Chapter #1

Implement a more radical diversity, equity, and inclusion agenda

A DE&I culture will minimize exclusion of key employee sub-groups, drive commitment and extend their talent advantage.

Gen Z is the most diverse generation to date, characterized by high levels of activism for social justice, ethical, racial and cultural, and gender issues. As such, this generation feels that homogeneity in their workplace only serves to stifle innovation and creativity. This is also the “we, not me” generation with individuals favoring inclusive organizations and preferring not to work for, or engage with, financial institutions (FIs) that don’t respect diversity or reflect their own or others’ unique identities.

Unfortunately, most organizations are still on a lengthy journey to build and cultivate a culture of DE&I within their workplaces. For instance, global gender parity in economic participation and opportunity only narrowed by a minuscule 0.3 percentage points year-on-year in 2023. More concerningly, this has not only stagnated in APAC for over a decade, but registered a 1.6 percentage point decline this year.

Among others, course correction calls for more inclusive hiring practices, continual upskilling, and the provision of career opportunities for women — particularly in the fast-growing, higher remunerating disciplines in science, technology, engineering, and mathematics (STEM). Committing to gender diversity means that APAC banks need to be doing more to support women’s equal opportunities to pursue and thrive in financial services (FS) careers that could enhance their economic security.

To help leaders understand the status of belonging in one of the world’s most diverse regions that is APAC, EY teams conducted a regional Belonging Barometer research. Here, only 43% of regional employees feel like they belong in their workplace, with 25% considering switching organizations within the next 12 months.

Unsurprisingly, levels of exclusion experienced by key employee sub-groups registered at much higher levels. Racial and ethnic minorities, those from the LGBTQIA+ community, people with disabilities (PwD), and neurodivergent workers (who exhibit different mental orientations) feel that their authentic selves are least welcomed at work, and thus are less able to contribute in a meaningful manner.

As these individuals comprise a sizable percentage of the world’s population, ensuring that they are included is not only socially appropriate, but critical to access their largely untapped talent pool. For instance, globally 16% of us have a disability, so embedding disabilities inclusion across banks has a strong business-building value. Supporting this observation is an EY collaborative report exploring APAC perspective on disability inclusion indicating that 68% of employers reported productivity benefits (e.g., from reducing hidden costs of low morale and high rates of absenteeism and staff turnover) from having provided workplace inclusivity for PwD.

Organizations that prioritize people in their workforce decisions see markedly better outcomes. Thus, in this time of change and heightened discourse among Gen Z about social equity, banks must dismantle age-old banking sector stereotypes to advance DE&I and foster employees’ sense of workplace belonging.

Major benefits of integrating a diverse workforce include the fostering of out-of-the-box thinking and varied approaches to problem solving that could enhance creativity, spur innovation, and potentially engender a more competitive edge for the banks.

DE&I priorities are crucial also because these typically ensure more engaged and committed employees, and enhance team morale and retention, with 63% of APAC employees from very diverse workplaces experiencing a strong sense of belonging against 36% from less diverse organizations. Echoing this is the EY/IIF global risk management survey wherein 35% of bank chief risk officers (CROs) outline the implementation of effective DE&I strategies as being critical to building positive ways of working and retaining personnel within their organization.

To create more meaningful talent advantage, APAC banks should:

- Determine what DE&I means to the organization. Instead of attempting to tackle a myriad of issues and not getting significant traction on most, prioritize specific differences* (e.g., gender, ethnicity, PWD) as starting points. This shortlist would vary across APAC depending on factors such as local cultural norms, political climate, and legislative requirements.

- Embed diversity metrics into talent hiring and promotion processes, continually monitor trends and conduct social listening to ensure inclusivity.

- Source talent from nontraditional pools such as diversity platforms, community colleges and other industries beyond the FS sector to build more representative teams.

- Design a program of systemic interventions such as educating non-minority staff and influencing behaviors to address exclusion, and reduce inherent or intentional biases.

- Ensure leaders prioritize diversity dimensions and seek to create conditions for belonging by being open, authentic, and empathetic toward others.

Chapter #2

Attract Gen Z to replenish the data and tech talent pool

This new generation of digital natives are a natural pool of tech talent, but must be convinced to want to work in a bank.

Today’s workforce is eagerly awaiting tomorrow’s digital capabilities and enthused about the promise of buzzy consumer-facing emerging technologies. This is more so among Gen Z who are quickly familiarizing themselves with novel tech and expecting to leverage this over the course of their careers.

For instance, generative AI (GenAI) — the disruptive tech made popular in late-2022 with the viral deployment of ChatGPT that propelled AI into mainstream deployment — is one such tech that’s expected to have an outsized impact on the Gen Z labor market, on their career and learning pathways, and the realities of work.

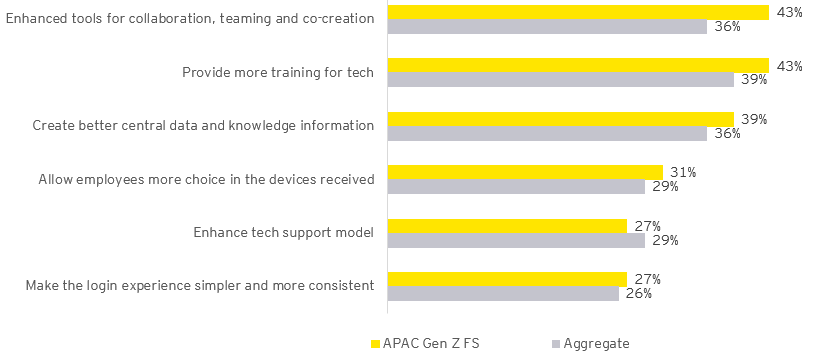

With employees believing that novel tech would boost productivity and new ways of working, they are formulating their expectations around deeper use of technologies by employers. Here, in EY Team’s 2023 Work Reimagined Survey, Gen Z already working in FS in APAC would like to see their employers elevate workforce technologies with enhanced tools for collaboration, teaming and co-creation; and avail staff with greater tech trainings (both at 43% of this segment’s respondents, versus a sub-40% aggregate for all global respondents).

Actions employees want employers to take to improve workforce technology

Note:

Multiple response selections permitted.

N=51, filtered for APAC (Australia, China, Indonesia, Japan, Malaysia, New Zealand, Philippines, and Singapore), Gen Z (1997-2010) working in FS (Banking & Capital Markets, Insurance, and Wealth & Asset Management).

Aggregate N count (across all regions, generation of employees, and sectors) = ~ 17,000

Source: EY Team’s 2023 Work Reimagined Survey

To successfully participate in today’s ever-changing financial ecosystem, banks must not only hire the best and brightest talent, then further upskill them to transform into a digitally-driven institution — but evaluate potential new tools and tech for the future. In this same poll, a somewhat eye-opening 33% of APAC Gen Z FS employees further opine that their employers require “extensive changes” to their tech and tools before they can provide adequately sophisticated tech- and customer-centric financial solutions to support internal and/or external users.

Given that incumbent FIs still fall short with the maturity of their data and tech, yet face exponentially greater competition from new entrants, they aren’t the preferred employer that top tech graduates gravitate to.

In a race for talent, the more glamourous and snazzy digital disruptors are the organizations drawing in Gen Z, offering a more dynamic and entrepreneurial environment, innovative spirit, and diverse opportunities to work with cutting-edge tech that could disrupt traditional FS. Also appealing is their faster-paced startup-like culture, flatter hierarchies, and exposure to higher levels of responsibility and autonomy for those who want to make a significant impact, and do so sooner.

Although recent labor events like global technology sector layoffs provide pockets of opportunity for FS to recruit more data and tech talent, the APAC markets have been relatively buffered. Redundancies in tech companies are primarily concentrated in non-tech roles such as sales and corporate functions, and the dearth of tech employees remains, particularly within emerging South-east Asian markets.

The implication here is that regional banks must act swiftly to capture the Gen Z digital talent that remains in scarce supply into the foreseeable future. Confirming this comment is an industry survey where nearly one-third (32%) of APAC businesses indicated a lack of tech talent as a core challenge to their tech adoption, yet just 49% have upskilled and/or reskilled existing employees over the previous year to address that shortfall.

Practical next steps for APAC banks to attract and retain Gen Z talent are to:

- Establish tailored strategies to entice critical technologists most sought after in APAC, such as coders and cyber specialists. This includes factoring in defined career trajectories, diverse assignments or rotational experiences, immersive development programs, and of course — attractive compensations (such as the equity shares typical in digital disruptors).

- Forge partnerships with local technical universities, colleges, and relevant community groups to access a deeper pool of candidates to fill vacant positions and support greater workforce diversity. This is especially critical in emerging markets such as Vietnam and Indonesia where fewer adults possess tertiary education. Hiring for data and tech positions that can be fulfilled via on-the-job training without requiring higher educational qualifications would ease the banks’ Gen Z staff crunch.

- Modernize legacy tech and systems to segue to a flexible, modular, cloud-native business transformation platform optimized for banking. Gen Z employees would not typically be excited by sunsetting legacies when they could be honing their skills on more cutting-edge tech (involving GenAI, the metaverse, virtual reality, edge computing, and other disruptive areas) to design, build, and launch new client propositions.

How EY can help

Workforce transformation services

Workforce transformation strategies for the banking and capital markets industry.

Read moreSummary

It takes a whole-of-bank approach to sharpen the talent narrative to attract Gen Z. With significant workforce generational shifts as individuals within this demographic begin to make their entry-level career decisions, the time to do so is now.

Incumbent APAC banks must make radical changes around their DE&I policies and data and tech hiring strategies to maximize appeal to this next generation of employees. It’s only by speaking directly to this demographic can they pull the right levers to win over tomorrow’s Gen Z leaders.