Consulting

Consulting at EY is building a better working world by realizing business transformation through the power of people, technology and innovation.

The nature of work is evolving fast, we’re all being asked to adopt new behaviors — to be more innovative, more agile, more collaborative, more everything.

Business today is anything but usual. There is an urgency demanding we look ahead through a new lens, reframe the future and ask new and different questions:

- How do you create customer intimacy without proximity?

- Where does employee centricity meet the future of work?

- How can technology at speed create competitive advantage?

- Where does innovation at scale meet the new "S-curve" of growth?

By placing humans at the center, leveraging technology at speed and enabling innovation at scale, our clients are transforming to realize long-term value for people, business and society as a whole.

Technology Consulting

Our Technology Consulting teams provide strategic advisory, full stack implementation and managed services across emerging and established technologies.

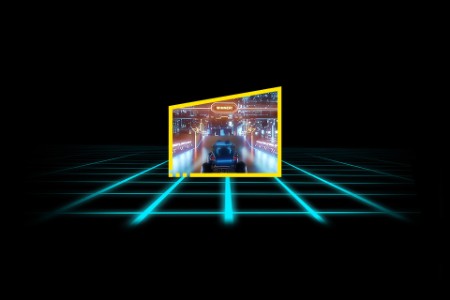

How blockchain helped a gaming platform become a game changer

Microsoft Xbox and EY implemented a transparent blockchain network so game publishers, creators and asset owners can focus on the future.

A blockchain solution that integrates with publishers and creators

Together, EY and Microsoft Xbox are implementing smart digital solutions to help game publishers and creators do their best work.

The team

Contact us

Like what you’ve seen? Get in touch to learn more.