Introduction

Switzerland is considered as a major global financial hub. Yet, it is struggling to establish itself as an international fund domicile.

One reason for this is that Swiss fund distribution within the EU is limited, especially for private clients - Swiss and non-Swiss - who are therefore traditionally offered foreign investment funds (Luxembourg and Ireland). In addition, Swiss funds are perceived as not being very competitive even for qualified investors (e.g., regulated financial intermediaries, pension funds and insurance companies) who do not face significant restrictions on distribution, in part due to the costs and time required for product approval. Finally, Swiss withholding tax is much more restrictive in relation to funds than the regimes applicable in major fund centers such as Luxembourg and Ireland. As a result, Swiss clients themselves often prefer to opt for foreign collective investments, especially in the field of alternative investments and innovative products, which are very popular. One example is the Luxembourg “RAIF” (Reserved Alternative Investment Fund), which appears to be widely used by Swiss institutional investors.

These elements have been identified as undermining the efficiency of the Swiss financial center and pushing qualified Swiss investors to invest abroad. To strengthen the position of the Swiss investment fund market, the Swiss government decided to offer a new type of fund subject to a simplified regulatory framework based on a similar investment model as the RAIF.

On 9 June 2021, the Senate unanimously adopted a first draft proposal introducing into the Swiss Collective Investment Schemes Act (CISA) a new type of alternative investment fund and non-traditional asset class strictly reserved for qualified or sophisticated investors (institutional or private), named the "Limited Qualified Investor Fund" or "L-QIF". It is exempted from authorization or approval from the FINMA.

The Senate finally adopted the draft law on 17 December 2021 in the final vote. The revised CISA is expected to come into force mid-2023.

The purpose of this article is to answer the following questions:

- What is an LQIF and what are its characteristics?

- What similarities and differences does it bear with its Luxembourg cousin, the RAIF?

- What is the tax treatment for the LQIF and its investors?

1. Structure and key features

As per the revised CISA’s, the regulation of the L-QIF is comprised of the following mandatory core elements:

Collective investment scheme according to the CISA

The L-QIF is not a new category of financial instrument but a qualified collective investment scheme according to the CISA. It is thus generally subject to the mandatory provisions of the CISA with respect to these schemes, notably the collective investment criterion, the third-party management requirement and the principle of equal treatment of investors.

Therefore, it must be structured under one of the legal forms authorized by CISA: an L-QIF must have the legal form of either

- a contractual investment fund, or

- an investment company with variable capital (société d’investissement à capital variable (SICAV)), or

- a limited partnership for collective investment (société en commandite de placements collectifs (SCmPC/KmGK)).

An investment company with fixed capital (SICAF) is not an eligible legal form.

The revised CISA however does not set out any requirements regarding investments or risk allocation, making the concept of the L-QIF extremely flexible especially in terms of investment products and techniques, strategies or risk diversification. Therefore, it appears to be particularly suitable and appropriate for alternative investments and innovative strategies.

The revised CISA also does not provide for any specific documentation requirement such as the preparation of a prospectus. That being said, the fund documents, including advertisements, must include on the first page the denomination as an L-QIF and the fact that the fund is therefore not subject to authorization nor regulatory supervision by FINMA.

There will also be a public register of all L-QIFs, which will provide information on the persons responsible for administering the L-QIF and make it possible to collect reliable data for statistical purposes.

Concept of indirect supervision

Whilst an L-QIF itself is exempt from FINMA supervision, it must be managed by a FINMA supervised entity, which is ultimately responsible for ensuring proper management and compliance with all applicable regulations, including all specific limits or restrictions that are set forth in the fund documentation.

Based on the revised CISA, this new vehicle has the following profile:

- L-QIFs structured as Swiss LPs (SCmPC/KmGK) must delegate their “management”, including investment decisions, to a manager of collective assets (an investment fund manager regulated under the Financial Institutions Act (FinIA)).

- L-QIFs structured as SICAVs are required to delegate both the administrative and investment decisions to the same fund management company, which may sub-delegate the portfolio management to an authorized fund manager.

- L-QIFs structured as contractual funds (Fonds commun de placement (FCPs/Anlagefonds)) may only be managed by a fund management company, which may, in turn, delegate the investment decisions to an authorized fund manager.

- No mandatory product approval/licensing or supervision by FINMA

This is probably the most important and innovative feature of the L-QIF: it is exempted from FINMA licensing, FINMA approval and FINMA supervision. Consequently, an L-QIF may be launched within a short time. This feature allows for the best possible time-to-market, which also significantly improves the predictability and efficiency of fund formation.

This absence of direct FINMA supervision does not mean total absence of supervision: L-QIFs have to be administered by specific institutions that are themselves subject to FINMA supervision. FINMA is therefore able to ensure that these institutions have the appropriate organization and the knowledge and experience to administer the relevant L-QIF.

Only open to qualified investors

To compensate for these relative procedural simplifications, certain restrictions aim at ensuring adequate investor protection: the L-QIF is only open to qualified investors as defined by the CISA, i.e., market participants who are professionally qualified, receive professional advice or do not need special protection because of their financial situation, as well as professional and institutional clients within the meaning of FinSA. Therefore, this type of vehicle will also be accessible to wealthy private clients who declare themselves to be considered as professional clients and to private investment structures. Finally, investors with a written asset management agreement, provided they have not indicated their refusal to be considered as qualified, will also be able to invest in an LQIF through their (FINMA-supervised) asset manager.

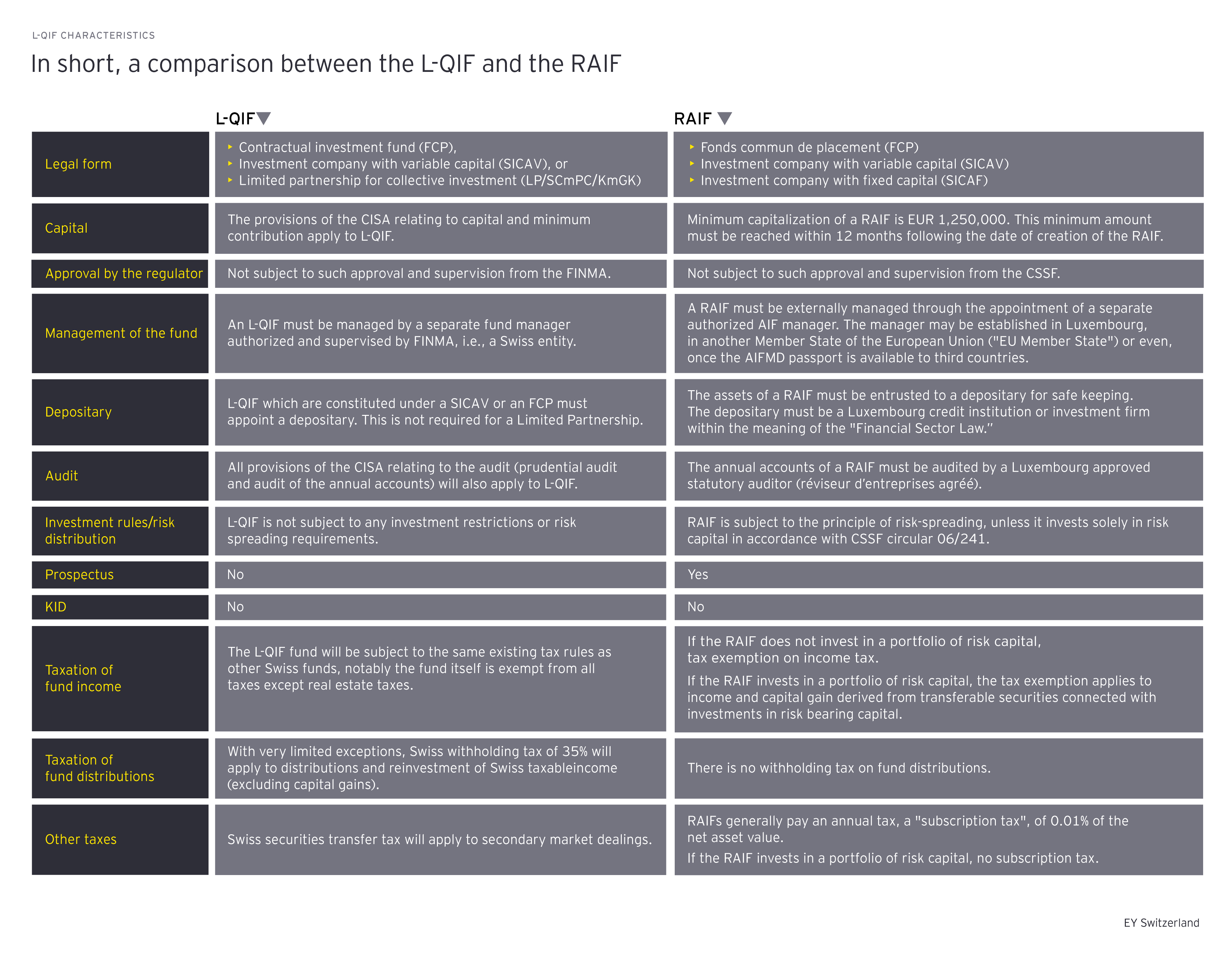

2. The LQIF compared to its ‘cousin’, the RAIF

The RAIF was introduced by the law dated 23 July 2016 which entered into force on August 1, 2016 (the “RAIF Law”), as a new type of Luxembourg investment vehicle. The RAIF is regulated under the Directive 2011/61/EU of 8 June 2011 on Alternative Investment Fund Managers (the “AIFMD”) and benefits from the corresponding European “passport” but is not supervised by the Luxembourg regulator (Commission de Surveillance du Secteur Financier or the “CSSF”), which makes it an attractive vehicle from a time-to-market perspective.

In order to be eligible for this regime, the RAIF has to be an Alternative Investment Fund (AIF) managed by an authorized AIF manager (AIFM), both within the meaning of the AIFMD. The AIFM may be established in Luxembourg, in another Member State of the European Union or even, once the AIFMD passport is available to third countries, in a third country in accordance with the provisions of the AIFMD.

RAIFs are limited to well-informed investors that are able to adequately assess the risks associated with an investment in such a vehicle.

The RAIF Law allows full flexibility with respect to the assets in which a RAIF may invest however, they are subject to the principle of risk-spreading except for the RAIFs which invest solely in risk capital in accordance with CSSF circular 06/241. The preparatory works of the RAIF Law clarify that, in the absence of any detailed rules in the law itself, the principle of risk-spreading and its interpretation in relation to Luxembourg specialized investment funds (the “SIFs”) should be taken into account. The main elements of this risk spreading principle are:

- a RAIF may not invest more than 30% of its assets or commitments in securities of the same type issued by the same issuer;

- Short sales must not result in the RAIF holding a short position in securities of the same type issued by the same issuer, which represents more than 30% of the RAIF´s assets.

These principles apply also by analogy to financial exposures from the use of financial derivative instruments.

3. Excursus: tax regime

The L-QIF will not constitute a new form of investment product: the CISA does not provide for any specific tax treatment to be applied to the L-QIF and explicitly states that the tax treatment of the L-QIF will be similar to that of other Swiss collective investment vehicles.

Therefore, the L-QIF will be qualified as a tax transparent fund for direct income tax purposes and as a consequence, the fund itself will be exempt from Swiss taxes, except the various Cantonal real estate taxes, and the unitholders will be subject to tax on their proportionate share of the income and gains generated by the fund, save income from real estate investments.

With limited exceptions, fund distributions (or reinvestment) of Swiss taxable income (typically, interest and dividends) will therefore be subject to Swiss withholding tax (WHT) of 35%. Whilst the impact of this is somewhat mitigated by the fact that income attributable to capital gains is not subject to this tax (so venture capital and private equity-oriented funds may not be affected), and that there is the possibility to apply an exception for foreign investors under the “affidavit procedure”, this is realistically still a very significant limitation on L-QIFs.

Swiss WHT will be levied/reclaimed at the following various stages:

WHT on income received by the L-QIF:

- Swiss WHT reclaim by the L-QIF: the L-QIF will be entitled to a full refund of the Swiss WHT charged on Swiss-sourced income regardless of the investors’ identity, tax residence and entitlement to a (full or partial) refund of the Swiss WHT.

- Foreign WHT reclaim by L-QIF: the L-QIF not being subject to an unlimited income tax liability in Switzerland, it cannot in principle claim the benefits of any double tax treaties concluded by Switzerland as it is not considered as a tax subject. For some jurisdictions, Switzerland does have bilateral agreements as per which Swiss collective investment vehicles can nevertheless (in part) claim in their own name the tax refund with regard to levied foreign WHT for the percentage of returns accruing to Swiss investors pro rata to their respective fund’s units.

- Foreign WHT reclaim by Swiss investors: generally, Swiss investors will need to demonstrate that they are the economic beneficial owners of the income, and that the income is properly accounted and declared. Swiss investors may credit the amount of the non-refundable foreign tax (normally, the portfolio tax rate) against their Swiss income tax liability in respect of the underlying investment (held through the L-QIF) provided there is a tax treaty between Switzerland and the source state. In that case, the investors would need to procure to the tax authorities the documents (WHT statements) attesting that the income received by the L-QIF was reduced by the foreign WHT.

- Foreign WHT reclaim by foreign investors: foreign investors’ eligibility to a tax reclaim of any foreign WHT depends on the applicable double tax treaty concluded between the investors’ state of tax residency and the source state. In the case of foreign investors, they will have to lodge the refund claim themselves directly with the source state: this usually requires detailed documentation that is often challenging in practice and is assessed on a case-by-case basis.

WHT to be levied upon distributions by the L-QIF:

- Swiss WHT will need to be levied upon distributed or reinvested Swiss taxable profits of the L-QIF (i.e., excluding profits attributable to capital gains, and also excluding profits attributable to real estate investments)

- Swiss WHT reclaim by Swiss investors: Swiss investors will be able to claim a Swiss WHT refund provided that the income subject to Swiss WHT is properly accounted for and declared in the investor’s tax return

- Swiss WHT reclaim by foreign investors: the eligibility to a tax reclaim of any Swiss WHT depends in general on the applicable double tax treaty concluded between the investors’ state of tax residency and Switzerland. Non-treaty-entitled investors may also request a reclaim if less than 20% of the fund’s income is from Swiss sources. Funds for which this is expected to be generally the case (e.g., investing in Asian equities) may apply the “affidavit procedure” in order to claim an exception from Swiss WHT on distributions.

Even for Swiss investors who are normally entitled to fully recover the withholding tax, this reclaims process represents a timing difference of up to a year, sometimes more, and almost certainly more for foreign investors (assuming that the affidavit procedure does not apply) entitled to a partial or total refund.

From a stamp duty perspective, the issuance of units of an L-QIF will be exempt from Swiss issuance stamp tax as well as from securities transfer tax (primary market). In the secondary market, however, the transfer of L-QIF units against consideration will trigger Swiss securities transfer tax (applicable tax rate being 0.15% of the sales/purchase price) (secondary market). Redemption of L-QIF units is exempt from Swiss securities transfer tax.

RAIF tax considerations

In comparison with the Swiss tax treatment of the L-QIF, the tax treatment applicable to the RAIF is simpler and more favorable. Depending upon its investment policy, a RAIF is subject to a dual tax regime:

- General tax regime: the RAIF is, in principle, exempt from corporate income tax, municipal business tax and net wealth tax, save an annual subscription tax that is levied on its net assets at a rate of 0.01% and payable every quarter (subject to exemptions).

- Optional tax regime: the RAIF invests in risk capital, thus, it is entitled to a special tax regime applicable to SICARs, which makes it exempt from subscription tax. Under this regime, the RAIF (as a separate entity) is fully taxable but exempt from net wealth tax (except for a minimum net wealth tax) and may benefit from double tax treaties. However, any income and gains arising from/cash held in association to qualifying investments in risk capital are exempt.

Profits distributed to RAIF’s unitholders are not subject to WHT.

4. Conclusion

The hope is that the L-QIF will enhance the fund and asset management landscape in Switzerland by reducing the incentive for Swiss investors to use foreign vehicles given the flexibility allowing a swift and cost-efficient set up.

From a Swiss tax perspective however, no new tax treatment is being introduced and such funds will be treated as other Swiss funds. The burden of withholding tax of 35%, heavy in comparison with funds from other neighboring jurisdictions, will therefore be favorable for Swiss investors who can reclaim the Swiss withholding tax.