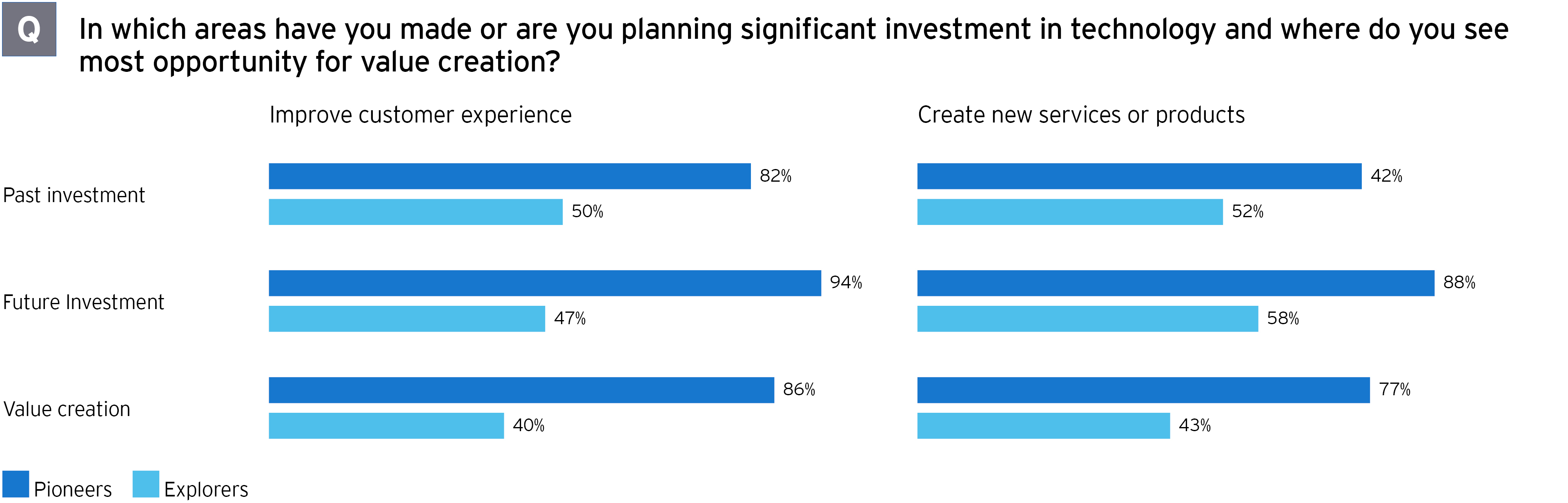

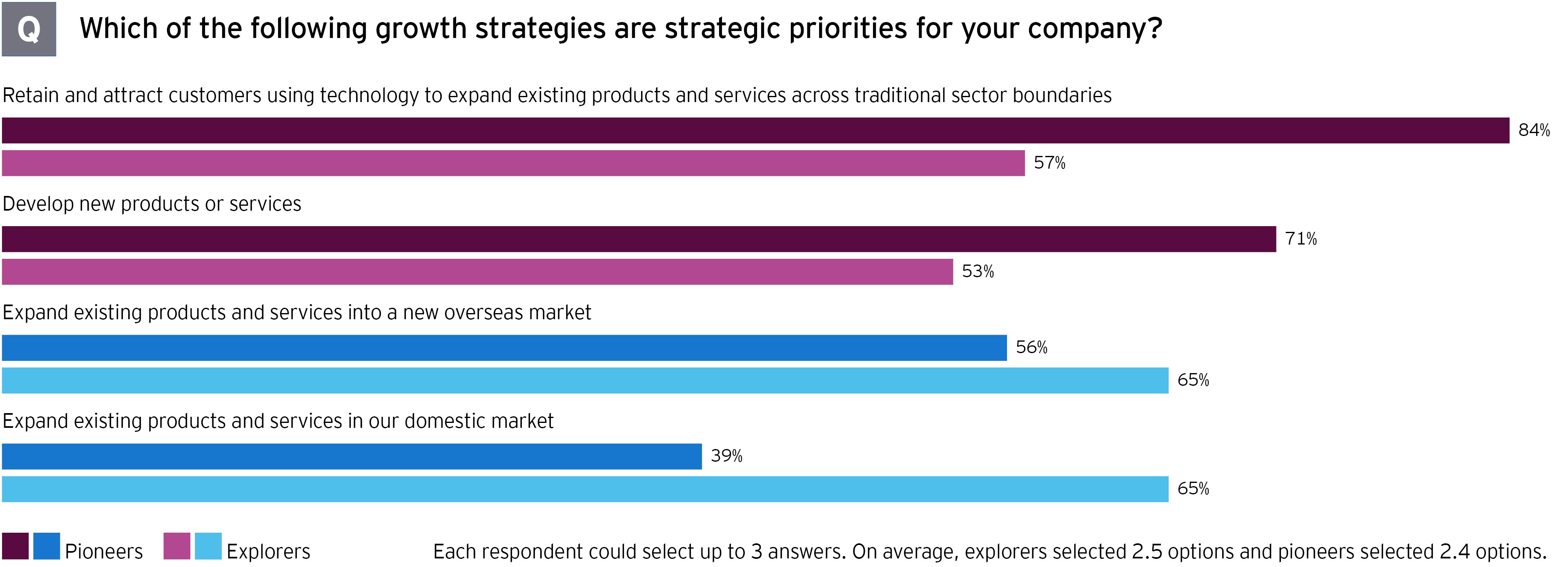

In a market of increasing competition and decreasing customer loyalty, finding new growth opportunities to deliver new products, services or innovative business models will be a crucial differentiator.

Explorers, meanwhile, are less focused on customer experience and therefore less likely to achieve their full investment potential. At the same time, their top two strategic priorities are focused on expanding their core business into new markets as a way to find growth. This may yield efficiencies today. However, it will not prepare explorers for the new customer landscape of tomorrow.

Why adopting an ecosystem mindset is key to build digital capabilities through M&A

When we look at how companies go about building their digital capabilities, both groups are using in-house development and R&D, as well as inorganic approaches. However, pioneers place more bets and more frequently look to acquire capabilities from the outside. They are 20 percentage points more likely to pursue joint ventures and alliances (47% versus 27% of explorers), and almost 10 percentage points more likely to go after direct investments and acquisitions (45% versus 37% of explorers).

This approach reflects an understanding that leveraging M&A to acquire digital capabilities provides the speed and flexibility to capture emerging opportunities before the competition.

As such, pioneers are more likely to view the increasing competition for assets as a threat to their digital strategy.

Increasing competition for assets

84%of pioneer respondents expect to see increasing competition for assets in the next 12 months, versus 59% of explorers.

This highlights the importance of the business ecosystem. Companies are no longer operating in a closed environment and disruptive opportunities exist across the value chain. So, they need to consider the ecosystem of their suppliers, customers and competitors, which in itself is a complex task. As such, it is key that companies adopt the right mindset in developing an ecosystem that will enable them to be more agile and accelerate their growth.

Why a flexible business strategy enables companies to embrace disruption

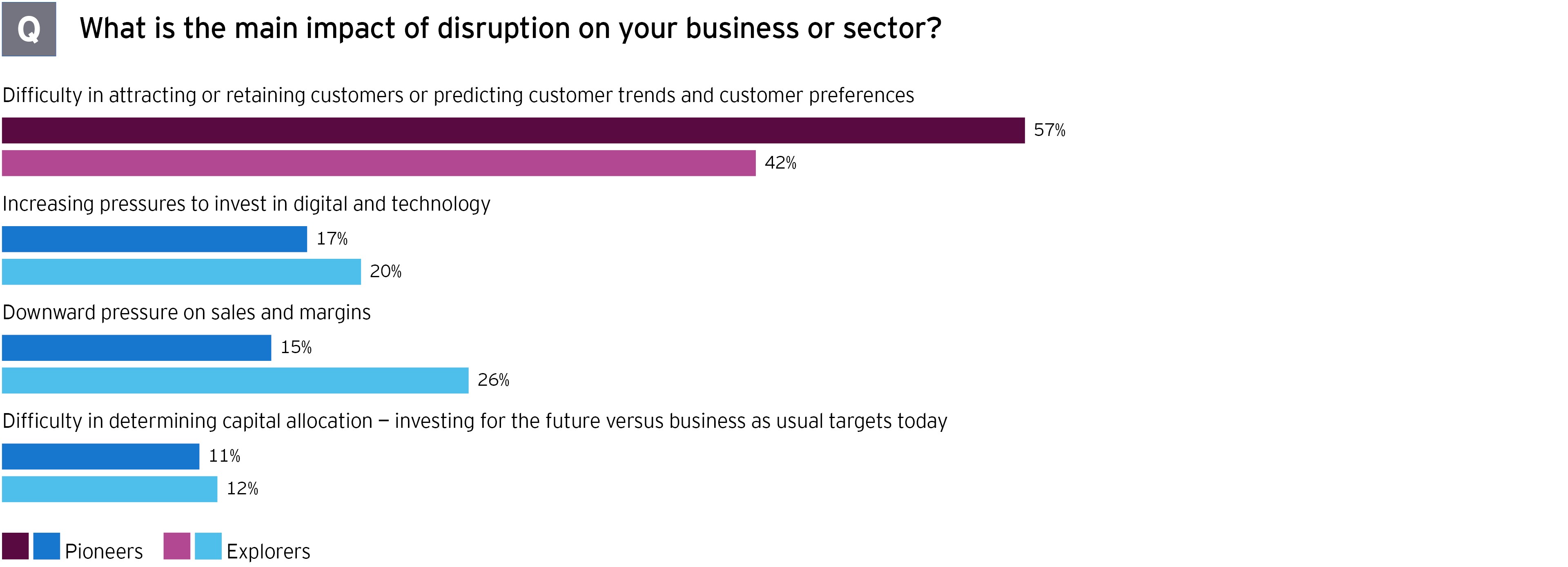

Geopolitical trade and tariff uncertainty, increasing competition from startups and technology, and regulatory uncertainty are the top three challenges that pioneers and explorers are both seeing as the greatest risks to their business growth. Additionally, explorers are much more concerned about an economic slowdown and the downward pressure on sales and margins. While pioneers are most worried about how these risks will negatively impact their value proposition and ability to serve customers.

All along the digital journey, pioneers are prioritizing innovation, understanding their ecosystem and embracing challenges.

Becoming disruptors rather than becoming the disrupted. Pioneers are better positioned to find pockets of growth and new opportunities, even in times of uncertainty. Explorers, in contrast, appear to spend much of their time protecting what they have now, potentially at the expense of what they may achieve in the future.

Four key actions to help navigate the digital future

From vision to action to outcome, EY data analysis suggests that companies will perform better overall and be more resilient in the face of continuing uncertainty if they take these four actions:

- Create a culture that embeds digital into the organization’s DNA from the top down and throughout.

- Define a business strategy that invests in digital to drive customer-centricity to create long-term value.

- Adopt an ecosystem mindset and utilize M&A as a lever to accelerate growth.

- Implement a flexible business strategy by embracing digital disruption to better respond to the ever-changing competitive landscape and risks.

Digital is the present for 99% and the undeniable imperative for all in the future. Companies that believe in digital’s transformative power will excel. Those slower on the journey may continue to perform well in the short term, but will find themselves on the back foot, or out of the race entirely soon enough.

Read more about M&A and digital

Resumen

The business ecosystem has evolved significantly in the past few years. With almost all companies having invested in digital to some extent, it’s no longer a question of whether to invest, but how to leverage these investments to create the most value. Successful companies are those that use digital to drive the next wave of innovation to address emerging challenges and generate competitive advantage.