The rise of long-term renting

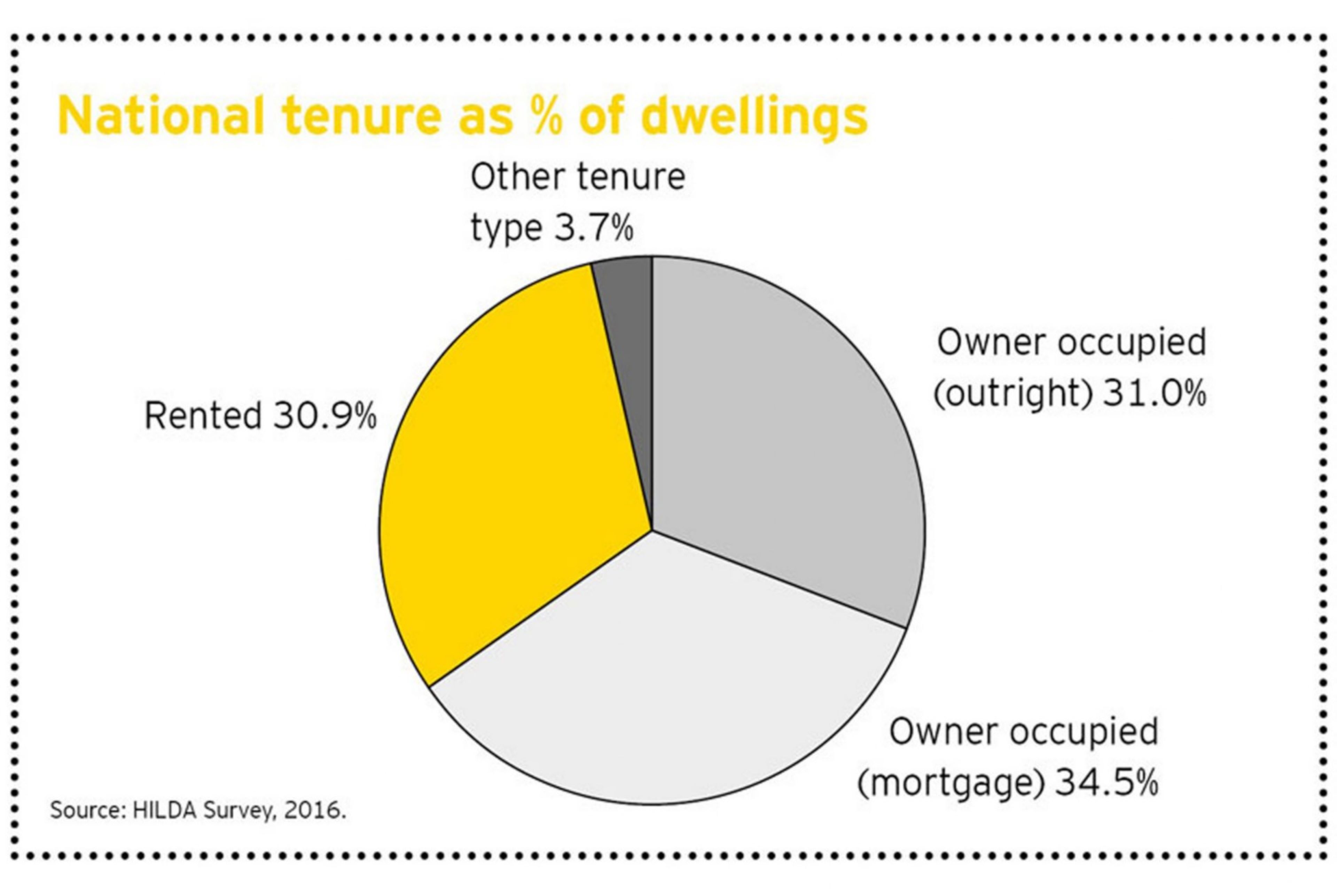

Renting is the most common form of housing tenure for Millennials, dubbed ‘Generation rent’. Only one in five of Australia’s 6.79 million Millennials owned their own home in 2014, well below the national average of 69.3%. Their decision to rent is driven by a range of factors, from affordability to convenience.

Generation Z, scarred by the global financial crisis, shy away from large debt and are more comfortable with fractional ownership and sharing. Importantly, as home ownership becomes less accessible, this generation increasingly sees housing as a service.

Traditional private rental in transition

According to the Australian Housing and Urban Research Institute, the private rental market grew by 38% between 2006 and 2016 – making it the fastest growing segment in our nation’s property market.

Since the 1980s, negative gearing provisions have enabled investors to deduct any losses from residential investment properties from their personal income. This policy has delivered broader market benefits by increasing supply, maintaining affordable rental prices while driving property price growth.

In response to sustained political, public and media pressure, unprecedented state and federal government policy and regulatory intervention has aimed take the ‘heat’ out of the residential property market.

All these interventions have disrupted investor activity and eroded the value of Australia’s housing market – equating to a combined $13 billion in value in the three months to July 2018. Investors – both foreign and local – have been discouraged from investing in residential housing, which is reflected in the declining investment approvals over the last 24 months.

Can institutional multifamily housing turn the tide?

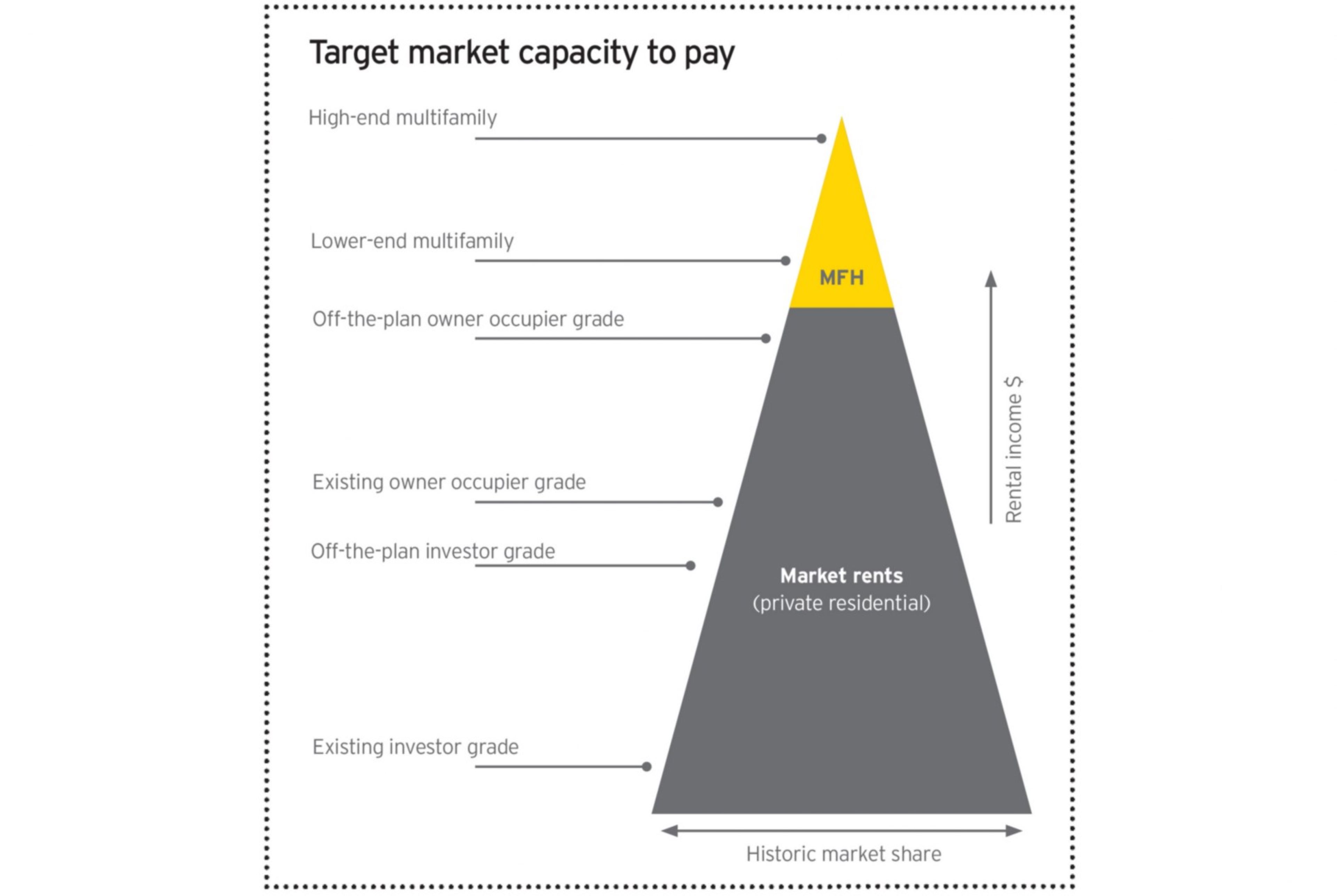

Multifamily housing is a sub-sector of the build-to-rent asset class, which includes social and affordable housing, purpose-built student accommodation, co-living and retirement villages.

Multifamily housing is designed specifically for renting rather than for sale, is owned and managed by institutional investors (such as superannuation or sovereign wealth funds) and delivers high levels of service to tenants.

Multifamily housing will not replace build-to-sell product, nor will it be the single solution to social housing shortfalls. However, as institutional investment is injected into the sector, governments may be able to circumvent the looming housing shortage to encourage large-scale housing development, including affordable housing, to be delivered in a relatively shorter period.

Make your move on multifamily

Multifamily housing appeals to institutional investors as it provides high-quality, risk-adjusted returns and adds diversity to portfolios. The following are some considerations to take into account:

- It’s not a matter of if, but when MFH takes hold here in Australia. Understand the differences and be ready for change.

- It is critical to understand the difference in Build-to-Sell (BTS) to Build-to-Rent (BTR), understand the design required to deliver successful MFH product and know your sector and be prepared for change.

- Collaboration is the key to a successful design. Establish a design standard brief clearly articulating your values, design principles etc.

- Know your product. MFH is about delivering the right product in the right location for the right price.

- Understand your development feasibility and benchmark the types and scale of fees you are able to charge to an institutional investor including Development Management, Construction & Design Management etc.

- Understand your stabilised cash flows to ensure they are both believable and achievable.

- Management is key. MFH will require a total change to the way residential property is managed in Australia.

- Affordable housing needs to form part of the product being offered in a MFH project.

- In every jurisdiction globally, MFH has only succeeded on scale where governments have provided incentives to both developers and investors, with the caveat of supplying a component of affordable housing.

- Understand your operational model which may include the developer leaving their development profit in the ownership vehicle and the establishment of both a property management and asset management operation.

The time is right for Australia to establish a multifamily asset class. While the sector will require billions of dollars in capital and supportive government policy, we are already seeing evidence that experienced global institutions are committing hundreds of millions of dollars to Australia to capture the first mover advantage. Will your company be one of them?

Summary

Multifamily housing has the potential to stimulate large-scale new residential property supply and moderate Australia’s housing affordability crisis. At the same time, it can provide alternate opportunities for residential developers and a stable long-term income for institutional investors.