The data from smart sensors raises many new questions. Employees who analyze it and communicate the results can become bridge builders with in company.

In doing so, they act as company interpreters, making sense of the collected data, interpreting it, and communicating it effectively.

Silo thinking needs to decrease further in the operations organization to enable new networks to be established. Furthermore, broad knowledge in computer and data management will become even more important for many production tasks than it is already.

Smart sensors offer special opportunities for some industries

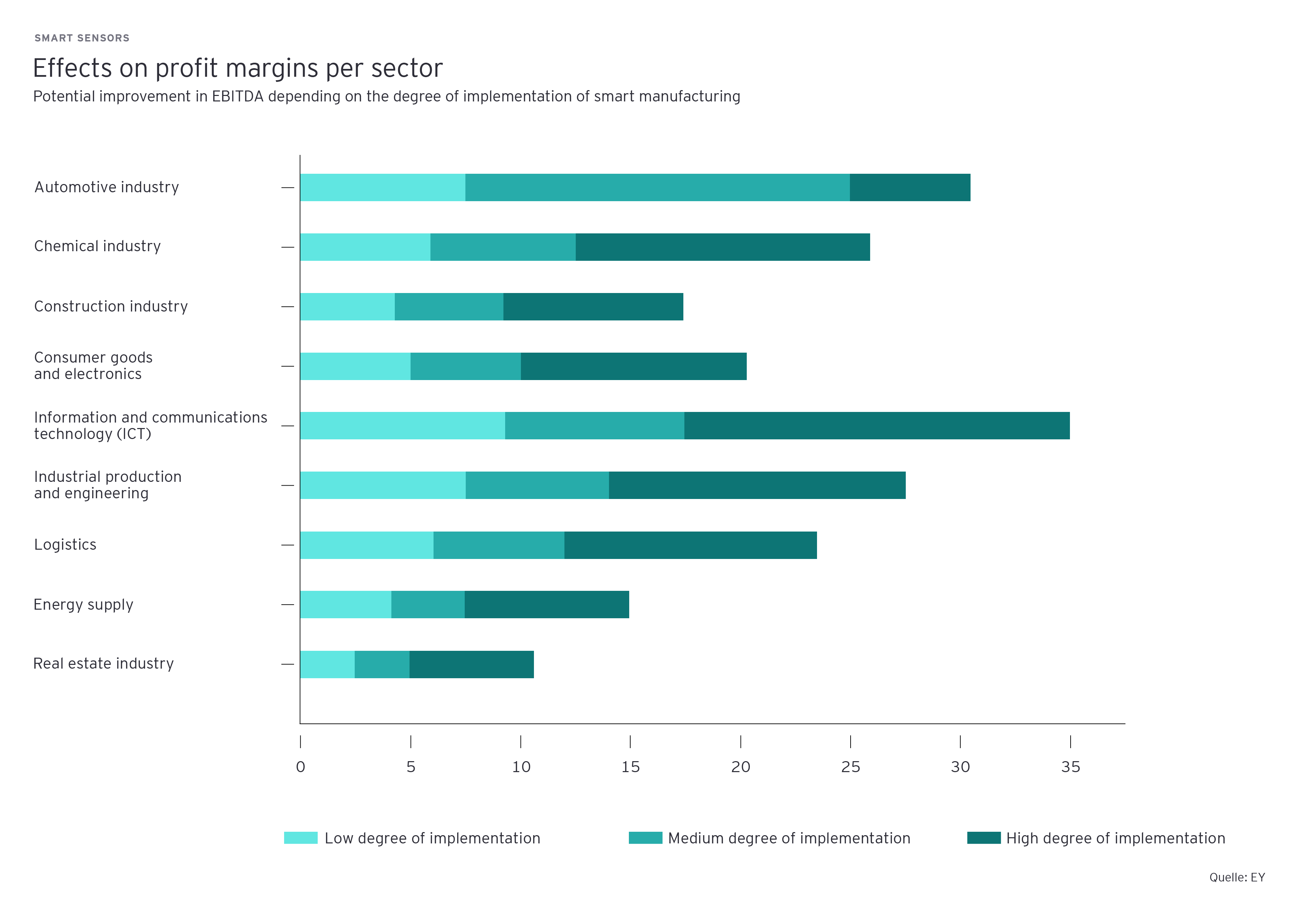

In a detailed analysis, EY examined how smart sensors affect profits in nine industries. The analysis revealed that even with a low degree of implementation, companies in all branches of industry benefited from the introduction of sensors. In the most sophisticated scenario with the highest sensor saturation, profit margins (EBITDA) are set to increase between 11 and 34 percent by 2030.

Some companies, however, will benefit more than others. For the automotive industry and information and communications technologies (ICT), experts see special potential for long-term increase in profit margins.

Challenge: who owns the data?

All of these opportunities also raise some complex questions that will need to be worked out in detail. Above all is the question of who owns the data that is collected. Sensor manufacturers and analysis providers could generate valuable industry knowledge, but companies are reluctant to publish internal data. On the other hand, private users are often more generous, for example when they allow their smartphone sensors to be used to estimate traffic times. It seems doubtful that companies would agree to public use of their data.

What is clearer is which business areas will be most influenced by the use of smart sensors. Along with production, the after-sales sector will see the biggest shifts. In the future, tasks like maintenance will no longer be scheduled at certain time intervals but instead determined by sensors based on current conditions.

It is also clear that innovation in this area needs to be a collaborative effort. An example of this is the 5G mobile telephone standard that is able to transmit larger quantities of data more quickly and more reliably than ever before. It is the basis for the secure use of mobile sensors and also for internal company wireless networks. To promote the introduction of 5G, both business and government need to work together. Not only is a coherent legal framework needed, but new structures and ways of thinking at companies are needed, as well as cooperation between the two spheres. The revolution of Industry 4.0 is a joint effort.

Summary

Smart sensors are a significant force driving the transformation to Industry 4.0. They influence not only production, but also maintenance with modified service intervals; human resources with new job requirements; and marketing with new and detailed knowledge of customers’ individual use cases. The central challenge, however, is to clarify who actually owns the data collected by the sensors.