) consumption and that generate warnings to prevent damage caused, for example, by water leaks.

A very interesting finding is that, even though 58% are interested in an insurance that provides these extra services, only 49% are willing to install sensors themselves and share these sensors’ real-time data in exchange for a discount. As mentioned in the first key takeaway, even though there is a shift in consumer willingness to share data, it is still in its initial stages. It is important for insurers to prepare and be ready to act swiftly based on future changes in regulation and data capabilities.

EY Insurance Consumer Survey

68%of respondents are interested in usage-based insurance for cars.

Chapter #3

Key takeaway #3

Consumers value product transparency and convenient digital purchasing options

Consumers value product transparency and convenient digital purchasing options

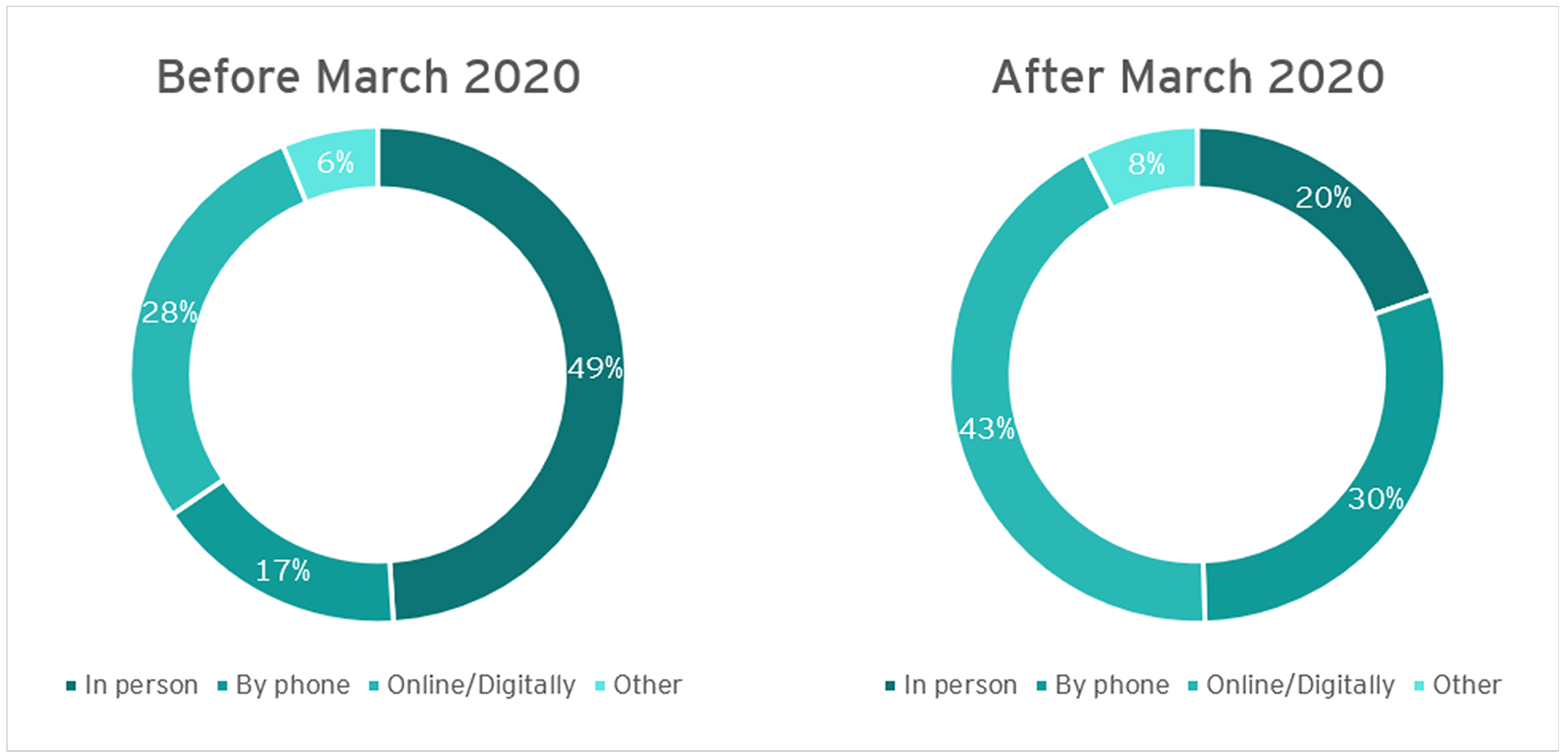

The lockdown has led to a significant increase in e-commerce activity, a trend that is also visible in the insurance sector. Since the start of the COVID-19 outbreak, and consequent lockdown periods, consumers have been more willing to partially digitize their purchasing journey. One of the impacts is a change in preferred contact methods with insurance agents. In EU markets, only 28% of consumers used to favor digital contact with their agents before COVID-19, jumping to a whopping 43% during the pandemic.

EU (France, Italy) survey data, EY Global Insurance Survey conducted in late 2020.

The survey also shows that 63% of EU respondents now display an interest in purchasing health insurance products online, followed by 58% who are interested in doing so for life insurance products. A similar trend applies to purchasing car insurance products digitally (64%) and home insurance products (52%).

EY Insurance Consumer Survey

63%of EU respondents show an interest in purchasing health insurance products online.

Insurers should be aware of this shift in consumer behavior and, going forward, include this knowledge in their strategy. Note that the Belgian insurance market differs from other EU countries as it relies heavily on brokers and offers limited digital purchasing options. It will be key to supplement the personal broker relationship with the convenience that digital offers, hence seamlessly combining both types of touchpoints. EY Belgium will soon release the EY Begium Online Insurance Barometer 2021 on consumers’ digital habits for car and home insurance, providing elaborate insights into the national market.

Even though consumers increasingly turn to digital to buy products, insurers have a long road ahead of them. One of the main concerns that emerged from the survey is that consumers do not fully understand the extent of their product coverage. In life and retirement products, 64% of respondents note insufficient understanding, as well as 74% for personal lines products. Helping consumers comprehend what they are buying provides a level of transparency that results in more products sold, including add-ons and other insurance products in your portfolio.

Conclusion

Based on the results of this survey, we can conclude that not only a shift is happening in the types of insurance products that customers require since the COVID-19 impact, but also in the way consumers want to purchase these products and have interactions with their insurance officer. The benefits of digital buying and servicing are certain to have a lasting influence on the way consumers approach and are approached by insurers and brokers in the future.

In our next article(s) we will further explore these results and analyze their impact on the insurance sector and ways for insurers to adapt their way of working.

Newsletters EY Belgium

Subscribe to one of our newsletters and stay up to date of our latest news, insights, events or more.

Summary

COVID-19 has brought about many changes, and the insurance industry has to adapt. More specifically, insurers need to respond to consumers’ changing expectations, including their worries on income loss and desire for usage-based products. Moreover, insurance companies need to propose transparent digital purchasing options.