EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Tax Alert 2023 No. 51, 13 December 2023

The application of Canada’s Underused Housing Tax Act (UHTA) has resulted in a substantive amount of change in the first year of enforcement, as the Canada Revenue Agency (CRA) has exercised its administrative powers twice to extend and waive interest and penalties on late-filed returns by taxpayers.1 Furthermore, in the 2023 Fall Economic Statement on tabled on 21 November 2023, the government released draft legislative and regulatory proposals, with accompanying explanatory notes, to the UHTA in an attempt to relieve some of the burden faced by many Canadian property owners not otherwise targeted by the underused housing tax.2 Interested parties are invited to provide their feedback with respect to these proposed amendments by 3 January 2024.

In this Tax Alert, we provide a brief overview of the main draft legislative and regulatory proposals released in the 2023 Fall Economic Statement.

Updates to the definition of “excluded owner”

The most significant proposed amendment to the UHTA is the addition of trustees of a specified Canadian trust, partners of a specified Canadian partnership, and specified Canadian corporations to the definition of “excluded owner.” As a reminder, an excluded owner is not required to pay tax under the UHTA nor is it required to file an annual underused housing tax return.

Prior to this proposed amendment, these categories of owners were required to file an annual return for each residential property owned and claim an exemption from the underused housing tax despite being exclusively or primarily Canadian owned and controlled. This annual filing obligation to mitigate both the underused housing tax itself, as well as the significant penalties for failure to file each return, created a significant administrative burden on a group of owners not likely intended to be targeted by the UHTA.

While the proposed amendment is a welcome change, it would only come into force for the 2023 and subsequent calendar years. No retroactive relief was proposed for these owners (who are currently categorized as “affected owners”) of residential property in respect of their obligations for the 2022 calendar year.

Consequential to the proposed updated definition of “excluded owner,” the exclusion from tax provision for trustees of specified Canadian trusts, partners of specified Canadian partnerships, and specified Canadian corporations would be repealed for 2023 and subsequent calendar years.

Update to the definitions of “specified Canadian partnership” and “specified Canadian trust”

The definitions of “specified Canadian partnership” and “specified Canadian trust” have been expanded to include a broader range of Canadian ownership structures, effective for 2023 and subsequent calendar years.

Under the existing UHTA, a specified Canadian partnership is generally a partnership for which each member is either an excluded owner or a specified Canadian corporation on 31 December of the calendar year. Under the proposed amendments, this definition would be expanded to include another partnership or a trust, each member or beneficiary of which is such a person.

Under the existing UHTA, a specified Canadian trust generally includes a trust under which each beneficiary (having a beneficial interest in the residential property) is either an excluded owner or a specified Canadian corporation on 31 December of the calendar year. Under the proposed amendments, this definition would be expanded to include another partnership or another trust, each member or beneficiary of which is such a person.

Owners with multiple capacities

Another significant proposed amendment addresses situations where a person may have multiple capacities with respect to the ownership of a property, and potentially multiple underused housing tax filing obligations and/or exemptions. In Question 3.2 of Underused Housing Tax Notice UHT15N, Questions and Answers About the Underused Housing Tax, the CRA stated that taxpayers could opt to declare only one exemption or declare all the applicable exemptions when filing a paper return by mail; however, for electronic returns, affected owners would only be permitted to declare one exemption.

This discrepancy between paper and online returns created uncertainty with respect to underused housing tax filings; in response, the government has proposed to add section 4.1 to the UHTA to specifically address instances where a person has multiple capacities applicable to their ownership of residential property. More specifically, proposed section 4.1 provides that if a person is an owner of a residential property in more than one capacity, the person is treated as if the person were a separate person in each capacity in which the person is an owner of the residential property. To illustrate this situation, the explanatory notes provide an example in which an individual who is neither a citizen or permanent resident of Canada owns residential property in their individual capacity and in their capacity as a trustee of a specified Canadian trust. The individual would be considered an excluded owner in their capacity as trustee of a specified Canadian trust, but an affected owner in their capacity as an individual; as such, the individual would be required to file an annual return and potentially be subject to the applicable tax (if an exemption was unavailable) based on their ownership percentage in the residential property.

Proposed section 4.1 of UHTA would apply retroactively to 1 January 2022; other technical amendments to the UHTA in respect of filing and payment requirements have been amended to adopt the new principle.

Reduction in the minimum failure to file penalties

Another welcome proposal is the reduction of the minimum failure to file penalty from $5,000 to $1,000 per property for individuals and from $10,000 to $2,000 per property for a person who is not an individual. This proposal would apply retroactively to 1 January 2022.

The total assessable failure to file penalty continues to be equal to the greater of the minimum amount as computed above, and the total of:

- 5% of the applicable tax for the property for the calendar year; and

- 3% of the applicable tax for each complete calendar month the return is late.

The percentages computed above are applicable on the gross amount of underused housing tax prior to certain exclusions. The list of exclusions would be expanded by the legislative proposals to include eligible vacation properties in respect of annual returns for the 2023 and subsequent calendar years.

Given the magnitude of the total penalty amount, which is computed for each property, taxpayers are advised to file their annual returns on a timely basis.

Exclusion for certain residential condominium units

Proposed amendments to the Underused Housing Tax Regulations (the Regulations) would exclude certain types of condominium apartment rental arrangements from the definition of residential property if all of the following conditions are met:

- The residential condominium unit is part of a building containing four or more residential condominium units;

- The person is the owner of all or substantially all of the residential condominium units in the building; and

- All or substantially all of the residential condominium units are held by the person for the purposes of providing individuals continuous occupancy of a residential condominium unit as a place of residence or lodging for a period of at least one month.

This proposal would apply retroactively to 31 December 2022.

In the absence of this proposed amendment, condominium buildings where a person owned all or substantially all of the separately titled units had significant filing obligations that were inconsistent with other owners of multi-unit residential buildings.

Expansion of prescribed condition for a tax exemption

Subsection 2(3) of the Regulations has commonly been referred to as the vacation property exemption since this subsection aims to provide relief to affected owners who hold more than one residential property, the additional residential property is located within a prescribed area (generally outside a census metropolitan area or a census agglomeration having 30,000 or more residents), and the affected owner (or the owner’s spouse or common-law partner) uses the property as a place of residence or lodging for at least 28 days during the calendar year. Proposed amendments to the Regulations would ensure that the vacation property exemption can be claimed by an individual or a spousal unit for only one residential property for a calendar year, effective for 2024 and subsequent calendar years.

In addition, the prescribed conditions for an exemption from tax would be expanded to include a property held by an affected owner (referred to as an “operator”) that carries on a business in Canada, where the particular residential property is held during the year primarily to provide a place of residence or lodging for an officer, an employee or a contractor (or subcontractor) engaged to render services at that location. An example of this could be an owner of several bed and breakfasts where it’s necessary for the staff to reside in the residential property in order for them perform their employment duties. The exemption would apply for residential properties located anywhere in Canada other than in a population centre within either a census metropolitan area or a census agglomeration having 30,000 or more residents. The proposal would apply to the 2023 and subsequent calendar years.

What are the next steps?

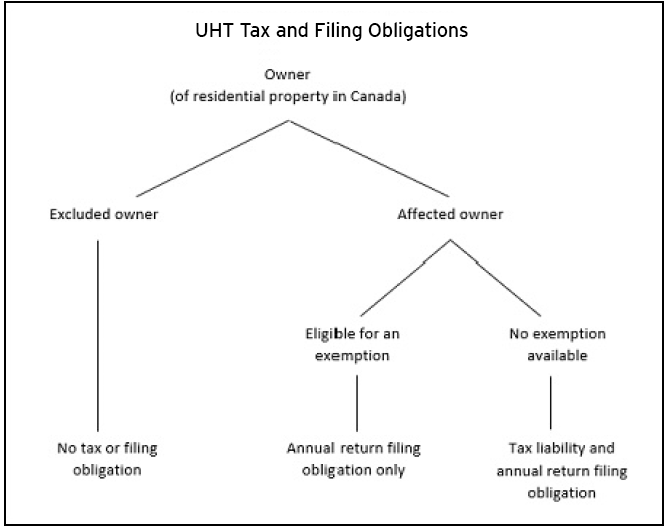

The chart below may assist you in determining your obligations under the UHTA.

For an overview on who is affected by the UHTA and the resulting implications, see EY Tax Alert 2023 Issue No. 39 and EY Tax Alert 2023 Issue No. 10. For EY’s complete summary of the UHTA released when the legislation first became law, see EY Tax Alert 2022 Issue No. 35.

We recommend you consult with your real estate lawyer to review the proposed amendments to the UHTA and identify all instances of Canadian residential property ownership, including bare trust and nominee ownership arrangements. While the penalties for a failure to file an annual UHTA return may be reduced, they remain significant; as such, care must be exercised to ensure exposure to penalties and interest is minimized.

Learn more

For more information, please contact your EY or EY Law advisor or one of the following professionals:

Toronto

Jeremy Shnaider

+1 416 943 2657 | jeremy.shnaider@ca.ey.com

Matthew Mammola

+1 416 943 2779 | matthew.mammola@ca.ey.com

Gabriel Baron

+1 416 932 6011 | gabriel.baron@ca.ey.com

David Robertson

+1 403 206 5474 | david.d.robertson@ca.ey.com

Montreal

Jadys Bourdelais

+1 514 879 6380 | jadys.bourdelais@ca.ey.com

Philippe Dunlavey

+1 514 879 2662 | philippe.dunlavey@ca.ey.com

Ottawa

Chris Jerome

+1 613 598 4865 | chris.jerome@ca.ey.com

Waterloo

Ameer Abdulla

+1 519 571 3349 | ameer.abdulla@ca.ey.com

London

Heather Wright

+1 519 646 5521 | heather.a.wright@ca.ey.com

Saskatoon

Ryan Ball

+1 306 649 8225 | ryan.ball@ca.ey.com

Wes Unger

+1 306 649 8247 | wes.unger@ca.ey.com

Calgary

Thomas Brook

+1 416 943 2117 | thomas.brook@ca.ey.com

Dean Radomsky

+1 403 206 5180 | dean.w.radomsky@ca.ey.com

Sanjaya Ranasinghe

+1 780 441 4692 | sanjaya.ranasinghe@ca.ey.com

Edmonton

Hayat Kirameddine

+1 780 412 2383 | hayat.kirameddine@ca.ey.com

Vancouver

Perry Yuen

+1 604 643 5451 | perry.yuen@ca.ey.com

___________________

- On 31 October 2023, the government announced that the first UHTA filing deadline for affected owners for the 2022 calendar year would be extended again to 30 April 2024.

- For more information on the measures included in the Fall Economic Statement, see EY Tax Alert 2023 Issue No. 42.

Download this tax alert

Budget information: For up-to-date information on the federal, provincial and territorial budgets, visit ey.com/ca/Budget.