Chapter 1

Pressing need for better environmental data

Better data and consistent methodologies will enable financial institutions to take stronger actions and bolder steps toward improvement.

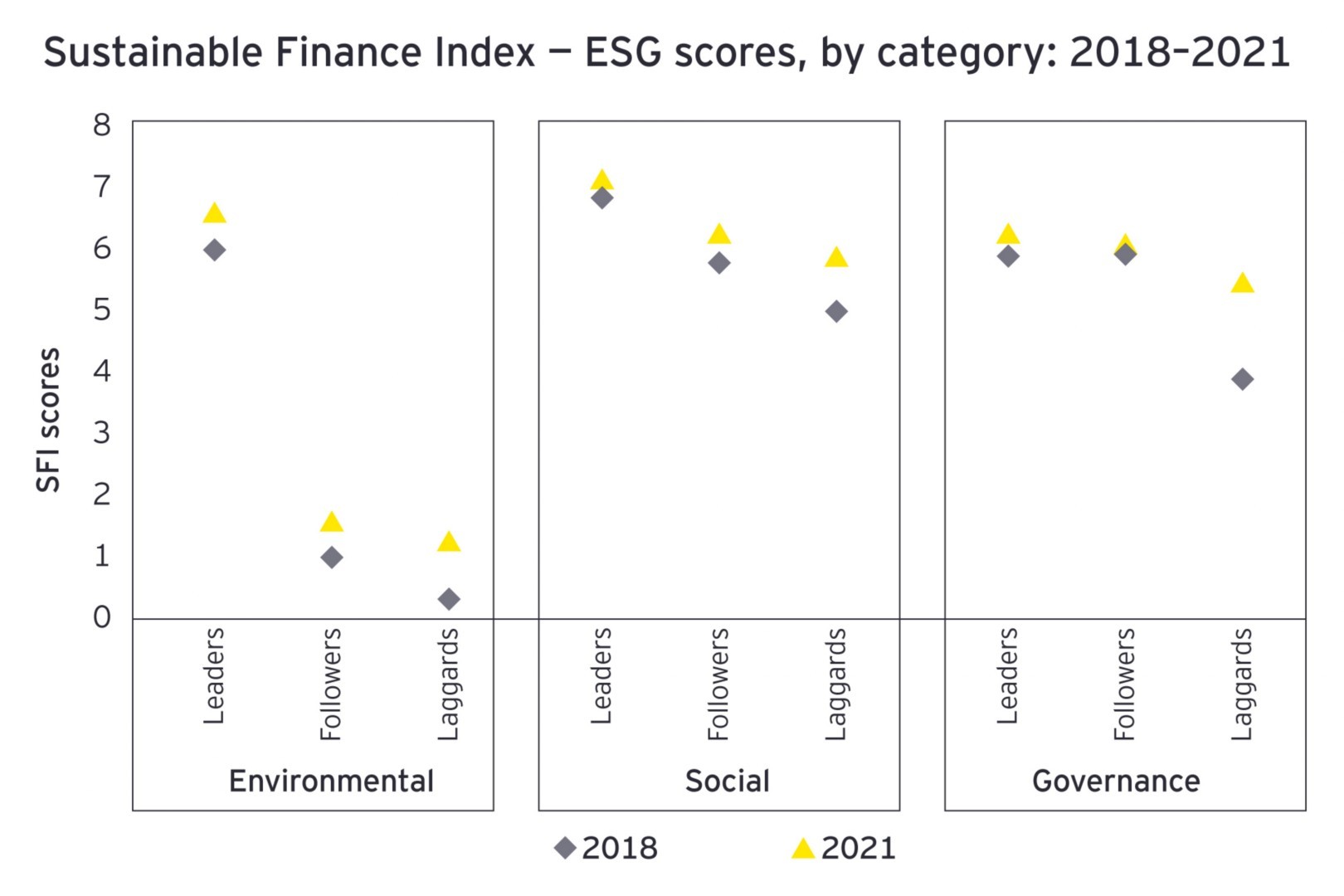

The greatest gap between leaders and other firms is on the environmental parameters. Many institutions are still trying to come to grips with new reporting requirements. The SFI found there is a real lack of accurate, quality data on environmental parameters, as it is not consistently reported and methodologies are still evolving.

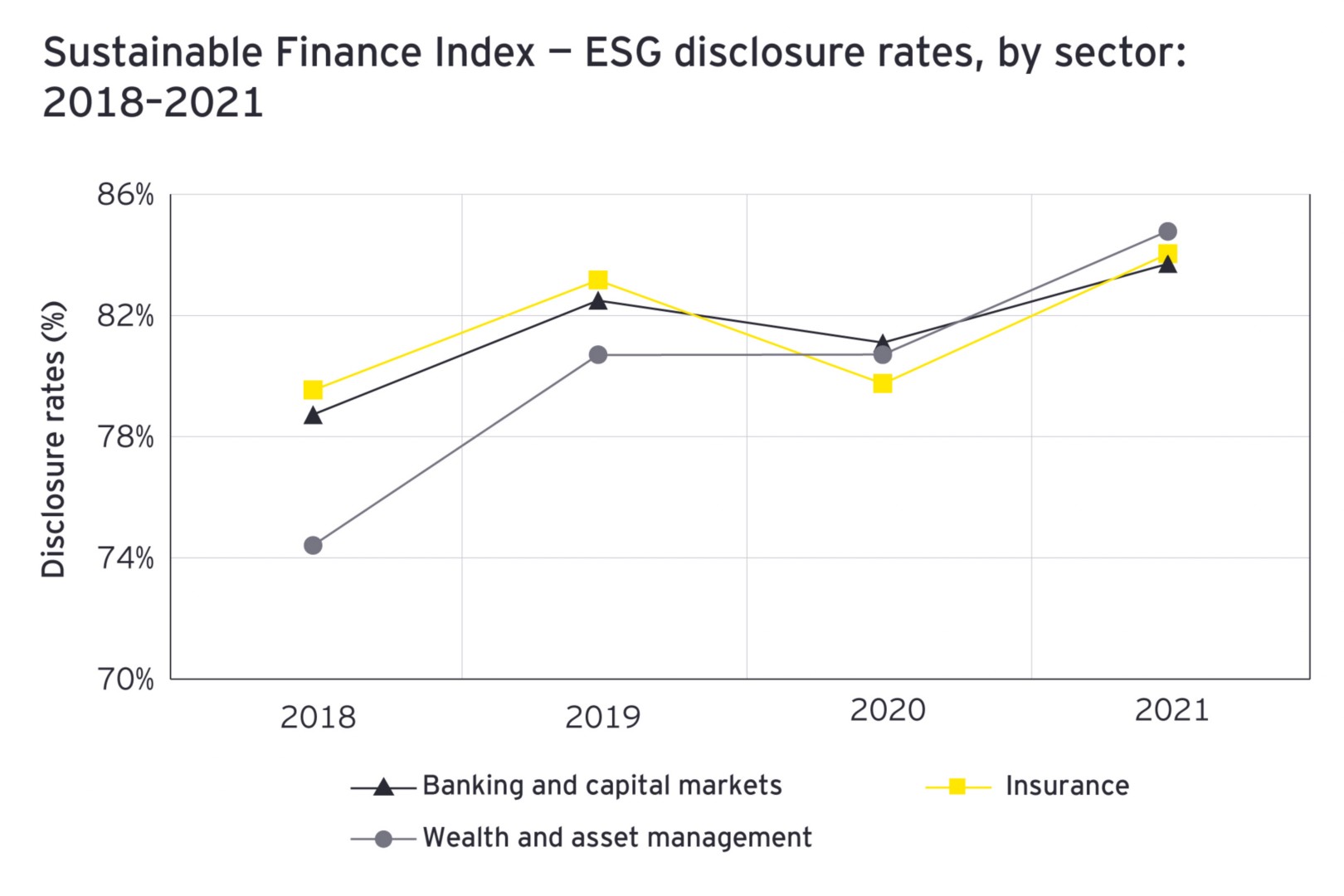

Despite these challenges, some institutions are trying to be more transparent. Wealth and asset managers significantly improved disclosure rates on environmental parameters, rising from 59% in 2018 to 69% in 2021. Disclosure rates for both banks and insurers were 66% in 2018, which increased to 68% and 70%, respectively, in 2021.

European institutions have the highest ESG scores and highest environmental disclosure rates. The average disclosure rate for European institutions on environmental parameters was 84% compared to just 58% for their North American peers. This is largely attributable to the focus of European regulators who have introduced more regulations to promote transparency (e.g., Corporate Sustainability Reporting Directive or CSRD) than their counterparts in other regions.

Slow progress on emissions

Financial institutions have struggled to progress on emissions. In disclosing the data on financed emissions (i.e., emissions attributable to companies that are financed by financial services firms), of the 226 banks that have signed up for the Partnership for Carbon Accounting Financials (PCAF), only one-third report their numbers on the PCAF site.

More broadly, only one-third of firms disclose their scope 1-3 emissions data. Approximately 40% of those that consistently report emission data failed to reduce emissions from 2018 to 2021. Consider how firms are performing on emissions intensity (the average emission per US$1m in assets, assets under management (AUM) or gross written premiums):

- The banks in the index reported an average emission of 1.18 tonnes per US$1m assets in 2021, up from 0.85 tonnes in 2018.

- Insurers reported an average emission of 6.49 tonnes per US$1m gross written premiums in 2021, nearly doubling the 3.32 tonnes reported in 2018.

- Wealth and asset managers' emissions were stable at 0.09 tonnes per US$1m AUM throughout 2018 to 2021.

Reduced emissions can only be achieved by increasing climate-aligned investments and financial inflows, with a simultaneous shift away from investing in emissions-intensive projects over the next few years. As more financial services institutions disclose the greenhouse gas (GHG) emissions associated with their loans and investments, financed emissions intensity is likely to increase. This position may worsen in the short-term — as the current energy crisis may require greater investment in high-emitting energy producers, such as coal as well as over the medium-term — as greater financing is required by brown sectors to transition. This points to a particular challenge: it will be difficult to understand how emissions are really evolving until a baseline, anchored by a consistent understanding and methodologies for calculations, is established. However, greater transparency will help financial institutions undertake informed actions as they decarbonize their portfolios.

Top priorities in the sustainability agenda

Another area of opportunity highlighted by the SFI is the alignment of product offerings to green strategies. Currently, fewer than half of all financial institutions report offering green products or solutions. Banks are the laggards here, while insurers and wealth and asset managers have made significant progress.

| Institutions offering green products |

2018 | 2021 |

| Insurers | 35% | 57% |

| Wealth and asset managers | 22% | 44% |

| Banks | 34% |

42% |

About 70% of institutions in Europe and the Asia-Pacific region offer green products, compared to only 20% in North America. However, firms and regulators need to factor in greenwashing as one of the threats that could undermine the effort to protect the environment and achieve sustainability.

Improving disclosures of environmental risk that are embedded in value chains, business models and operations should be a priority. The average disclosure rate of these risks has increased from 20% in 2018 to 31% in 2021. Despite these gains, today only 36% of banks, 35% of insurers and 34% of wealth and asset managers provide these disclosures.

Disclosures on the use of renewable energy sources follow the same pattern: An increase from just 19% in 2018 to 30% today is encouraging, but the majority of institutions still fail to disclose this information.

Chapter 2

Skills, talent and accountability dominate the ESG market

Regulatory oversight is providing the impetus for investment in data protection, privacy and up-skilling the workforce.

The disclosure rates of social parameters – including data protection, workplace safety, equality policies, and whistle-blower protection – has increased from 83% in 2018 to 87% in 2021. However, there are notable regional and sectoral variations within that strong overall performance. For example, the average disclosure rates of social parameters for wealth and asset managers improved the most. At a regional level, the rise in the disclosure rates of the Asian-Pacific financial institutions was higher than their peers in Europe and North America (See table below).

| Average Disclosure Rate (Social Parameters) | ||

| Sector | 2018 | 2021 |

| Banking and capital markets | 84% | 88% |

| Insurance | 82% | 86% |

| Wealth and asset management | 81% | 87% |

| Region | ||

| Asia-Pacific | 83% | 89% |

| Europe | 87% | 91% |

| North America | 81% | 85% |

Whistle-blower protections: Globally, insurers take a lead

More companies understand the importance of enabling their employees to feel safe in reporting concerns in the workplace. The SFI reveals that 77% of institutions had whistle- blower protections in place in 2021, up from 63% in 2018.

Insurers are setting the standard: 81% have established policies, compared to 76% of banks and 72% of wealth and asset managers. Only 60% of European institutions disclosed that they have such protections in place, compared to 70% of firms in the Asia-Pacific region and 90% of North American firms.

As of Q1 2022, only 10 out of 27 EU countries had adopted the 2019 EU Directive on Whistleblowing; 16 nations had delayed the adoption and one had not started. As more EU nations adopt the Directive, the level of disclosure by European institutions will likely rise.

Customer data protection and privacy: Asian institutions make significant gains

Longstanding regulations in Europe and North America mean almost 100% of institutions in those regions have had customer data and privacy protection policies in place for many years. But far fewer Asia-Pacific institutions reported having a customer data protection policy in 2018. Today, the gap has closed as Japan, China, Australia, India and other nations have strengthened their regulatory oversight and reporting requirements.

| Asia-Pacific institutions with data protection policies in place | 2018 | 2021 |

| Insurers | 82% | 94% |

| Wealth and asset managers | 57% | 86% |

| Banks | 68% | 86% |

Talent retention and diversity: fierce competition puts a premium on training

Financial services firms around the world have made significant strides in disclosing their diversity and equal opportunity initiatives. In 2021, 90% of the institutions publicly reported their targets, initiatives and policies, compared to just 70% in 2018. This improvement should enable financial services companies to strengthen their reputation and attract talent.

Still, there are opportunities to improve. Only six out of 10 institutions report on gender balance across the workforce. Women represent 49% of total employees across the industry, but there continues to be much lower representation at the top levels of the organization; just 38% of managerial positions across all subsectors are held by women.

| Women in management 2021 | |

| By sub-sector | |

| Banks | 38% |

| Insurers | 37% |

| Wealth and asset managers | 35% |

| By region | |

| North America | 45% |

| Europe | 37% |

| Asia-Pacific | 35% |

Given that financial services compete with the tech industry for top talent, it’s no surprise that more firms have made training their workforce a top priority. This year’s SFI found that 80% of institutions have a policy on up-skilling and re-skilling employees, up from 62% in 2018. Nine in 10 banks reported having such a policy versus 70% of wealth and asset managers. In Europe and the Asia-Pacific region, 85% of financial services firms report having such a policy, versus only 67% in North America.

Chapter 3

Striving for better governance

Building confidence, ensuring accountability and linking remuneration and compensation to sustainability targets

Financial services firms have improved their disclosures related to governance parameters during the last three years. The greatest improvement in governance scores was by firms in the Asia-Pacific region; the average governance score rose from 5.2 in 2018 to 5.8 in 2021 and disclosure rates jumped from 75% to 87%.

Gender diversity on the board

Across all regions, female board member representation has improved from 18% in 2018 to 26% in 2021, which is still below the minimum target called for by campaigns such as the 30percentclub. Wealth and asset managers report the highest average proportion of women on their boards (29%), followed by insurers (28%) and banks (24%). There is also significant regional disparity:

- Europe: 32%

- North America: 24%

- Asia-Pacific: 22%

The largest institutions typically have more women on their boards, 30% on average, compared to 25% for smaller institutions.

Dedicated ESG sustainability committees

Compared to five years ago, twice as many institutions now have board committees dedicated to ESG and sustainability. In 2018, just 30% of institutions had such committees; that number rose to 60% in 2021. Moreover, larger institutions are far more likely to have dedicated ESG or sustainability committees (76% reported having a dedicated ESG committee) than their smaller counterparts (50%). Still, there are significant variations based on sub-sector and region, as detailed below.

| ESG and/or sustainability committees on the board | |

| By sub-sector | |

| Insurers | 70% |

| Banks | 58% |

| Wealth and asset managers | 47% |

| By region | |

| Europe | 73% |

| Asia-Pacific | 66% |

| North America | 43% |

Focusing on compensation, remuneration and auditing practices

A significant proportion of financial services firms remain reluctant to link board and executive compensation with the achievement of ESG targets. Almost 65% of institutions did not report linking executive members' compensation to sustainability targets. In 2021, 40% of wealth and asset managers had connected renumeration to sustainability outcomes, compared to 30% of banks and insurers.

Among European institutions, nearly 60% of institutions have linked executive members' compensation to sustainability targets, compared to only three in 10 in North America and the Asia-Pacific region.

More financial services institutions now publish a separate ESG report or a dedicated section for ESG in their annual report. The proportion increased from 43% in 2018 to 55% in 2021. However, only 20% of firms say their ESG reports are reviewed by external auditors, which could enhance their credibility. There are huge variations across regions and significant differences among sub-sectors.

| External auditing of ESG reports | |

| By sub-sector | |

| Insurers | 35% |

| Banks | 20% |

| Wealth and asset managers | 19% |

| By region | |

| Europe | 50% |

| Asia-Pacific | 32% |

| North America | 4% |

During the last four years, banks, insurers and asset managers have made strong progress in several areas across their sustainability agendas. But most firms are still in the early phases of a long-term journey, with lots of opportunity to expand and accelerate their efforts. Actions that firms should take include:

- Progressing in terms of agreement on ESG methodologies

- Strengthening links between ESG targets and remuneration for leaders across the organization

- Building confidence in ESG disclosures, especially through independent validation

While the speed of change has not been fast, it has been steady. Sustainability is now firmly back at the top of board agendas globally and the data shows that small changes can result in large-scale progress. The next version of the EY Sustainable Finance Index will tell us just how far the industry has advanced.

Related articles

Summary

The EY Sustainable Finance Index 2022 shows that the financial services industry is reaffirming its commitment to sustainability. Firms are moving in the right direction and demonstrating the power of governance and other social parameters. Yet, findings reveal that much greater progress is needed, particularly in the areas of disclosure, data protection, privacy, gender diversity and up-skilling talent.