Realizing the full potential of electrification will require rethinking how mines are designed.

Companies also need to understand the risk-reward profile of investing in technology and automation – considering how their adoption will generate returns or reduce costs, as well as changing the risk profile of their operations. A phased approach enables mines to immediately lower costs and carbon footprints and deploy technology in stages, as it becomes scalable and more cost-effective. It also helps companies limit their upfront capital investment, which can be challenging to navigate.

Many of the technologies enabling electrification are still prototypes, and moving from lab to mine will require patience – and a new mindset. Safety must remain the priority, but the traditionally risk averse culture of mining should also commit to supporting and shaping the development of emerging technologies.

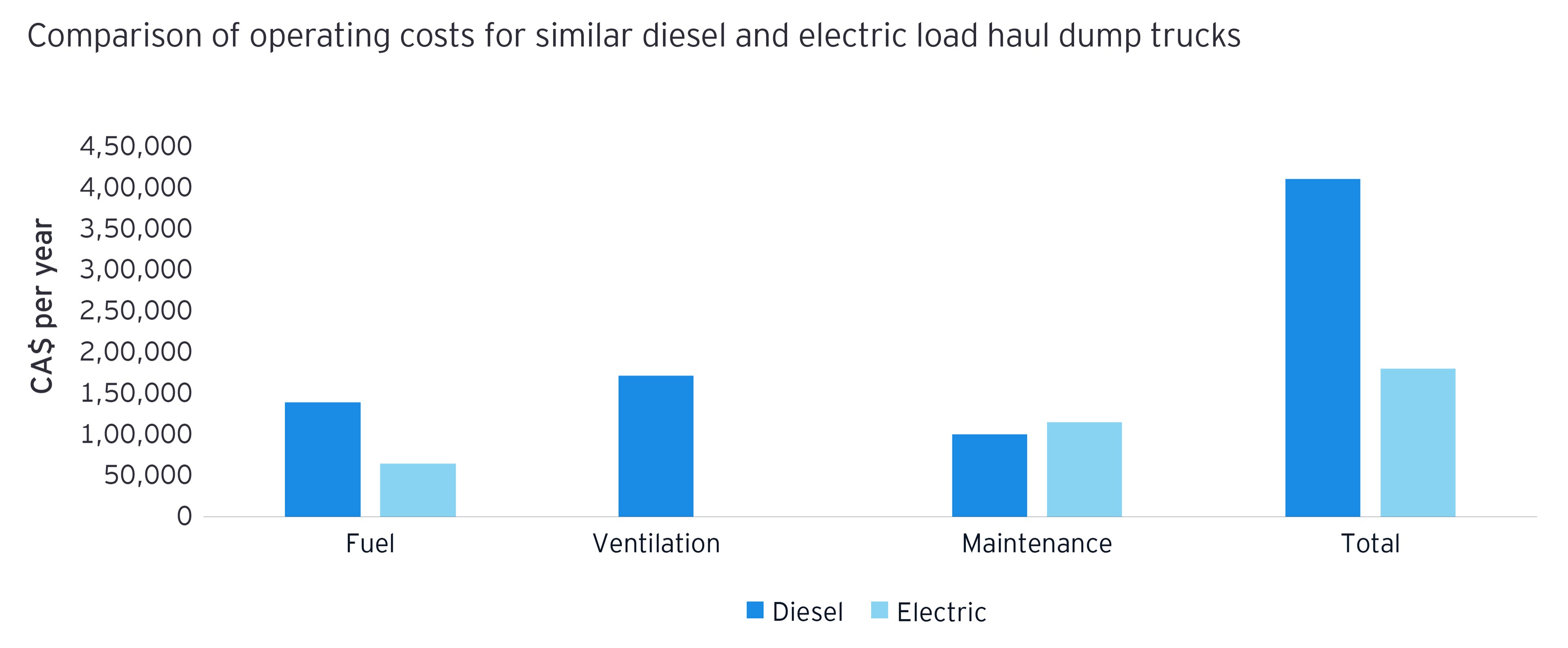

For example, electric fleets present sector-specific challenges that go beyond the relative newness of the technology. Electric haulage vehicles have a more limited range than traditional diesel equipment and the need to introduce charging facilities, and factor in time to charge vehicles, adds a layer of complexity. Miners need to follow a staggered approach to charge vehicles to manage charging time and minimize downtime.

Prepare now to mine tomorrow’s deposits

Consider a world where:

- The supply of energy to mining sites goes far further than fuel mix.

- The IoT forms part of site design, sending data on energy usage and production schedules to central or area processors.

- Artificial intelligence identifies patterns in usage, intensity, frequency, or mixture of staff or assets.

- Power supply is based on renewables and battery storage. Conventional power is directed only to the parts of the site that require it, leaving batteries to charge in other areas or excess power to be sent back to the grid.

Integrated, linked, thinking and responsive systems will bring the new technologies that are transforming the power grids of today, into the mining sites of tomorrow. Electrification represents a viable channel for the mining sector to increasingly adopt or develop new technologies, and processes to explore mineral resources, while meeting environmental and social expectations. But it will not happen overnight – safely and cost-effectively integrating conventional and renewable energy in mines may best be tackled in stages. An initial addition of renewable capacity could be balanced by including flexibility in power contracts that allow for incremental increases in clean energy during the contract term.

Above all, miners need to remain competitive in terms of productivity, reduced operational risks and improved mineral recovery rates and recover metals and minerals of higher quality. As deposits are increasingly becoming deep, remote and difficult to access, new innovative processes are required — yesterday’s expertise may not be able to mine tomorrow’s deposits.

Summary

Electrification offers huge potential to reduce the energy costs of mining, while making it safer and more sustainable. But moving from conventional to electric equipment represents a fundamental shift for the industry, and will require new workplace skills, collaborating with equipment manufacturers and other sectors, and rethinking how mines are designed.