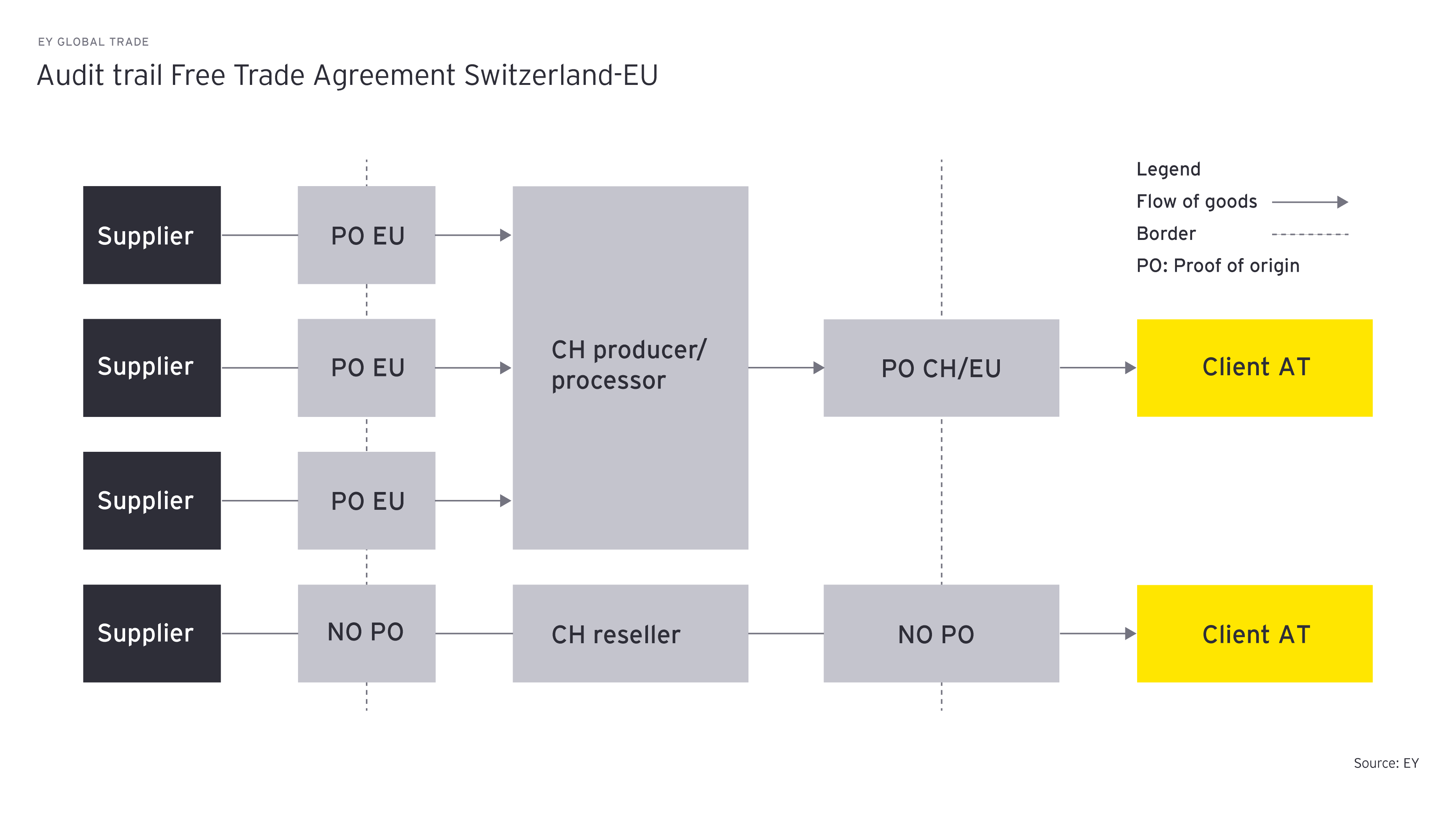

The example above provides a simplified view of the audit trail within the EU and Switzerland.

In the first scenario, a Swiss manufacturer/processor imports industrially produced goods with an EU proof of origin under the framework of the Switzerland-EU free trade agreement. Customs duties would no longer be levied due to the abolishment of tariffs; however, a proof of origin is still needed for further steps. Subsequently, the imported materials are used to manufacture a final product. The manufacturer / producer can provide evidence of the preferential origin of the imported materials from the EU which allows him to issue a proof of preferential origin assuming the rules outlined in the free trade agreement with the EU are met. The final product can be imported into Austria by the customer duty-free due to the proof of origin.

In the second scenario, a Swiss reseller sources goods without a preferential EU proof of origin from a supplier abroad. Since industrial tariffs would no longer apply, the Swiss reseller does not have to pay any customs duties. Subsequently, the Swiss reseller sells the goods to a customer in Austria. Since there is no proof of origin from the supplier, the Swiss reseller cannot issue a proof of origin and the customer in Austria has to pay applicable customs duties upon importation.

The examples illustrate why preferential proofs of origin are still needed even though industrial tariffs are to be abolished. Without said proofs, the rules of origin outlined in a free trade agreement may not be met in certain circumstances and a proof of origin cannot be issued for customers. Therefore, retailers and companies whose products are destined for final consumption in Switzerland will particularly benefit from the tariff elimination. Whether proofs of origin still have to be declared for import clearance or whether there will be an alternative option is currently not known but it is fairly likely due to the Swiss customs administration’s ongoing transformation program “DaziT” and the planned revision of the customs act.

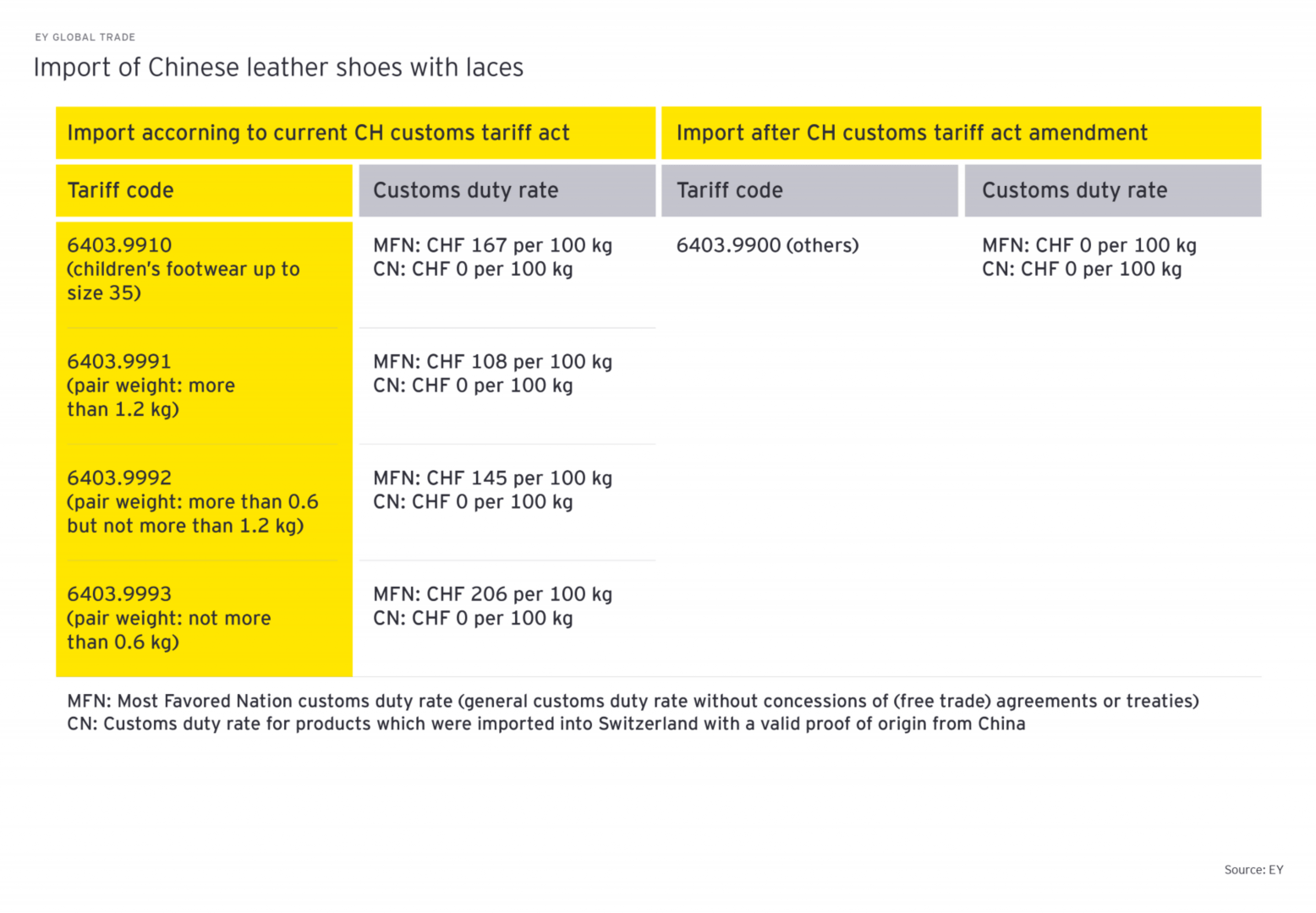

The amendment of the Swiss customs tariff with its vast reduction of Swiss tariff codes also require early preparation. Despite simpler tariff classification, tariff codes are still the core element of customs clearance and provide essential information regarding applicable license requirements, rules of origin as well as export controls. Thus, it is important that internal master data are updated accordingly to prevent unexpected events and risks.