Chapter 1

What does digital transformation mean for finance?

The digital transformations we are seeing today will occur within much shorter timeframes.

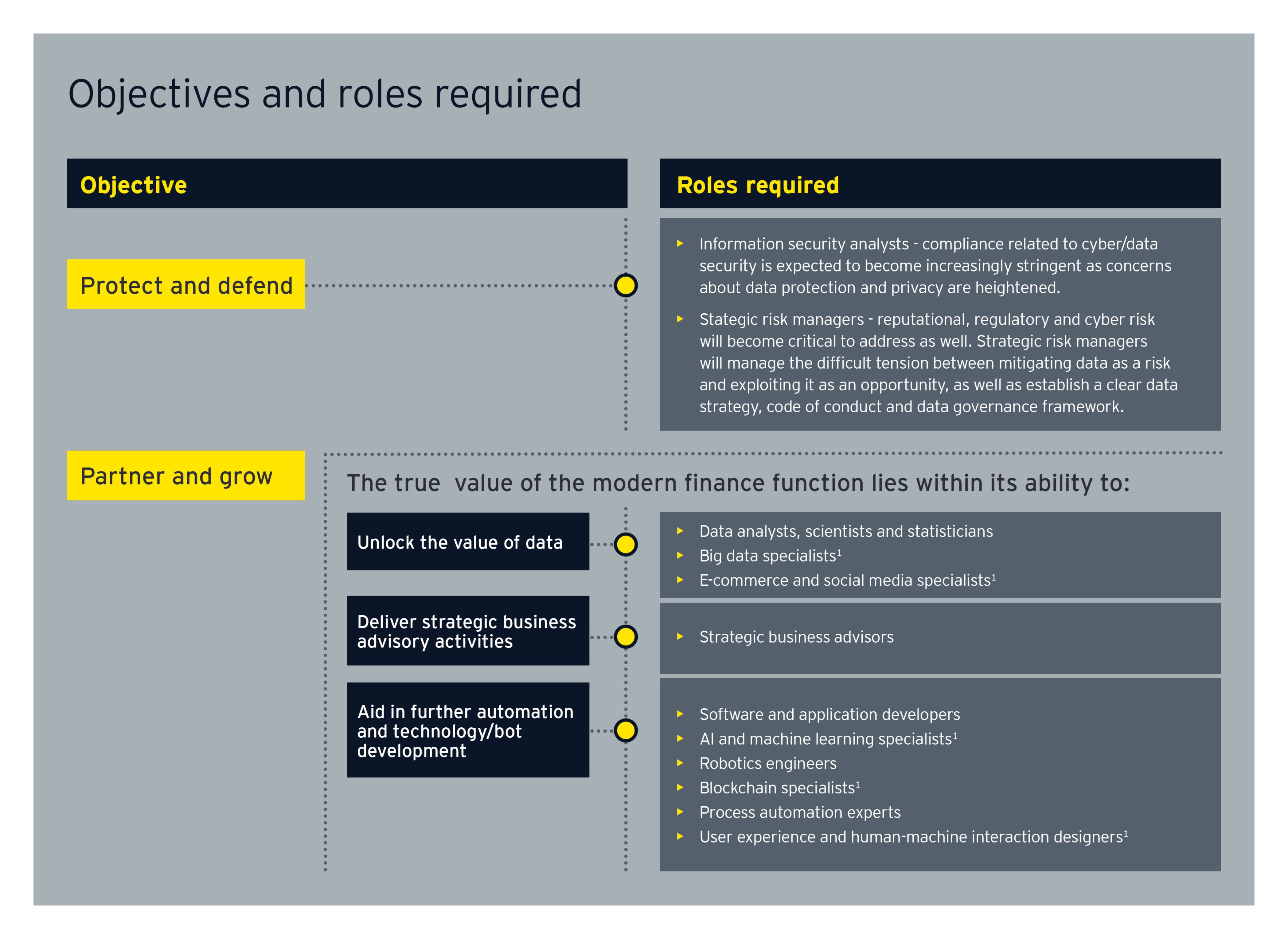

But amid all this accelerating change, the main objectives of the CFO agenda remain the same: protect and defend and partner and grow (the finance function and the business). Similarly, finance’s objectives will not change from:

- Operate and maintain a robust control environment

- Safeguard assets and comply with fiduciary responsibilities – “protect and defend”

- Unlock the value of data

- Drive strategic insights and the strategic business agenda. How these objectives are delivered, and the competencies and capabilities needed to deliver them, however, will change dramatically.

The finance function of 2025

80%of typical finance tasks to be automated, consolidated or procured as a service through a managed-services provider.

In the finance function of 2025, we expect at least 80% of the typical tasks to be automated, consolidated or procured as a service through a managed services provider. Accounting tasks will move upstream (to legal and commercial functions, for example), secured by blockchain and monitored by robotic process automation (RPA). Traditional global business service roles, along with audit, statutory and regulatory reporting, will be automated or procured (or both). And financial data will be available on demand through self-service portals and as an output from artificial intelligence (AI).

Cost efficiency and productivity will, therefore, be addressed through automation/digitization of processes, consolidation and/or outsourcing. The finance function will be left with a leaner pool of highly skilled talent focused on higher-value activities, positioned to team better with other functions in an agile manner to innovate and create value for the organization.

Research indicates that by 2022:

- 85% of large and very large organizations will have deployed some form of RPA.3

- 85% of organizations are likely or very likely to have expanded their adoption of user and entity big data analytics. (Additionally, 75% are likely to make considerable investments in the Internet of Things and app- and web-enabled markets, 73% in machine learning and 58% in augmented virtual reality.)1

- 62% of an organization’s information and data processing and information search and transmission tasks will be performed by machines (compared to 46% today).1

Chapter 2

Impacts to roles and capabilities

Certain jobs will rise in prominence to support needed capabilities.

Nearly three-quarters of all finance leaders say AI experts will be critical to driving innovation in finance over the next two years.2

Because of the shift in the division of labor between humans and machines, 75 million jobs may be displaced by 2022. However, 133 million new roles may emerge over that time.1

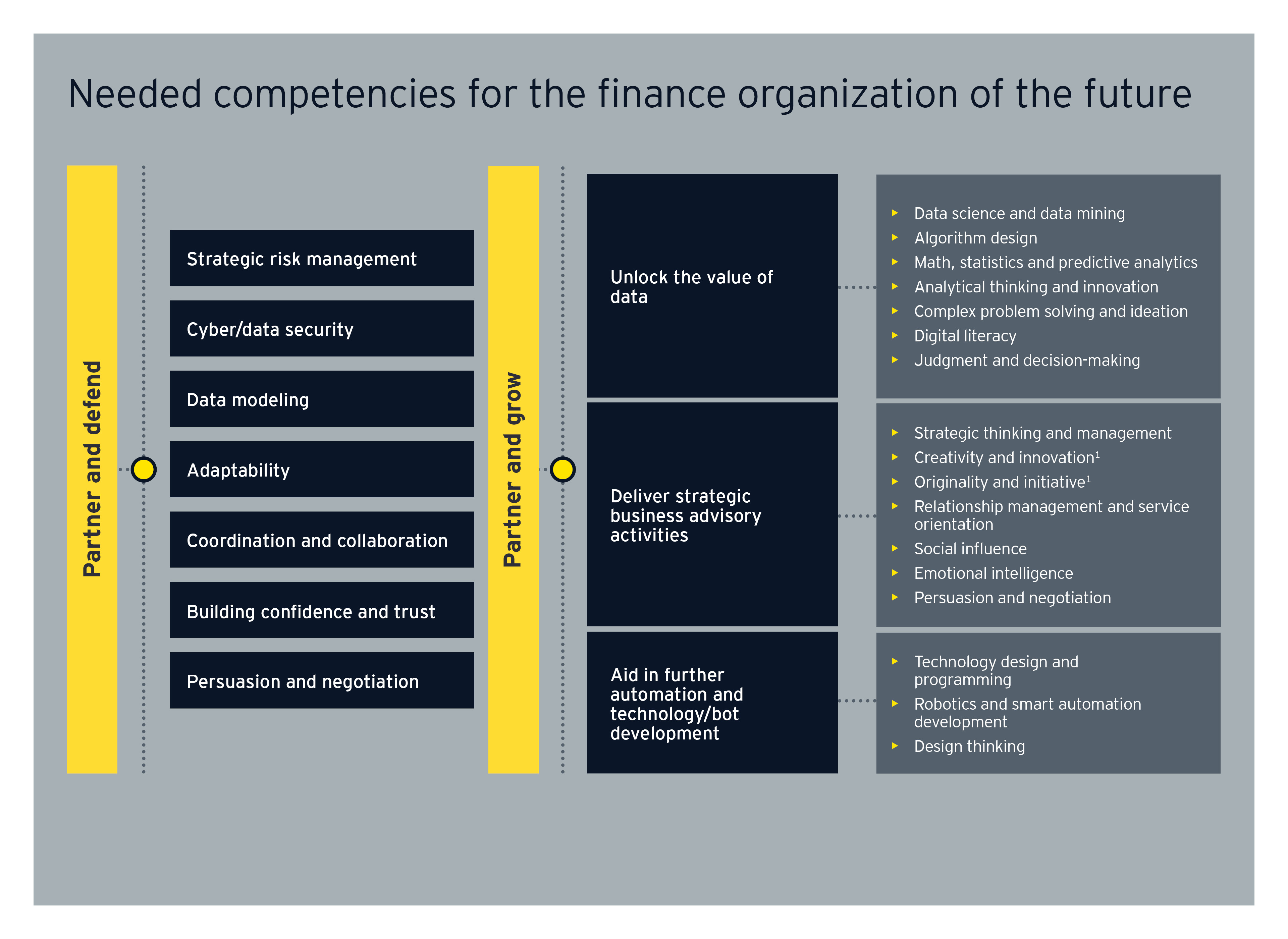

As activities related to operate and maintain the function — such as traditional controllership activities, back-office tasks, and close and reporting — get automated, consolidated and/or outsourced, finance will focus more on the objectives of protect and defend, partner and grow, unlock the value of data and drive strategic insights. As a result, finance will need fewer specialists (such as accountants, auditors and controllers) aligned to operate and maintain. Delivering on the other objectives requires new capabilities.

To unlock the value of big data, for example, there will be an increased need for more statisticians, mathematicians, algorithm developers, data scientists and data engineers — not only to analyze information in real time but also ask the better questions.

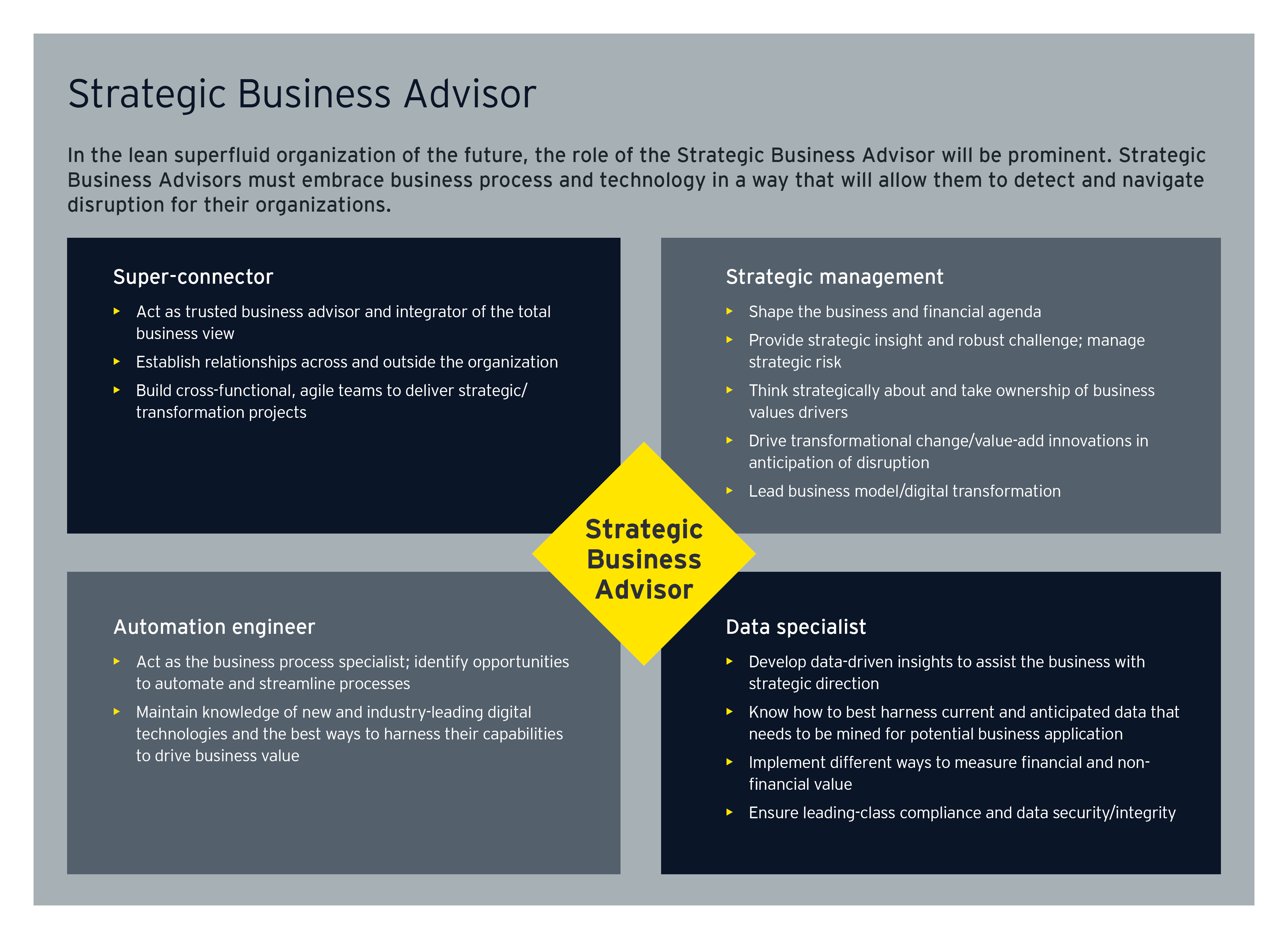

Equipped with insights, finance strategic business advisors can team with other support function strategic advisors and strategic risk managers to set the organization’s strategy and define its capital agenda. Strategic risk managers will provide predictive, real-time, risk-informed insights and coordinate responses across multiple stakeholders. Programmers and developers can further refine capabilities to get the most out of digital technologies and take them in new directions.

What does it mean for the rest of the organization?

The changes described in the graphic above will resonate across other functions — such as IT, supply chain and HR — deeply impacting the way the organization of the future is structured, its size, and the future competencies and capabilities needed to operate it.

If, for instance, as a result of automation and outsourcing, finance became a 10-person organization, and supply chain, IT and HR followed suit, then the overall organization would be smaller and flatter. It would then resemble a 21st-century digital start-up instead of a traditional 20th-century corporation, heavy with employees performing activities that may not necessarily be strategic or value-generating. Even though big corporations will continue to be large in terms of revenue, they will operate with the nimble workforce of a start-up.

Each function will have to team closely with others in an agile manner to achieve a common goal, mission or project. Strategic business advisors will coordinate and drive these partnerships. Strategic risk managers will be embedded within the agile teams to stay on top of new, emerging technologies; assess the downside risks of business decisions; and capture the upside opportunities by taking informed, calculated risks. These two roles will be among the most prominent that remain in-house.

What competencies will finance need to enable an accelerating digital transformation?

Finance leaders must consider their future operating model and embrace the notion that it will continually evolve, resulting in functional/technical competencies that have a much shorter shelf life. Their organization’s strategic priorities will shift rapidly, and finance must have the agility to change with them.

Finance should, therefore, focus on how people adapt and interact. In the 2018 EY Global Alumni Survey, CEOs acknowledge they need to not only nurture technical competencies but also human capabilities, such as critical thinking, the ability to collaborate, and levels of comfort with ambiguity and change. Along with empathy, active learning and listening, these competencies will be especially important as a smaller, superfluid, digital finance team works alongside smaller, digital-driven IT and HR functions.

As the role of the strategic business advisor becomes one of the most prominent in the future, competencies such as strategic thinking and management, creativity and innovation, relationship management, persuasion and negotiation will become fundamental. Strategic business advisors will allow finance and other functions to create effective relationships with internal and external stakeholders and offer their internal clients fresh insights into the strategic challenges they face, drawing on finely honed influencing and communication skills.

The strategic risk manager will work hand-in-hand with the strategic business advisor to think about what’s around the corner — to conceptualize not just what is, but what could be. Competencies such as the ability to use sophisticated data modeling and data mining tools to assess the upside and downside risks that technologies could mean for the organization will become very important. The ability to coordinate risk responses across multiple functions and stakeholders and sell insights across the organization also will become very important.

Many of the needed competencies are in high demand and can be difficult to find. Examples include:

Organizations understand they require new competencies and profiles. But too often, they look to the tried-and-true instead of attempting creative new approaches to source and/or develop their employees.

Opportunity to create value

As organizations automate their close process, they create resource capacity that can be redeployed. Instead of spending time on accruals and reconciliations, for example, a resource can now:

- Perform real-time data analysis — to inform strategic decisions as they are being made in the C-suite

- Build digital confidence — by ensuring the integrity of the data and financial information that will be accessed through self-service portals for strategic decision-making

- Improve digital capability of processes — by identifying additional automation opportunities for the record-to-report process

Finance leaders recognize they need to do more to challenge their view of what constitutes finance capabilities and the entrenched approaches to sourcing them. For example, 79% of CFOs say there is an urgent need for finance to recruit new competencies, and 76% say finance should widen its recruitment net to find people with non-traditional backgrounds.2

While reskilling and/or transitioning employees to new jobs may take considerable investment and time, it is still less costly and disruptive than letting people go and recruiting new talent. As such, leaders must recognize their investment in reskilling and up-skilling as an asset rather than an expense and must strike a balance between recruiting for in-demand capabilities, such as data science, and developing them in-house.

As time to mastery decreases, organizations will have to establish a continuous, dynamic and fast-paced approach to building emerging competencies and capabilities, one that will increasingly replace traditional training and certification.

Leaders should ask themselves:

- Is our finance function staffed with strategic business advisors who can deliver on the promise of value creation and innovation?

- Have we defined our workforce needs to effectively deliver the new capabilities?

- What learning and development will be delivered to elicit maximum performance?

- How will it be delivered?

Chapter 3

What’s next?

Organizations cannot reskill and retool their workforce fast enough.

At a minimum, employers believe, 54% of workforces will require significant reskilling and up-skilling by 2022.1

Competency gaps will slow digital adoption and the organization’s overall ability to stay relevant and take advantage of new opportunities in a perpetually changing marketplace. Finance leaders have recognized the need to proactively prepare their people for the future and reboot their function’s talent profile.

To build a workforce of agile learners equipped with emerging digital capabilities and competencies, finance functions must forecast their future workforce capability needs, using strategic workforce planning based on the organization’s three-to five-year strategy and the timelines around emerging technology investments. This will provide a clear future vision of learning needed.

Finance must then team with HR and other functional stakeholders to craft a dynamic learning strategy and program that provide:

- Readily accessible, relevant content — to guide workers to the learning opportunities that best support them in developing future-focused competencies

- Fast-paced, intensive learning — to allow employees to upgrade their competencies and capabilities through short bursts of learning and reinforcement, delivered right when they can be applied

This will serve to not only prepare employees to perform new jobs but allow them to develop the resiliency and ability to continuously reinvent themselves over a lifetime of dramatic change.

Kokkuvõte

Skill gaps will delay digital adoption, impact an organization’s relevancy and limit its ability to quickly leverage new opportunities in a fluid marketplace. Finance leaders must proactively prepare employees for the digital future, reimagining and recasting the function’s talent profile.