- Issue volume rose by 89 percent in the first quarter, number of IPOs increased by 11 percent worldwide

- The Asian market in particular developed strongly in the first quarter despite the corona crisis

- Alternative routes to the stock exchange come into focus

- Increase in IPO activity expected for the second half of the year

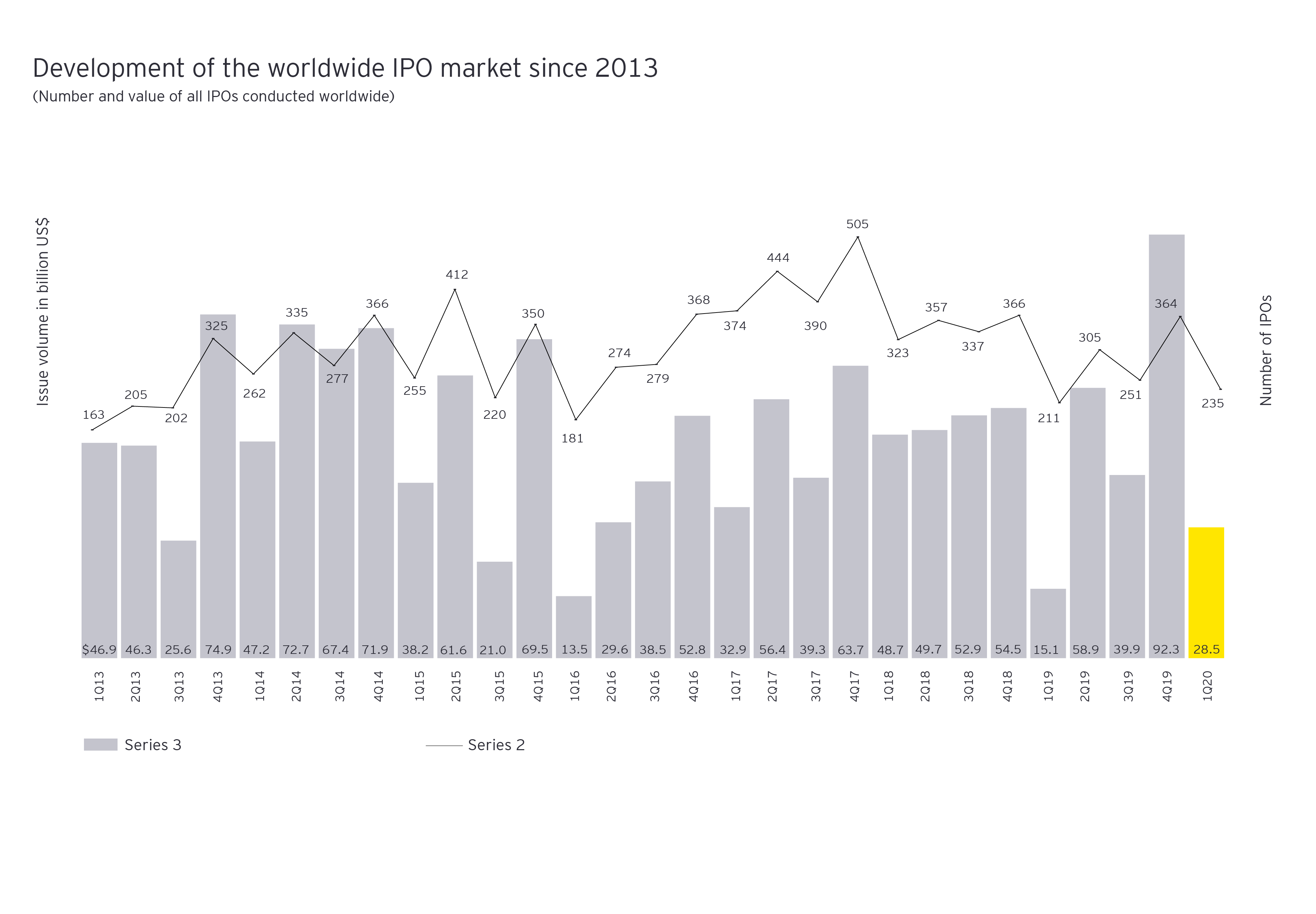

Despite the global spread of the novel coronavirus, the global IPO market was strong in the first quarter. A total of 235 companies worldwide dared to take the plunge in the traditionally slow first quarter ‑ 11 percent more than the same period last year. The issue volume even increased by 89 percent to 28.5 billion US dollars. Despite the corona crisis, the number of IPOs registered worldwide rose continuously during the first quarter, from 75 in January to 77 in February and 83 in March.

The reason for the strong increase is a continuing upturn in the IPO market in Asia. 68 percent of all global IPOs in the first quarter took place in Asia, especially in Shanghai and the young technology exchange STAR. Compared to the same quarter of the previous year, the number of IPOs on Asian stock exchanges rose by 13 percent to 159, and the issue volume even doubled to 18.1 billion US dollars. These are the results of the current IPO barometer of the auditing and consulting company EY (Ernst & Young).

While the Asian IPO markets remain remarkably unimpressed by the COVID-19 outbreak, activity in Western countries has largely come to a standstill during March. There was only one IPO in Europe and the USA in the second half of March ‑ the IPO of the Swedish medical technology company Monivent. "In the western markets, the IPO market stalled towards the end of the first quarter. The global outbreak of the pandemic came as a complete surprise to most market participants," notes Jolanda Dolente, Head of Financial Accounting Advisory Services at EY in Switzerland. Tobias Meyer, EY Head of Transaction Accounting & IPO adds, "It was long expected that the impact would be limited to Asia. In addition, not least due to the easing of the US-Chinese trade dispute leading to record levels on the international stock exchanges, the IPO markets developed in a correspondingly positive way at the beginning of the year.”

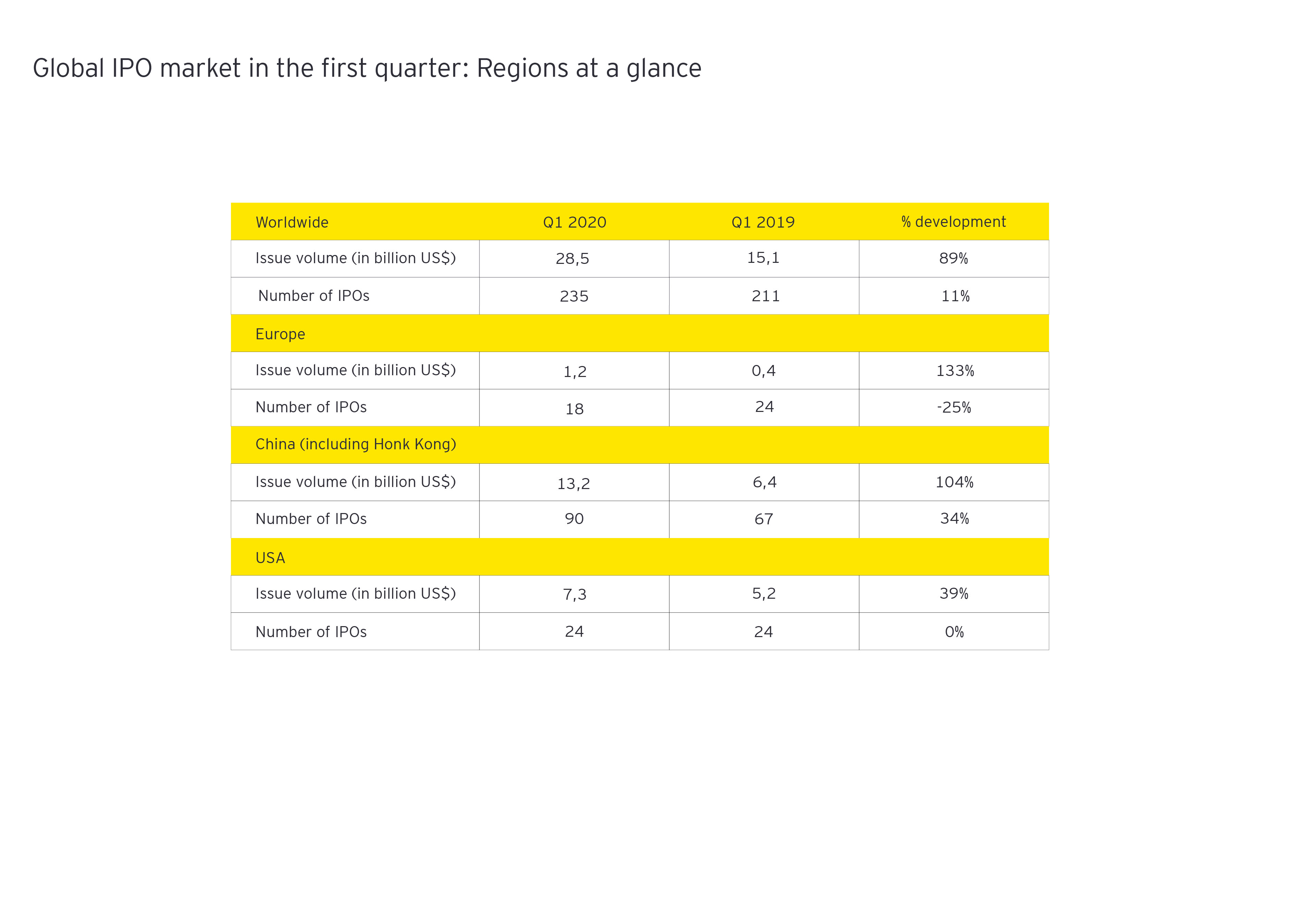

Increase in issue volumes in all regions

It is noteworthy that China remained the most active IPO market worldwide in the first quarter, despite the strong spread of the virus and in part massive restrictions on public life. A total of 90 IPOs were registered in China (including Hong Kong), 23 more than in the same period last year. In the USA, activities remained at the previous year's level with 24 transactions. In Europe, the number of IPOs fell from 24 to 18.

China was also ahead in terms of issuance volume in the first quarter. In total, the newcomers collected 13.2 billion US dollars on the Chinese stock exchanges, more than twice as much as in the same period last year. In the USA, the issue volume climbed by 39 percent to 7.3 billion US dollars. In Europe, it was 1.2 billion US dollars – a good tripling compared to the very weak first quarter of the previous year.

Alternative paths to the stock exchange

"The global IPO market had a good start to the year initially," says Dolente. "However, the increasing worsening of the corona crisis and the enormous volatility on stock markets slowed down IPO activity, especially in Europe, which is strongly export-oriented." According to Dolene's observation, some companies in Switzerland were also on the verge of making their stock exchange plans public. "Stock market candidates and investors were caught by surprise by the escalation of the corona crisis. In the coming months, however, companies with very resilient business models in selected sectors, such as healthcare and technology, in Europe and the USA will also continue to take the plunge," Dolente expects.

It is also possible that the IPO window will open again in the second half of the year, says Dolente. "If the recent positive developments in China continue and the concerted measures of the governments and central banks take effect, we expect increasing IPO activities from the currently backed-up IPO pipeline." And in other regions, too, there will always be stock market candidates who can be considered attractive even in these times of crisis, especially since not all sectors are affected equally. "Some sectors, such as the healthcare sector, are attracting more investor attention again, especially now."

Largest IPO in China

After not a single deal above the one billion mark had been counted worldwide in the same period last year, there were at least six equally large transactions in the first quarter of this year. The world's largest IPO in the first quarter was the IPO of the Chinese high-speed rail operator Beijing-Shanghai High Speed Railway, which raised 4.4 billion US dollars in January. The second largest transaction also took place in January, in Thailand. The retailer and shopping mall operator CRC earned 2.3 billion US dollars at its stock exchange debut. The US drug developer PPD achieved an issue volume of 1.9 billion US dollars in February. The largest transaction in Europe was the IPO of Calisen plc, a British manufacturer of smart electricity meters, with a volume of 436 million US dollars. In Switzerland, there was no IPO in the first quarter.