We need new approaches and technologies to combat money laundering

Current AML compliance processes are dominated by high levels of manual, repetitive and data-intensive tasks that are perceived as inefficient at disrupting money laundering activity. Given the relatively low impact of current AML efforts, combined with the increasing complexity of threats and growing volume of data to analyze, the time is now to explore the capabilities of artificial intelligence (AI), which has the potential to enable a notable change in AML capability and provide a means to scale and adapt to the modern threat of money laundering.

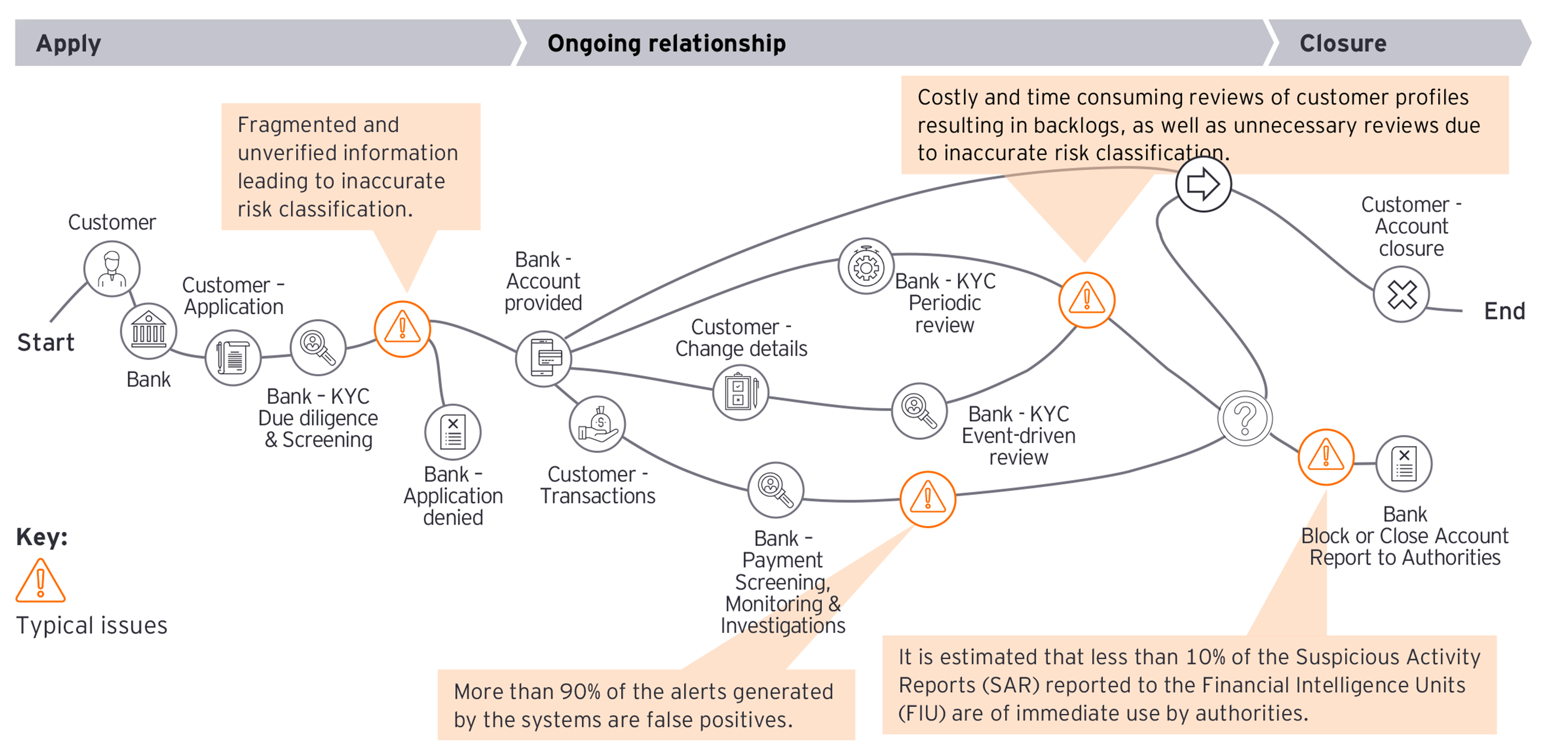

AI capabilities have grown in recent years, as demonstrated by real-life examples such as virtual assistants and robotics. Their transformative potential has thus stimulated the imagination of businesses that are seeking to reduce costs, more effectively manage risk and increase productivity. AI’s potential to support regulatory compliance has been noted by risk and compliance managers. AI can drive significant efficiencies in typical operational hotspots, such as customer due diligence, screening and transaction monitoring controls. For example, incumbent AML transaction monitoring controls typically generate high levels of false positive alerts and significant operational workloads.

AI offers immediate opportunities to significantly reduce operational costs with no detriment to effectiveness by introducing machine learning techniques at different levels of the transaction monitoring process. AI is also being applied to customer due diligence and screening controls using natural language processing and text mining techniques.

Navigating the impact and incurred challenges of the COVID-19 pandemic

The COVID-19 pandemic has triggered unprecedented change, forcing major lifestyle adjustments and turbulence in financial markets. While financial institutions are providing essential services, they must consider the impact on operations, employees and customers while remaining compliant with key KYC, AML and Sanctions obligations.

COVID-19 events are impacting customer and payment transaction patterns, and AML systems are calibrated to handle the emerging risks and typologies. These risks originate from a sudden increase in transaction volumes due to:

- government stimulus packages being routed through banking channels,

- emergency aid-related fund flow to government bodies, spurious aid agencies and existing non-governmental organizations (NGOs), and

- a surge in faceless digital transactions.

Additionally, with the onset of the pandemic, financial institutions face operational challenges resulting from closure, limited services or suspension of conventional account opening and servicing channels such as branches. Coupled with lockdowns and social distancing measures in various areas, this also poses challenges in executing conventional KYC and Customer Due Diligence (CDD) measures. For financial institutions, which onboard and interact with their customers in-person, the business disruption can pose critical risks. For corporate clients, the challenges are compounded by limitation in client outreach for completing complex tasks such as identification of beneficial owners, for which all regulators may not tread the same path.