Multiple factors are impacting CM’s advancement:

- Evolving technology requirements, alongside maturing aspirations of corporate treasurers who are becoming more involved with their corporate strategies (pdf). These raise expectations for more sophisticated offerings, enterprise-wide solutions, and digital connectivity to deliver on superior corporate banking experiences.

- Faster global payments and SWIFT’s mandatory global payments innovation system that are considerably reducing turnaround time between invoicing and payments. Corporates must ensure enough liquidity to fulfill payments in almost real-time.

- New, stricter regulations [e.g., around FinCrime, anti-money laundering (AML), and know-your-customer (KYC) sanction screening] and increased scrutiny that make it more cumbersome for corporates to manage multiple accounts or entities and nudge them to simplify banking relationships. To retain relevance, banks need to respond with alternative solutions to help manage regulatory changes.

- More open legislations that permit the sharing of authorized customer data, enabling non-banks to enter and compete with new, attractive payments and liquidity management solutions.

Evolving market dynamics, expanding corporate aspirations, a leap-frog in technology usage and regulatory changes mean that the previously staid CM business is about to get more exciting.

Revamping cash management strategies

A maturing CM landscape implies that mandates for treasurers are rising alongside their expanded job scopes and complexities. As corporates look to incumbent institutions to provide innovative support and solutions, their banks must invest to build out more sophisticated offerings.

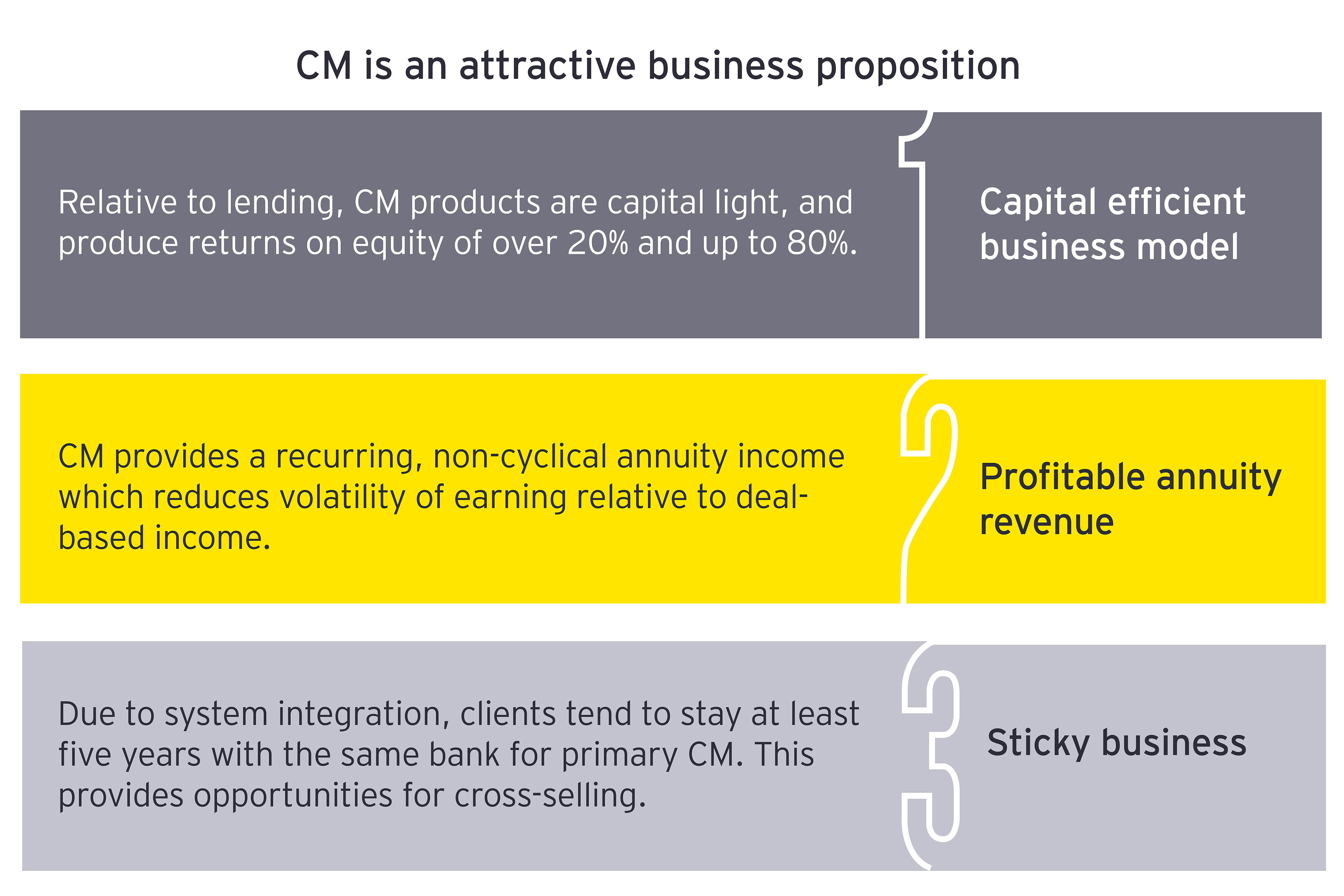

Most banks have defined and identified their CM value proposition (e.g., around channels, sales force, product management, client service or operations) and have constructed a clear business model for growth. They should have also identified major lending clients that would be most receptive for cross-selling CM businesses.

Next steps for corporate banks

1. Embed CM via “as-a-Services” tools: Corporates want to incorporate multiple bank-provided products into their enterprise resource planning (ERP) systems to enhance risk management and efficiencies. Banks and software vendors should deliver “as-a-Service” solutions that replace monolithic models with bite-size banking functionalities connected via open application programming interfaces (APIs) into corporates’ core tools.

As corporates increasingly (and ideally) outsource their working capital management to their banks, migrating to an ecosystem of web-based CM solutions would ease connection of these services to the clients and enhance agility, flexibility and overall effectiveness of enterprise innovation. This requires reengineering existing bank systems investments and reviewing issues such as user entitlements and IT security.

2. Deliver on enhanced connectivity: As corporates extend their international trading network, their connectivity challenges increase. Integration could involve not just linking up to their banks’ proprietary systems, but external enterprise financial tools offering CM functionalities like payment initiation. This is a complex undertaking given the lack of standardization, multiple channels for data transmission, and perhaps even uncertainty around security and authenticity of files being transmitted.

Banks, therefore, need to lay the foundation for industrial-strength connectivity and consider open source technology to enable easier linkage between their information systems and other ERP systems regardless of format and transmission protocol.

3. Leverage real-time analytics to proactively offer insights: Treasurers desire real-time visibility on their financial exposures to enhance liquidity, cash forecasting and manage funds across multiple geographies and legal entities.

Their bankers must progress beyond end-of-day balance and reactive transaction reporting to provide accurate real-time analytics, generate deeper strategic insights and offer proactive CM ideas. It is only when banks can fully integrate into the corporates’ CM businesses (such that the process of cash collection, payment of suppliers, management of working capital and the entire capital stack becomes seamless) that they are able to progress up the value chain from facilitating transactions to becoming trusted corporate treasury advisors.

4. Expand networks through partnering: Corporate banks should source a broader range of value-added services for clients through collaborations (such as via correspondent banking and white-labelling) and continued co-innovation with fellow peers.

But the CM arena is no longer just the domain of traditional banks. As clients seek more sophisticated treasury capabilities, they would increasingly consider supplementary, specialist solutions to sit on top of their current platforms. They might not hesitate to engage newer payment providers and technology platforms that offer competitive solutions (such as foreign exchange payments to smaller business clients with lower fees).

Corporate banks therefore should seek collaborations with non-banks to enhance their client-serving capabilities.