Charged With Change

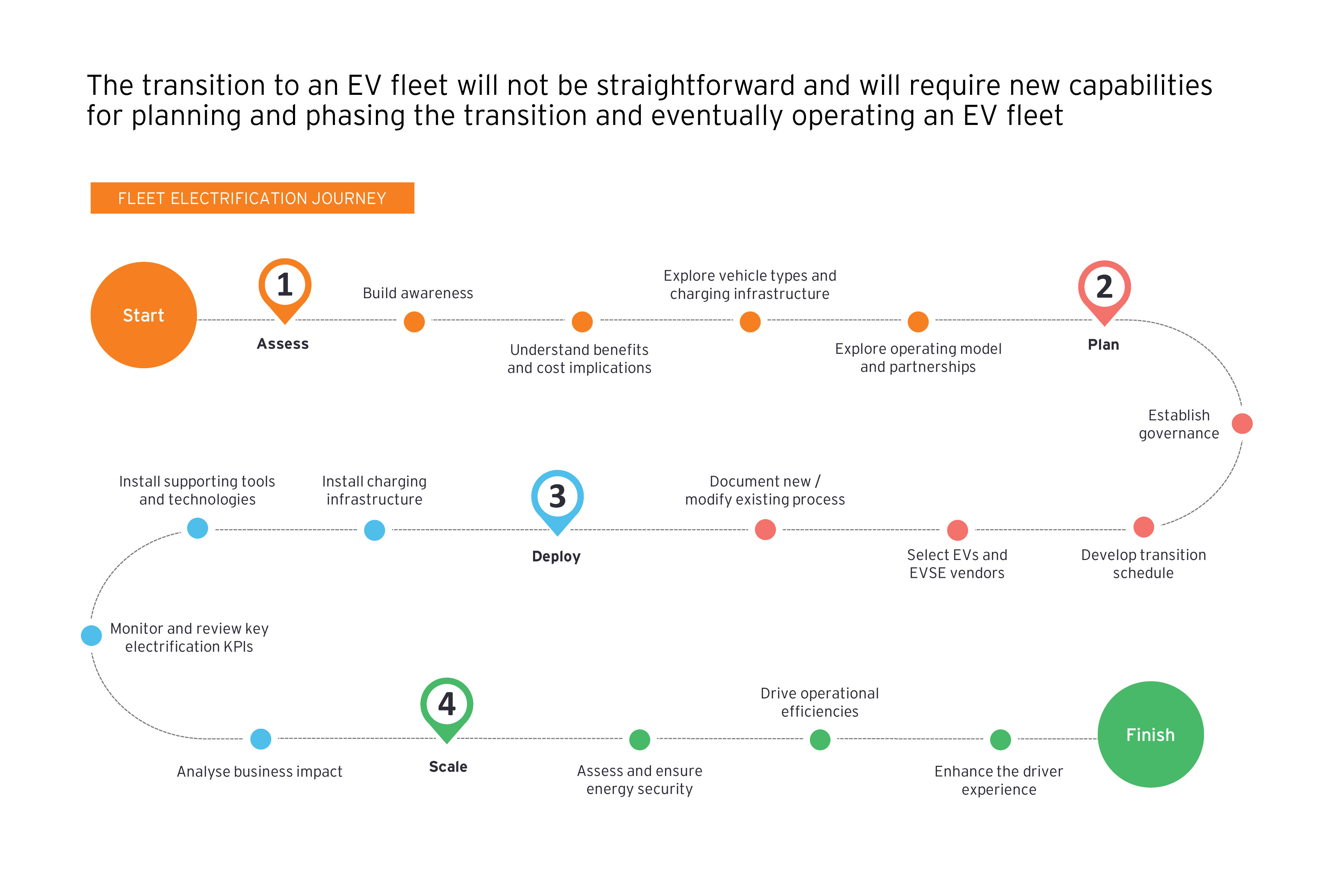

Along with model availability and usage, operators must grapple with charging requirements. If vehicles return to a depot, for instance, the solution isn’t simply about wiring more sockets into an existing wall. Chargers need floor space. Then there are questions such as how many and what type of chargers are needed. And what is the lead time for installation and does the existing location meet physical space, safety and network considerations?

Many fleet operators will need to design strategies to deal with a mix of charging at a central location, at employees’ homes and at public charging stations. Additionally, they must consider who pays for the charging and how. According to Grattan, over two-thirds of Australian households will “find it easy to charge electric vehicles at home”, based on access to easily installed at-home charging infrastructure. Though it’s a hefty proportion of the population, it obviously leaves a sizeable number of potential fleet users in need of alternative creative solutions.

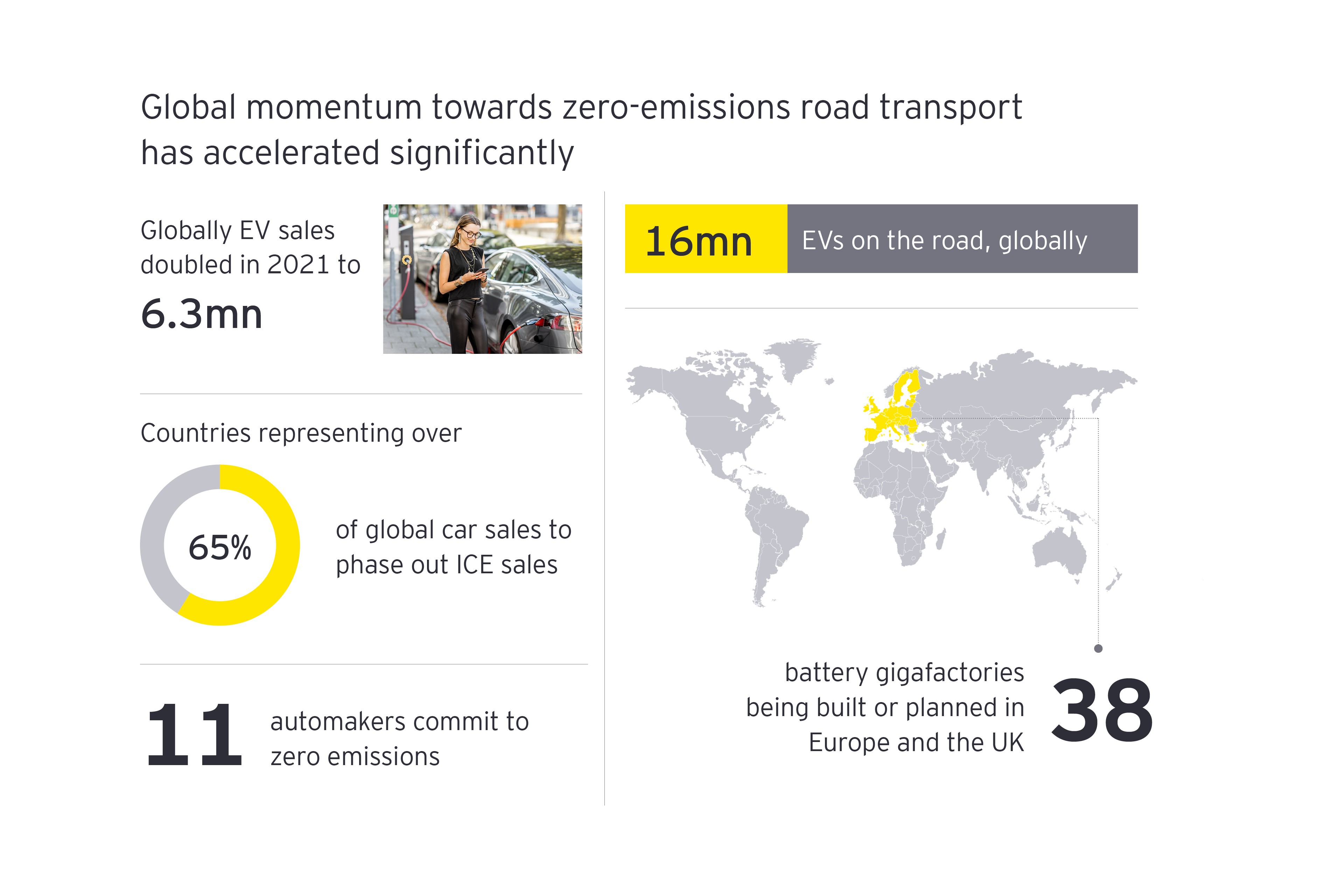

It is a similar story in Europe. Our EY report authors estimate that 130 million EVs will hit the road in Europe by 2035, necessitating 65 million chargers. They also calculate that 85% of chargers will be residential, 6% in the workplace, 4% on public highway corridors and 5% at destinations, such as shopping malls.

Home charging for fleet vehicles brings new considerations, such as modifications to an employee’s property, and the inevitable question of what happens when an employee leaves their position.

The Federal Government’s recent 2021 update to its Low Emissions Technology Statement goes someway to recognising this. It introduces a new technology category: “enabling infrastructure, [which is] critical for enabling commercial deployment of low emissions technology”. The priority is “battery charging and hydrogen refuelling stations to support consumer choice in electric vehicles” along with digital energy grid enhancements.

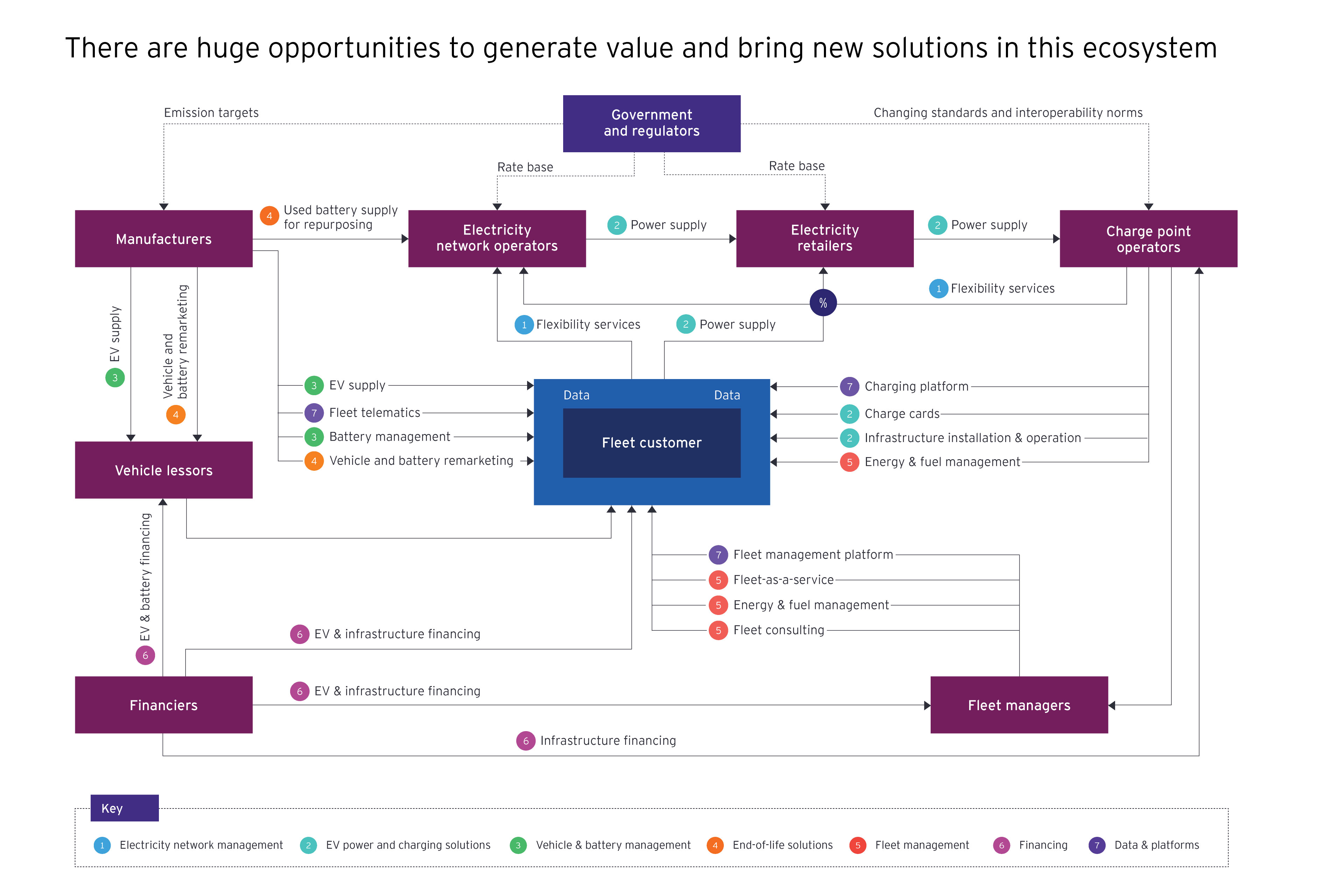

The updated policy is an acknowledgment that BEVs and, to a lesser extent, Fuel Cell Electric Vehicles (FCEVs), can prosper in a broadly mature ecosystem that allows all parties to thrive. While governments don’t need to do all the heavy lifting on investment and infrastructure costs, fostering a broad electrified transport ecosystem will give policy certainty to foundational investments for long-term business plans.

“It's quite a complex puzzle when all the issues are considered,” says Damien Smith, Partner, EY Australia. “We see it less as a transition and more as a transformation. Some of the changes to EVs might be more straightforward. You come back into the depot when you're finished, plug the car in, the fleet manager gets all the data on the charge levels overnight and the cars are meted out according to their specific task. But the remaining portion of the fleet is likely to require sophisticated planning and strategy.”