EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Limited, each of which is a separate legal entity. Ernst & Young Limited is a Swiss company with registered seats in Switzerland providing services to clients in Switzerland.

Customer Tax Operations and Reporting Services (CTORS)

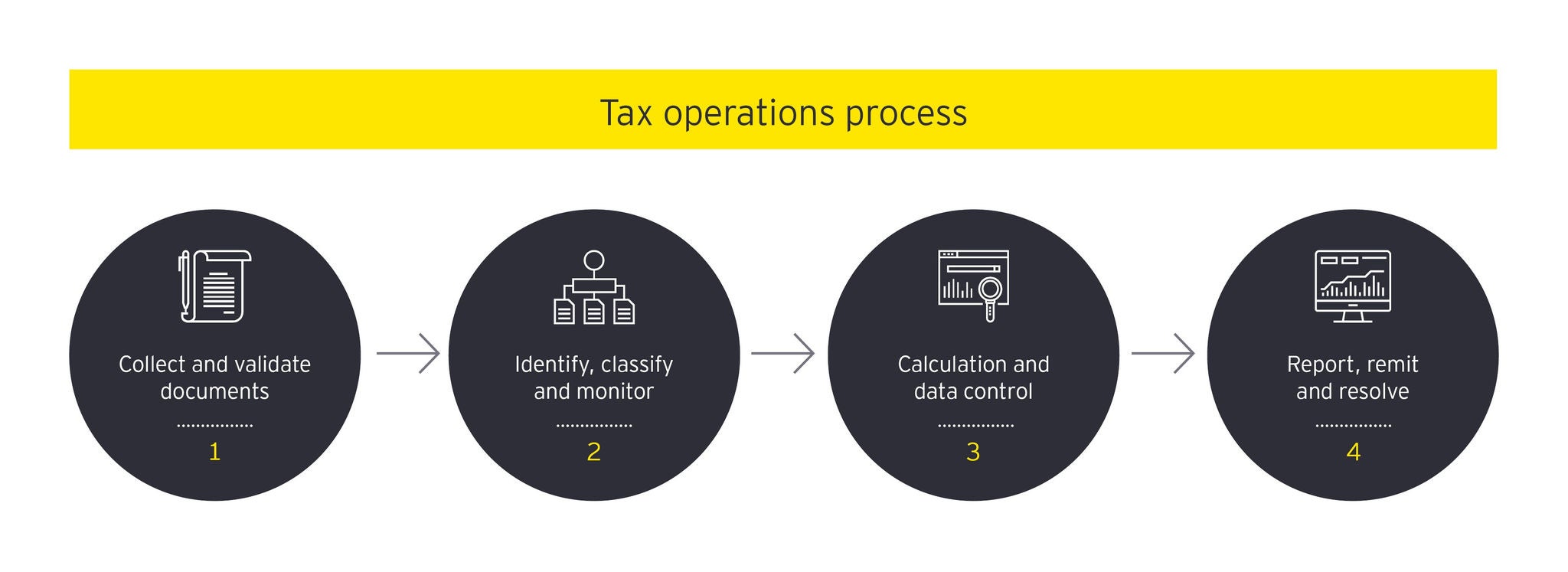

The EY Customer Tax Operations and Reporting Services (CTORS) help your organization meet its customer-related regulatory tax reporting obligations including, FATCA, CRS, DAC6, DAC8, and withholding tax (WHT). Our scalable customer tax operations services are supported by EY tax professionals across the globe and underpinned by leading technology, including FATCA and CRS reporting and due diligence solutions, Mandatory Disclosure (DAC6) tool and qualified intermediary (QI) compliance support.

Your business challenge

If your business makes payments to customers or other intermediaries, it is likely you face a growing regulatory requirement to report data relating to those customers and payments to tax authorities, and in some cases to withhold a tax element. These regulations impact a wide range of businesses, including financial institutions, digital platforms and payment service providers, and in latest developments, impacted payments can include those made in crypto currencies and e-money.

With both financial penalties and reputational risks for noncompliance with regimes such as FATCA, CRS, DAC6 etc., businesses with a customer reporting obligation need:

- Rigorous yet sensitive data gathering

- Robust processing and reporting

- The agility to adapt to evolving regulations

Explore CTORS

Our services evolve with the regulatory environment, and include support with:

- Foreign Account Tax Compliance Act (FATCA) and FATCA reporting obligations

- Qualified Intermediary (QI) services and IRS QI agreement support

- Common Reporting Standard (CRS) and CRS reporting obligations

- DAC6 (EU mandatory disclosure regime) and DAC8

- W-8, W-9, 1099 FATCA, 1042-S forms

- Central Electronic System of Payments (CESOP)

- Crypto Asset Reporting Framework (CARF)

Whether you’re looking for a quick FATCA/CRS health check, withholding tax reclaim support, or a full managed service, CTORS offerings are scalable and accommodate a range of budgets.

Why EY

Global reach

EY CTORS teams have over 400 subject matter professionals across the globe, offering their knowledge and support wherever you operate.

Scalable technology

Our technology platforms are designed for growth. For instance, when a client's digital platform’s users expanded from 2,000 to 200,000, our electronic Tax Form Validator (eTFV) seamlessly scaled to meet the demand.

Experienced since 2009

For over 15 years, EY CTORS professionals have been assisting multinational corporations in meeting their customer-related reporting and operational tax obligations.

Data security

Our leading-class, cloud-based technologies give the highest priority to data security to protect your information.

Tax technical experience

EY CTORS teams are not just tax professionals; many are also former tax authority employees, offering a deep understanding of evolving regulations.