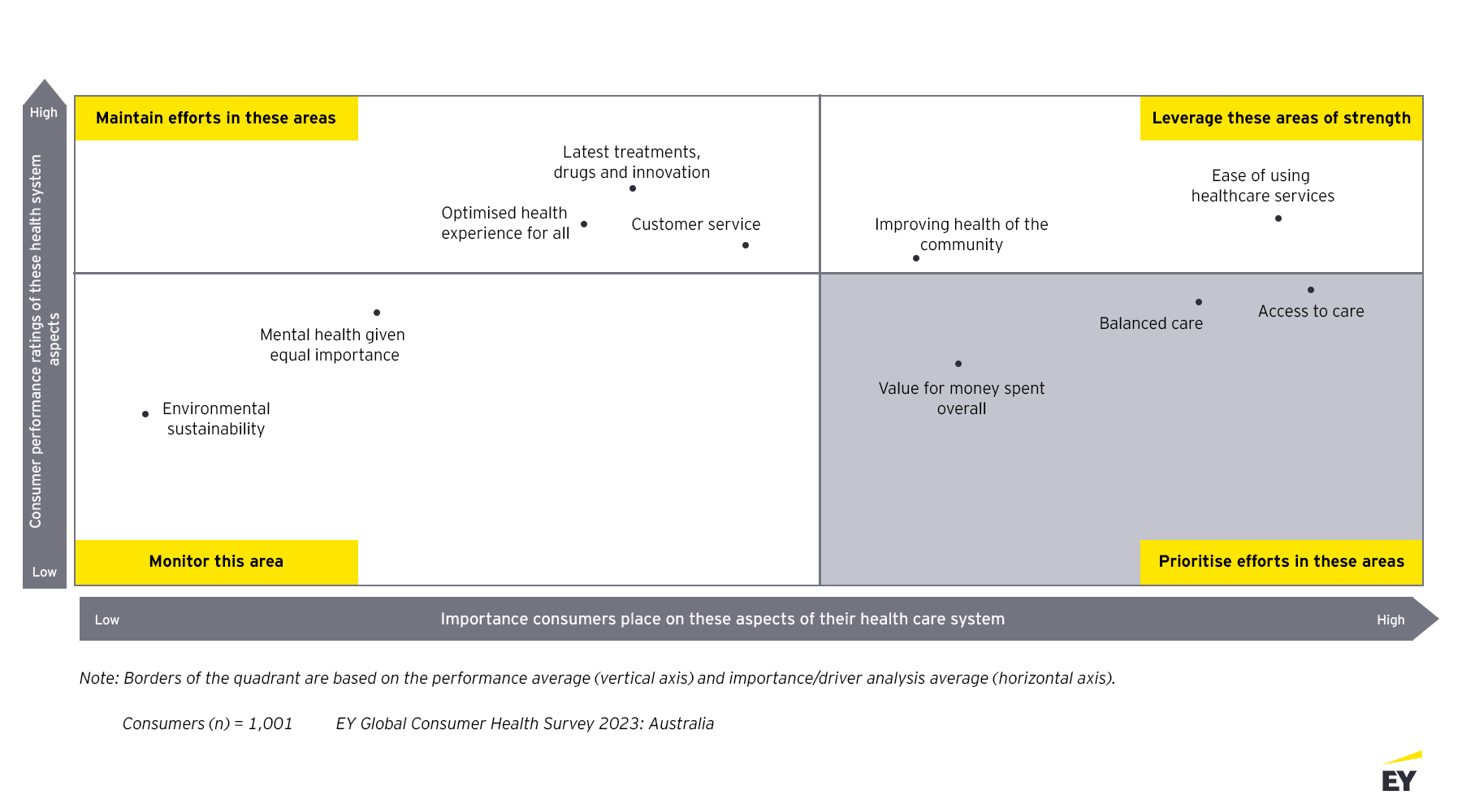

Where to focus efforts for improved consumer perceptions Australia. Expand the quadrant titles below the graph to learn more.

Five clear priorities for health executives to give consumers the access and experience they value most:

Special thanks to the following individuals who contributed greatly to the EY Global Consumer Health Survey 2023:

Aishwarya Benjwal, EY Health Sciences and Wellness Analyst; Sheryl Coughlin PhD, EY Health Sector Analyst; Rachel Hall, EY US Consulting Digital Health and Smart Health Experience Leader; Kenny O’Neill, Principal, Digital Health Consulting, Ernst & Young LLP; Aakanksha Kaul, EY Health Sciences and Wellness Analyst; Crystal Yednak, EY Global Health Senior Analyst.

Summary

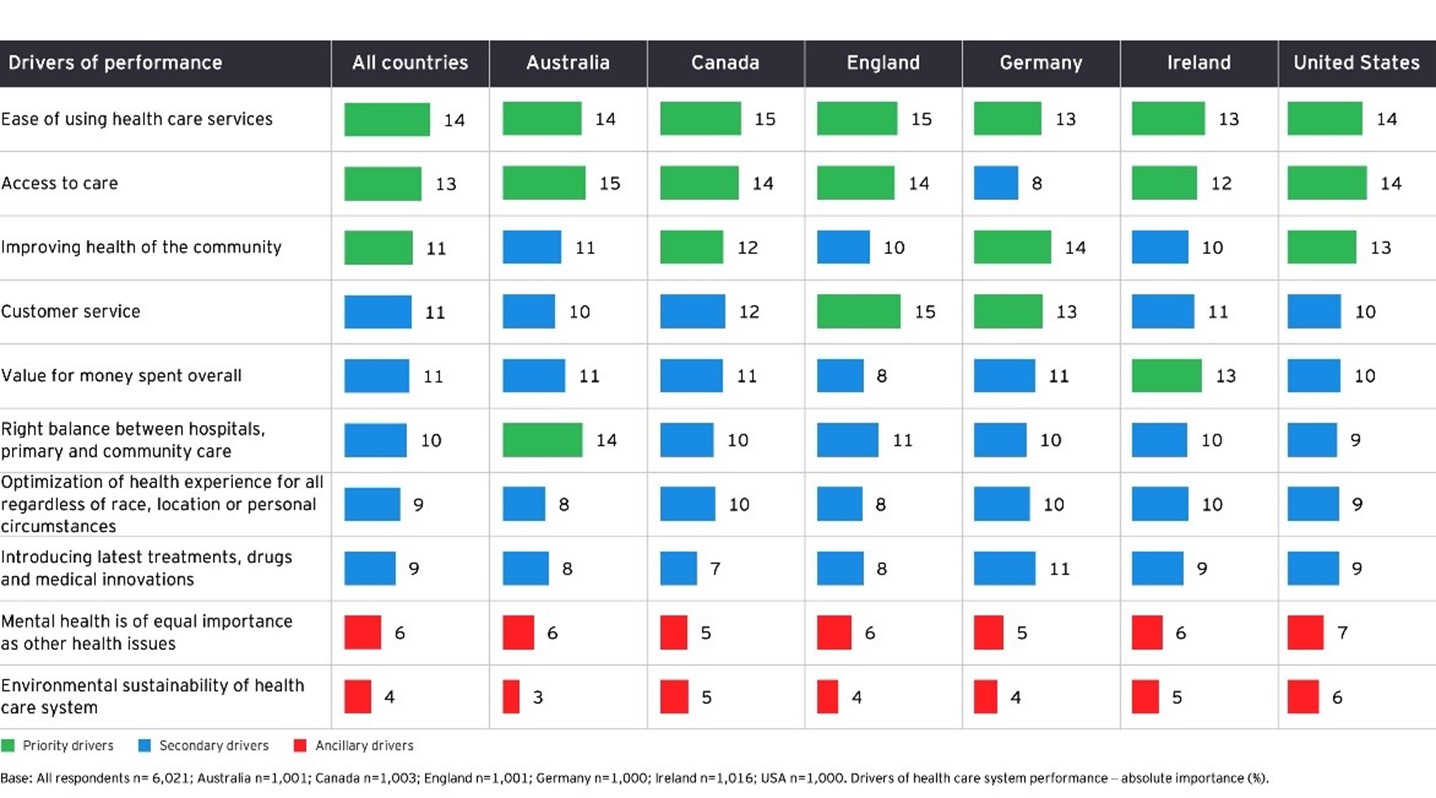

The EY Global Consumer Health Survey 2023 found that consumers highly value access to care. Health systems and organisations will need to think through how consumers engage with various touch points in the system. This includes taking clear steps towards closing the gap to build a fairer Australia - of healthcare for all, by bridging the digital divide and ensuring access to services, including vulnerable and hard-to-reach groups.