EY Nearshoring

Mexico has become an attractive market for foreign direct investment

What advantages does Mexico offer?

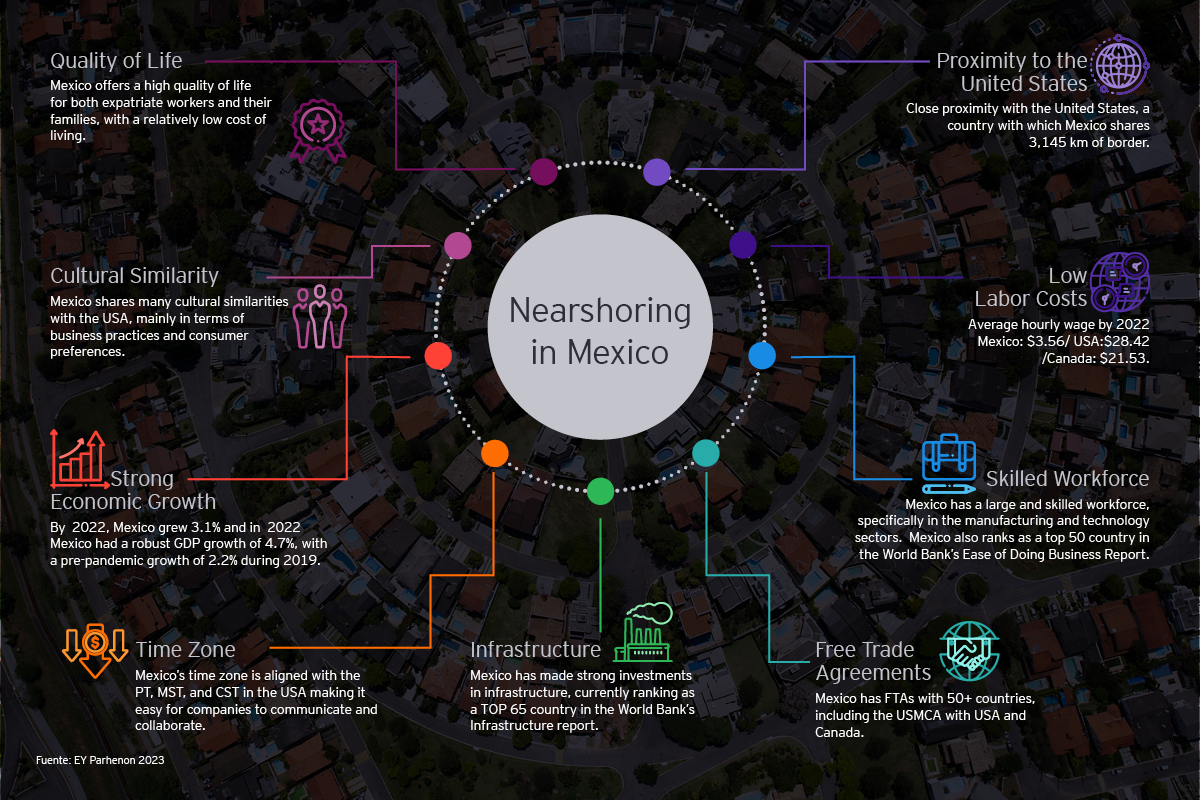

Nearshoring consists of relocating a business operation from a distant country to a neighboring country. In the midst of this trend, Mexico has become an attractive market for foreign direct investment (FDI) thanks to the following factors:

- Strategic geographical position and competitive costs

- Young and talented population, which translates into a high-quality labor force

- Size and strength of its internal market

- Macroeconomic and political stability

- Open economy that provides access to the most important markets worldwide through a network of free trade agreements

- Mexico is part of the T-MEC, an agreement that provides preferential access to North American markets

Overview of FDI in Mexico

According to data from the Organization for Economic Cooperation and Development (OECD), Mexico is the world’s ninth largest FDI recipient, totaling USD 35.3 billion in 2022. On the other hand, the 14th edition of the Global Best to Invest - a ranking that lists the main countries and the most attractive metropolitan areas for foreign investment - recognized Mexico as the best place to invest in Latin America in general.

Advantages of nearshoring in Mexico

Industries in Mexico with potential for nearshoring

EY Analysis: business environment in Mexico

- Balance opportunity and political risk. Mexico provides a favorable location for manufacturing firms, though a subset of political risk elements create a challenging operational environment and should be managed as a “cost of doing business”.

- ESG issues add to known operational risks in the country. Regulation in many sectors and businesses is uncertain and evolving – providing both opportunities and challenges for Nearshoring Investing Companies.

- Mexico-China and U.S.-Mexico factors raise strategic questions. Mexico has a favorable posture towards Chinese trade and investment; however large-scale imports or raw materials may face more complex regulatory and safety scrutiny.

- Supply chain strategy. Supply chain exposure is pervasive throughout the identified political risks and raises important considerations for Nearshoring investments and locations.

How EY can help

One Stop Shop - Nearshoring Investment Services Network is a one-stop-shop within the EY network, in which multiple services related to the establishment of a new investment or manufacturing operation in Mexico are offered so that investors can find a complete solution within EY Mexico.

Our nearshoring investment services