It is to be noted that similarly to CHF LIBOR, SARON linked derivatives into which the market has transitioned from end-2021 are still not proposed to become subject to the clearing obligation under FMIA given the relatively low trading volumes.

Reason for amendment and global markets context

Some of the interest rate derivatives previously declared subject to the clearing obligation by FINMA refer to benchmarks which have not been published or available for new use since December 31, 2021 (e.g. GBP LIBOR, JPY LIBOR, USD LIBOR, EONIA) due to their transition to more robust alternative reference rates (ARR) (e.g. SONIA, TONAR, SOFR, €STR). While the most popular USD LIBOR tenors are still published until end-June 2023 for use in legacy (pre-2022) trades, the reduction in trading activity in USD LIBOR swaps as a result of “SOFR First “and “No new LIBOR” market events could reduce liquidity in those swaps ahead of the USD LIBOR permanent cessation. When it comes to other IBORs for which the clearing mandate was declared previously, such as NIBOR (Norwegian Crown), STIBOR (Swedish Crown) and WIBOR (Polish Zloty), they are also proposed to be removed from the clearing mandate. While there is currently not cessation date for latter, by removing a wider array of IBORs from the clearing obligation, FINMA is taking a forward-looking view and reduce the potential for market disruption should one of those IBORs permanently cease to exist in the future.

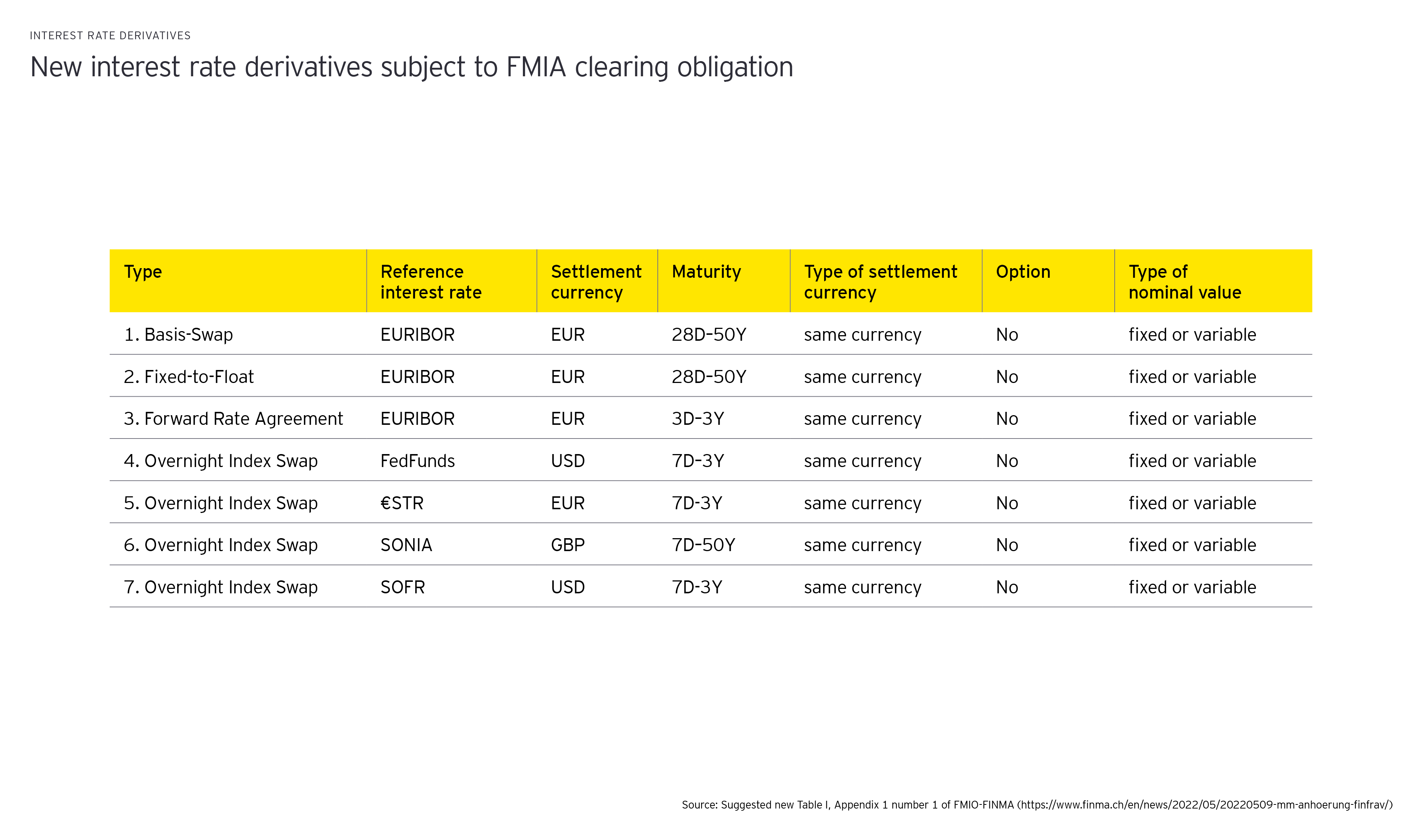

Therefore, on the one hand, the clearing obligation for affected transaction types is not anymore supported by the market volumes. On the other hand, there is currently no clearing obligation for the interest rate derivatives linked to the new ARRs into which the liquidity has moved since early 2022, resulting in a regulatory gap that could lead to lower clearing volumes and thus potentially to higher systemic risks.

The market needs global conformity with respect to mandated clearing. Similar amendments are taking place in the financial centers that are important for Switzerland (EU, UK, USA).

There have been two approaches to the clearing mandate for swaps referencing ARR by global regulators: (i) a clearing mandate at the time of conversion from LIBOR to an ARR; or (ii) a clearing mandate at a later effective date. In Europe, ESMA had removed the LIBOR2 from the clearing obligation before recently adding ARR swaps3.

FINMA has opted for the simultaneous removal of LIBOR clearing and implementation of the ARR clearing, while giving sufficient notice period for the market participants to adapt.

Substantially, the amendments proposed by FINMA will be in line with foreign legal developments and restore the original synchronization with the corresponding EU regulation (i.e. European Market Infrastructure Regulation).

Market feedback

Clearing is one of the key pillars of derivatives regulatory reform given its benefits for derivatives business such as the risk reduction through multilateral netting, tight operational processes and ultimately reduction of counterparty risk. Moreover, other onerous regulations provide incentives to clear centrally, such as uncleared margin requirements . This is evidenced by clearing rates for new ARR products while they were outside the scope of clearing obligation and already voluntarily cleared by market participants in very large proportions. According to the Commodity Futures Trading Commission’s (CFTC) consultation on the same topic: “Reviewing swap transaction data from January 2021 to October 2021, the Commission staff has estimated that over 90% of the volume of fixed-to-floating swaps referencing USD SOFR, GBP SONIA, CHF SARON, JPY TONA, and EUR €STR has been cleared on a voluntary basis.”4

When it comes to USD interest rates swaps which have not yet fully transitioned from USD LIBOR to SOFR (the transition deadline is end June 2023), it is critical that there is sufficient liquidity in SOFR before supporting a clearing obligation to avoid detrimental market impacts. The conversion of LIBOR swaps by CCPs should provide the required liquidity in ARR swaps. The conversion date for JPY LIBOR was on 6 December 2021 and GBP LIBOR on 20 December 2021, while the USD LIBOR conversation is currently being planned.

While the consultation is open until 5 July 2022, the proposed amendment was unanimously welcomed in a pre-consultation with industry representatives. In particular, industry representatives supported the decision not to extend the clearing obligation to include CHF interest rate derivatives related to SARON. Due to the relatively small size of the market, there is currently no need for such an extension, especially since a large proportion of SARON contracts are already voluntarily cleared centrally, which reduces the systemic risk accordingly.

In its response to the similar consultation from the CFTC, the International Swaps and Derivatives Association (ISDA) asked to contemplate an exemption from the clearing mandate applying to ARR swaps in the case of trades resulting from exercises such as multilateral risk rebalancing cycles, which reduce uncleared counterparty credit risk and/or shift existing risk from the uncleared space to CCPs. With the extension of the clearing obligation to ARR swaps, such risk management practices, currently undertaken by many large dealer banks, could be impaired, as OIS as a tradeable instrument for both cleared and uncleared interest rate risk would no longer be available.

Next steps

The changes in clearing obligation will come with a cost for e.g. system changes, control framework changes, documentation and training. To reduce these costs, it is important to start adapting early in order not to be forced to adopt tactical solutions to meet short deadlines. From previous experience, market participants need a minimum of 6 months to implement new clearing obligations.

For market participants who have already established clearing processes, they can already consider how to adapt such processes to incorporate the new interest rate derivatives into the clearing eligibility criteria.

For those market participants that have not yet established clearing processes but (plan to) trade in the new interest rate derivatives subject to the clearing obligation, they will need to consider whether the respective clearing processes need to be established or whether the types of derivatives traded need to be revisited. For these smaller, less sophisticated counterparties who do not currently have to clear, the clearing obligation could be a significant cost that could deter them from hedging using swaps if not addressed in an appropriate manner early in advance.