Newsletters EY Belgium

Subscribe to one of our newsletters and stay up to date of our latest news, insights, events or more.

Summary

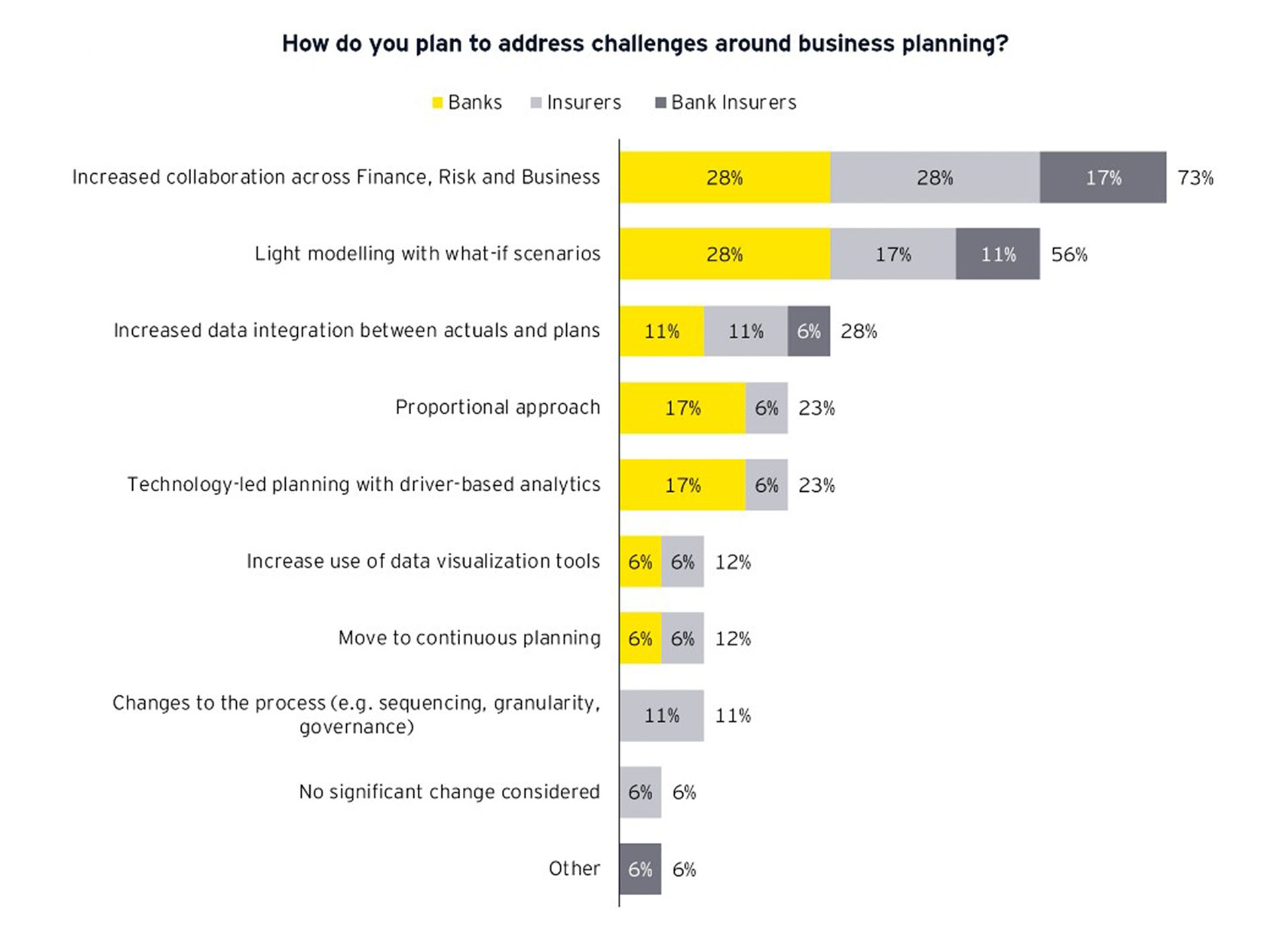

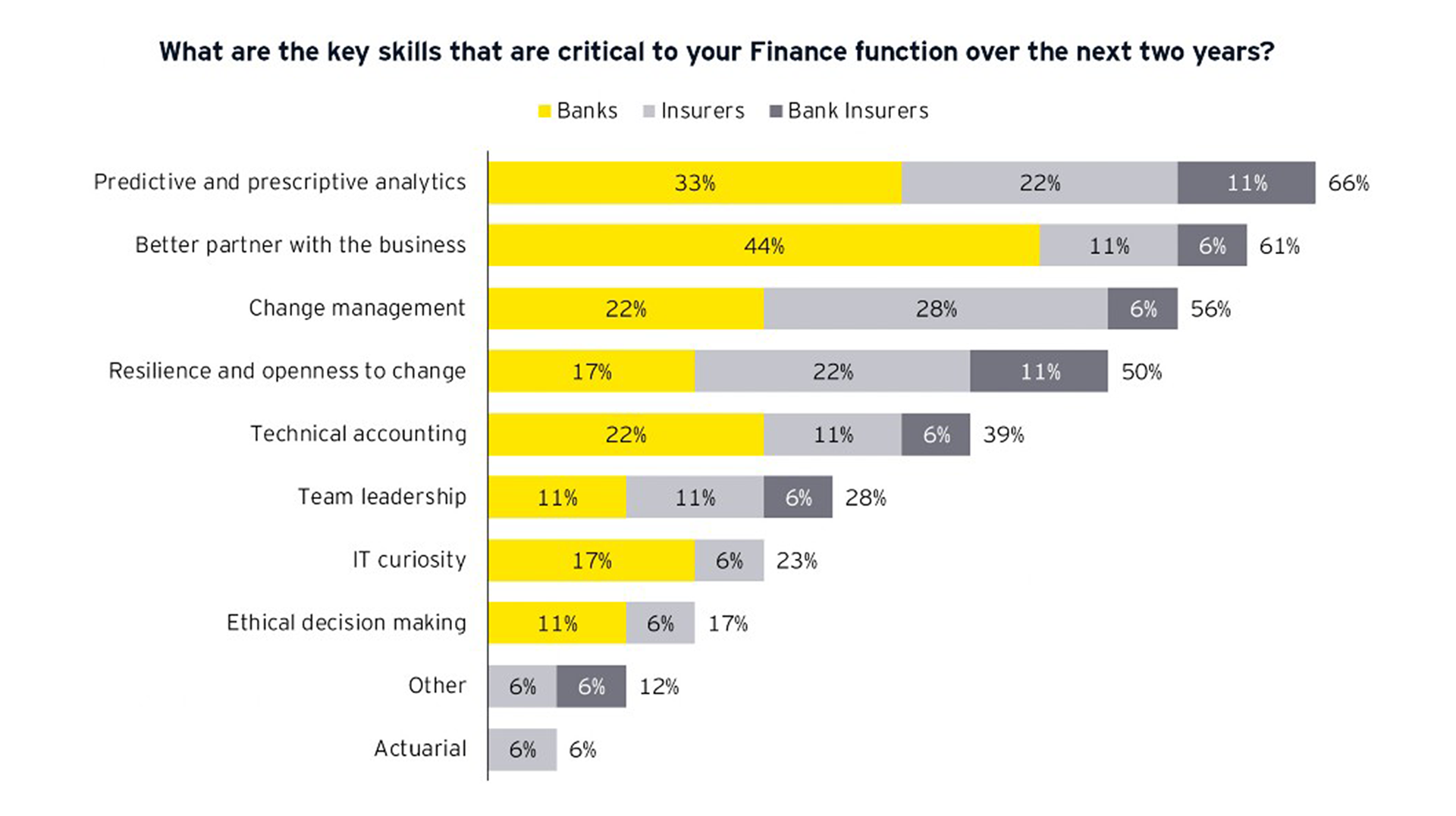

The Finance function proved to be agile in its ability to quickly adapt its day-to-day activities in the early days of the COVID-19 crisis. The remote operations ensuring business continuity, the absence of delays in the year-end financial closing and the responsiveness to the additional regulatory constraints are only a few examples of this fact. At the same time, the current context brings to light areas for improvement to the Finance function and provides an opportunity to re-focus its role within the organization. Indeed, CFOs are offered an opportunity to take an important step forward in further developing its strategic, forward-looking business partner role.