The step change in demand for ACCUs from 1 July 2023 is certain to drive new demand.

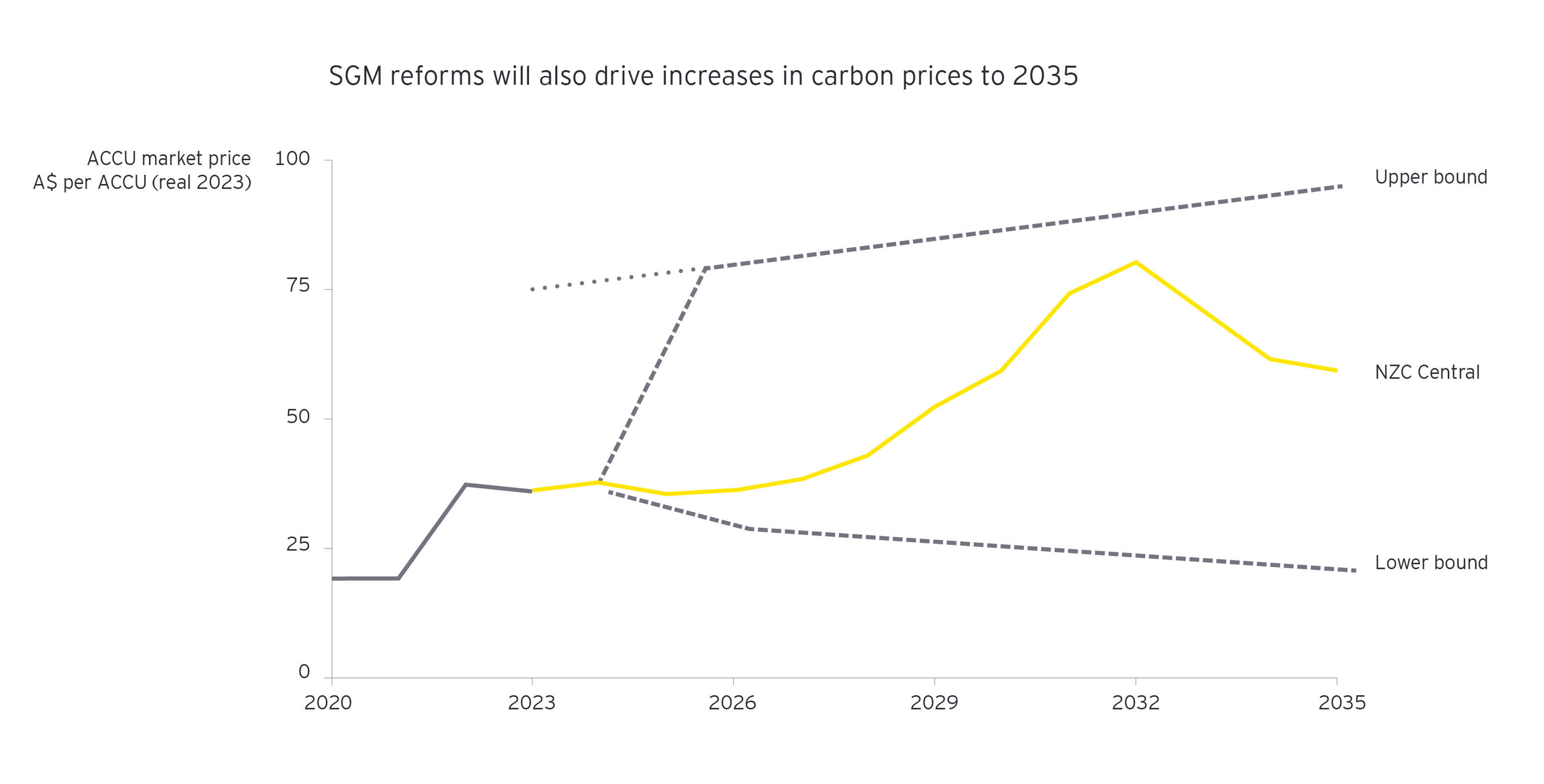

However, our modelling and analysis finds the new linked SMC and ACCU markets are delicately balanced. Near-term ACCU prices and volumes will thus be very sensitive to the behaviour of SGM facilities and other market participants.

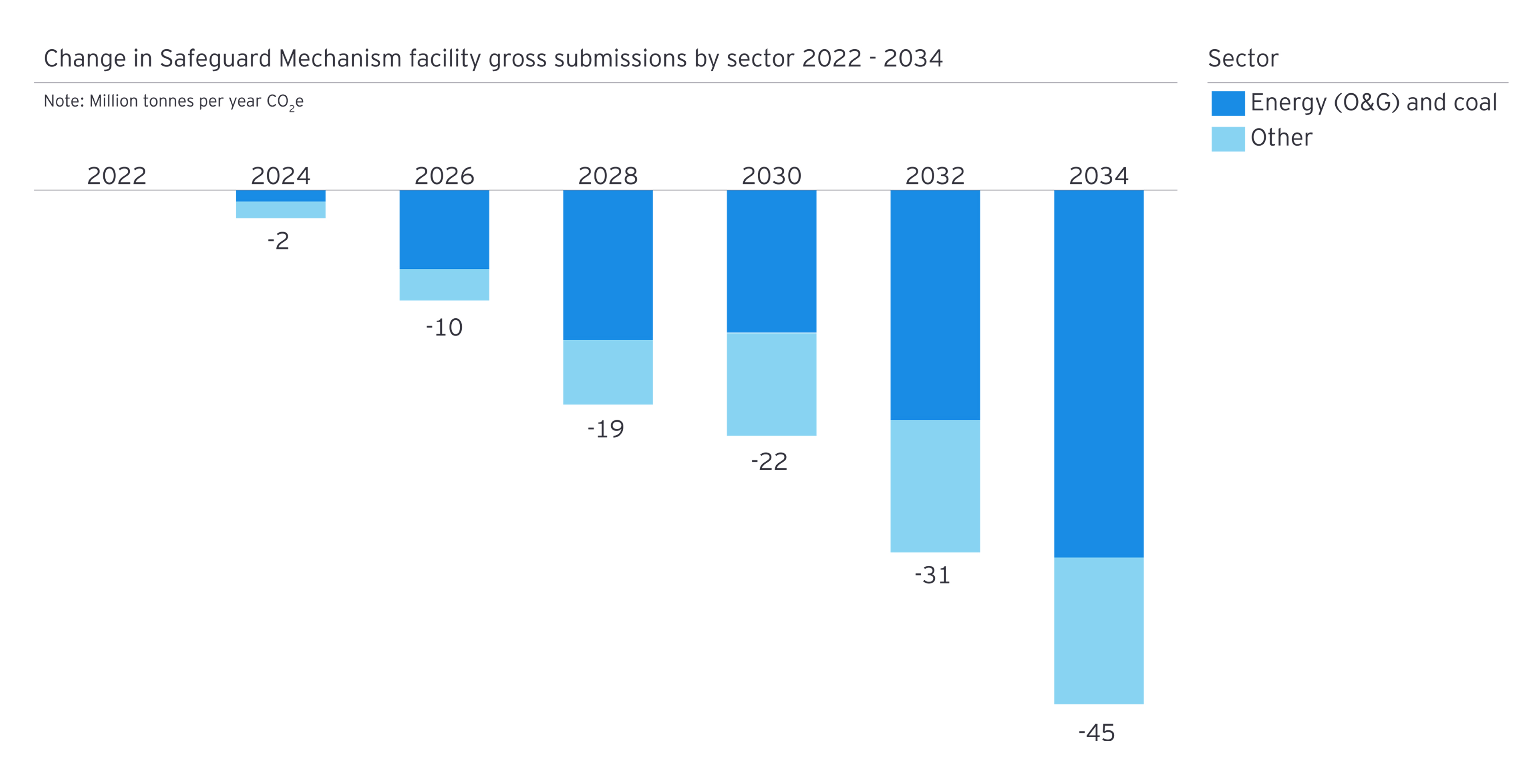

This makes market dynamics and outcomes highly uncertain, including the potential for boom-bust patterns. Key uncertainties for 2030 include the timing and extent of SGM abatement investments, decisions to hold or sell Safeguard Mechanism Credits (SMCs), and entry of new SGM facilities.

In principle, this intrinsic instability could be moderated by a natural evolution of the market, with long-term contracts, for example, providing future price visibility and allowing companies to manage their risk.

In the shorter term, as prices and market volumes increase, our central estimate is that the total value of Australia’s ACCU market will more than triple before 2030.

Delaying abatement by a few years could see prices more than double and hit the price cap before 2035. Similarly, we can expect higher prices if facilities that generate SMCs decide to hold a substantial share of these credits for future use.

Remove the sting by rethinking your strategy

Our call to action is clear. Carbon credits will become more expensive to purchase, and that means all businesses – not just those captured by the SGM – need to start thinking about the future.

The first step is to reassess the role of carbon offsets in your organisation’s decarbonisation strategy. How you use offsets will be determined by the same factors that shape your decarbonisation strategy itself: the exposure of your business and the abatement opportunities within reach. Ask yourself:

- What is your emissions intensity? Consider your emissions profile now and into the future under different outlooks. How will emissions intensity change over time? What are the key decision points and options? How do your potential emissions profiles compare to those of your peers and competitors, and global leaders in your sector?

- How immediate are the pressures to act? Understand the underlying drivers of stakeholder attitudes and their implications. Consider the potential pace of change, and possible triggers or tipping points – like further government regulation – that could increase the pressure to act.

- What is the opportunity space for reducing emissions? Identify the most relevant types and sources of emissions. Consider how well your asset lifecycle aligns with your desired timeframe to reduce emissions and the technology solutions that could help.

There’s a salve to the sting. A well-functioning ACCU market could generate very large volumes of high integrity removals-based credits – and this can help Australia to meet its net zero emissions targets and move from laggard to leader in climate action.

Note: Dr Steve Hatfield-Dodds was a panel member of the Independent Review of Australian Carbon Credit Units in a personal capacity.