Source: EY

Seventy-five percent of network leaders say regulation is not moving fast enough.1

The regulatory framework should also recognize the changing use of the network and enable greater participation by the growing energy community. Whether prosumers, peer-to-peer traders, aggregators or providers of flexibility services, there should be scope to make money from generating, trading or facilitating the exchange of energy, as well as incentive mechanisms.

Urgent need for flexible regulatory framework

Despite not being the decision-makers, the entire industry can influence the direction and progress of regulation. The challenge is that this transition is bigger than anything experienced in the energy industry before.

The EU’s clean energy package includes ambitious promises on renewable energy, efficiency and performance. Other reforms – not ratified, but being actively pursued by industry body Eurelectric – recognize the role of the DSO in prioritizing renewables, empowering customers, enabling better management of energy flows and collaborating with transmission system operators (TSOs) to secure supply.

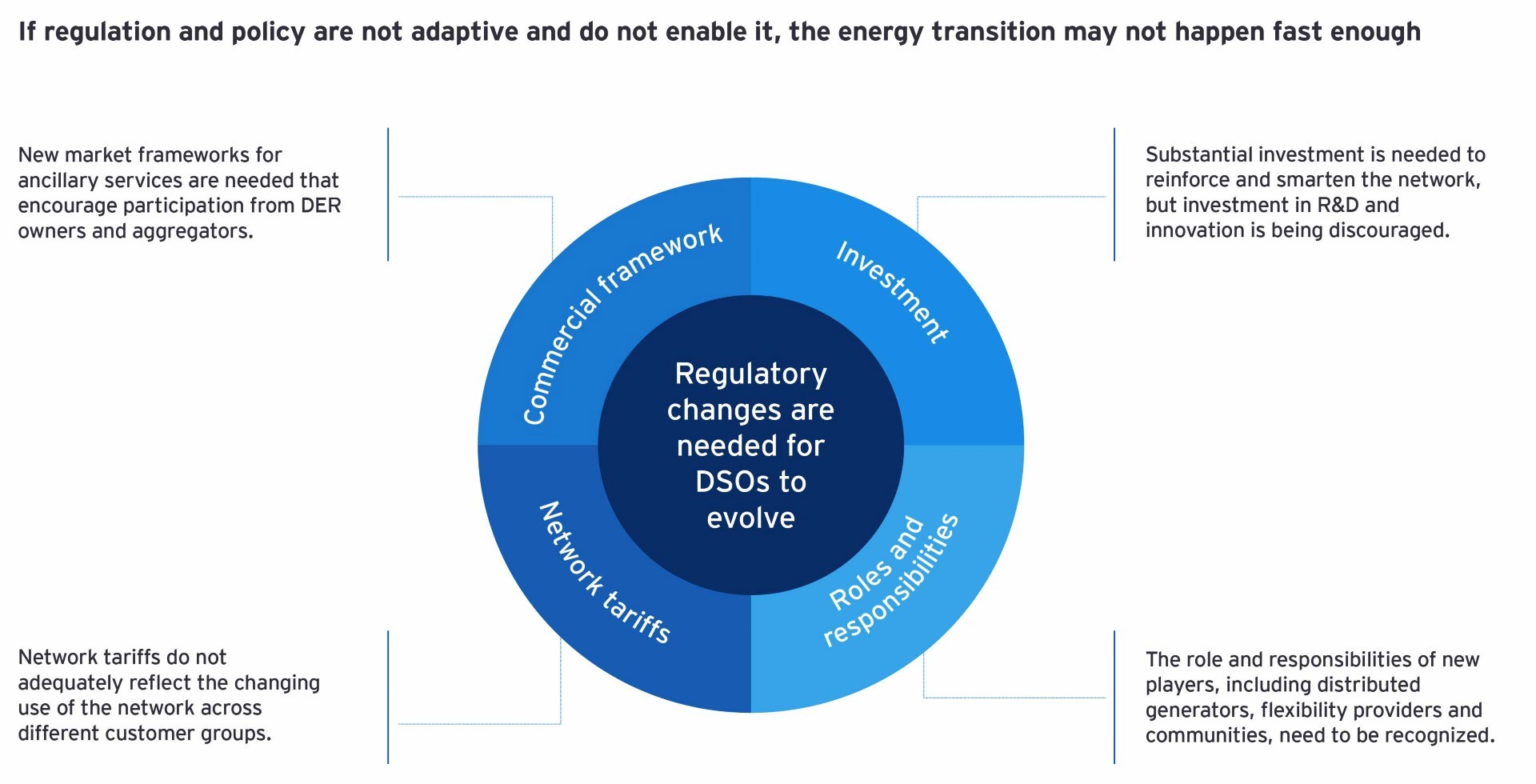

The industry believes that more can be done though, with DSO respondents to the EY 2018 survey pointing to areas where clear regulatory direction is needed to:

- Define the DSO’s current and evolving role, aligned with the TSO, and scope to harness flexibility

- Ensure customers are not disadvantaged financially

- Enable fair returns to investors by being less short term and more forward focused

- Give DSOs flexibility, with targets rather than specific policy and expenditure restrictions

- Recognize long-term paybacks from innovation and digitization expenditure, and the overall “smartening” of power networks

- Determine the optimum risk allocation, especially for emerging technology investments with short life-spans

- Create a level playing field for all market players, not prioritizing one particular business model, but ensuring that tariffs are designed so all users contribute fairly to network and policy costs

- Enable intermediaries to act on behalf of customers who may struggle or be reluctant to adjust to a smart, market-based energy ecosystem

Priorities are clear, but will regulators move fast enough?

If regulation and policy don’t adapt and enable the energy transition, it will still happen, just not fast enough.

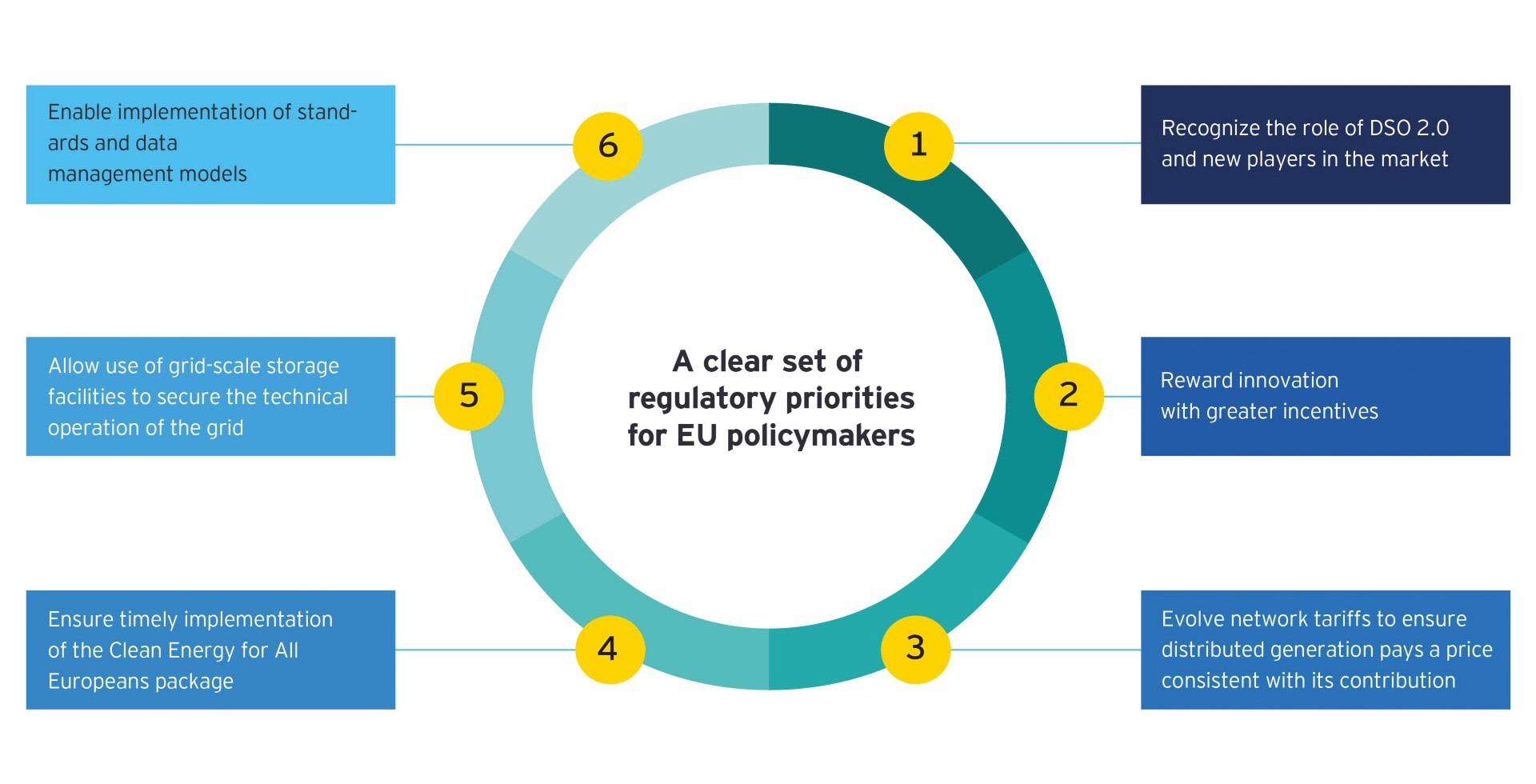

Industry participants were asked what they wanted from policymakers. Six priorities emerged:

1. Recognition of the DSO’s role and regulatory framework support. Including incentives to implement initiatives that support the DSO’s transformation and enable the energy transition.

2. Reward innovation with greater incentives. Providing bigger incentives to offset innovation risk and incentives that apply to both CAPEX and OPEX, acknowledging the shift from one to the other. And where returns take decades to materialize, regulatory stability and a predictable investment framework to help phase in innovations.

3. Rethink tariff design. Ensuring consumers who generate their own electricity, but use the grid, contribute to the cost of grid modernization and digitization charges.

4. Timely implementation of the clean energy package. Facilitating distributed generation and flexibility services at a local level and, in turn, allowing for competitive procurement and congestion management – leading to greater efficiencies in the distribution system.

5. Remove barriers to battery development. Allowing for greater public ownership and enabling DSOs to operate grid-scale storage facilities within clearly defined regulatory parameters.

6. Regulatory intervention on energy standards and data management. Giving customers and other market participants access to information to fully engage in the market.